1. Forex Market Insight

EUR/USD

The policy divergence between the ECB and the Fed is indeed very important. If the euro is to strengthen, it will have to wait for the ECB to say ‘inflation will be more persistent than we think and monetary policy will not be as accommodative as we think’, but it may take a few months for the central bank to make this statement. Therefore, the recent trend of the euro is more on the volatile side.

Technical Analysis:

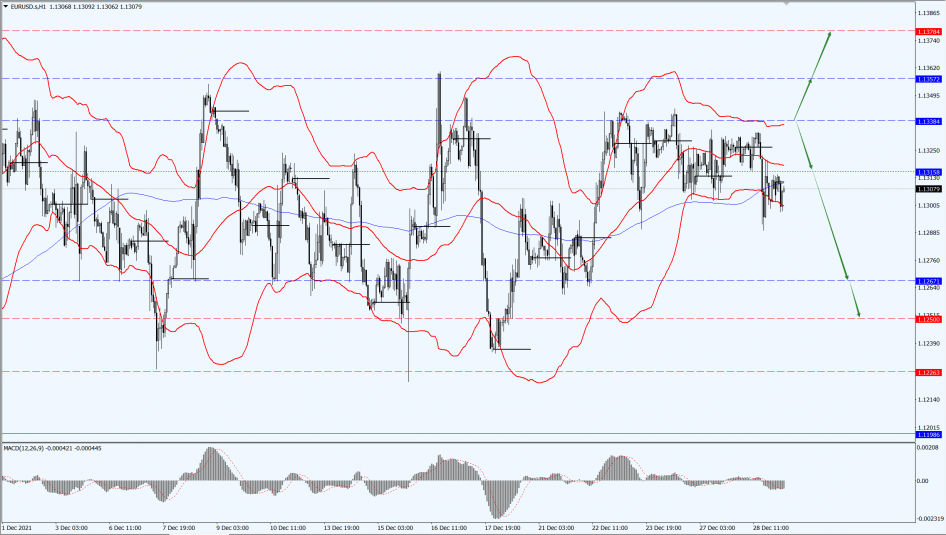

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the suppression of the 1.1338-line. If the euro runs stably below the 1.1338-line, then pay attention to the support at the lower 1.1315 and 1.1267 positions. If the euro breaks through the 1.1338-line, then pay attention to the suppression at the 1.1359 and 1.1378 positions.

GBP Intraday Trend Analysis

Fundamental Analysis:

Based on a series of early studies, the Omicron strain appears to be more benign, so the UK government is currently delaying the implementation of stricter restrictions. However, the Bank of England may continue to raise interest rates in February next year.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3450-line. If the pound runs below the 1.3450-line, then pay attention to the support at 1.3409 and 1.3365. If the pound runs above the 1.3450-line, then pay attention to the suppression of the 1.3522-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices closed lower after rallying higher yesterday as investors assessed the resilience of the global economic recovery amid a record number of Covid-19 cases worldwide.

Despite the rapid global spread of Omicron, studies show it is not causing as much disease severity as some previous strains.

Intraday, pay attention on the monthly U.S. wholesale inventories rate and the quarterly index of contracted home sales for November.

Technical Analysis:

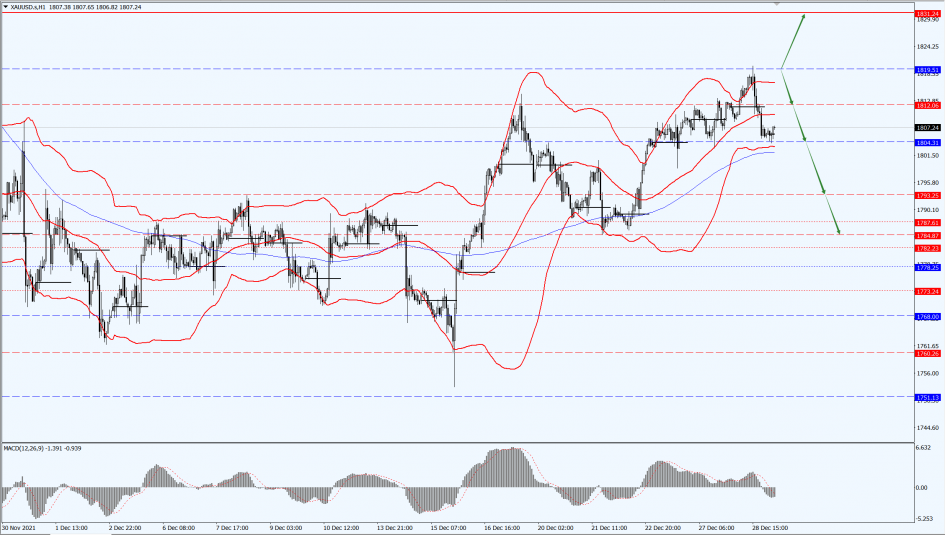

(Gold 1-hour chart)

Trading Strategies:

Today, gold is paying attention to the 1819-line. If the price of gold runs stably below the 1819-line, then it will pay attention to the support at 1804 and 1784. If the price of gold breaks above the 1819-line, it will open up a further upside space. At that time, pay attention to the suppression of 1831.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, early in the Asian market, U.S. oil extended its gains and is now at $76.20 per barrel, supported by supply disruptions in some countries and declining U.S. crude inventories. In addition, the market is digesting the potential impact of the Omicron variant on energy demand; oil prices have room for further upside in the short term.

Technical Analysis:

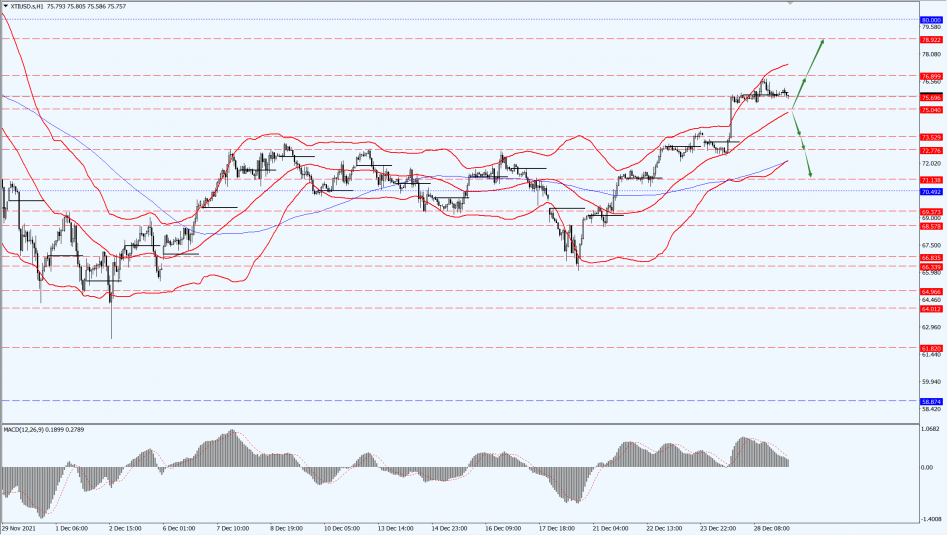

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are focused on the 75.04-line. If oil prices run above the 75.04-line, then focus on the suppression of the 76.89 and 78.92 positions. If the oil price breaks below the 75.04-line, then pay attention to the support at the 73.52 and 72.77 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.