1. Forex Market Insight

EUR/USD

The minutes of the ECB meeting show that the willingness of policymakers to withdraw stimulus measures seems to be strong, with some policymakers even pushing for more action, as the conditions for a rate hike have either been met or are about to be met.

Policymakers at the meeting agreed to end bond purchases sometime in the third quarter but made no further promises to withdraw stimulus, even as inflation continued to soar on the back of high energy and food prices.

However, the minutes meeting of yesterday, 7th April 2022, has shown a significant number of policymakers wanted to go further and set a clear end date for bond purchases. This is because the bond purchase program has already achieved its target and there is a risk that inflation will exceed the target for a long period of time.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

We focused on 1.0890-line today. If the euro runs steadily below the 1.0890-line, then pay attention to the support strength of the two positions of 1.0832 and 1.0776. If the strength of the euro breaks above the 1.0890-line, then pay attention to the suppression strength of the two positions of 1.0940 and 1.0986.

GBP Intraday Trend Analysis

Fundamental Analysis:

As seen in the minutes of the Fed’s March meeting released this week, the Fed seems to have no objection to the pace of subsequent rate hikes rising to 50 basis points once, especially in the context of rising commodity prices and intensifying inflation.

On the other hand, the Bank of England has adopted a moderate rate hike rhythm under the situation that UK domestic inflation continues to rise. The comparison between the two sides has also caused the pound to be suppressed recently.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3104-line today. If the pound runs below the 1.3104-line, it will pay attention to the support strength of the two positions of 1.2991 and 1.2872. If the pound runs above the 1.3104-line, it will pay attention to the suppression strength of the two positions of 1.3186 and 1.3302.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Although the biggest hawk of the Federal Reserve has called for a 50-basis point interest rate hike at every interest rate meeting this year, the market did not buy it because Russia admitted the “tragedy” of troop casualties and serious economic shocks are brewing a major offensive.

The concerns about rising prices and the Ukraine crisis have boosted gold’s appeal as a hedge against inflation and a safe-haven asset.

Bull morale has improved but gold prices are still in a volatile trend.

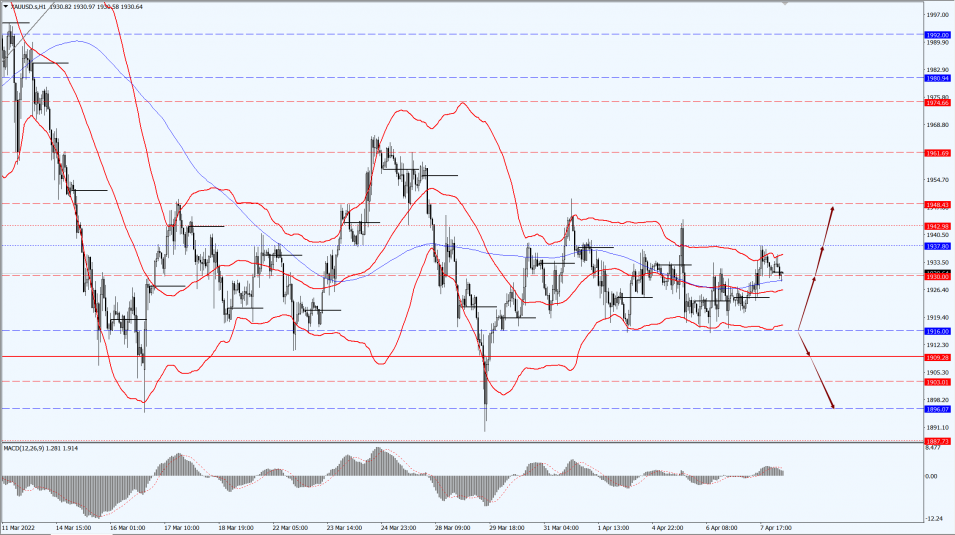

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1916-line today. If the gold price runs steadily above the 1916-line, then it will pay attention to the suppression of the 1930 and 1937 positions. If the gold price breaks below the 1916-line, it will open up further downside. At that time, we will pay attention to the support strength of the two positions of 1909 and 1896.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices have plunged recently. This is mainly due to the IEA’s announcement of a major sell-off of crude oil reserves and a new round of sanctions against Russia that did not ban crude oil, which has put downward pressure on oil prices.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

The oil price is focused on the 93.57-line today. If the oil price runs above the 93.57-line, then it will pay attention to the suppression strength of the two positions of 97.33 and 100.65. If the oil price runs below the 93.57-line, it will pay attention to the support strength of 91.54 and 90.44.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.