1. Forex Market Insight

EUR/USD

The euro fell by 0.38% against the dollar to 1.1307. The move to safe-haven assets overshadowed the impact of the expected tightening of monetary policy by the ECB.

ECB President Lagarde also recently reiterated that any policy action would be gradual. Another area of pressure for the euro is the non-core eurozone government bond yields, especially the 10-year yield differential between Italian and German government bonds continues to rise.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1267-line. If the euro runs steadily above the 1.1267-line, we will pay attention to the suppression strength of the two positions above 1.1338 and 1.1357.

GBP Intraday Trend Analysis

Fundamental Analysis:

The market expects interest rates could reach the “excessive” 2% by the end of the year, but higher inflation could depress real incomes and demand later this year, triggering higher unemployment.

Some agencies have also lowered their growth forecasts to reflect the cost of living squeeze, with real incomes expected to fall by 2.5% in 2022 and remain flat in 2023.

As the Bank of England’s Monetary Policy Committee has been emphasizing, the combination of high inflation and low growth makes weighing policy even trickier.

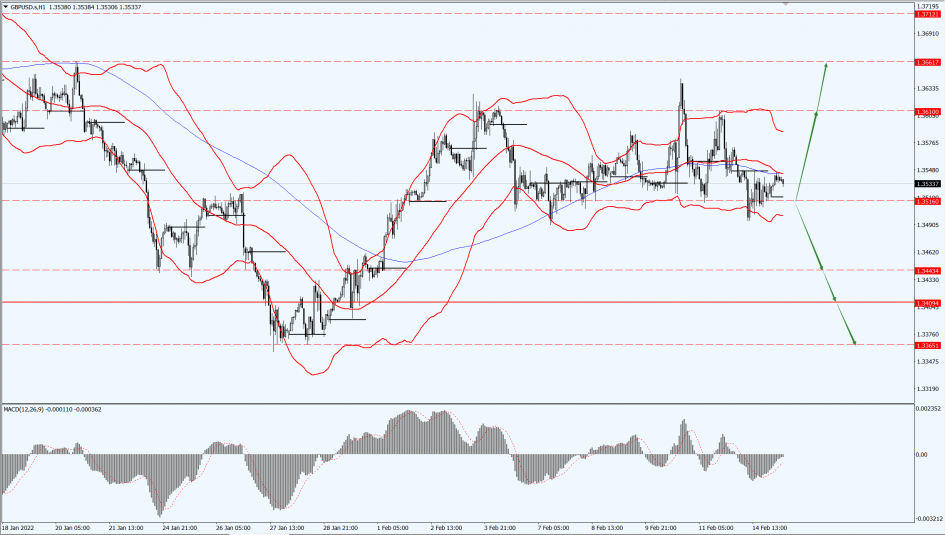

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3516-line today. If the pound runs above the 1.3516-line, it will focus on the suppression strength of the 1.3610 and 1.3661 positions. If the pound runs below the 1.3516-line, it will focus on the support strength of the 1.3443 and 1.3409 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices continued to strengthen yesterday, rising to a near three-month high, as continued geopolitical tensions around Ukraine led to renewed safe-haven demand from investors.

At the same time, U.S. stocks closed lower collectively. However, the stronger dollar and hawkish speeches by Federal Reserve officials limited the gains in gold prices.

Intraday, focus on the U.S. January PPI.

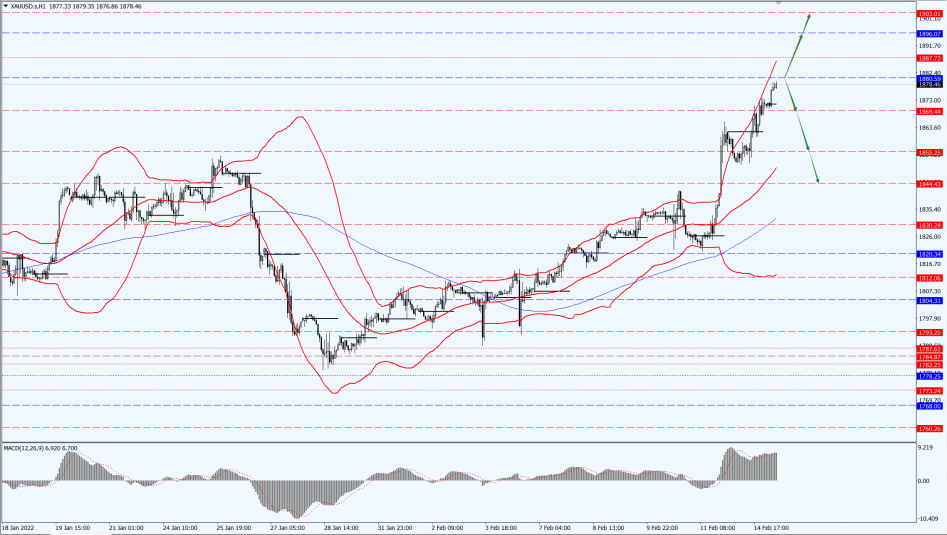

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1880-line today. If the gold price runs steadily below the 1880-line, it will pay attention to the support strength of the two positions of 1869 and 1855. If the gold price breaks above the 1880-line, it will open up further upward space. At that time, pay attention to 1896 and 1903 positions.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose by nearly 1% on Monday, 14th February 2022, hitting another seven-year high, with U.S. oil breaking above the 95 mark to as high as $95.82 per barrel.

The markets remain highly sensitive to the geopolitical situation as geopolitical tensions between Russia and Ukraine keep markets on edge, with the Ukrainian president saying he heard Russia could invade on Wednesday.

In addition, keep an eye on the API data during the day.

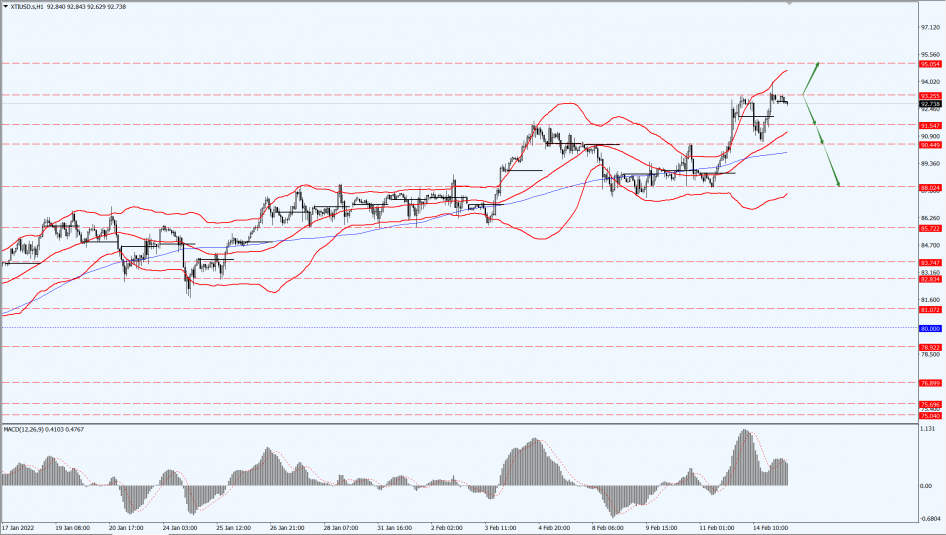

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 93.25-line today. If the oil price runs below the 93.25-line, then pay attention to the support strength of the 91.54 and 90.44 positions. If the oil price breaks above the 93.25-line, then pay attention to the suppression of the 95.05 position.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.