Michael Burry MD, The Big Short investor who famously predicted the 2008 financial crisis, has recently taken a USD 1.6 billion short position on the S&P 500 and Nasdaq.

With the AI-driven bullish sentiment being recently tempered by the Federal Reserve’s hawkish stance, Burry’s new big short position raises new questions about the sustainability of the current bullish rally.

Is the stock market headed for a meltdown? Is it time to panic? Or is the market simply experiencing a temporary correction?

In this article, we will explore the key factors that could trigger a sell-off in the stock market, and we will assess whether Michael Burry’s short position is a prudent trade. We will also highlight and discuss the most important economic indicators that investors need to keep their eyes on.

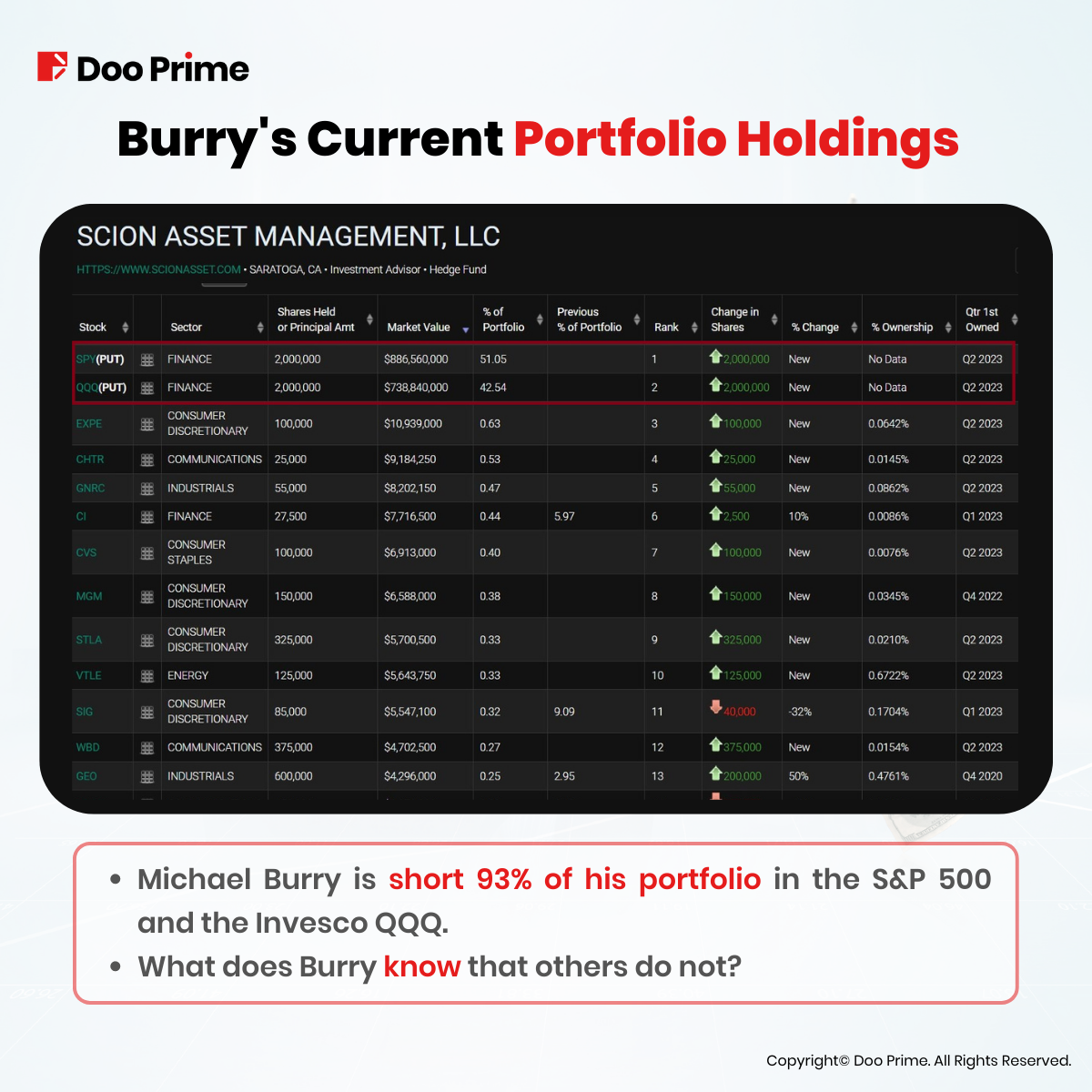

Michael Burry Stocks Portfolio

Michael Burry in The Big Short movie was portrayed by Christian Bale in the 2015 film. The movie tells the story of how Burry personally made over USD 100 million betting against the housing market before the 2008 financial crisis.

In addition to his success in 2008, Michael Burry’s hedge fund performance has generated positive returns over the long term. This gives him enough credibility to make investors consider his reasons for taking huge short positions on SPY and Invesco QQQ.

Burry has warned of a potential recession in 2023 on multiple occasions. He is known for his contrarian investing style, and he is not afraid to bet against the consensus.

Moments before taking a short position on 93% of his portfolio in the overall market, Michael Burry’s Scion Asset Management sold huge share stakes in Alibaba Group, Zoom Video Communication, JD.com Inc and many others.

This could be an indication of Burry’s urgency. What does Burry see that others do not?

Having said all of that, investors should not follow Burry’s current investment strategy out of FOMO (fear of missing out). We should remember that he began shorting mortgage-backed securities in 2005, three years before the crisis hit. This means that his timing was not impeccable, and he was underwater for several years before his prediction was successfully realized.

“Markets can remain irrational longer than you can remain solvent.”

John Maynard Keynes

Where Is The AI Momentum When You Need It?

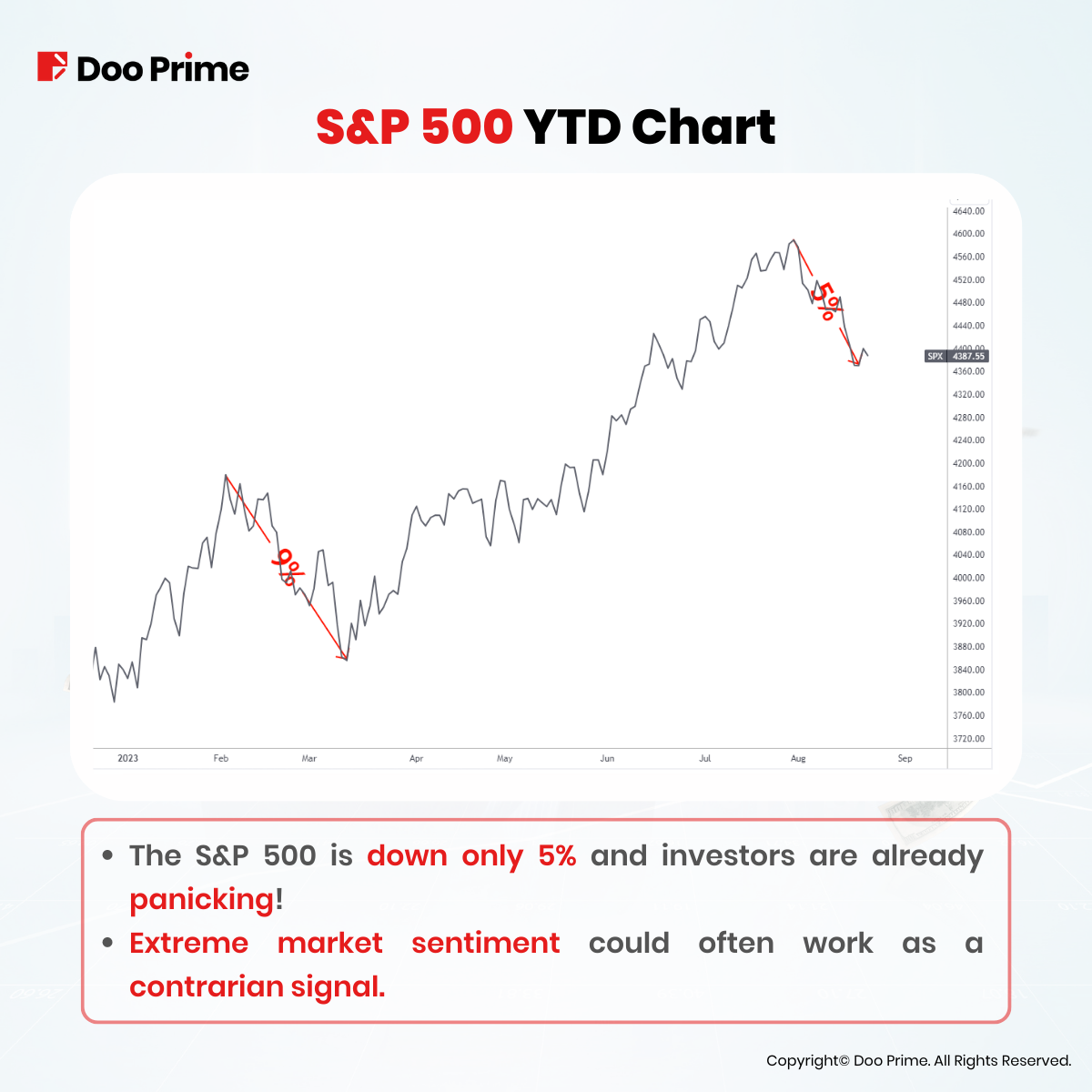

The AI-driven bullish sentiment has shifted from Extreme Greed to Fear in a matter of days, as the NASDAQ has fallen only 5% from this year’s high. This major shift in sentiment could be a positive signal for the markets, suggesting that the AI momentum is still there but is simply taking a breather before another potential bull run.

Others, such as Michael Burry, believe that the AI momentum is starting to fade, and that this is a sign that the market is nearing a top. This is a contrarian view, but it is one that is worth considering.

However, if we go back to February of this year, the market had a 9% healthy correction before skyrocketing around 20% higher. Could we see a similar scenario play out again?

What Could Trigger A Sell-Off In The Stock Market?

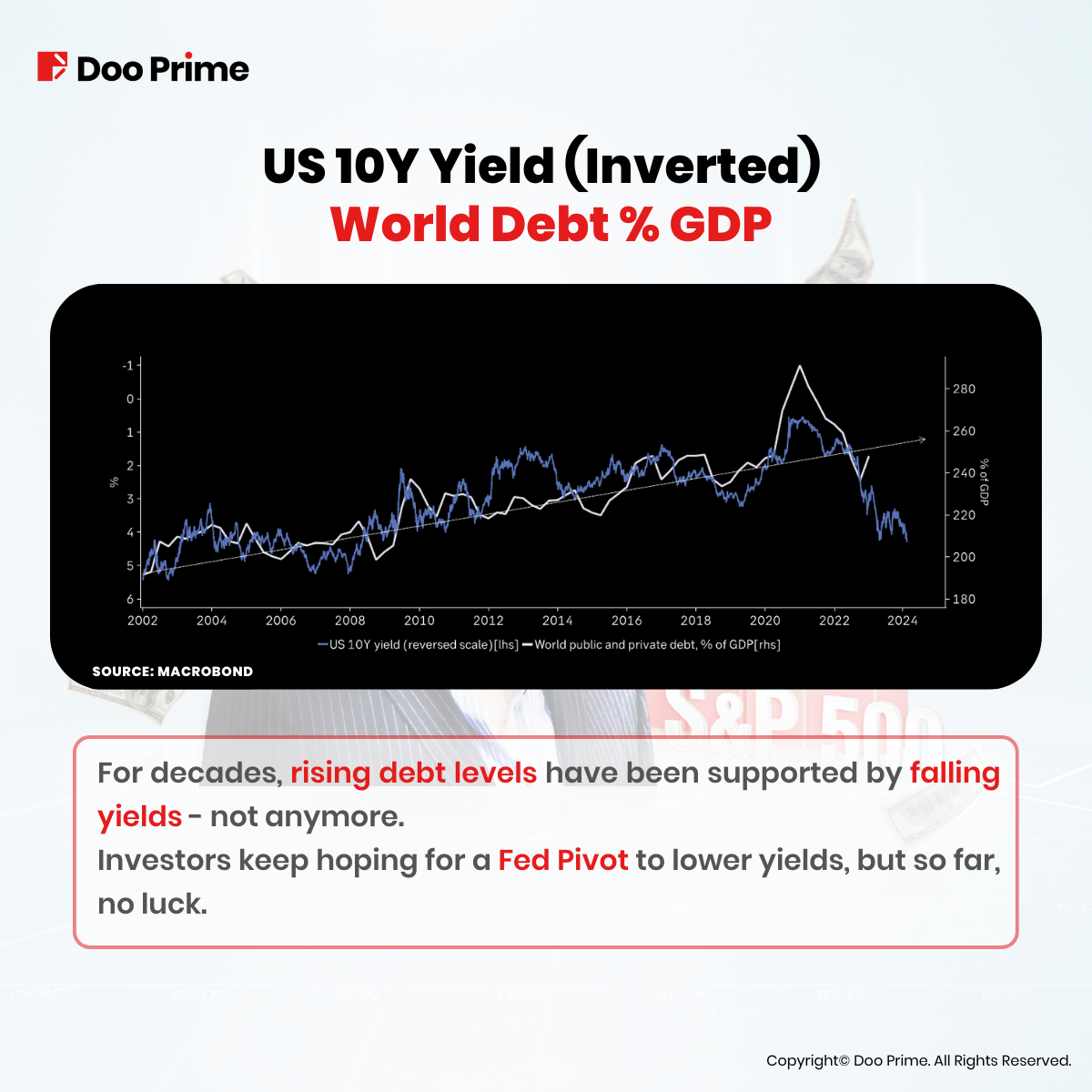

The Debt Problem Combined With Rising Yields

One of the biggest concerns for investors is the level of debt that is currently outstanding.

The US government is 32.7 trillion dollars in debt, and the global debt is getting close to USD 100 trillion. These record-breaking debt levels are not sustainable, and the odds of a deeper recession are increasing day-by-day as long as interest rates and bond yields keep rising in tandem.

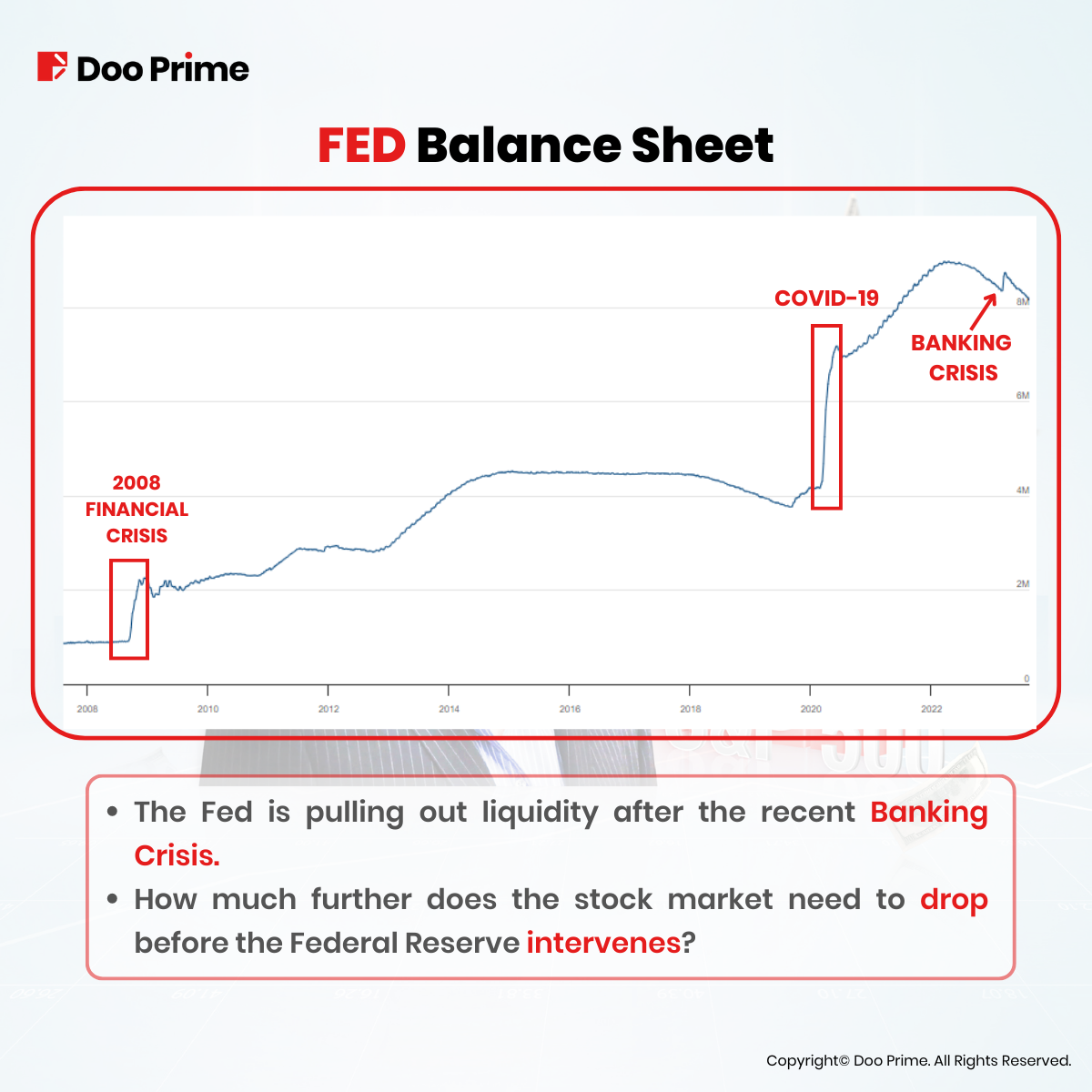

Falling Fed Balance Sheet

During the 2008 financial crisis, the whole financial system was at risk of collapsing.

The Fed had to intervene to prevent that from happening, so they started implementing a monetary policy called Quantitative Easing (QE).

Basically, they inject liquidity into banks, corporations, stocks, bonds or in any other aspect of the economy, whenever something emerges unexpectedly that threatens to destabilize the system.

The most recent intervention was in February/March of this year, when the Silicon Valley and other major banks collapsed. The Fed intervened with a new round of liquidity to prop up the market.

However, after that event, the Fed started to pull out liquidity once again from its balance sheet as Chairman Powell initially promised. This outflow of liquidity impacted the stock market recently and dropped around 5%. If the Fed keeps reducing the balance and keeps increasing interest rates, it is bound to break something new in the system.

Once that happens, will they intervene once again? Most probably they will.

If the Fed does not, the combination of rising debt levels, interest rates and the balance sheet reduction could create a downward spiral for stocks.

Main Indicators To Watch

WTI Crude Oil

Oil prices rallied more than 20% in the past 2 months, and the risk of further upside remains elevated (read our full article on WTI Oil for more in-depth analysis).

If Oil prices continue to rise, it could reaccelerate inflation and force the Federal Reserve to raise interest rates even more aggressively, to bring oil inflation under control.

If this scenario plays out, then the odds of a stock market crash will dramatically increase.

Dollar Index (DXY)

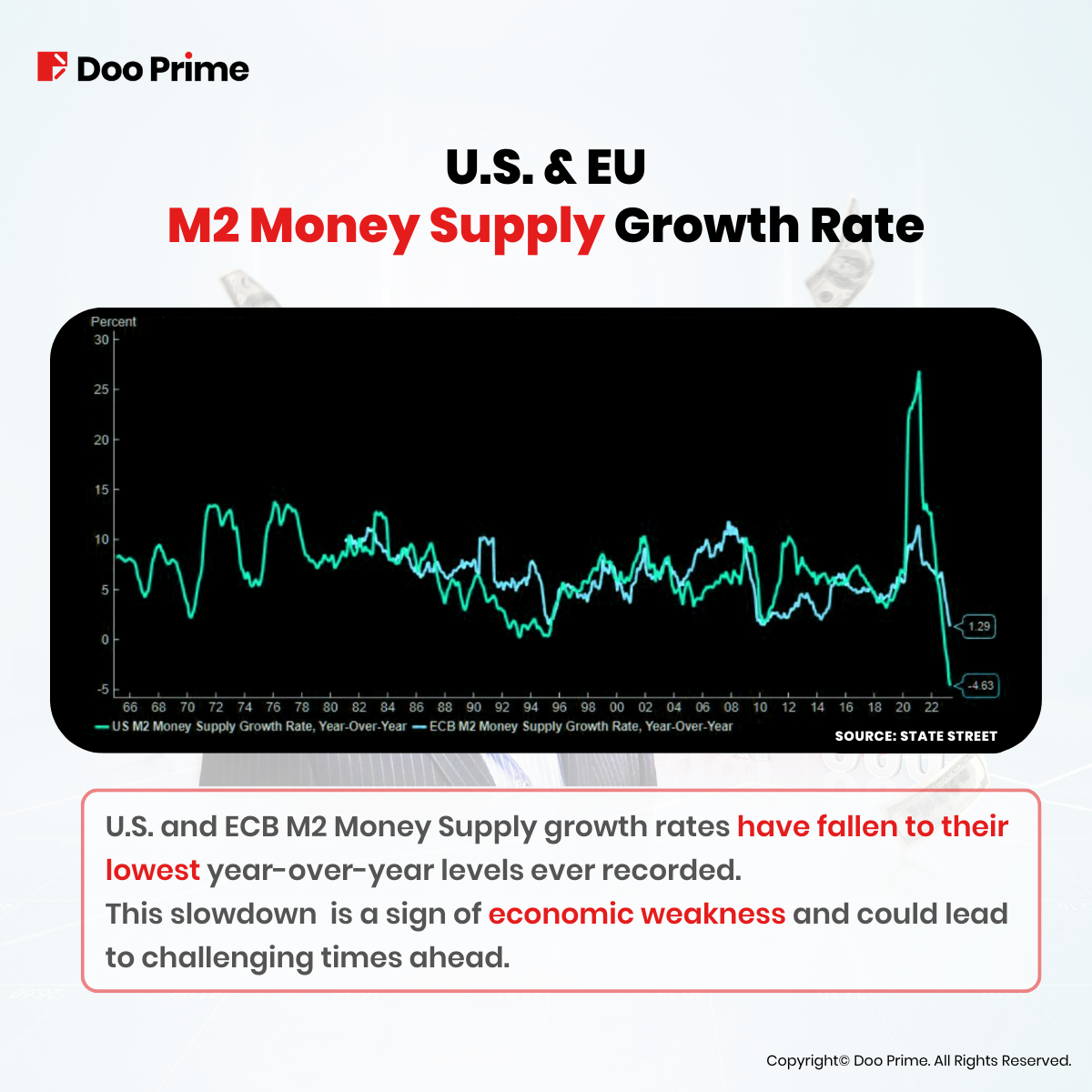

There are two main reasons why the Dollar is getting stronger.

- Higher interest rates and yields.

- A decrease in the money supply.

If yields keep on rising and the money supply keeps on falling to its lowest levels ever recorded, the DXY could probably skyrocket! This could cause a deflationary environment, which could lead to a major sell-off in equities.

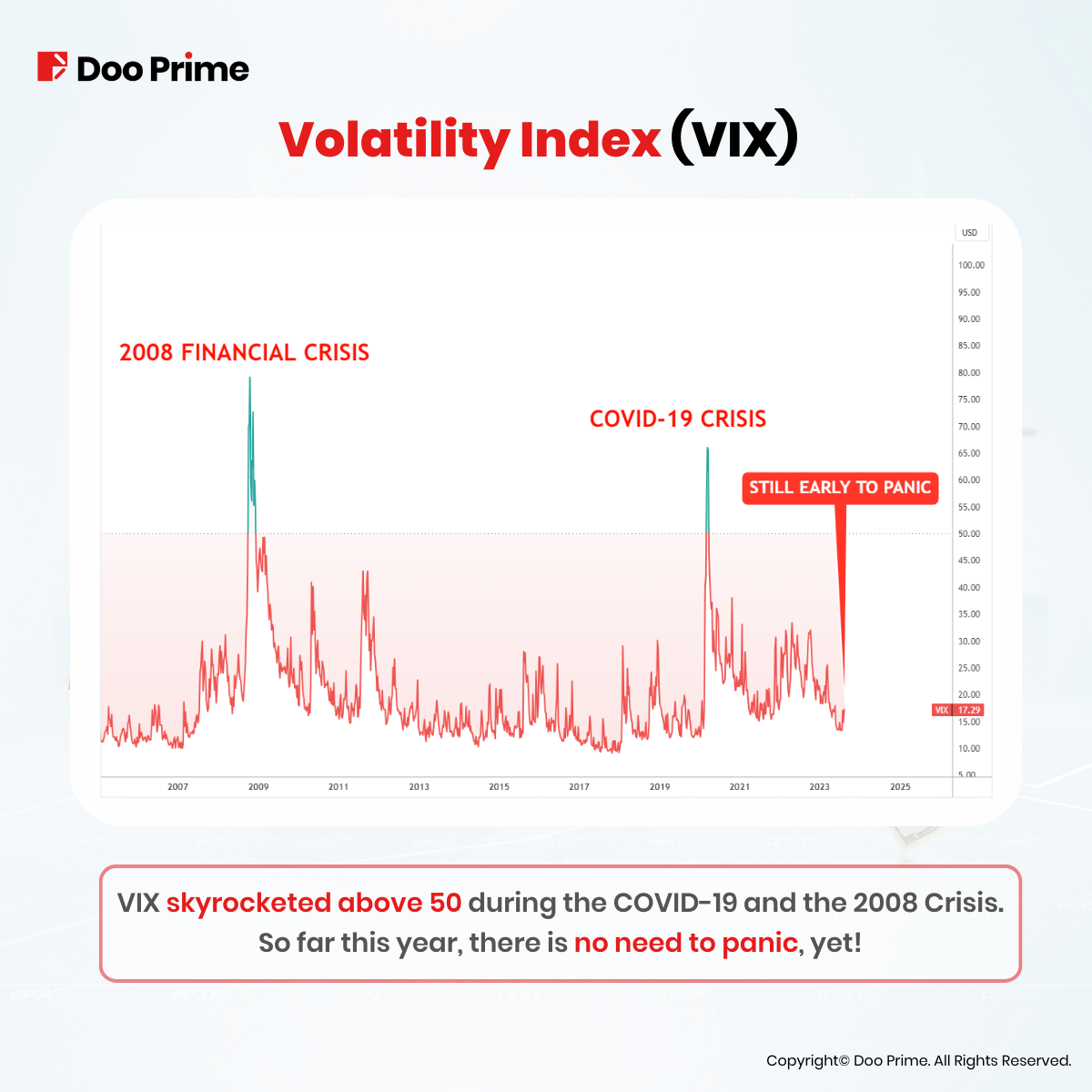

Volatility Index (VIX)

The VIX is a forward-looking indicator that reflects investor sentiment and measures expectations for market volatility.

Based on the VIX chart, there is no need to panic yet. For a major systemic risk event to occur, the VIX would need to accelerate above 50.

With this recent drop in equities, the VIX has only elevated from 15 to 18, which is perfectly normal in a correction.

Nonetheless, using the VIX as part of your trading arsenal could be very beneficial to your trading performance, as you could assess your risk more efficiently by adjusting investment positions and implementing hedging strategies.

S&P 500 Seasonal Performance

Historically, the stock market has done worse in the summer than in any other season. There are a couple of reasons for this.

First, the summer is a time when many investors are on vacation, so there is less trading activity. This can lead to more volatility, as there are fewer buyers and sellers in the market to keep prices stable.

Second, investors are more risk-averse in the summer. This means they are less willing to take on risk with their investments. As a result, for example, if earnings reports miss analyst expectations, it can easily trigger a sell-off in stocks.

In this illiquid and news-slow August, this might be the most important chart to explain current price action. The months of June, July and August are known to be nerve rackingly slow. September, on the other hand, volume comes back!

So… Is It Time To Panic?

It is impossible to say for sure whether or not a stock market meltdown is coming. However, the risks are real, and investors should be aware of them. If you are concerned about the possibility of a meltdown, you may want to consider taking some steps to protect your investments.

Michael Burry’s short position on the S&P 500 is a bold move, but it is not without merit. The factors that he is concerned about, such as the rising debt levels, the falling Fed balance sheet, and the rising oil prices, are all real and could potentially lead to a sell-off in the stock market.

Investors should carefully consider all of the factors involved before making any investment decisions. They should also remember that Michael Burry’s track record is not perfect. He was correct about the 2008 financial crisis, but he was also wrong about other investments.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment, and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to learn more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.