US Stocks

Fundamental Analysis:

The three major U.S. stock indices rose by 1% on Wednesday, 22 September 2021, as investors mostly took in stride the latest signals from the Federal Reserve, including clearing the way for the central bank to reduce its monthly bond purchases soon.

Although trading was choppy following the Fed’s latest policy statement and comments by Fed chairman Jerome Powell, stocks finished close to where they were before the central bank news.

In its statement, the Fed also suggested interest rate increases may follow more quickly than expected and said overall indicators in the economy “have continued to strengthen”.

Stocks began the day higher as concerns eased over a default by China’s Evergrande. Bank shares rose following the Fed news, with the S&P banks index ending up 2.1% on the day, and the S&P 500 Financials up 1.6%. They are among the biggest gainers among sectors.

At the close, the Dow Jones Industrial Average rose by 1%, to 34,258.32 points; the S&P 500 gained 0.95%, to 4,395.64 points; and the Nasdaq Composite added 1.02%, to 14,896.85 points.

Technical Analysis:

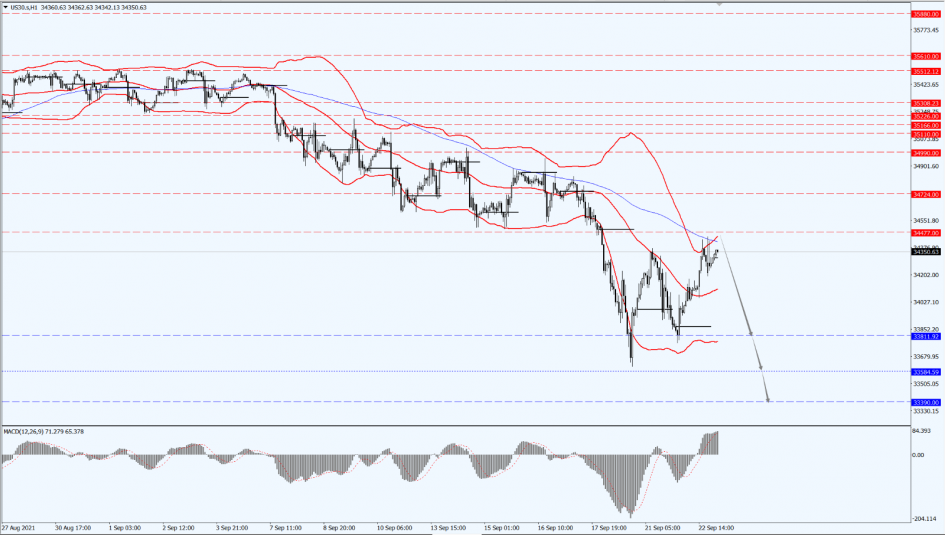

(Dow30,1-hour chart)

Execution Insight:

Today, on the Dow, focus on the 34477 line. As long as the Dow runs below the 34477 line, it will maintain a bearish trend. Only when the Dow rises again to the top of the 34477 line, there is a possibility of further upward movement. At that time, pay attention to the suppression of the two positions of 34724 and 34990.

Hong Kong Stocks

Fundamental Analysis:

In the long run, investors should still adhere to the allocation of the new economy sectors and new industries. In the future, the global and China’s economic development and policies will still focus on industries such as science and technology and new energy vehicles. On the other hand, the traditional industry needs to have a major transformation to be more favored by the market.

Looking back on the overall performance of Hong Kong stocks in 2020, its higher proportion of old economy industries also affected the overall performance. Meanwhile, the MSCI China Index also includes a considerable number of medium-sized stocks and A shares, which hit a new high in 2020 and performed quite well.

Technical Analysis:

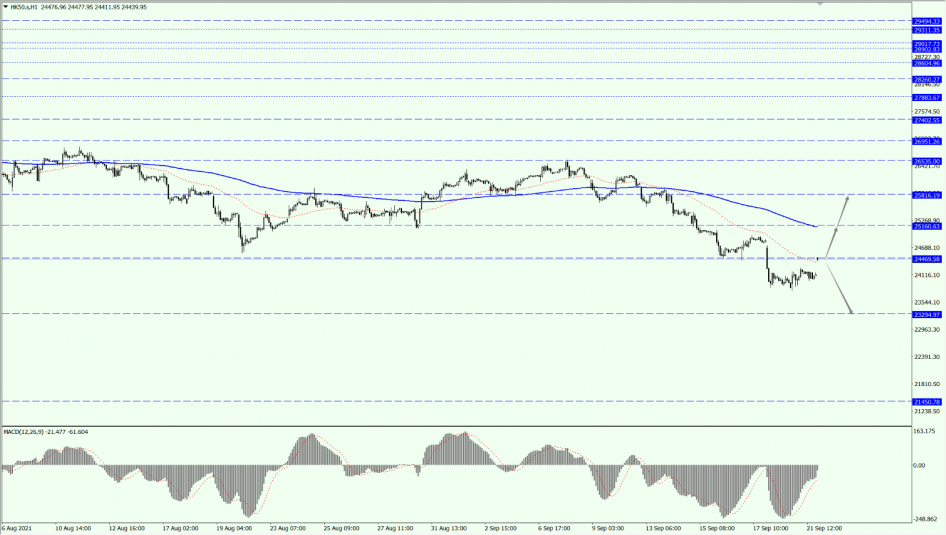

(HK50,1-hour chart)

Execution Insight:

On HK50 today, we pay attention to the support of the 24469 line. Once the buy order is obtained, then focus on the suppression strength of the two positions of 25160 and 25816 above. If HK50 falls below the 24469 line, it will open up further downward revision.

FTSE China A50 Index

Technical Analysis:

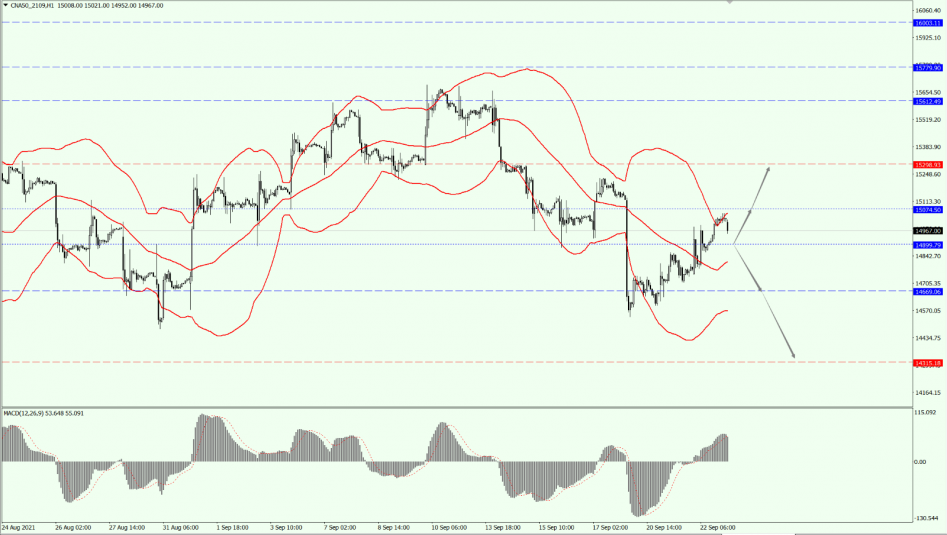

(A50,1-hour chart)

Execution Insight:

On China A50, pay attention to the 14899 line today. And take a closer look at the suppression strength of the two positions of 14899 and 14669 above. Then, focus on the support of the 14315 line below.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.