The ongoing Israel-Hamas war and fears of the conflict escalating further in the Middle East are driving defense stocks higher. Iraq, Yemen, Syria, and Lebanon are joining forces with Hamas to put pressure on Israel to stop the war crimes against Palestinian civilians. Investors should remain vigilant regarding the unfolding events in the Middle East and understand the potential implications these may have on global markets.

When war breaks out, defense companies tend to make money. This leads aerospace and defense stocks to rise during geopolitical unrest, especially if the conflict involves one of the U.S. allies.

Following the recent attacks on Israel, concerns are growing about the potential implications for global peace and security. This led military contractor stocks to spike as both institutional and retail investors bought shares out of fear.

The iShares U.S. Aerospace & Defense ETF, home to big names like Raytheon, Lockheed Martin, General Dynamics, Northrop Grumman, and Leidos Holdings, soared more than 10% in the wake of the initial strikes on Israel.

This article aims to dissect the current surge in defense stocks and explore how investors might position themselves in the defense ETF and stock market during these troubled times.

Top 5 Defense Companies

Lockheed Martin (Stock: LMT):

Lockheed Martin is the largest defense contractor out there, best known for manufacturing the F-35 fighter jet, which is the most expensive and advanced of its kind. They develop all the latest groundbreaking military technology at their “Skunk Works” lab in California, which keeps them at the forefront of the defense industry.

Lockheed Martin Stock Performance:

Raytheon Technologies (Stock: RTX):

Raytheon Technologies does not build warships or fighter jets. However, it’s a big player in the military world, working on numerous critical military systems crafted by leading contractors. Born from a 2020 merger, it combines Raytheon’s strength in defense electronics and missile design with United Technologies’ experience in crafting aircraft engines and other airplane parts.

Raytheon Stock Performance:

Northrop Grumman (Stock: NOC):

Northrop Grumman is the name behind stealth bombers and has a large portfolio of space projects. They are a big part of America’s defense, working on the nuclear triad. This includes a mix of missiles, bombers, and submarines, ready to respond if the country ever needs to defend itself.

Northrop Grumman Stock Performance:

General Dynamics (Stock: GD):

General Dynamics is best known for military ships, tanks, and land vehicles for the Army. They focus on defense IT and services, ensuring a steady cash flow even during budget cuts by the Pentagon.

General Dynamics Stock Performance:

Leidos Holdings (Stock:LDOS):

Leidos Holdings tops the charts in government IT services and isn’t just about software. The company also develops hardware. They create smart systems for ships that are capable of piloting themselves. Additionally, they conduct secret research for spies and space explorers.

Leidos Holdings Stock Performance:

Defense ETFs

For those investors looking to diversify their investment in the defense industry without putting all their eggs in one basket, investing in defense ETFs (exchange-traded funds) is the best way forward. Gain exposure across a range of defense assets and defense stock ETFs without the risk of individual stock selection. This can be particularly attractive in a volatile market with uncertain geopolitical tensions.

Three main defense ETFs to choose from include:

- Invesco Aerospace & Defense (NYSE:PPA)

- SPDR S&P Aerospace & Defense (NYSE:XAR)

- iShares U.S. Aerospace & Defense (BATS:ITA)

The Surge of Defense Stocks Amidst Rising Tensions

The defense industry usually gets an uptick in investments during times of military conflict. However, these gains are often short-lived, and stocks reverse after the initial buzz wears off as investors tend to forget about it after a while.

The most recent conflict was the Russia-Ukraine war. The iShares defense ETF surged by 5%, while Lockheed Martin and Northrop Grumman’s shares jumped about 20%. But within a few months, these stocks reverted, losing most of their gains.

This time, however, there is a unique twist. President Joe Biden has proposed a 4% increase in defense spending, raising the budget to USD 814 billion. Yet, this proposal hangs in balance, awaiting Congress’s action to pass an appropriations bill by November 17.

But with the recent conflict’s risk of escalating into a regional war, this bill might just have a stronger chance of passing. If it does, it could significantly affect the duration of the gains in defense stocks, potentially leading to more sustained investment interest in the sector.

US Defense Stocks: A Safe Haven?

US defense stocks are often considered a safe haven during geopolitical conflicts. But what does that mean for gold?

Even with defense stocks in the spotlight, gold does not lose its shine.

In our previous analysis, we said that gold is waiting for some kind of catalyst to break above the USD 2000 psychological resistance. This current conflict could be the event we were waiting for.

Gold surged more than 9% since the attack on Israel as Treasury yields pulled back, as expected. This drop in yields is the second biggest we have seen in ten years, trailing only the plunge during the COVID-19 outbreak.

Professional investors consider allocating money to both modern defense companies and the old-school security of gold to be the cleverest way to stay steady during these times, no matter which way the wind blows.

Powell’s Dovish Turn: Positive For The Market

During the latest Federal Open Market Committee (FOMC) meeting, Chairman Powell’s dovish remarks were a surprise twist from the expected ‘hawkish pause’, catching markets off guard. With just two sentences, Powell reassured the markets that there are no more rate hikes on the horizon. This triggered a wave of optimism that sent the stock market to rally 5% while simultaneously driving 10-year Treasury yields down by around 10%. This shift in tone suggests a pivotal moment for monetary policy. It may signal a turning point in the Fed’s approach to inflation and economic growth.

If this current macro environment remains bullish for stocks, then this could be another positive catalyst for defense stocks to keep climbing higher.

Stock Market Seasonality

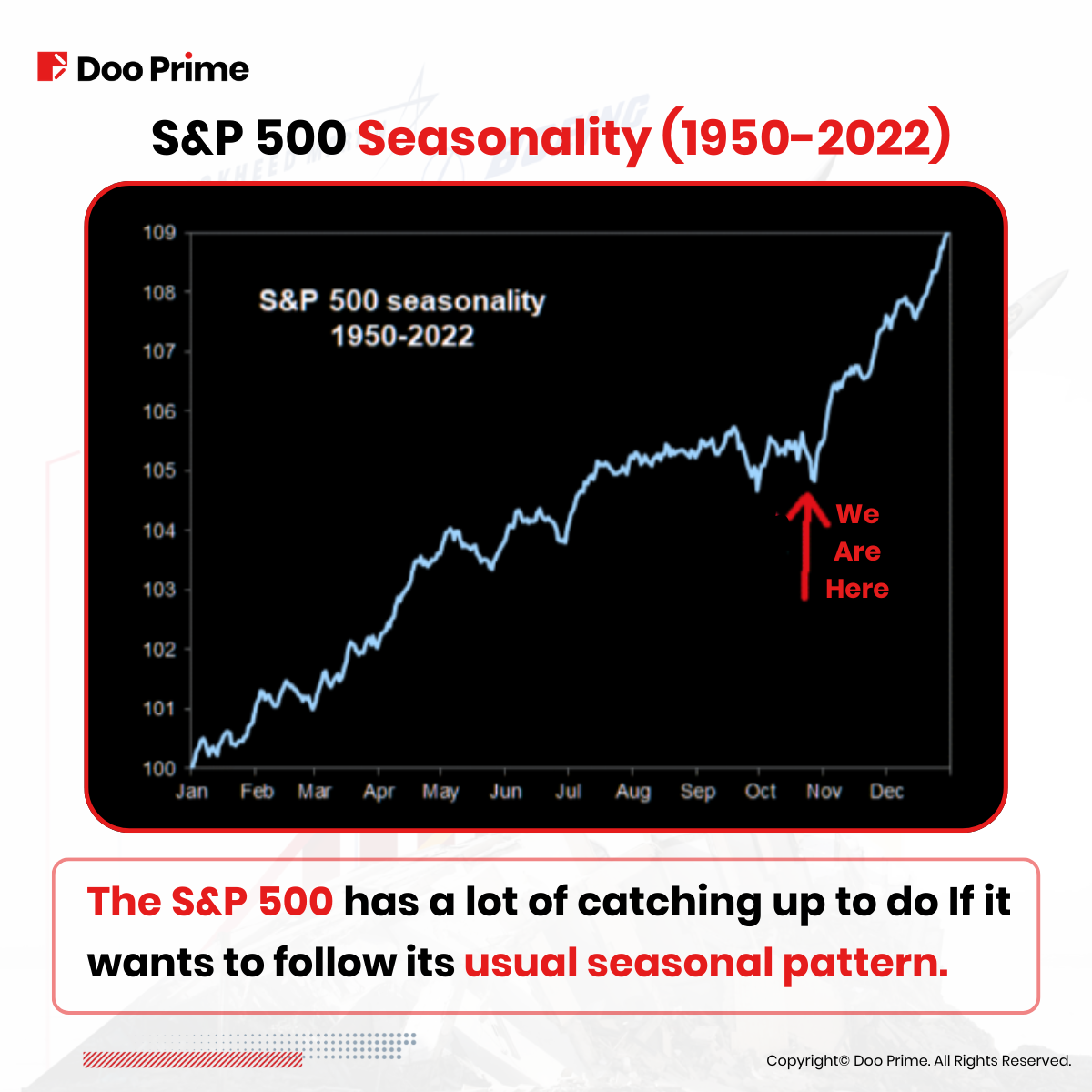

Since 1950, November and December have been the best 2-month period of the year for the stock market. 66% of the time, November has seen positive returns, with an average gain of 1.44%.

The trend is even more encouraging when we consider that the S&P 500 has closed higher in 10 of the past 11 Novembers.

We are entering the best two-month period of the year. The chart above gives a clear picture. If the market continues to follow this usual pattern, then we might witness a significant end-of-year rally.

Uncertainty Creates Opportunity

The alignment of certain Middle Eastern nations in the current geopolitical climate is an important reminder of the world’s fragility. For investors, this uncertainty can translate into opportunities. Particularly in defense stocks and ETFs, which offer potential growth during times of conflict.

We advise investors to keep a close watch on the developments in the Middle East and the ripple effects they have across global markets. As always, due diligence and strategic planning are paramount.

While the performance of defense stocks during times of conflict can be attractive to investors, it is important to diversify portfolios with other assets, such as gold.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.