In just a few weeks, Elon Musk‘s DOGE (Department of Government Efficiency) has reportedly saved the U.S. government a staggering $100 billion by cutting waste and cracking down on corruption. This bold initiative, launched under President Donald Trump’s administration, is designed to streamline federal spending and eliminate inefficiencies.

For traders and investors, DOGE’s rapid success signals potential shifts in the U.S. economy, with implications for the national debt, deficit, inflation, and overall economic growth.

But can Musk’s DOGE truly be a catalyst for economic prosperity? Let’s explore its impact and what it means for the financial markets.

What is DOGE?

Elon Musk’s DOGE, introduced in early 2025, is an aggressive initiative aimed at reducing unnecessary government expenditures. Its name, a nod to the Dogecoin cryptocurrency and the viral Shiba Inu meme, reflects Musk’s signature unconventional approach.

In just a short time, DOGE has already uncovered and eliminated wasteful spending across multiple federal agencies. Reports suggest the initiative is saving the government up to $1 billion per day. With total savings already surpassing $100 billion.

This is big news for investors. Excessive government spending has long been a concern, contributing to rising national debt and economic instability. If DOGE continues on this trajectory, it could boost investor confidence and stabilize financial markets.

The U.S. National Debt Crisis: Why It’s a Big Deal

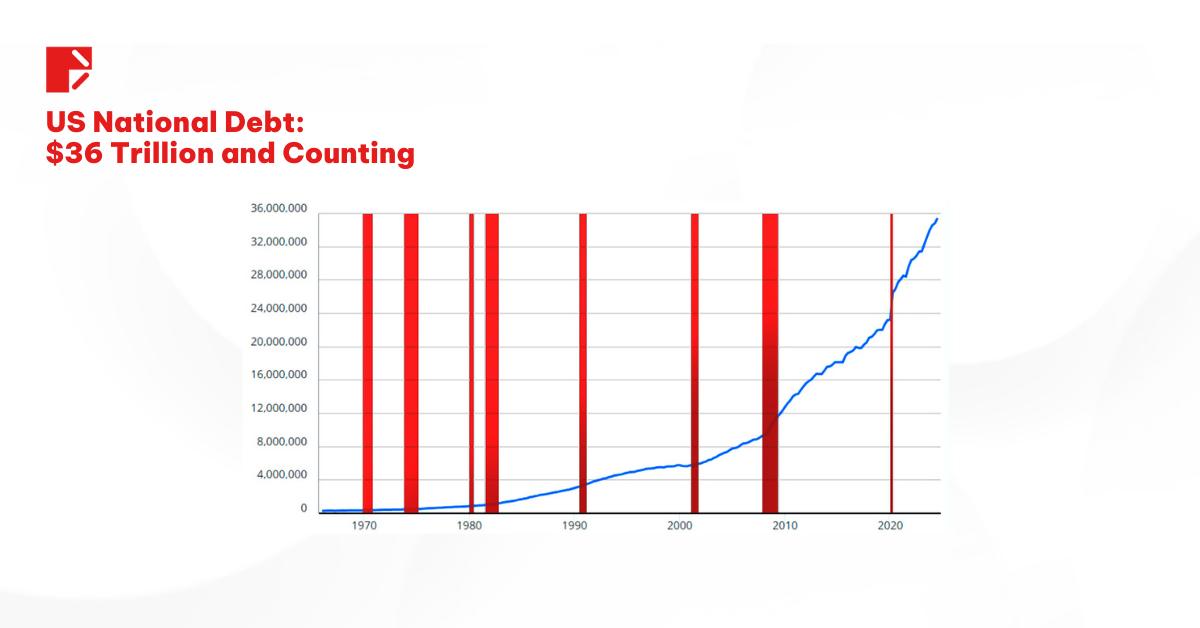

As of early 2025, the U.S. national debt has soared past $36 trillion, with annual deficits exceeding $2 trillion. If left unchecked, this deficit could reach $2.5 trillion by 2035.

One major consequence of this growing debt is the burden of interest payments, which now account for roughly 13% of the federal budget—more than the entire defense budget. This raises serious concerns about long-term economic stability and the government’s ability to fund essential services.

This is where DOGE steps in. If the initiative continues saving $1 billion per day, it could reduce the national debt by $365 billion annually. While this amount may seem small in comparison to the total debt, it’s a step toward greater fiscal responsibility.

For investors, a reduced deficit could mean less government borrowing, which in turn could keep interest rates in check. Lower interest rates typically lead to a more favorable environment for stocks, cryptocurrencies, and other high-risk assets, as they make borrowing cheaper and stimulate economic activity.

DOGE’s Role in Controlling Inflation

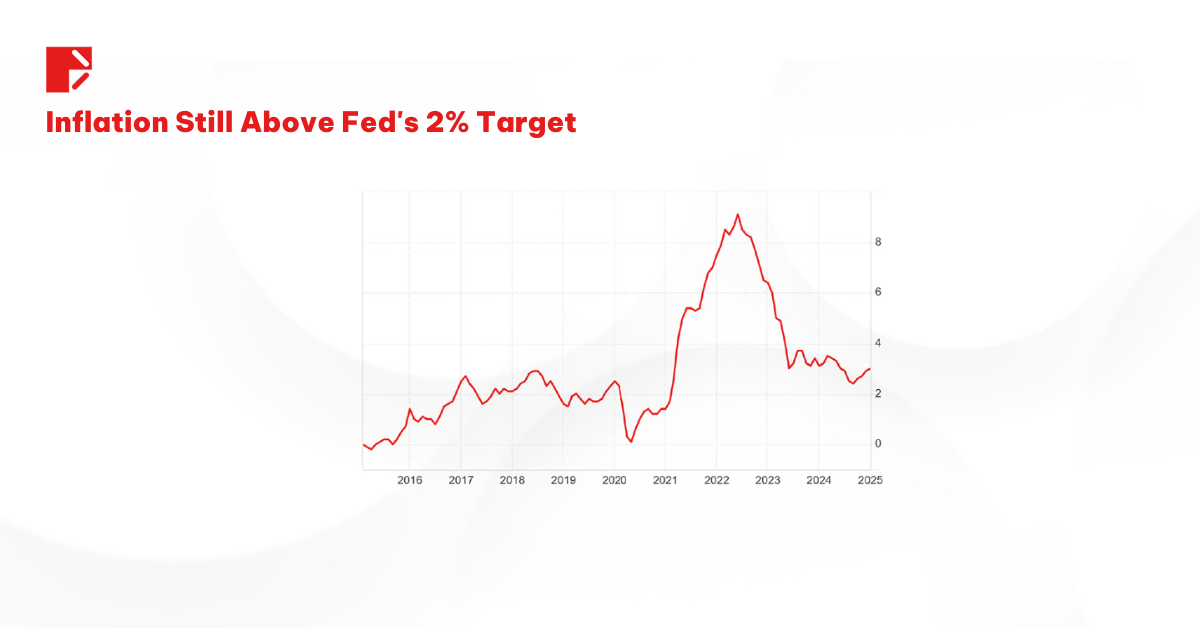

Inflation has been a persistent issue in the U.S. economy, especially after peaking around 9% in 2022 due to pandemic-related stimulus spending and supply chain disruptions. To combat this, the Federal Reserve implemented aggressive interest rate hikes, which led to higher debt servicing costs and fears of a “debt spiral.”

Musk has argued that reducing government spending is key to controlling inflation. By cutting $100 billion in waste, DOGE aims to align government spending with actual revenue, potentially reducing the need for excessive borrowing and money printing. If successful, this could help stabilize inflation, making economic conditions more predictable and investment-friendly.

Elon Musk’s DOGE Impact

Elon Musk, appointed by President Donald Trump to lead DOGE, has embarked on an ambitious mission to cut federal spending by up to $2 trillion. In just one month, Musk’s DOGE has identified and eliminated over $100 billion in fraudulent and wasteful spendings. Here are some of the key actions they’ve undertaken:

- Canceling Redundant Contracts: DOGE canceled 167 federal contracts, saving over $115 million. One notable example was a $2.23 million contract for “equity assessments” within the Department of Health and Human Services.

- Shutting Down Inefficient Agencies: Agencies like the U.S. Agency for International Development (USAID) and the Consumer Financial Protection Bureau (CFPB) were closed due to excessive spending, reducing bureaucratic overhead.

- Identifying Fraudulent Payments: Musk highlighted systemic fraud in federal entitlement programs, where losses exceed $100 billion annually. DOGE enforces stricter oversight to prevent taxpayer money from being wasted.

Challenges and Criticisms

While DOGE has made an impressive start, it’s not without challenges. Here are some of the main obstacles:

- Political Pushback: Major budget cuts and agency closures inevitably face resistance from lawmakers, government employees, and program beneficiaries. Navigating this political landscape will require careful negotiation.

- Legal Challenges: Restructuring or eliminating federal agencies could trigger legal battles, slowing down or even blocking some of DOGE’s initiatives.

- Economic Risks: While reducing waste is beneficial, abrupt spending cuts could have unintended consequences, such as job losses or reduced public services. Striking the right balance between fiscal responsibility and economic stability is crucial.

Musk’s DOGE: A Catalyst for Economic Growth?

Elon Musk’s DOGE has made an undeniable impact, saving $100 billion in less than a month and shining a spotlight on government inefficiency. This initiative offers hope of addressing the U.S. national debt, reducing the deficit, and curbing inflation.

While challenges remain, DOGE’s early success suggests it could be a catalyst for long-term economic growth, potentially reshaping the fiscal landscape and boosting investor confidence.

For now, traders and investors should stay informed, weigh the risks and opportunities, and consider how this bold experiment could shape the future of the U.S. economy.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.