1. Forex Market Insight

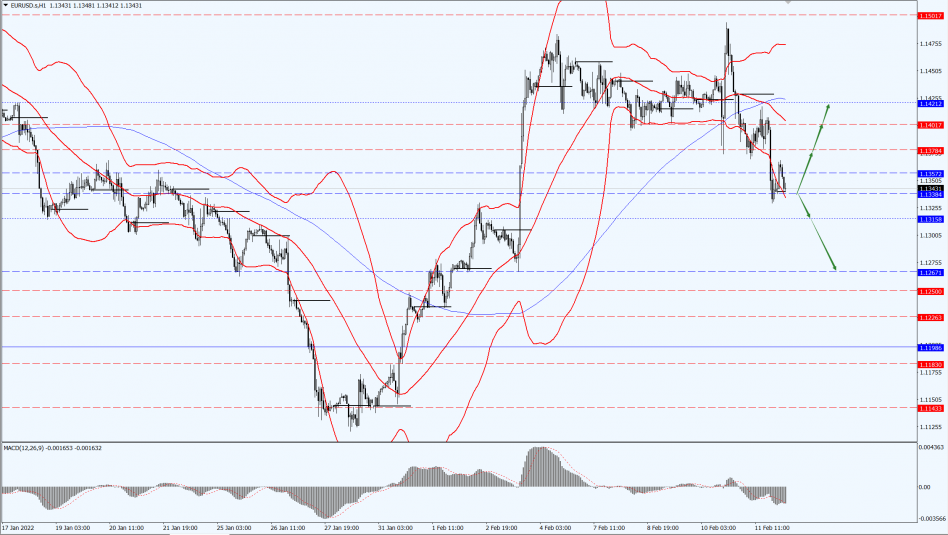

EUR/USD

European Central Bank executive Philip R. Lane said last week that euro zone inflation would return to trend without the need for significant policy tightening as coronavirus-related commodity and labor bottlenecks are resolved.

Faced with growing pressure from investors and policymakers to raise interest rates at the ECB, Lane defended his long-standing view that the current record inflation in the eurozone is only temporary.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1338-line. If the euro runs steadily above the 1.1338-line, we will pay attention to the suppression strength of the two positions above 1.1378 and 1.1401.

GBP Intraday Trend Analysis

Fundamental Analysis:

The U.K. economy shrank by 0.2% in December from the previous month, a smaller-than-expected contraction, when the rapid spread of a new variant of the coronavirus prompted many Britons to work from home and avoid Christmas social events, which has hit many service businesses.

The gross domestic product (GDP) rose by 6.0% in December from a year earlier, said the Office for National Statistics.

Economists surveyed had previously forecast a 0.6% drop in GDP in December from the previous month and a 6.3% increase from a year earlier.

Overall, December GDP was in line with the level seen in February 2020 before the outbreak of the Covid-19 outbreak, while the entire fourth quarter was slightly below the level seen in the fourth quarter of 2019.

November’s GDP growth was revised down to 0.7% month-on-month from 0.9%.

The Bank of England has said it expects to continue raising interest rates to slow demand as U.K. inflation rises above 7%, more than three times the central bank’s target.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3516-line today. If the pound runs above the 1.3516-line, it will focus on the suppression strength of the 1.3610 and 1.3661 positions. If the pound runs below the 1.3516-line, it will focus on the support strength of the 1.3443 and 1.3409 positions.

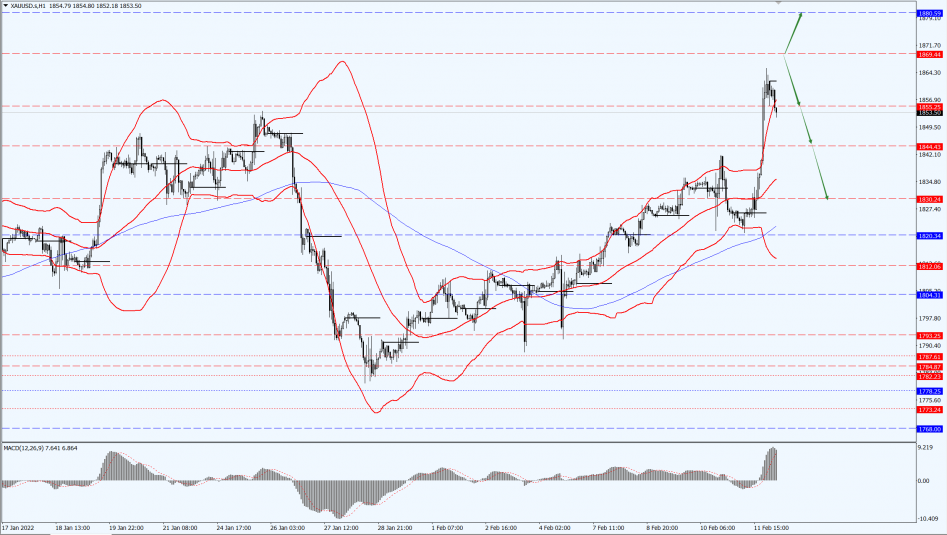

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

On Friday, 11th February 2022, gold prices surged by 1.75% to a near three-month high, mainly supported by tensions between Russia and Ukraine.

The plunge in U.S. stocks market and a drop in consumer confidence to a ten-year low also supported the price of gold.

However, the strong dollar and the prospect of a hawkish Fed rate hike limited the gains in gold prices.

This week, the United States will release important data such as the PPI, retail sales, EIA and initial claims. In addition, the Fed will also release the minutes from the January meeting.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1869-line today. If the gold price runs steadily below the 1869-line, then it will pay attention to the support strength of the 1844 and 1830 positions. If the gold price breaks above the 1869-line, it will open up a further upward space. At that time, pay attention to the suppression of the 1880 position.

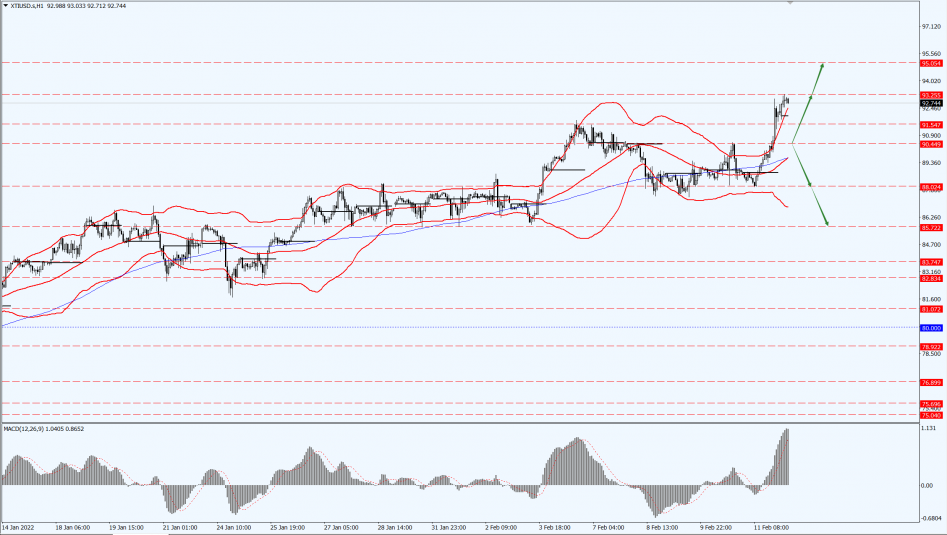

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose by more than 4% last week, to another seven-year high, peaking at $94.66 per barrel, approaching the 95 mark.

Concerns on the invasion of Ukraine by major energy producer, Russia, has intensified. This adds to the continued concerns on the tight global crude oil supplies.

The rise was also met with some resistance, with Iran indicating on Sunday, 13th February 2022, that it may increase exports.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 90.44-line today. If the oil price runs above the 90.44-line, then focus on the suppression strength of the 93.25 and 95.05 positions. If the oil price falls below the 90.44-line, then pay attention to the support strength of the 88.02 and 85.72 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.