1. Forex Market Insight

EUR/USD

Inflation in the eurozone surged to 7.5% in March, hitting a new record high, and is expected to be a few months away from peaking.

This has increased the pressure on the ECB to curb runaway prices despite a sharp slowdown in economic growth.

Data released by Eurostat showed that the harmonized consumer price index (HICP) in the euro zone jumped to 7.5% in March from 5.9% in February, far exceeding expectations of 6.6%.

The war in Ukraine and sanctions on Russia have pushed fuel and natural gas prices to record highs.

Although energy is the main culprit, inflation in food, services and durable goods are all above the ECB’s 2% target, further evidence that price increases are becoming more widespread, and not just for oil.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

We focus on the 1.0940-line today. If the euro runs steadily below the 1.0940-line, then pay attention to the support strength of the two positions of 1.0890 and 1.0832. If the strength of the euro breaks above the 1.0940-line, then pay attention to the suppression strength of the two positions of 1.0986 and 1.1055.

GBP Intraday Trend Analysis

Fundamental Analysis:

Bank of England Governor Bailey’s speech will provide monetary policy signals that the Bank of England may launch at its May rate meeting.

In addition to the fact that the Russian-Ukrainian talks have still failed to resolve the conflict, it is expected to break the range-bound trend pattern of the pound against the dollar last week.

Furthermore, , we have seen that the dollar has strengthened since the beginning of April, which has put pressure on the pound.

However, now that the pound against the dollar can remain near 1.3100, indicating that the market’s expectations for the Bank of England to continue raising interest rates in May constitute certain support.

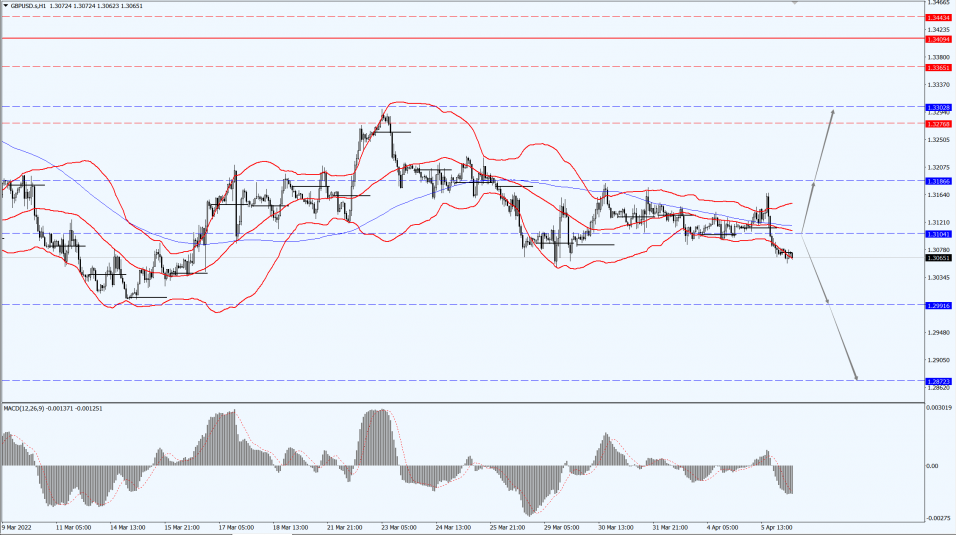

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3104-line today. If the pound runs below the 1.3104-line, it will pay attention to the support strength of the two positions of 1.2991 and 1.2872. If the pound runs above the 1.3104-line, it will pay attention to the suppression strength of the two positions of 1.3186 and 1.3302.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Overnight gold prices surged higher and retreated yesterday, 5th April 2022.

Despite the possibility of new Western sanctions against Russia, some safe-haven buying have been boosted, hence, gold prices rose to near $1,944 at one point.

However, as the ISM non-manufacturing PMI in the United States performed beautifully, and the Fed’s dovish officials delivered hawkish speeches, the market expected the Fed to further tighten monetary policy rapidly, putting pressure on gold prices.

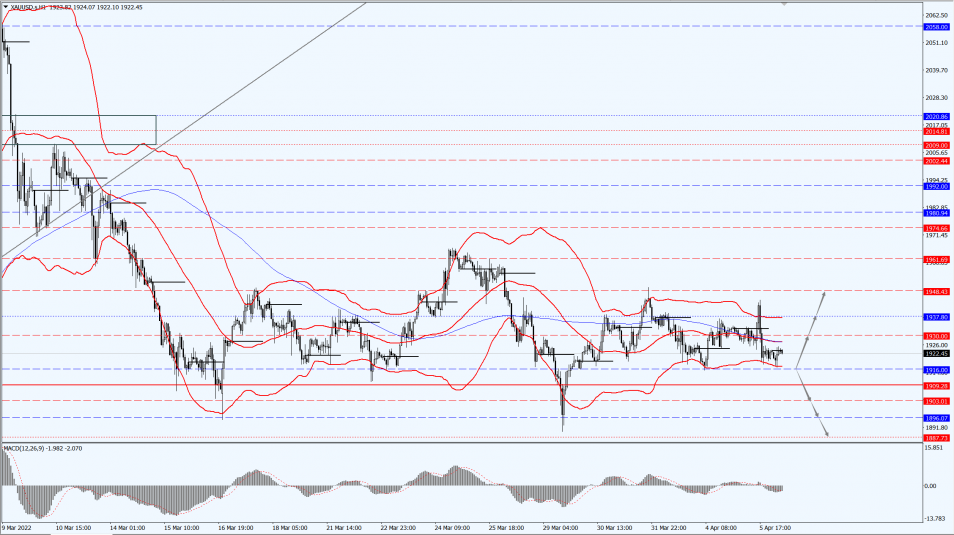

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1916-line today. If the gold price runs steadily above the 1916-line, it will pay attention to the suppression of the 1930 and 1937 positions. If the gold price breaks below the 1916-line, it will open up further downside. At that time, we will pay attention to the support strength of the two positions of 1903 and 1896.

3. Commodities Market Insight

WTI Crude Oil

U.S. oil fell slightly and is currently trading around $101 yesterday, 5th April 2022.

The members of International Energy Agency (IEA) still discussing on how much oil reserves they will jointly release to cool the market.

Meanwhile, oil prices were pressured by early API data which showing an increase in U.S. crude inventories, a rising dollar and growing concerns that a new epidemic could slow the impact of demand.

However, declines were limited as the possibility of more sanctions against Russia sparked supply concerns.

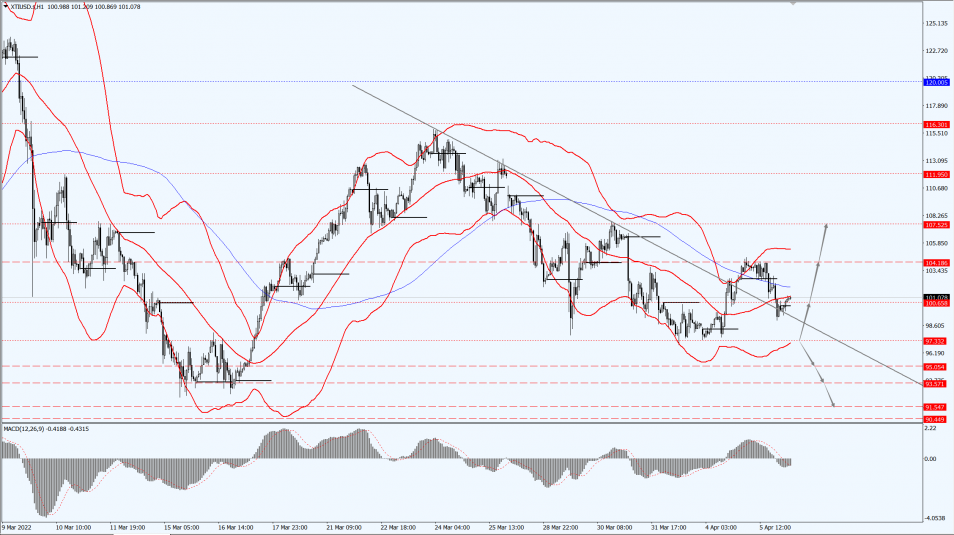

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices are concerned about the 97.33-line today. If the oil price runs above the 97.33-line, then attention will be paid to the suppression strength of the two positions of 100.65 and 104.18.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.