The Russia-Ukraine peace deal is back in the headlines. Markets are watching closely. Oil traders, even more so.

Since the war broke out in 2022, oil prices have been on a rollercoaster. At one point, crude surged nearly 50%, hitting highs above $120 per barrel. The conflict disrupted global supply chains, triggered sanctions, and squeezed energy markets.

Now, with talks of a peace deal, oil faces another big test. Will prices plummet as supply fears ease? Or is there another twist in the story?

Why Oil Prices Could See Volatility

A Russia-Ukraine peace deal could mean fewer sanctions, restored trade, and a return of Russian oil to global markets.

🔹 Russian crude supply could increase: Sanctions have limited Russian exports, forcing Moscow to sell at discounts. A peace deal might lead to relaxed restrictions, pushing more oil into global markets.

🔹 Geopolitical risk premium could fade: The war injected uncertainty into markets. Traders priced in supply disruptions. If the war ends, that risk premium vanishes.

🔹 OPEC+ response remains uncertain: Russia is a key player in OPEC+. If a deal shifts Moscow’s production strategy, it could impact the cartel’s output plans.

If supply increases while demand stays flat, prices could drop. But markets are never that simple.

The Russia-Ukraine Peace Deal Impact

A Russia-Ukraine peace deal could bring stability to the global oil market. If tensions ease and sanctions are lifted, oil production from Russia could surge. More oil in the market could push prices down.

Some analysts predict a drop of $5 to $10 per barrel. This is based on the assumption that Russian oil exports would increase significantly. More supply generally leads to lower prices.

However, the terms of any peace deal matter. What if the agreement includes production cuts to stabilize the market? That could limit the impact of any price drops. A peace deal doesn’t automatically guarantee lower prices.

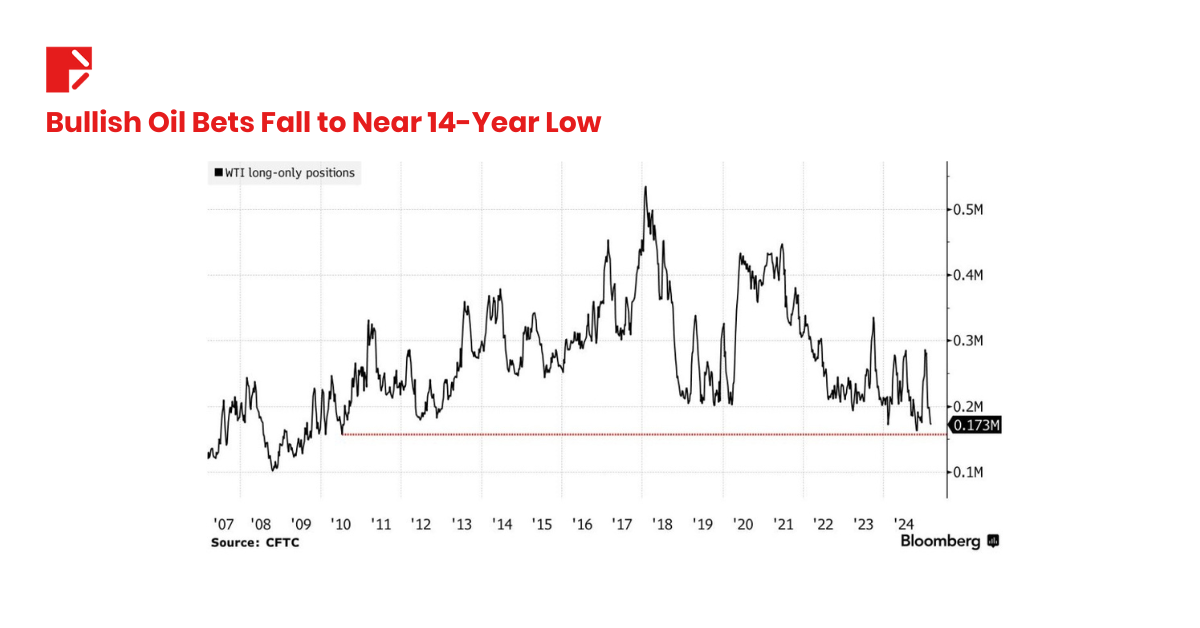

Hedge Funds Are Cutting Their Bets on Oil

Not everyone is betting on a price spike. Hedge funds have been slashing long positions in oil.

🔹 WTI Crude Oil long-only positions dropped to 172,576 contracts (March 4), near the lowest since 2010.

🔹 In just a few weeks, long positions fell by nearly 100,000, a huge move.

🔹 Since mid-January, oil prices have dropped 17%, falling to $67 per barrel, near the lowest since September 2024.

🔹 This marks seven straight weeks of declines, a streak last seen in late 2023.

The short oil trade is getting crowded. That could mean a short squeeze might be on its way.

Why Russia-Ukraine Peace Deal Might Not Crash Oil

While bearish bets are piling up, oil isn’t guaranteed to collapse. Here’s why:

🔹 Demand is still strong: Global energy consumption remains high. Any supply drop could still tighten markets.

🔹 OPEC+ could step in: If oil prices fall too much, the cartel could cut production to support prices.

🔹 Geopolitical risks remain: Even if the Russia-Ukraine war ends, tensions in the Middle East and other regions could keep oil volatile.

🔹 U.S. SPR restocking: The U.S. Strategic Petroleum Reserve (SPR) needs replenishing after record releases in 2022-2023. If prices drop too low, the U.S. could start buying, creating a floor for oil.

Technical Outlook: Oil at a Key Support Zone

Oil is currently trading in a descending triangle pattern on the weekly chart. This bearish formation signals potential downside risk.

🔹 Key support level is around $65 per barrel, which has been tested multiple times. A breakdown below this zone could accelerate selling pressure.

🔹 Bearish scenario: A confirmed break below the triangle’s support opens the door for a test of $60 per barrel and possibly lower.

🔹 Bullish invalidation: For bulls to regain control, oil needs to break above $77-$78, the upper boundary of the triangle. A breakout above this range could shift momentum back to the upside.

What’s Next for Oil?

For now, oil remains in a tight range, with traders waiting for confirmation. A decisive move in either direction could dictate the next big trend.

The question is which way will it break? Stay tuned to our blog for all the latest updates and insights on oil prices movement.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.