Doo Prime Daily Featured Trading Strategies – October 19, 2020

- Daily technical analysis of selected currency pairs

NZD/USD Bullish

Image Features: NZD/USD forms “Hammer” pattern

Target:

Opportunity recognized 2020 Oct 18 for the period of up to 12 hours

+0.00199 (199 pips) price change since the Technical Event at 0.66032

Technical Analysis:

We found a pattern called Hammer on 2020 Oct 18 at 22:00 GMT on a 30 minute chart suggesting the outlook is bullish for up to 12 hours.

On 2020 Oct 19 at 00:30 GMT, the 4-bar Moving Average crossed above the 9-bar MA which crossed above the 18-bar MA, signaling a new uptrend has been established.

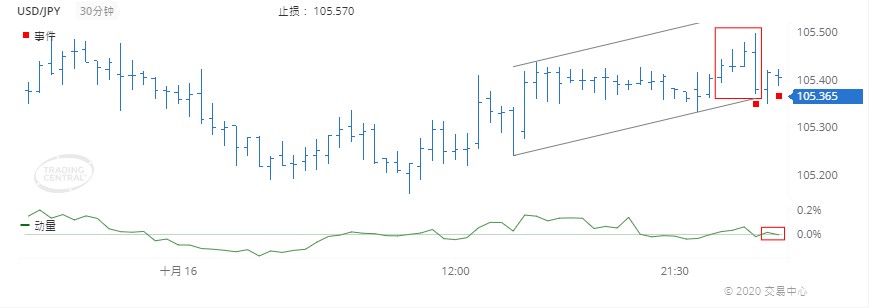

USD/JPY Bearish

Image Features: USD/JPY forms “Outside Bar (Bearish)” pattern

Target:

Opportunity recognized 2020 Oct 19 for the period of up to 12 hours

-0.018 (18 pips) price change since the Technical Event at 105.381

Technical Analysis:

We found a pattern called Outside Bar (Bearish) on 2020 Oct 19 at 01:00 GMT on a 30 minute chart suggesting the outlook is bearish for up to 12 hours.

The price crossed below its moving average on 2020 Oct 19 at 02:30 GMT signaling a new downtrend has been established.

- Daily Analyst View

EUR/USD

may fall 13 – 28 pips

Pivot: 1.1730

Our preference:

Short positions below 1.1730 with targets at 1.1705 & 1.1690 in extension.

Alternative scenario:

Above 1.1730 look for further upside with 1.1745 & 1.1765 as targets.

Comment

The upward potential is likely to be limited by the resistance at 1.1730.

GBP/USD

may rise 25 – 55 pips

Pivot: 1.2895

Our preference:

Long positions above 1.2895 with targets at 1.2960 & 1.2990 in extension.

Alternative scenario:

Below 1.2895 look for further downside with 1.2860 & 1.2840 as targets.

Comment:

The RSI has just landed on its neutrality area at 50% and is turning up.

USD/CAD

may fall 14 – 34 pips

Pivot: 1.3200

Our preference:

Short positions below 1.3200 with targets at 1.3160 & 1.3140 in extension.

Alternative scenario:

Above 1.3200 look for further upside with 1.3220 & 1.3240 as targets.

Comment:

The RSI is bearish and calls for further downside.

Gold spot

may fall to 1845.00 – 1875.00

Pivot: 1935.00

Our preference:

Short positions below 1935.00 with targets at 1875.00 & 1845.00 in extension.

Alternative scenario:

Above 1935.00 look for further upside with 1980.00 & 2015.00 as targets.

Comment:

A break below 1875.00 would trigger a drop towards 1845.00.

Brent (ICE)

is neutral

Pivot: 44.20

Our preference:

Short positions below 44.20 with targets at 40.00 & 38.20 in extension.

Alternative scenario:

Above 44.20 look for further upside with 46.90 & 49.50 as targets.

Comment:

The index currently faces a challenging resistance area at 44.20.

S&P 500 (CME)

may fall to 3457.00 – 3470.00

Pivot: 3490.00

Our preference:

Short positions below 3490.00 with targets at 3470.00 & 3457.00 in extension.

Alternative scenario:

Above 3490.00 look for further upside with 3508.00 & 3524.00 as targets.

Comment:

As long as the resistance at 3490.00 is not surpassed, the risk of the break below 3470.00 remains high.

Dax (Eurex)

may rise to 13050.00 – 13160.00

Pivot: 12780.00

Our preference:

Long positions above 12780.00 with targets at 13050.00 & 13160.00 in extension.

Alternative scenario:

Below 12780.00 look for further downside with 12690.00 & 12580.00 as targets.

Comment:

The RSI advocates for further advance.

SGX FTSE China A50

may rise to 16300.00 – 16415.00

Pivot: 15950.00

Our preference:

Long positions above 15950.00 with targets at 16300.00 & 16415.00 in extension.

Alternative scenario:

Below 15950.00 look for further downside with 15850.00 & 15790.00 as targets.

Comment:

The RSI advocates for further advance.

Disclaimer:

This report is prepared and published by Trading Central for all clients of Doo Prime. As a third-party indicator tool, Trading Central is only for your strategic reference during the investment process and does not constitute advice or a recommendation by Doo Prime or Trading Central. Neither Doo Prime nor Trading Central are responsible to bear the relevant legal liabilities for the investment risks arising from your use of this report to make buying and selling decisions.