Defense stocks are taking a hit. Investors are watching closely. The reason? Trump’s push to end endless wars.

For decades, defense contractors thrived on global conflicts. Now, with Trump vowing to scale back military interventions, the game is changing. The market is reacting fast.

Let’s break it down.

Why Are Defense Stocks Dropping?

The defense industry depends on war. Military spending fuels contracts, weapons sales, and tech development. When war is on the table, stocks soar. When peace talks begin, stocks take a hit.

That’s exactly what’s happening now. Trump is pivoting away from military conflicts, focusing on diplomacy instead. Investors are nervous. Defense stocks are slipping.

Lockheed Martin, Northrop Grumman, and AXON are falling fast. Wall Street isn’t sure what comes next.

Trump’s Shift: What’s Changing?

Trump has been clear: No more endless wars. He’s aiming to pull back U.S. military presence in global hotspots.

Some key moves:

- Troop withdrawals from the Middle East and Europe.

- Cutbacks on defense spending to prioritize domestic policies.

- Peace talks with countries that were once adversaries.

- Less intervention in foreign conflicts.

For defense companies, this spells trouble. Government contracts could shrink. International arms deals may slow. Investors see risk, and they’re pulling out.

US vs. EU Defense Stocks: Who’s Losing?

US defense stocks are falling.

Over the month:

| Stocks | Performance |

| Lockheed Martin (LMT) | -11.74% |

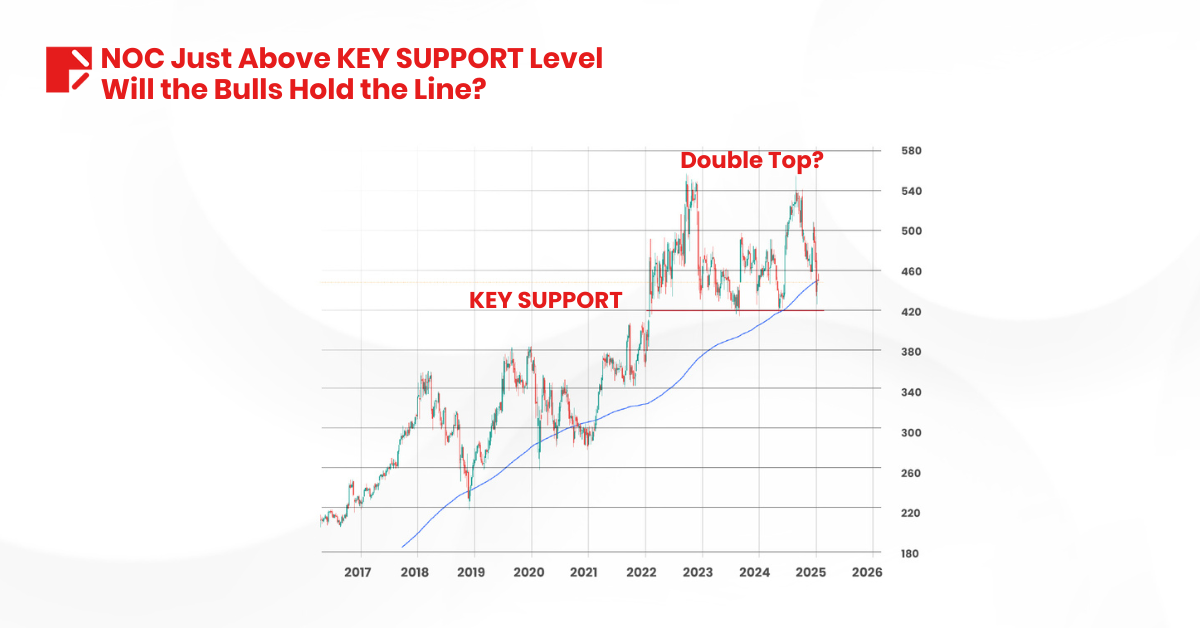

| Northrop Grumman: (NOC) | -10.84% |

| General Dynamics (GD) | -9.49% |

| AXON Enterprise (AXON) | -15.53 |

Meanwhile, European defense stocks are rising.

The fall in US defense stocks may be linked to news that the US Department of Defense is preparing for budget cuts ahead of the DOGE audit led by Musk.

In contrast, European defense stocks are gaining as investors expect increased European defense spending to fill the gap left by U.S. policy shifts.

Pentagon Budget Cuts: The Latest Blow

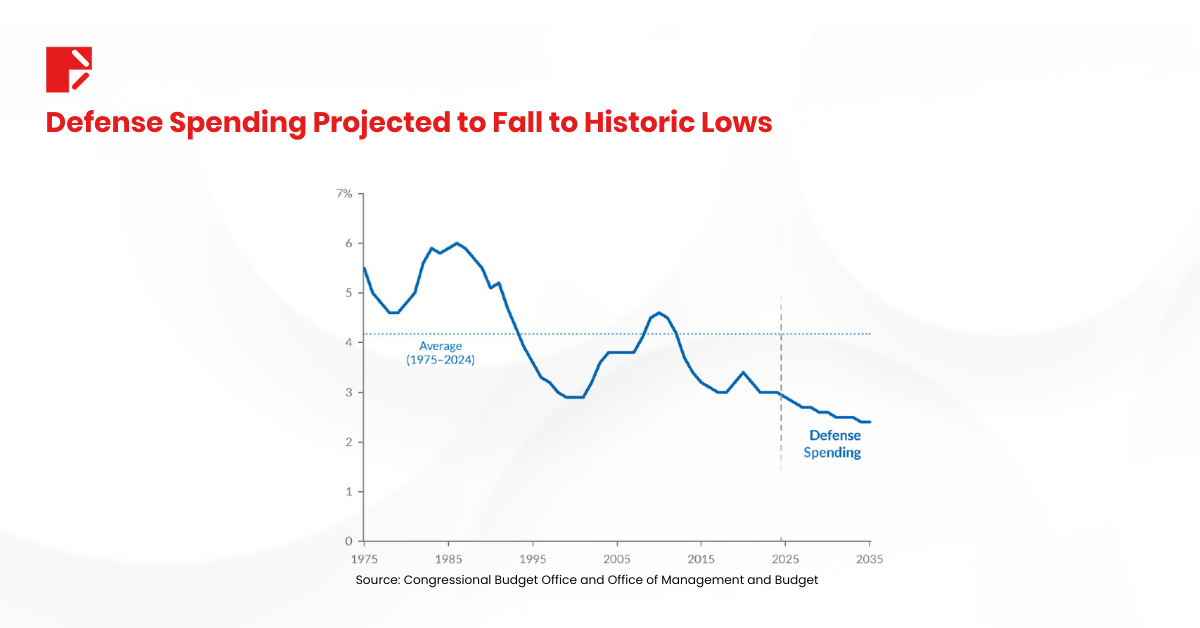

Trump wants to slash the Pentagon’s budget by 8% per year for the next five years.

That’s a massive $50 billion cut. The money will shift to border security and drone tech.

The market reacted fast. Defense stocks dropped hard.

Palantir Technologies plunged 10% after the announcement.

Deputy Secretary of Defense Robert Salesses weighed in. He said the cuts aim to streamline spending.

But there’s a catch. Big defense contractors could lose billions. Procurement and research budgets may shrink.

Investors are spooked. Many are rethinking their positions in US defense stocks.

Geopolitical Shifts: The Russia-Ukraine Conflict

Trump wants to end the war in Ukraine. He’s pushing for peace talks.

But Zelensky isn’t on board. Ukraine wants to keep fighting.

The EU also opposes a quick settlement. They see Russia as a long-term threat.

This standoff has shifted investor bets. Money is flowing into European defense stocks. The reason? The EU needs to keep military spending high.

If the U.S. steps back, Europe must fill the gap. Defense companies in Germany, France, and the UK are cashing in.

Another Factor: Shifting Alliances

Trump’s “America First” policy is shaking up global alliances. The U.S. is pulling back. NATO allies are on edge. Can they rely on the U.S. for defense? Many aren’t sure.

So, they’re investing heavily in their own military. More tanks, more fighter jets and more weapons. That’s why European defense stocks are climbing, even as U.S. stocks fall.

What’s Next for the Defense Stocks?

This isn’t a crash. But it’s a sign of uncertainty.

Will Trump’s peace-first stance hold? If yes, defense stocks could keep struggling. If tensions rise again, they might recover.

Some analysts believe this is a buying opportunity. Others warn that the industry is entering a new era. Here’s what investors should watch:

- Defense budgets for 2025: Will spending continue to shrink?

- Geopolitical tensions: If new conflicts emerge, defense stocks could rebound.

- Earnings reports: Companies might revise their revenue expectations.

Should Investors Be Worried?

Not necessarily. The defense industry isn’t going anywhere. The U.S. will always need military power. But the way money flows is shifting.

Companies may pivot to cybersecurity, AI, and space defense to stay competitive. Investors should look beyond traditional weapons manufacturing.

Defense stocks dropping isn’t just about Trump. It’s about a changing world. Less war, more diplomacy. A shift in spending priorities. And a market that hates uncertainty.

For investors, this is a time to rethink strategies. Defense is evolving. The question is: Are you ready for the change?

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.