Gold price defies gravity and is on track to reach record highs, despite the record pace of rising interest rates. With the ongoing Federal Reserve Board (Fed)’s disinflation narrative, the conventional wisdom suggests that the safe-haven asset should lose the current bullish momentum as investors will look for safer investments with higher yields such as bonds.

However, there are many reasons why gold demand remains strong and resilient. Fear of inflation reacceleration, the BRICS’ gold-backed currency, hedging against the possibility of a deeper recession, and more — all these factors have investors questioning whether this could be the start of a new gold bull market.

In this article, we will go back to history and understand price behavior by exploring several key factors that make the precious metal an attractive investment for many investors today. Also, we will explore what kind of fundamental catalysts could trigger a breakout to record highs.

Gold Has Stood The Test Of Time

Before we analyze the future, we must first look back at gold’s history to better understand the current price dynamics.

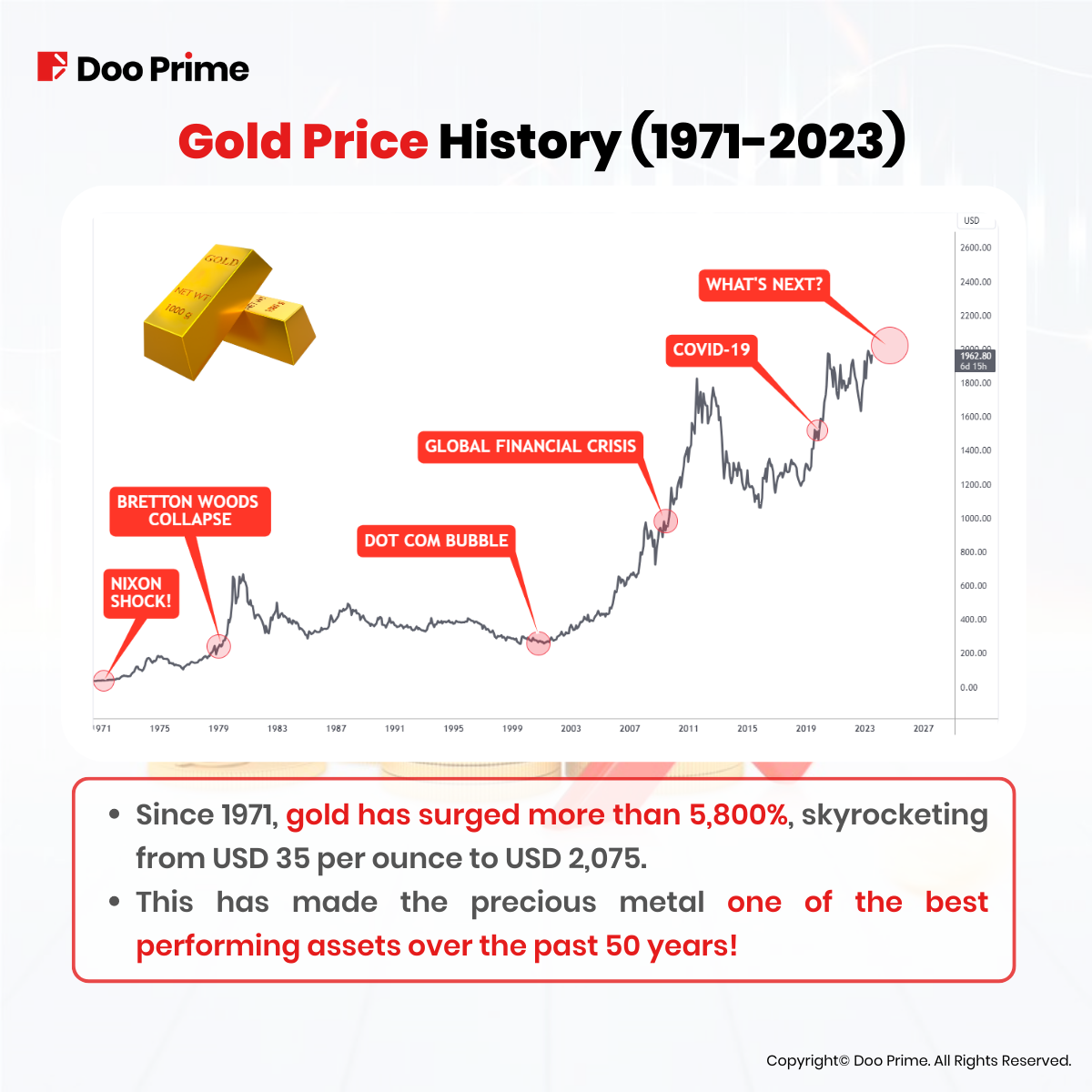

The price of gold has fluctuated wildly over the past 50 years. However, these moves generated certain patterns that could be useful for investors. By understanding these price behaviors in a historical context, we can gain a deeper understanding of the factors that influence the price of gold.

Before 1971, gold price was pegged to the USD at around USD 35 per ounce. For every dollar that circulated in the market, it was backed by real gold. To put it in simpler terms, the Fed could not overflow the market by printing money like they do today.

However, in 1971, the U.S. President Nixon changed the global financial system almost overnight, when he abandoned the gold standard. A decision had to be made to address the country’s inflation problem.

This decision led to a loss of confidence in the dollar and an increase in demand for gold, triggering the stagflation of the 1970s and ultimately the end of the Bretton Woods system of fixed exchange rates.

After the rush comes the calm. For the next 20 years, gold prices stayed relatively stable trading between USD 200 and USD 500 per ounce.

The next bullish wave started to form only after the burst of the Dot Com bubble in the early 2000s. Once again, fear of inflation and economic uncertainty revived the demand for gold after years of consolidation.

The safe-haven metal soared around 600% and reached USD 1000, but it did not stop there.

The 2008 subprime financial crisis put the global financial system at risk. This made the Fed, and the global central banks intervene and expand their balance sheets to save the world economy.

These back-to-back economic recessions of 2000 and 2008 triggered a historical gold rush of over 600% gains in the safe-haven asset. We can safely say that long-term gold investors were one of the biggest beneficiaries in that period of time, as the asset prices reached just shy of USD 2,000 per ounce.

After gold peaked in 2011, the same consolidation pattern seen in the 1980-1990s repeated. However, this time, COVID-19 disrupted it and cut it short by bringing back demand to the precious metal.

Once again, global central bankers intervened by cutting rates to near zero and doubling their balance sheets to record highs. This is a familiar pattern that has played out after every major economic recession in recent decades.

After every recession and central bank interference, gold breaks to new record highs. Finally, in 2020, for the first time in history, gold broke above the USD 2,000 psychological round number.

Well, at least temporarily.

Ever since summer 2020, Gold bulls have been repeatedly frustrated in their attempts to break the USD 2,075 record high. Three times they have tried to take out the barrier, only to be met by bears who pushed them back down.

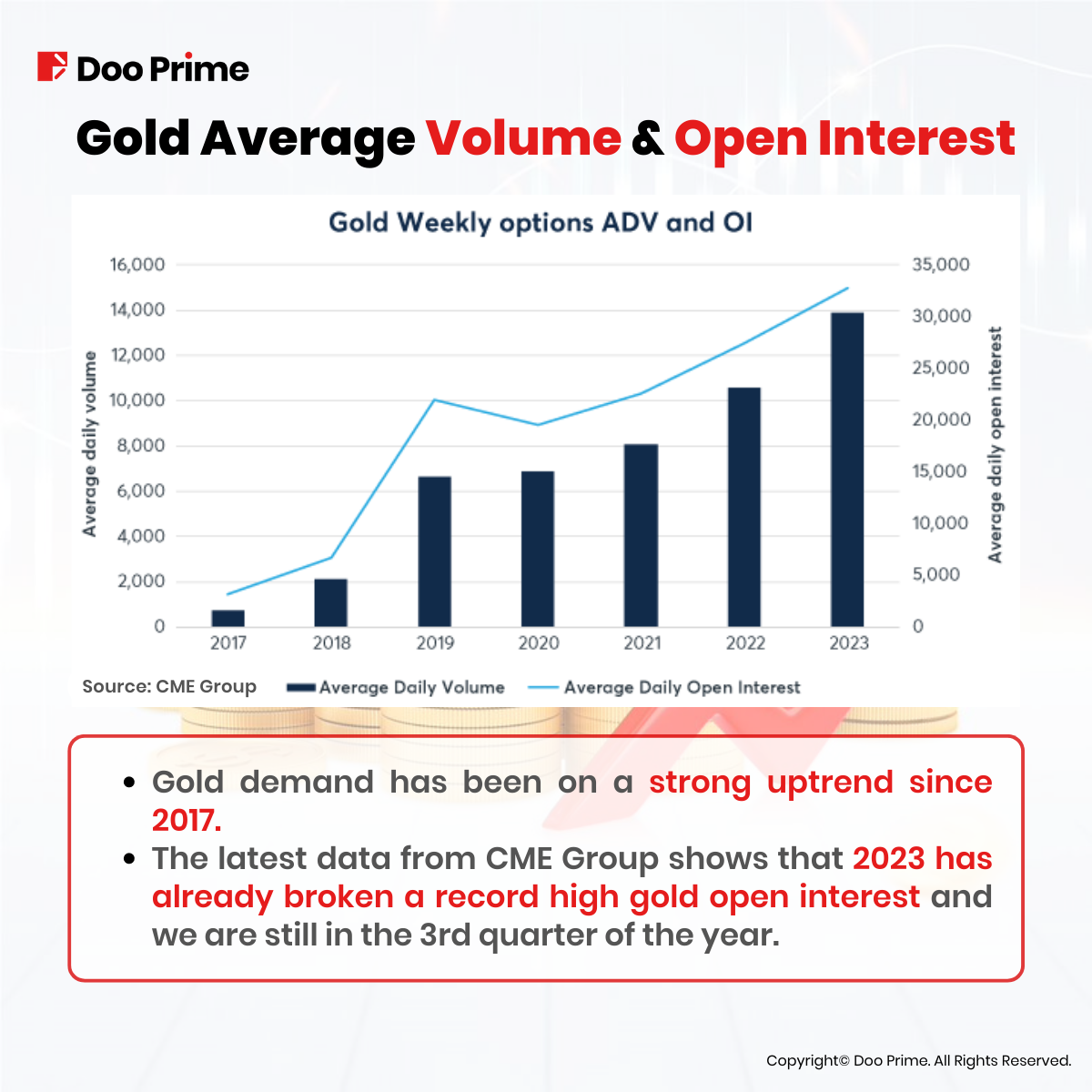

However, the pullbacks have been short-lived relative to historical fluctuations. The demand for gold remains strong, despite the rise of global interest rates, as investors wonder what could be next. Is there a recession on the horizon? Will the Fed be able to tame inflation before recession hits? Will we finally see the bulls break through and reach new heights, or will the bears continue to keep them at bay?

To answer these questions, we need to delve into some important economic and geopolitical factors.

Top 3 Gold Buyers In 2023

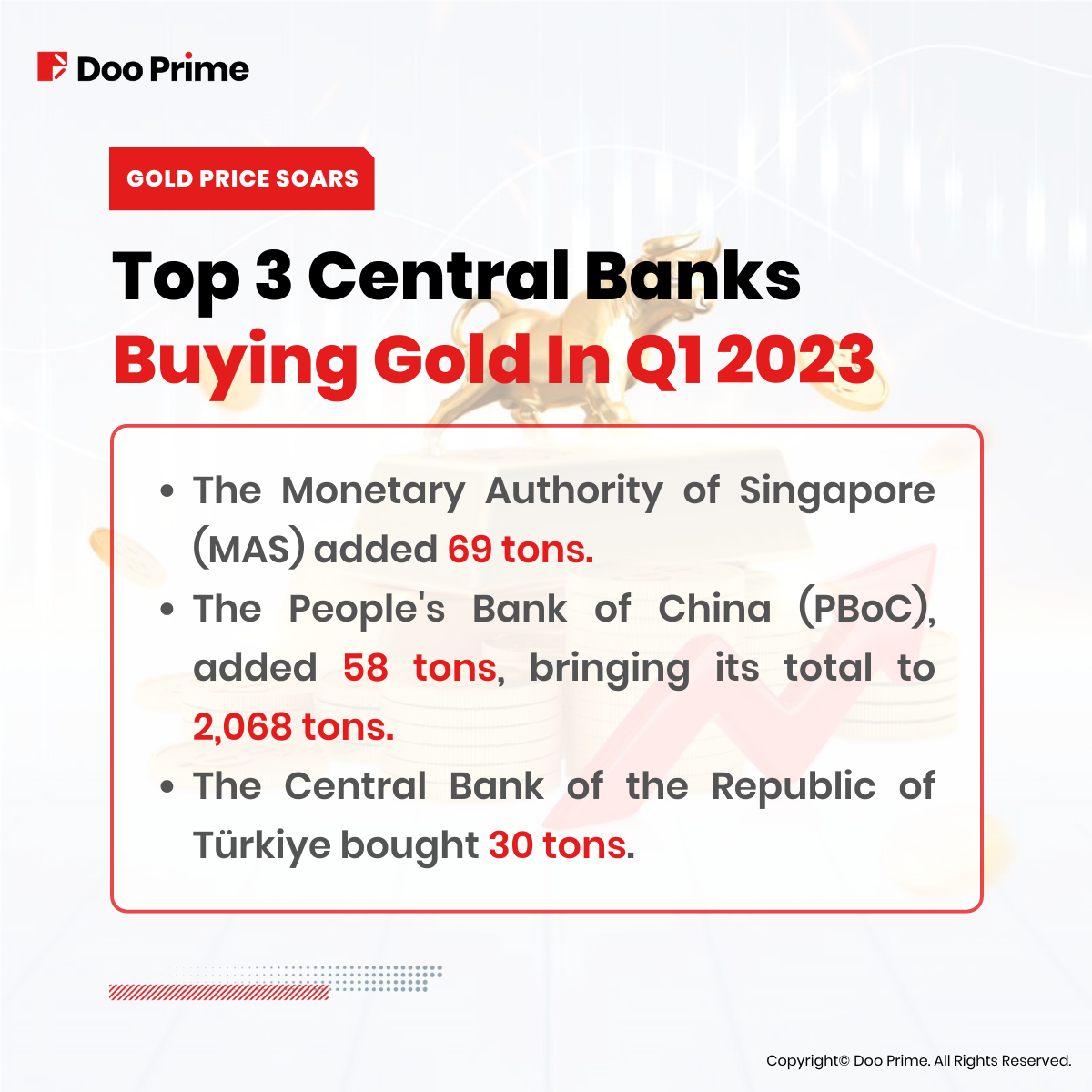

Central banks around the world are buying gold at a record pace as the demand hit 228 tonnes in Q1, 34% higher than the previous Q1 record set in 2013. This is a major sign of their concern about the future of the global economy and their desire to protect their reserves against economic uncertainty.

In addition to these significant buyers, India, Czech Republic and the Philippines also made notable purchases. Meanwhile, Russia’s gold reserves fell by 6 tons, but they are still 28 tons higher than the last reported figure from the central bank the previous year.

Alternatively, major banks such as JP Morgan reported that the bank remains structurally long-term bullish both gold and silver prices as we approach the likely end of the Fed rate hiking cycle. Citigroup sees gold prices potentially heading to USD 2,100/oz at some point in the first half of 2024.

The continued buying of gold by central banks and major investment banks is likely to support the price of yellow metal in the coming months. This could be good news for long-term investors who are looking to add gold to their portfolio and protect their wealth.

Follow The Smart Money

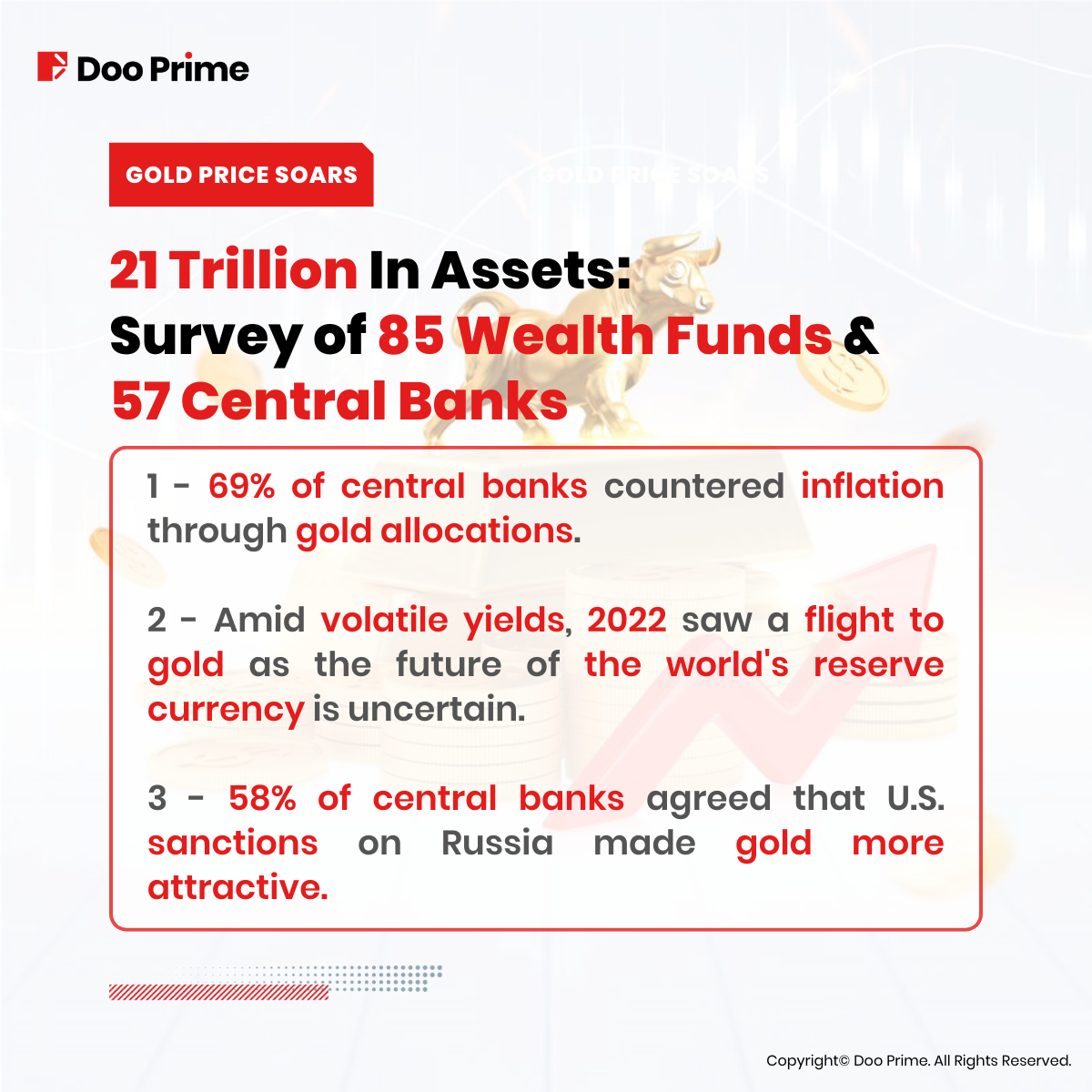

Invesco just released its annual global survey of 85 sovereign wealth funds and 57 central banks, collectively managing USD 21 trillion. Here are the most interesting points related to gold that we gathered from the survey:

In summary, if we combine both of these data, we conclude that the smart money is reallocating capital away from volatile bonds and they are buying gold and preparing for high levels of inflation.

BRICS Gold-Backed Currency

In the wake of U.S. sanctions on Russia, the BRICS nations (Brazil, Russia, India, China and South Africa) are leading a global shift away from the U.S. dollar by creating an alternative way to trade without the reliance on the U.S. Dollar. If they succeed, it could have a major impact on the global financial system and the price of gold could skyrocket.

For the first time in history, the U.S. dollar, the world reserve currency for nearly a century, is facing its most serious challenge yet. However, it is still very early for investors to panic. According to the most recent IMF’s data, the greenback remains the king compared to other currencies with a 59% market share.

Additionally, investors need to understand that the BRICS gold-backed currency is not a new currency, but rather a mechanism for using gold to settle trade between them. This makes BRICS countries less susceptible to fluctuations in the value of the U.S. dollar, which could give them more economic independence and more room for growth.

More than 40 nations are interested in joining the BRICS gold-backed trading system, Saudi Arabia being among them. Saudi Arabia is the world’s largest oil exporter, and if it were to join the system, it would be a major win for the BRICS countries and a big blow to USA.

Overall, the BRICS countries’ efforts to create a gold-backed trading system are a significant development in the global financial system. If successful, these efforts could lead to a more multipolar global financial system, in which the U.S. dollar is no longer the dominant currency. This would have several implications for the global economy, and it is something that investors should keep an eye on.

As the next BRICS summit approaches on August 22nd, any positive developments arising from it could potentially lead to a considerable upswing in gold prices. As such, investors should pay close attention to the outcomes of the summit.

Is Fourth Time The Charm?

Investors should watch the 2000-2075 resistance zone for any potential breakout in the gold market. However, to break out to new record highs, the gold market could be in need of a new catalyst. This could be anything from a renewed fear of inflation, the Fed pivoting on their monetary policy and starting to cut rates, or a strong development of the BRICS gold-backed currency.

Something has to trigger the next wave to the upside in order for us to potentially see the 2500 and 3000 levels. Once the precious metal sees record highs with strong momentum, short sellers will likely be forced to cover their positions, sending gold prices parabolically higher.

As we observe the gold market, keeping a keen eye on these factors will help investors gauge the likelihood of a significant breakout and the potential for further price gains in the future.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.