1. Forex Market Insight

EUR/USD

The Federal Reserve raised interest rates by 0.5 percentage points (50 basis points) for the first time in 22 years and will raise rates again in June. The Fed is expected to strip $2.7 trillion from its nearly $9 trillion (trillion) balance sheet in the next 2 years and 5 months, faster than previously expected.

At a press conference after the Fed’s policy statement, Powell indicated that the Fed was not actively considering a 75 basis point rate hike. Since this had been priced as expected, non-US currencies rebounded after the news published.

In addition, the currency market has also increased bets on the European Central Bank rate hike, which is expected to increase by 95 basis points by the end of 2022, which will at least narrow the interest rate differential with the dollar. As of early Asian trading on 5th May 2022, EUR/USD rose rapidly during the day at 1.0619.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If the euro runs steadily below the 1.0529-line, then pay attention to the support strength of the position of 1.0357. If the strength of the euro breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

Following the Fed’s rate hike, the Bank of England’s interest rate meeting will also be ushered in today.

Currently, it is widely expected that the Bank of England will raise interest rates for the fourth consecutive time to deal with soaring inflation, and traders are already betting that the Bank will join the 50 basis point rate hike camp by September.

Accordingly, GBP received corresponding support. While with the help of the dollar’s retreat, the pound pulled up sharply in the foreign exchange market yesterday.

Technical Analysis:

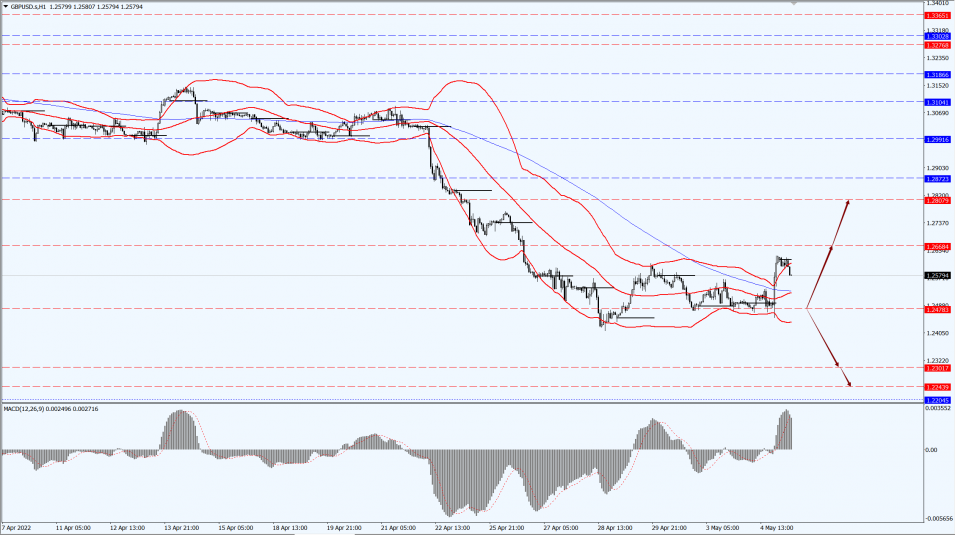

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2478-line today. If the pound runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2301 and 1.2243. If the pound runs above the 1.2478-line, then pay attention to the support strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold rose sharply in the short term, and the intraday increase reached nearly $40.

Gold prices rallied sharply as Fed Chairman Powell ruled out a single 75 basis point rate hike, while the dollar index plunged overnight after Powell’s speech.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1880-line today. If the gold price runs steadily above the 1880-line, then it will pay attention to the support strength of the 1909 and 1919 positions. If the gold price breaks above the 1880-line, then pay attention to the suppression strength of the two positions of the 1872 and 1861.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Brent oil futures settled up $5.17, or 4.9%, to $110.14 per barrel.

Earlier released EIA data showed that U.S. East Coast diesel stocks fell to record lows as U.S. refiners increased supplies to the global market against the backdrop of reduced Russian supplies, adding to supply pressure.

At the same time, European Commission President von der Leyen said that the EU proposed to ban the import of Russian crude oil for the next six months and the import of Russian refined oil by the end of the year.

Technical Analysis:

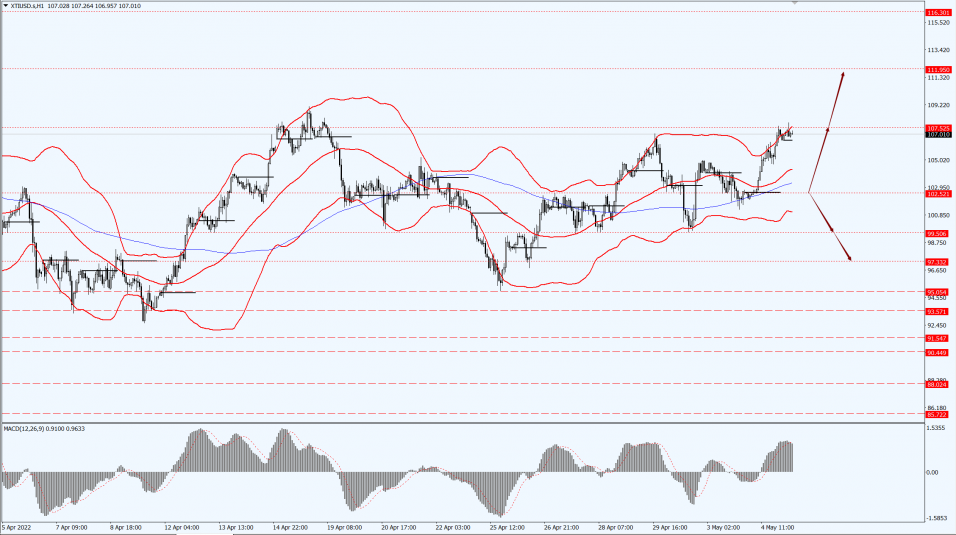

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 102.52-line today. If the oil price runs above the 102.52-line, then focus on the suppression strength of the two positions of 107.52 and 111.95. If the oil price runs below the 102.52-line, then pay attention to the support strength of the two positions of 99.50 and 97.33.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.