1. Forex Market Insight

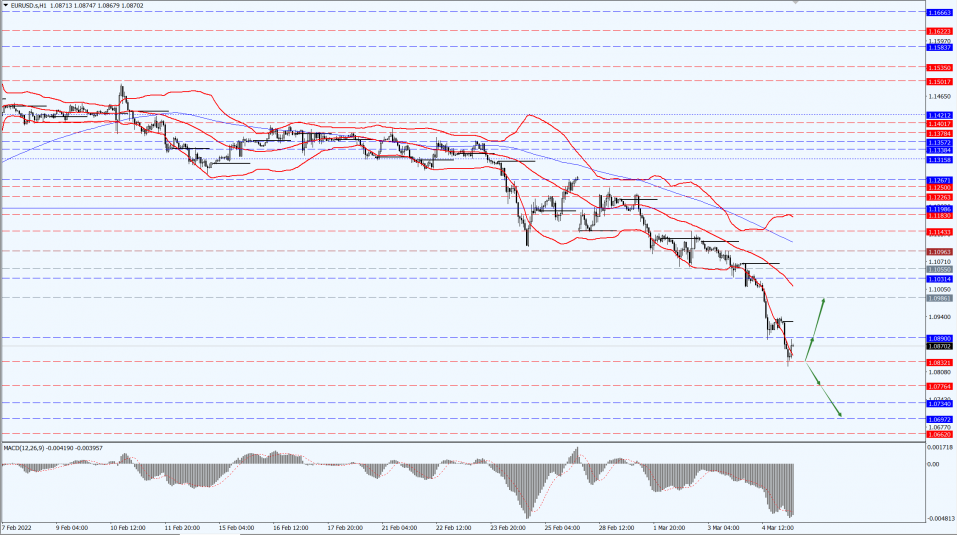

EUR/USD

Last week, the European Central Bank (ECB) announced its interest rate resolution, keeping rates unchanged, and will stop purchasing net assets under the pandemic emergency purchase program (PEPP) at the end of March 2022.

Plus, the ECB intends to reinvest the principal payments from maturing securities purchased under the PEPP at least until the end of 2024, under stress conditions where flexibility in the design and implementation of asset purchases can help counter impaired monetary policy transmission and make the ECB’s efforts to achieve its objectives more effectively.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, focus on the 1.0832-line. If the euro runs steadily above the 1.0832-line, then pay attention to the suppression strength of the two positions of 1.0890 and 1.0986. If the strength of the euro breaks below the 1.0832-line, then pay attention to the support strength of the two positions of 1.0776 and 1.0697.

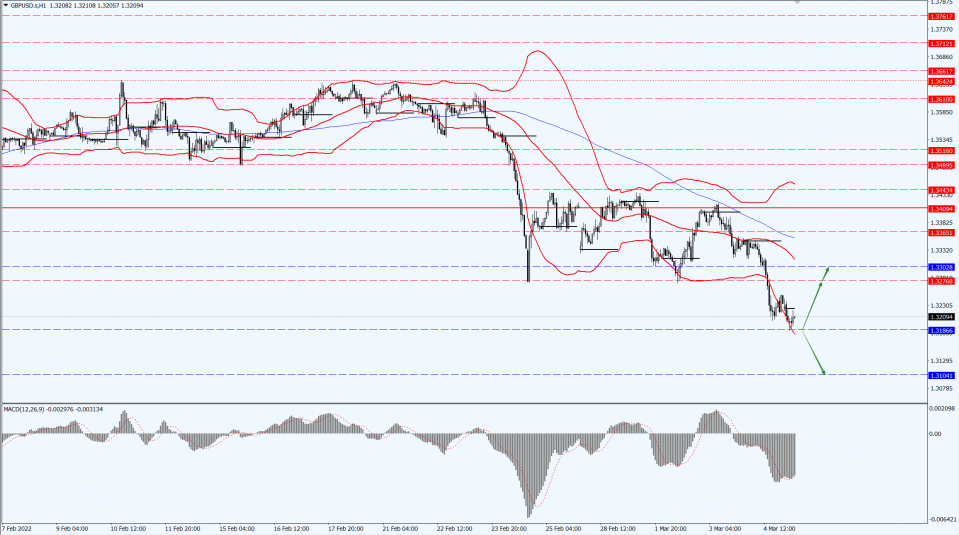

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England said at its last meeting that the UK’s current 5.5% inflation rate will peak at 7.25% in April when energy prices and taxes rise.

Thus, the market expects the central bank’s Monetary Policy Committee to raise interest rates again on March 17th.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3186-line today. If the pound runs above the 1.3186-line, it will pay attention to the suppression of the two positions of 1.3276 and 1.3302. If the pound runs below the 1.3186-line, it will pay attention to the support strength of the 1.3104-line.

2. Precious Metals Market Insight

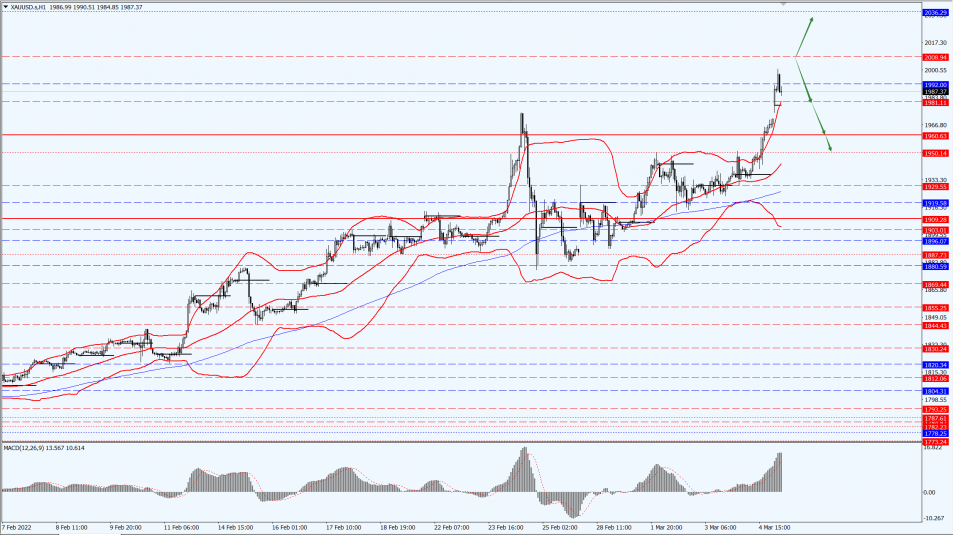

Gold

Fundamental Analysis:

The third round of Russia-Ukraine negotiations is scheduled for March 7th, and both sides have made new statements on the eve of the talks.

Putin said that any attempt by Ukraine to delay the negotiation process is futile and hopes that ” Ukraine will take into account the realities of the situation.”

On the Ukrainian side, the Ukrainian delegation mentioned an important point: “Ukraine is no longer committed to applying for NATO membership”. In addition, the Russian Defense Ministry made the latest statement on the situation, and the U.S. and EU also had the latest news.

Russia and Ukraine’s third round of negotiations is approaching, and it has become the focus of market attention. If the negotiations can make further progress, gold prices might be blocked at a high level. If the negotiations fail, the market risk aversion heated up, which may lead to gold prices continuing to rise to refresh new highs.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 2008-line today. If the gold price runs steadily below the 2008-line, then it will pay attention to the support strength of the two positions of 1981. At that time, pay attention to the suppression strength of the 2036-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices soared, with U.S. oil opening as high as $130.50 per barrel at one point, a new high since the end of 2008.

Negotiations on the Iran nuclear deal may be delayed due to disruptions to Russian oil exports caused by Western sanctions. Adding to this, the U.S. and European allies discussed a ban on imports of Russian oil.

That said, the market is concerned about further tightening of supply.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 127.10-line today. If the oil price runs below the 127.10-line, then focus on the support strength of the 116.30 and 111.95 positions. If the oil price breaks above the 127.10-line, then pay attention to the suppression of the 133.81-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.