Doo Prime CopyTrading is dedicated to providing its clients with high-quality signal providers that make it easy to achieve profitable results by copying trades.

In this issue, we would like to introduce “Bīngshān——huángjīn shèngshǒu” or “Iceberg ——Holy Hand of Gold” (冰山——黄金圣手) as our leading signal provider. This signal provider boasts the following key features:

- Return on investment: stable returns achieved by using Martingale strategy

- Investment stability: low level of drawdown and stable returns

- Capital allocation: a small amount of capital employed, suitable for investors to follow with a certain percentage of their investment

Return On Investment: ⭐️⭐️⭐️⭐️

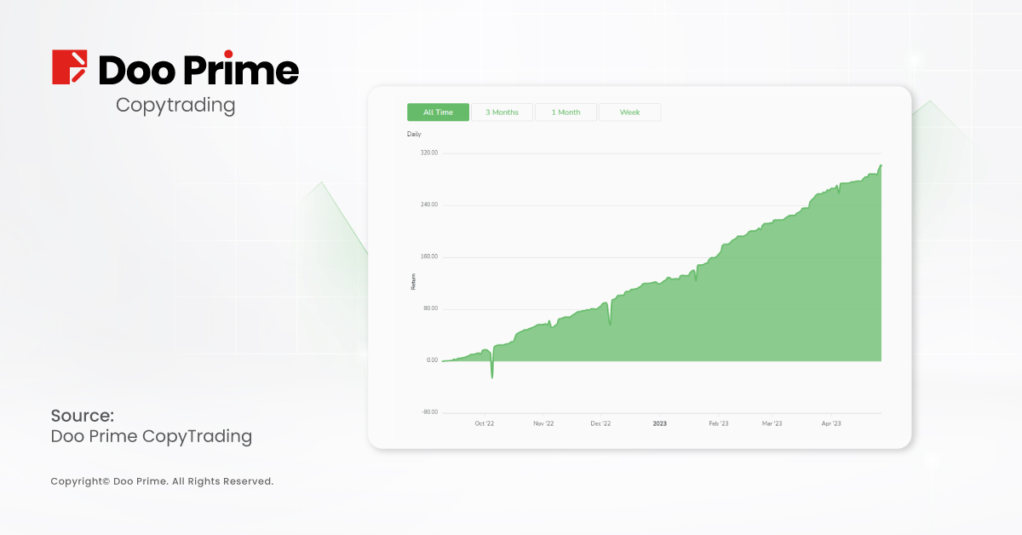

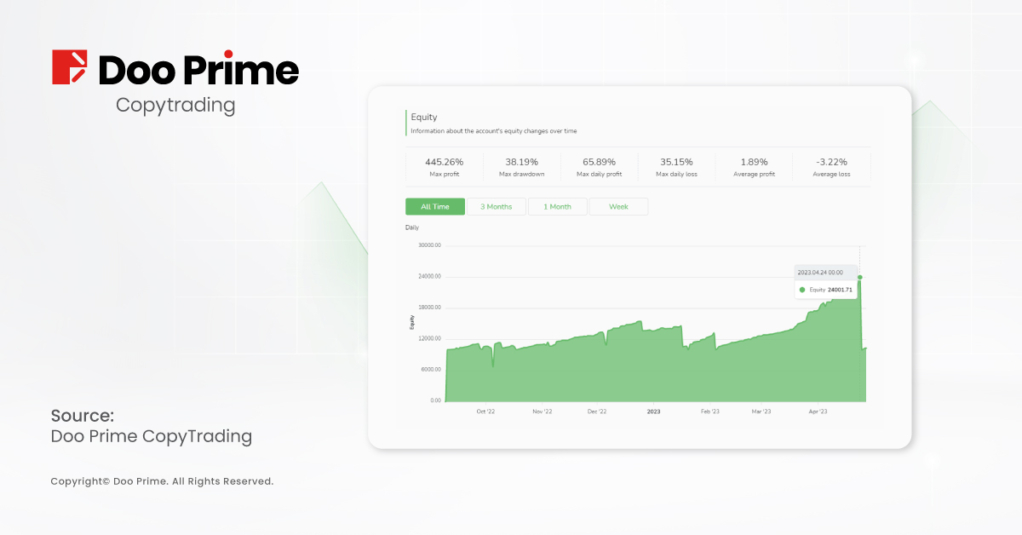

“Bīngshān——huángjīn shèngshǒu” or “Iceberg ——Holy Hand of Gold” (冰山——黄金圣手) a trading signal provider was established on 9th September 2022, and has achieved a return of 278.04% to date, equivalent to more than doubling the initial investment in just over six months.

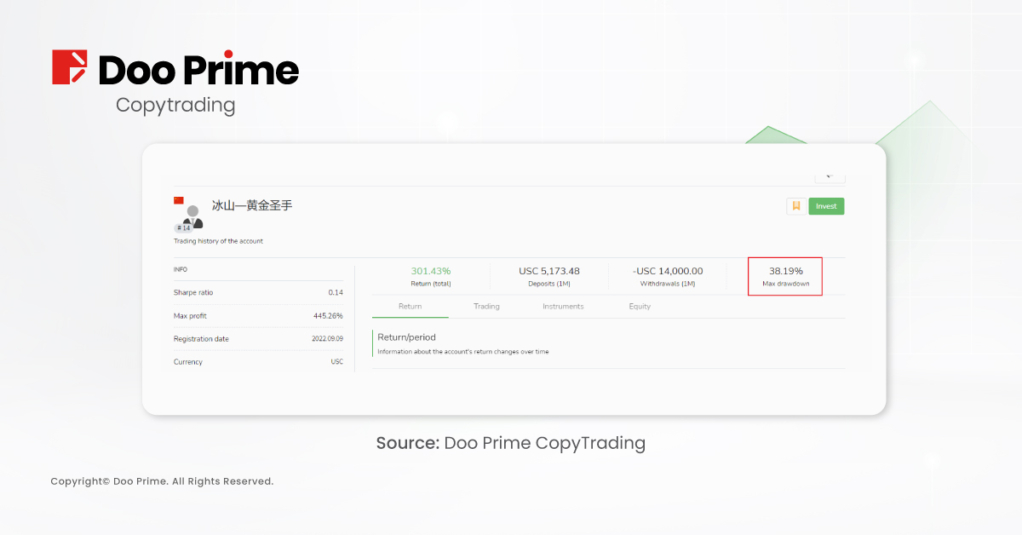

While this may not be an unprecedented return in the CFD market, what sets it apart is the fact that its maximum drawdown since its commencement is only 38.19%. This impressive return combined with exceptional stability makes “Bīngshān——huángjīn shèngshǒu” or “Iceberg ——Holy Hand of Gold” (冰山——黄金圣手) a standout among other signal providers.

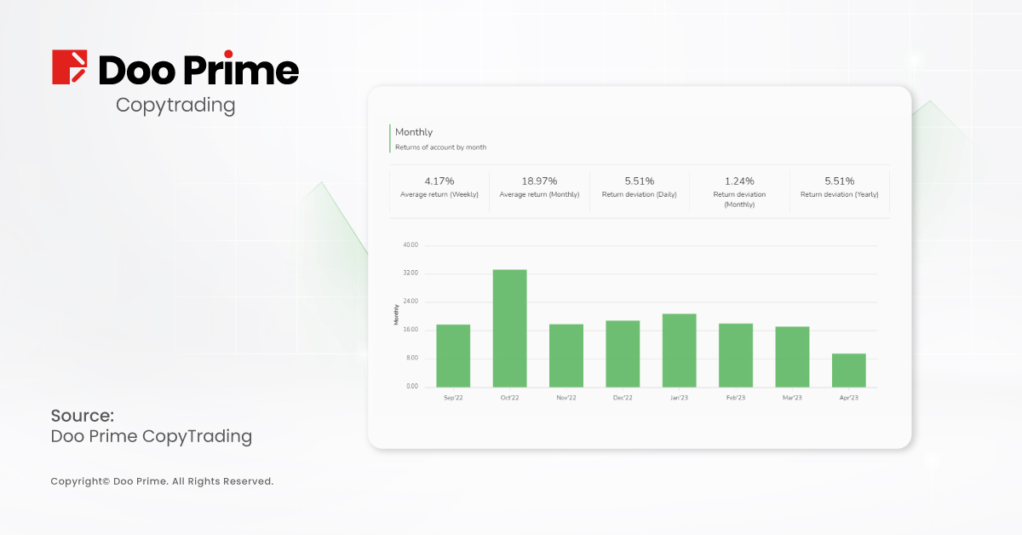

When looking at monthly performance, the signal provider has consistently achieved positive returns each month, with returns almost evenly distributed across the months. Since its commencement in September of last year, monthly returns have exceeded 16% except for the current month of April, which is not yet complete. The average monthly return since its commencement is an impressive 18.08%.

Investment Stability: ⭐️⭐️⭐️⭐️⭐️

As previously mentioned, “Bīngshān——huángjīn shèngshǒu” or “Iceberg ——Holy Hand of Gold” (冰山——黄金圣手) signal provider has a maximum drawdown of only 38.19% and an average monthly return rate of 18.08%, indicating its stability.

The use of the “Martingale Strategy” is one of the key factors that contribute to its consistent returns. The Martingale Strategy involves choosing to buy long or sell short when placing an order. If there is a loss, the amount of the next order is doubled to recover the loss.

For example, starting with a small position of 0.01 lot, if the trade is successful, the position is closed, and profits are taken. If the trade is unsuccessful, the next trade would be 0.02 lots.

By increasing the position size with each losing trade, the average position price decreases, and profits can be taken once the price rebounds. Thus, with sufficient capital, this strategy can potentially provide a stable return as losses can be regained in a single successful trade, making it a low-risk strategy.

Capital Allocation: ⭐️️⭐️

“Bīngshān——huángjīn shèngshǒu” or “Iceberg ——Holy Hand of Gold” (冰山——黄金圣手) operates with a relatively small amount of funds as the signal provider uses a cent account, with the current funds amounting to approximately 20,843 cents, or just over USD 200. Due to the low amount of funds, investors may consider following this signal provider with a proportionate amount of funds to mitigate potential risks.

Overall Assessment Of The Signal Provider: ⭐️⭐️⭐️️⭐️

Overall, despite the relatively small amount of capital in “Bīngshān——huángjīn shèngshǒu” or “Iceberg ——Holy Hand of Gold” (冰山——黄金圣手), its strength lies in its stable returns. Users can consider following this signal provider with a certain percentage of their funds to achieve steady profits.

Are you an aspiring investor seeking to embark on a winning trading journey by following a high-quality signal?

If so, we invite you to click the link and sign up as a follower now and start enjoying the benefits of our quality signal provider.

Additionally, Doo Prime CopyTrading has introduced the Instant Profit feature that allows signal providers to share their profits instantly. If you wish to join our CopyTrading platform, and earn more income, while leading novices to success, please click on this link and register as a signal provider today!

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.