U.S. Stocks

Fundamental Analysis:

The S&P 500 jumped by 2.6%, the biggest gain since June 2020. Meanwhile, European stocks also surged, with Germany’s DAX soaring by nearly 8%.

This reflects the recovery of market risk appetite, suppressing the safe-haven buying demand for gold.

Investors expected the two-week-long sell-off to have fully reflected the negative impact of the Russia-Ukraine war and sanctions against Russia on the world economy.

However, the rally has only recovered some of the ground lost in the stock market since the outbreak of the Russian-Ukrainian war, with the S&P 500 still down about 10% from the beginning of the year.

Technical Analysis:

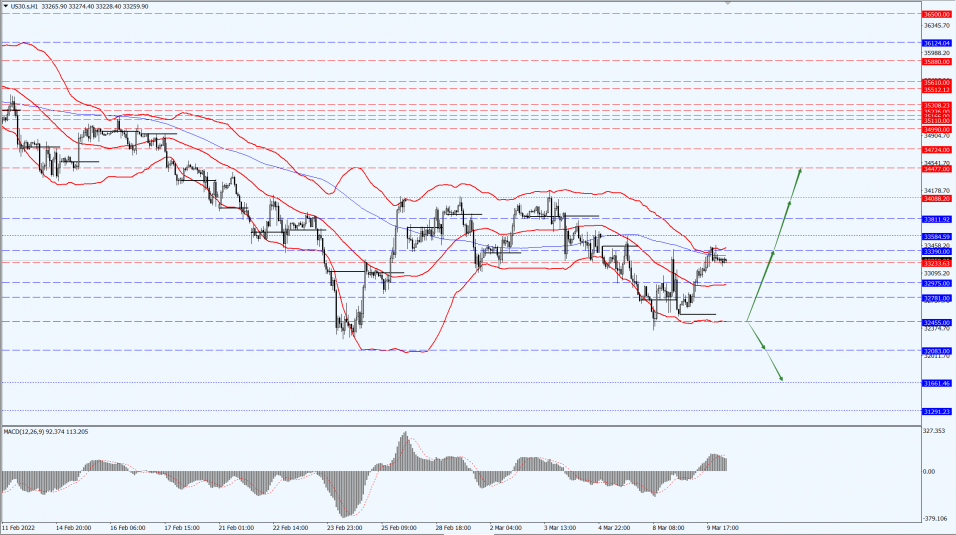

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 32380-line today. If the Dow runs stably above the 32380-line, it will pay attention to the repression strength of the 33390 and 34088 positions. If the Dow index breaks below the 32380-line, it will pay attention to the support strength of the 32083 and 31661 positions.

Hong Kong Stocks

Fundamental Analysis:

The situation in Russia and Ukraine took a turn for the better, and the European and the U.S. stock market ushered in a strong rebound overnight.

Hong Kong stock indexes opened higher across the board, with the Hang Seng Index (HSI) rising by 2.32%, the Hang Seng China Enterprises Index (HSCEI) rising by 2.57%, and the Hang Seng TECH Index (HSTECH) rising by 3.64%.

On the market, large technology stocks rose collectively, Kuaishou Technology (1024.HK), Baidu, Inc. (9888.HK), NetEase, Inc. (9999.HK) rose more than 5%, coal rose 4.8%, Tencent Holdings Limited (0700.HK), Alibaba Group Holding Limited (9988.HK), and Bilibili Inc. (9626.HK) are up.

The previous plunge in auto stocks, biotechnology stocks, sporting goods stocks, gambling stocks, education stocks, F&B stocks, insurance stocks, and airline stocks have rebounded. XPeng Inc. (9868.HK) rose by more than 8%, after a record low.

On the other hand, because of heavy losses in commodities across the board, gold, oil, coal, non-ferrous metal stocks plunged, with Shandong Gold Mining Co., Ltd. (1787.HK) fell by 5%, CNOOC Limited (0883.HK), and Aluminum Corporation of China Limited (2600.HK) are down nearly 4%.

Driven by the collectively closing gains of China auto stocks overnight, Hong Kong auto stocks collectively strengthened in early trading. Among them, Li Auto Inc. (2015.HK) rose by 10%, XPeng Inc. (9868.HK) rose by more than 8%, BYD Company Limited (1211.HK) rose by more than 6%, Great Wall Motor Company Limited (2333.HK) rose by 5%, Geely Automobile Holdings Limited (0175.HK) rose by nearly 5%, Guangzhou Automobile Group Co., Ltd. (2238.HK), China Evergrande New Energy Vehicle Group Limited (0708.HK) and Dongfeng Motor Group Company Limited (0489.HK) rose by more than 3%.

Technical Analysis:

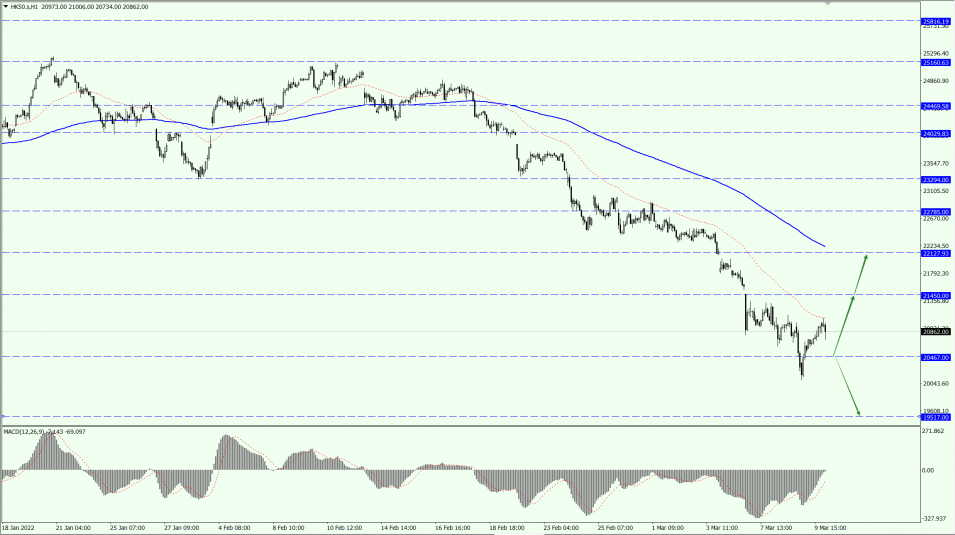

(HK50, 1-hour chart)

Execution Insight:

HK50 Index focuses on the 20467-line today. If HK50 can run stably above the 20467-line, then pay attention to the suppression strength of the two positions of 21450 and 22127. If HK50 falls below the 20467-line, then pay attention to the support of the 19517-line.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 13371-line today. If the A50 runs stably above the 13371-line, pay attention to the suppression strength of the 13983 and 14669 positions. If the A50 breaks below the 13371-line, it will open up further downside trend. At that time, pay attention to the support of the 12791-line.

Risk Disclosure

Trading in financial instruments involves a high degree of risk due to fluctuations in the value and price of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.