The 2024 Nobel Prize in Economics has addressed a critical question: why some countries are rich while others are poor? Through their research on how social institutions are formed and their influence on national prosperity, the three laureates have shed light on this economic disparity. But will this award have any real impact on our markets?

In this article, we will explore the potential effects of the 2024 Nobel Prize in Economics on sectors like energy, sustainable development trends, and the outlook for emerging economies.

Overview of the 2024 Nobel Prize in Economics

Answer For a Big-Unsolved Question

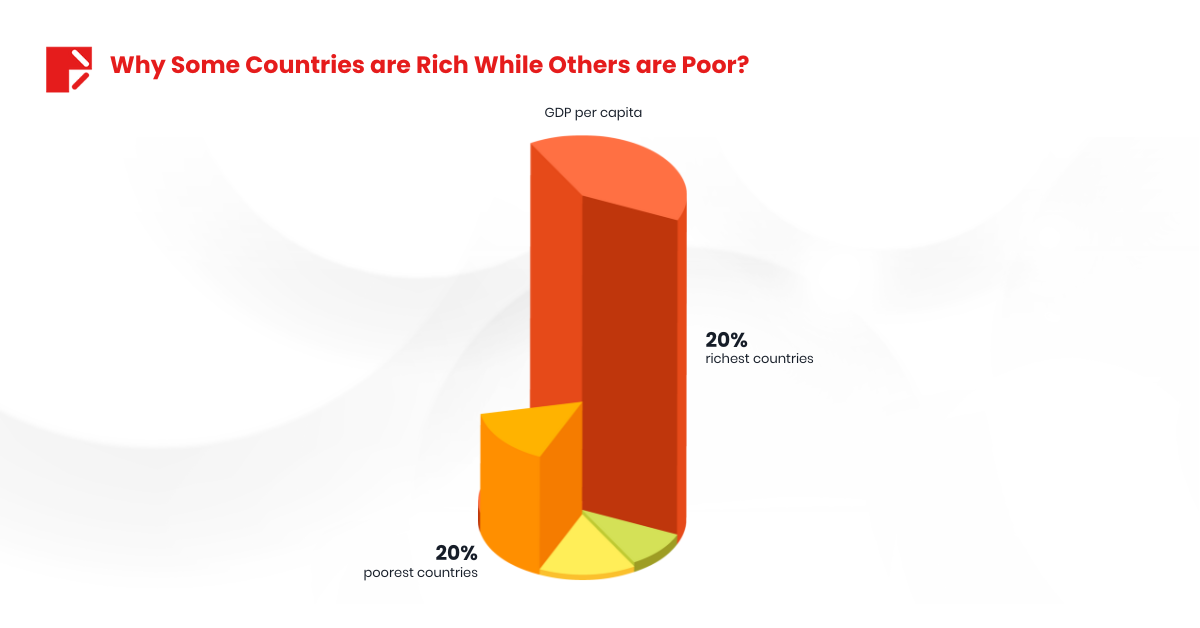

The richest 20% of countries in the world are now about 30 times wealthier than the poorest 20%. Despite some progress in poorer nations, the income gap between the richest and poorest countries remains stubbornly wide. Why is this the case?

Three American economists—Daron Acemoglu, Simon Johnson, and James A. Robinson—won the 2024 Nobel Prize in Economics for their work exploring the role of institutions in this disparity.

While their full research is complex, the core idea is the impact of “extractive” and “inclusive” institutions on economic development.

Extractive vs. Inclusive Institutions

The researchers classified economic institutions into two types:

- Extractive Institutions: These concentrate power and wealth in the hands of a few. Such systems stifle innovation and economic progress because resources are controlled by a small group that rarely shares benefits with the broader population. This inequality weakens sustainable development and increases instability.

- Inclusive Institutions: In contrast, these encourage broad participation in the economy and political life. They foster innovation, investment, and production, driving sustainable growth.

So, how do these insights affect us?

Impacts of the 2024 Nobel Prize in Economics

Economic Policy Implications

When a Nobel-winning study gains attention, policymakers often take note. In this case, governments might consider reforming their institutions to embrace the advantages of inclusive systems. These reforms could include strengthening property rights, promoting free enterprise, and encouraging competition—all of which are critical to sustainable economic growth.

Moreover, several industries and markets could benefit from the ideas in this year’s Nobel-winning studies.

2024 Nobel Prize: Emerging Markets and the MSCI Index

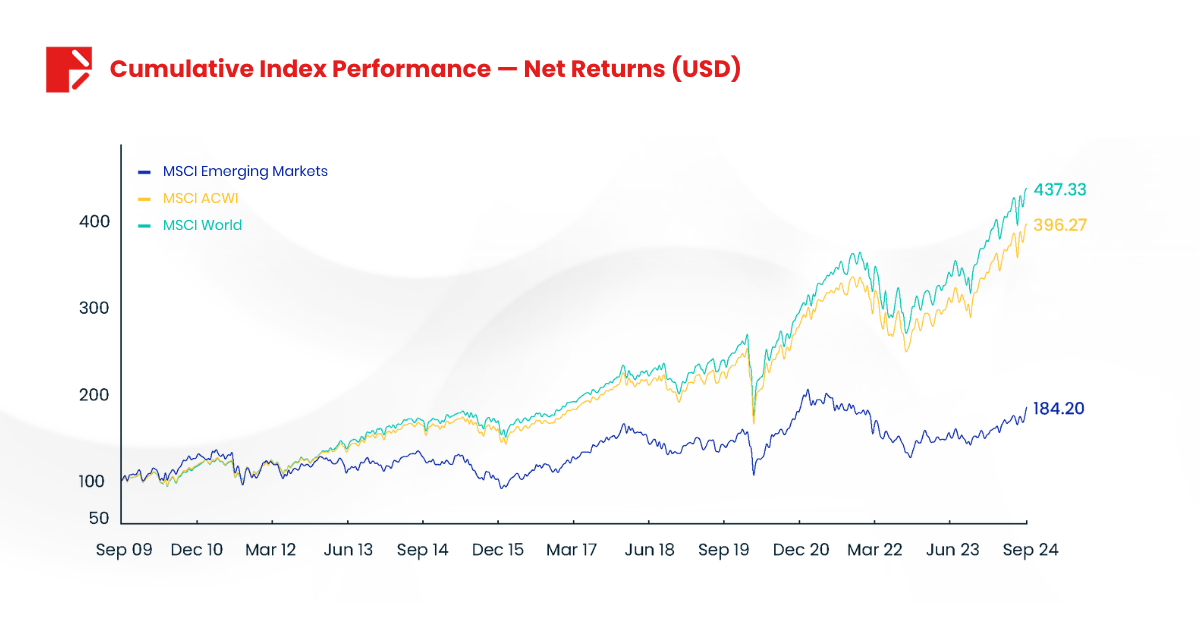

Emerging economies, like India, Brazil, and Southeast Asian nations, offer significant potential for institutional reform. Unlike developed economies, these nations are still shaping their policies and have room to implement changes that drive GDP growth.

To illustrate, the MSCI Emerging Markets Index, which includes 1,277 stocks from 24 emerging countries, achieved a growth rate of 9.83% in 2023. Sectors such as Finance, Information Technology and Consumer make up a large proportion of this index. Specifically, Finance accounts for 22.84% and Information Technology accounts for 22.23%. As you can see, this proportion is completely consistent with the general trend of the world, and also consistent with the proposals extracted from the 2024 Nobel Prize in Economics research.

Sustainable Development and ESG-Related Funds

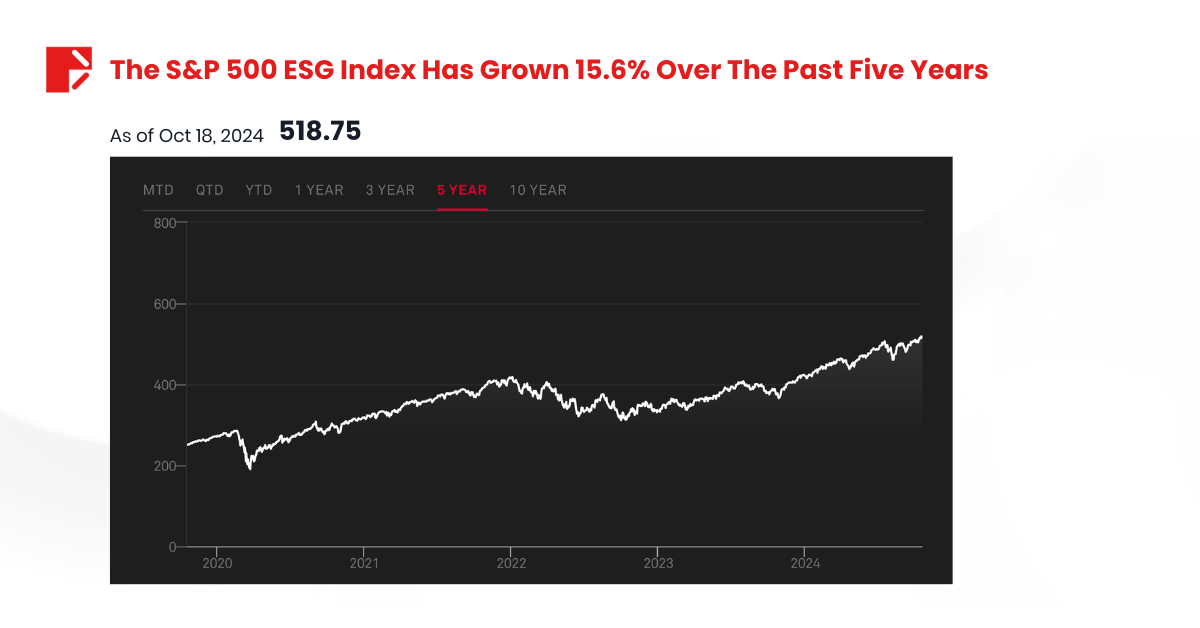

As mentioned in the study, inclusive institutions will facilitate more sustainable economic development. Therefore, businesses aiming for development along with social responsibility and environmental protection (ESG) will be further motivated.

The S&P 500 ESG Index, which tracks companies excelling in ESG performance, has grown 15.6% over the past five years, reaching an all-time high of 518.75 on October 18, 2024—just days after the Nobel Prize announcement.

You can also track the performance of ESG-focused funds like the BlackRock Global Impact Fund or the Vanguard FTSE Social Index Fund to identify opportunities in this sector.

2024 Nobel Prize: The Role of Technology

Technology is a crucial driver of innovation, helping to implement institutional reforms and enhance efficiency.

We will not talk too much about the power of technology, because this has been mentioned everywhere in the digital space at the present time.

Here, we want to emphasize that digitalization and technological investment can break down barriers that otherwise limit institutional reform.

Even countries with centralized political systems, such as China and Vietnam, can apply these Nobel-winning insights without disrupting their political structures. By digitizing processes, investing in public infrastructure, and embracing financial technology, these nations can foster sustainable growth.

The Importance of Macroeconomic Policies

From the above analysis, it can be seen that the impact of macroeconomic policies is extremely profound. It is undeniable that, although these are only proposed theories, the value of the 2024 Nobel Prize in Economics will be considered and actively applied by policymakers around the world in the most flexible and appropriate way.

Though there are still gaps in the data, especially concerning countries that haven’t adopted inclusive institutions from the start (like China), this study will help investors better understand the importance of sustainability, technology’s role in future growth, and the need to stay informed about global macroeconomic shifts. This, in turn, opens up new perspectives for investment strategies.

Follow our weekly market dive articles to never miss a market update.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.