Tesla has always been a market mover. Love it or hate it, you can’t ignore it.

But with TSLA stock down 50% from its all-time high, this isn’t just another dip. It’s a reset.

A reset in price. A reset in sentiment. And maybe… an opportunity?

TSLA Stock Down: The Sentiment Spiral

The drop wasn’t just about earnings or margins. It was the narrative around Elon Musk.

Between his DOGE experiments, the noise around X, and Tesla cars getting torched in public, sentiment turned fast.

Investors got nervous. The media piled on. Analysts started downgrading.

TSLA stock went from being the market’s golden child to its favorite punching bag.

But markets are forward-looking. And it seems like they’re starting to look past the noise.

TSLA Stock Down: Retail Traders Step Up

Here’s where it gets interesting.

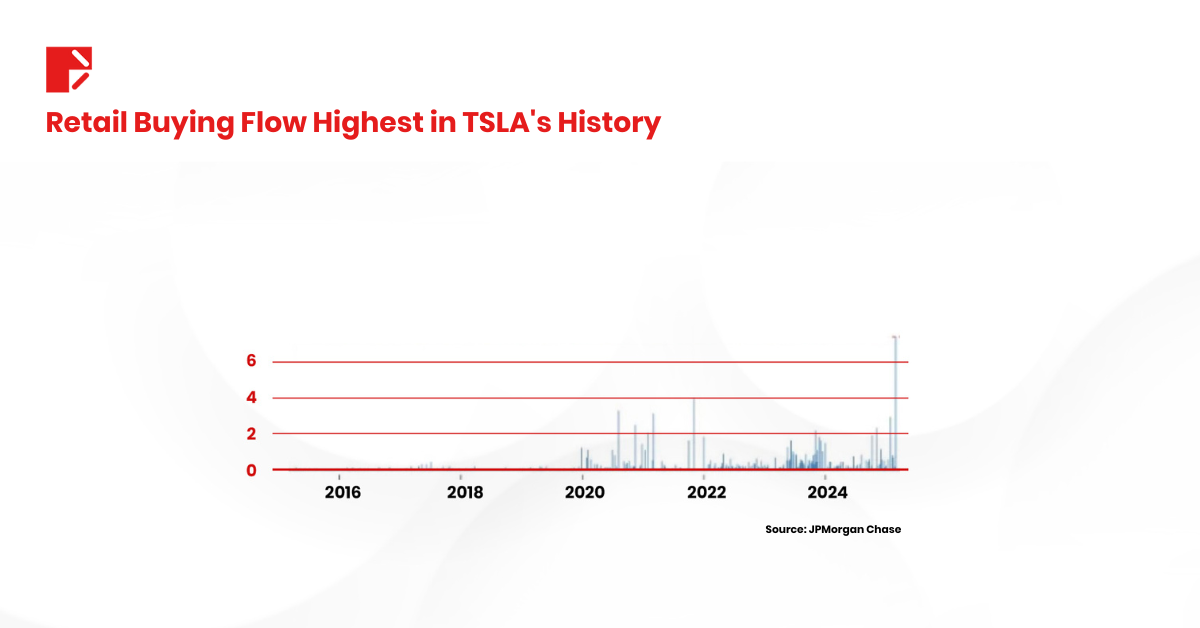

Despite all the negativity, retail traders are buying. A lot.

Net inflows show nearly $8 billion in retail money flowed into TSLA.

There has never been a 2-week inflow even HALF as large.

That’s a big vote of confidence, or maybe just blind loyalty.

Either way, retail is calling a bottom in Tesla. And historically, they’ve had a knack for getting loud just before big moves, up or down.

TSLA Stock Down: Is the Chart Starting to Turn?

Technically, after 9 consecutive red weeks, TSLA stock could potentially be building a base here. There’s a double hammer pattern forming on the weekly chart, just in time with the surge in retail inflows.

That $8B in buying pressure could be more than optimism. It might be the fuel this chart setup needs.

And the timing? Pretty interesting.

Tesla’s recent earnings report wasn’t a knockout, but it wasn’t a disaster either. Revenue came in a bit light, but margins held better than expected, despite price cuts across models.

So now we’ve got a base forming, retail stepping in, and a narrative that’s no longer getting worse.

If institutions start adding to the mix, this could become a fast-moving reversal.

But if not?

It’s just more exit liquidity disguised as retail conviction.

“Price doesn’t lie. Volume tells the truth.”

What to Watch

Here’s what traders are keeping an eye on:

- Weekly Double Hammer – The make-or-break pattern for bulls.

- Retail flow – Does the $8B trend continue?

- Options market – Are institutions quietly buying calls?

- Musk’s media behavior – The less noise, the better for sentiment.

TSLA’s Wild Card: AI, EVs, or Just Overhyped?

Even with TSLA stock down 50%, some bulls believe the real story hasn’t even started yet.

Musk continues to position Tesla as more than just a car company. From Dojo supercomputers to AI-driven full self-driving tech, and even humanoid robots like Optimus. There’s no shortage of futuristic fuel behind the Tesla narrative.

But here’s the thing: the market has heard it before.

Until the vision turns into real revenue and real adoption, these stories remain just that, stories.

Still, in a sentiment-driven market, narratives matter.

If Tesla delivers tangible progress on AI, autonomy, or robotics, it could trigger a serious shift in investor sentiment. Add a few headlines and a bullish tweet or two from Elon Musk, and the rally could reignite fast.

Trap or Turnaround?

Let’s be clear: the bottom won’t come with a flashing green light.

But signs are there. The flush may be done. The fear may be priced in. And if the next news cycle favors Tesla instead of fighting it?

We could be in for a sharp reversal.

Or… just another chapter in a slow bleed.

That’s the potential play.

TSLA Stock Key Takeaways

Tesla’s not dead. It’s bruised. It’s battered. But it’s still in the ring.

Retail is betting on a bounce. Smart money might be waiting to fade or join it.

Either way, TSLA is on watch. Big volume, big headlines, and big expectations.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.