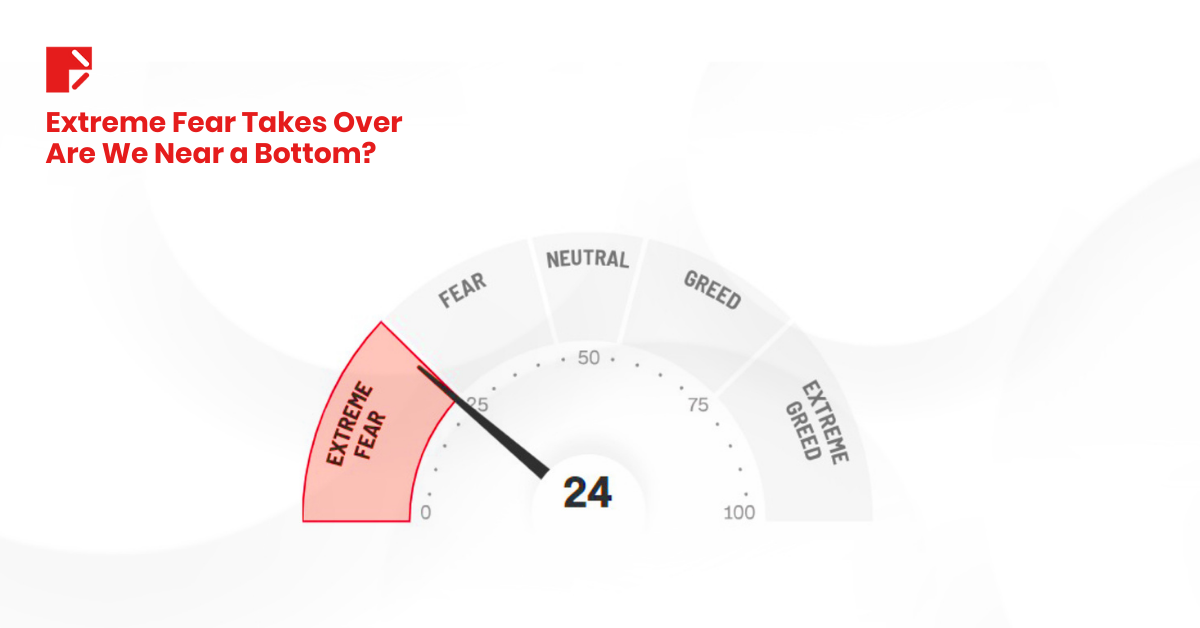

CNN’s Fear & Greed Index just hit “Extreme Fear.” If you’ve been around long enough, you know what that means: investors are in full-blown sell mode. Risk appetite is gone. Stocks are dumping. Crypto is bleeding. Money is flowing out fast.

But here’s the twist, this could be a bottoming signal.

When fear takes over the market, it often sets the stage for massive opportunities. The key? Knowing when to strike.

Let’s break down what triggered this sell-off and where the smart money might be headed next.

What Triggered the Panic?

It wasn’t just one thing. It was a perfect storm.

Trade tensions & tariffs: The U.S. and China are back at it, playing economic chess. Tariffs, sanctions, and supply chain disruptions are making traders nervous. Every time these two economic giants clash, markets feel the heat.

Adding fuel to the fire, the U.S. officially implemented 25% tariffs on imports from Canada and Mexico, effective Tuesday March 4th.

DOGE cuts spark concerns: Recent cost-cutting measures in key government agencies by the Department of Government Efficiency (DOGE), sparked concerns over economic policy shifts. Traders feared that reduced spending could slow down growth, and markets reacted.

Massive selloff in risk assets: Stocks? Down. Crypto? Down. Even commodities took a hit. The market went into full “risk-off” mode.

Gold: The Only Resilient Asset Standing

Amid this chaos, one asset has remained strong: Gold.

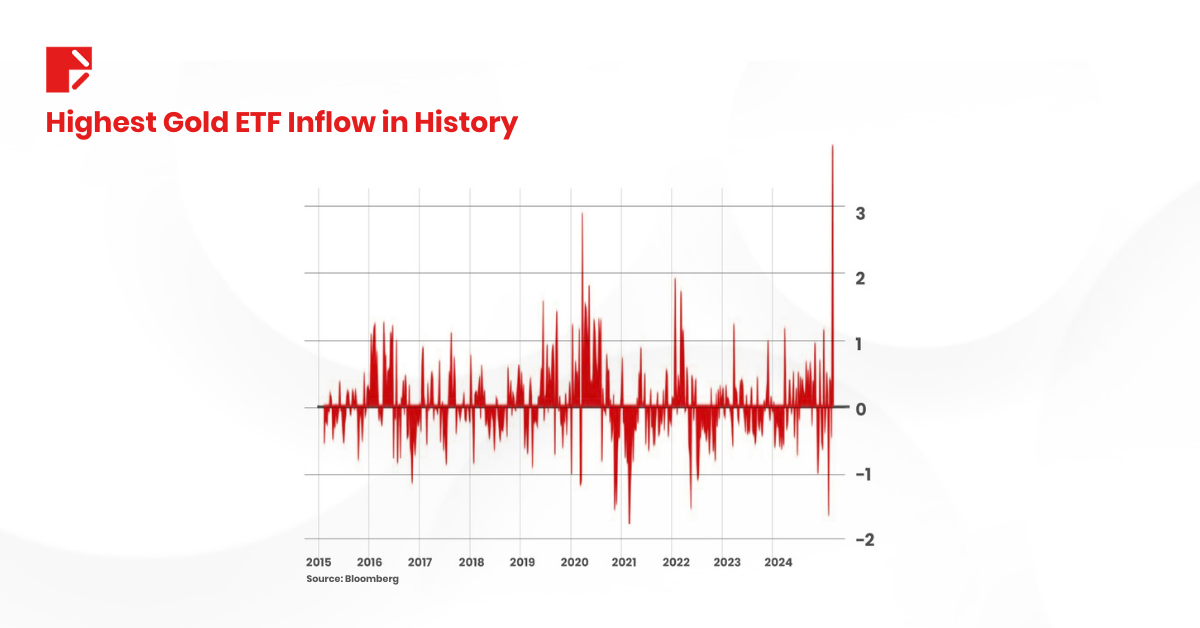

Gold ETFs just saw record-breaking inflows of $4.38 billion. Investors are running to safety. Gold prices are climbing. The GLD Gold ETF Weekly Fund Flow chart from Bloomberg shows a historic spike. Money is moving fast into gold.

Why? Because when markets panic, gold shines. It’s the ultimate safe-haven asset. While stocks and crypto crumble, gold is soaking up capital like a sponge.

This isn’t just a minor flight to safety, it’s a statement. Investors might be preparing for more turbulence ahead.

Fear & Greed Index: The Ultimate Contrarian Signal?

Let’s talk about the Fear & Greed Index.

It’s one of the most powerful contrarian indicators out there. Why? Because markets are emotional.

- When everyone is greedy, assets are overbought.

- When everyone is fearful, assets are oversold.

And right now? We’re deep in the “Extreme Fear” zone.

Historically, this is often a point where informed investors begin to consider purchasing opportunities.

Some examples:

🔹 In March 2020, when COVID fears sent the market into freefall, the Fear & Greed Index hit rock bottom. Within months, stocks and crypto staged one of the most insane bull runs in history.

🔹 In late 2022, as the Fed aggressively raised rates, the market crashed, and sentiment tanked. The Fear & Greed Index screamed “Extreme Fear.” Months later, the S&P 500 rebounded over 50%.

🔹 In early 2023, Bitcoin was trading at $16K, and everyone thought crypto was dead. The Fear & Greed Index was at historic lows. A year later? Bitcoin was pushing $50K.

See the pattern?

Fear can create opportunity.

Trump’s Tweet That Shook the Crypto Market

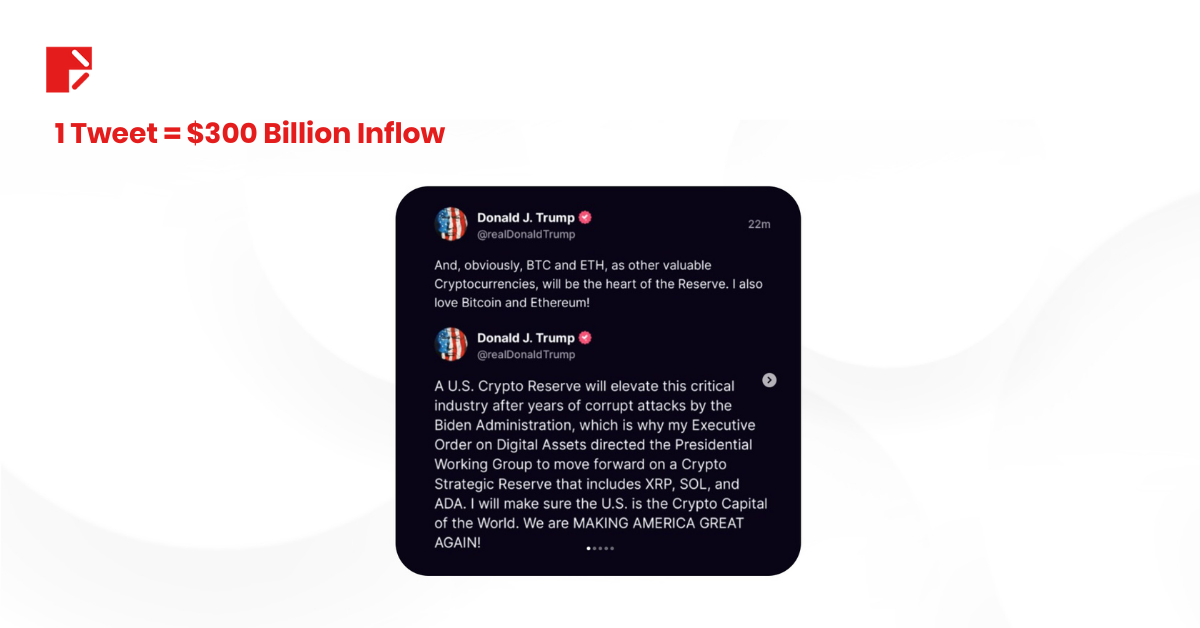

And then, out of nowhere, Trump tweets.

One post. One message. And boom—$300 billion floods into crypto within minutes.

Bitcoin soared. Ethereum followed. Altcoins exploded. Short sellers got obliterated.

This is why markets are wild. They can flip from fear to euphoria in an instant.

And if a single tweet can spark a rally, what happens when actual institutional money starts buying?

Fear & Greed Index: How to Take Advantage?

Extreme Fear doesn’t last forever. The question is: How do you position yourself?

Here’s what smart investors are watching:

Contrarians are preparing for reversals: If panic selling slows down, expect sharp rebounds. Historically, buying into extreme fear has been a winning strategy.

Look for oversold opportunities: Some assets are trading at fire-sale prices. Not everything is a bargain, but some stocks and cryptos are massively undervalued right now.

Crypto remains a wildcard: The Trump tweet was a reminder that narratives drive markets. With Trump now in office, crypto is back in the spotlight. If his administration pushes favorable policies, expect more upside.

Volatility = Opportunity: When fear grips the market, traders thrive. Big moves mean big trades. If you’re disciplined, you can capitalize on the chaos.

Fear & Greed Index: Bottom Line?

Fear feels terrible when you’re in it. But history shows that it’s where fortunes are made.

When everyone panics, the best opportunities are likely to emerge. The question is: are you ready to take advantage of them?

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.