1. Forex Market Insight

EUR/USD

The Eurozone economy is set to suffer a slowdown this winter. A renewed surge in new cases of the Covid-19 has led to new restrictions, while a sharp upward trend in gas prices is continuing, which could affect the income of households and businesses.

The eurozone economy is now expected to grow by 3.8% next year, down from the previously expected 4.2%. However, there is optimism that the rise in vaccine prevalence should end a new wave of epidemics. Meanwhile, gasoline prices should moderate in the spring and the eurozone economy is expected to quickly make up for the winter losses.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the suppression of the 1.1338-line. If the euro runs stably below the 1.1338-line, then pay attention to the support at the lower 1.1315 and 1.1267 positions. If the euro breaks through the 1.1338-line, then pay attention to the suppression at the 1.1359 and 1.1378 positions.

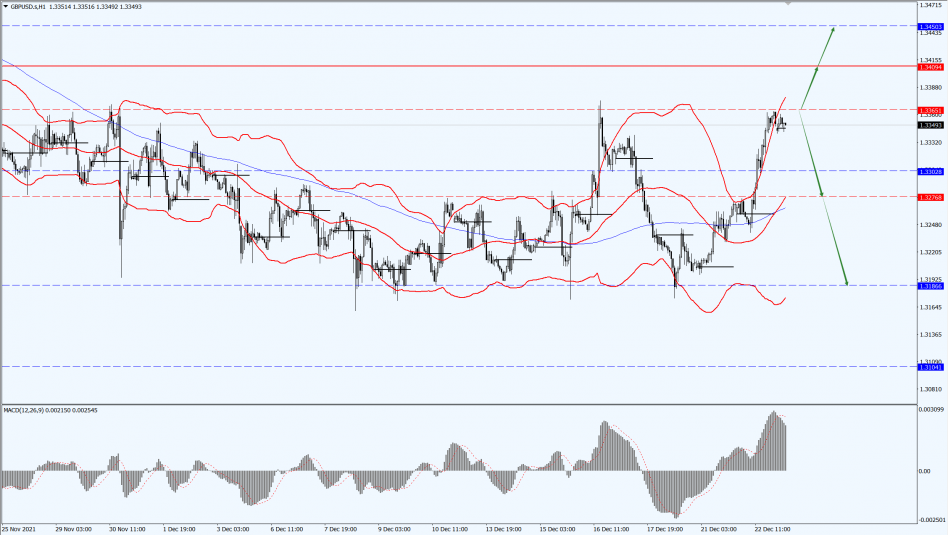

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose by 0.68% against the dollar to $1.3352, despite data showing that the U.K. economy grew at a slower pace than previously estimated in the third quarter.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3365-line. If the pound runs below the 1.3365-line, then pay attention to the support at the 1.3276 and 1.3186 positions. If the pound strength rises above the 1.3365-line, then pay attention to the suppression at the 1.3409 and 1.3450 positions.

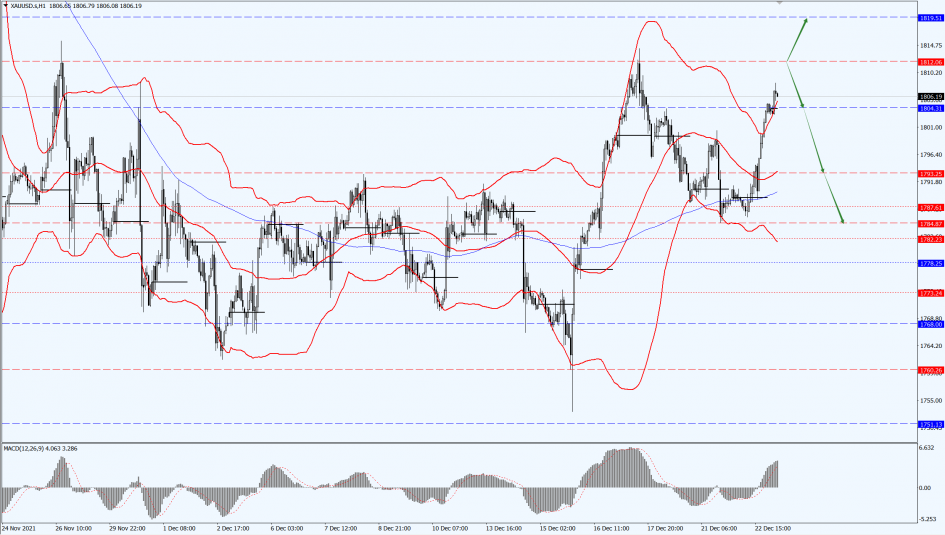

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose sharply yesterday, closing above 1800 for the first time in a month, as the dollar fell and concerns lingers as variant of the Omicron coronavirus could hinder the global economic recovery.

However, stronger U.S. consumer confidence and strong gains in U.S. stocks limited gold’s gains. The focus during the day will be on the U.S. PCE price index for November, which is the Federal Reserve’s most favored inflation indicator and has an important impact on gold prices, as well as on initial jobless claims, personal spending and durable goods orders.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the 1812-line. If the price of gold runs steadily below the 1812-line, then pay attention to the support at the positions of 1793 and 1784. If the price of gold breaks above the 1812-line, it will open up further upward space. At that time, pay attention to the suppression of 1820.

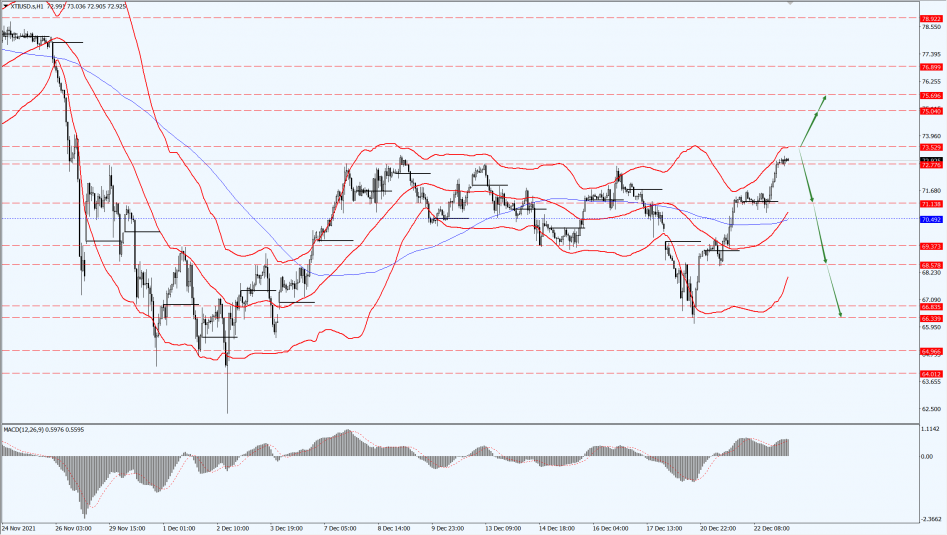

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices extended gains yesterday to a nearly one-month high of $73.21 per barrel as a larger-than-expected drop in U.S. inventories allayed fears that the spread of the Omicron variant could hit economic activity, and a U.S. emergency use authorization for Pfizer’s vaccine oral drug fueled gains.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices today pay attention to the 73.52-line. If oil prices run below the 73.52-line, then pay attention to the support at 71.13 and 68.57. If the oil price breaks above the 73.52-line, then pay attention to the suppression at the 75.04 and 75.69 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.