1. Forex Market Insight

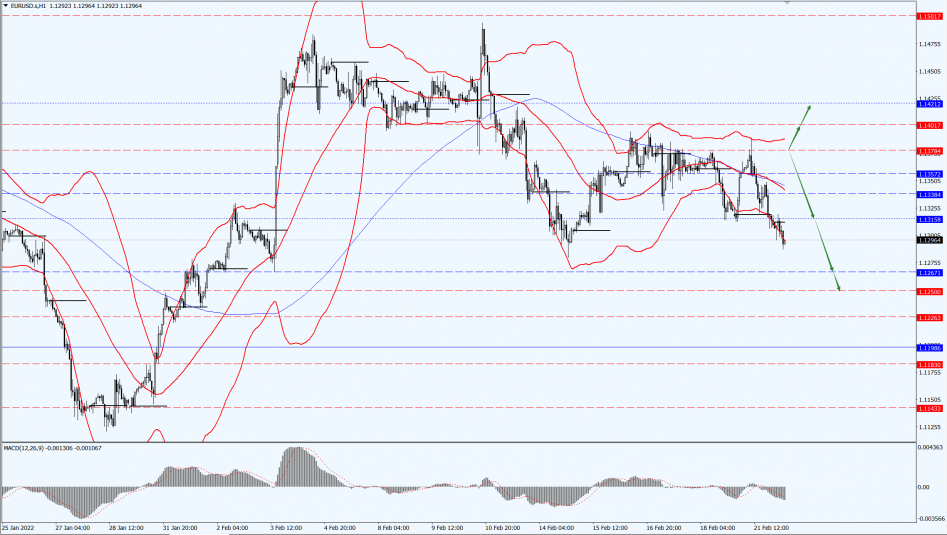

EUR/USD

The preliminary Eurozone Purchasing Managers’ Index (PMI) for February was released earlier on Monday, 21st February 2022, showing that confidence in the service sector rebounded sharply and better than expected. It also reflects a decline in the infection rate of the Omicron variant and the easing of related restrictions.

The strong recovery in the services sector has helped ease the pace of EUR/USD’s retreat from earlier highs, and foreign exchange market conditions will continue to be volatile in the coming days due to uncertainty over the Ukraine crisis.

In addition to geopolitical factors, speeches by Fed officials, preliminary U.S. PMIs, U.S. core personal consumption expenditure (PCE) inflation in January, and any further comments from the ECB policymakers are worth watching as markets assess the timing and pace of monetary policy tightening by the Fed and ECB.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression strength of the 1.1378-line. If the euro runs steadily below the 1.1378-line, we will pay attention to the support strength of the two positions below 1.1267 and 1.1250.

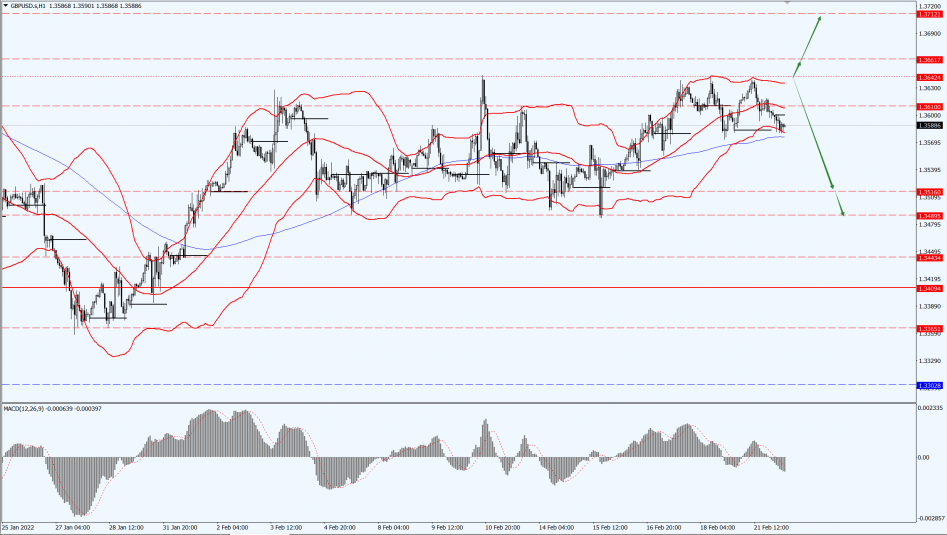

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England has raised interest rates twice since December, from 0.1% to 0.5%. In addition, the financial markets expect a further hike to 0.75% or 1% on 17th March 2022.

Better-than-expected U.K. retail sales data also provided support to the pound. The data showed that British retail sales rose by 1.9% in January from the previous month, beating analysts’ forecasts of 1.2%, compared with a 4% decline in December last year, as consumers began to resume more normal buying behavior.

However, the key question going forward is whether this apparent rebound in consumption can withstand the coming April tax and energy bill increases that will take a big chunk out of workers’ wages.

Money markets are now expecting a rate hike in the U.K. next month and digesting expectations of a rate hike of up to 136 basis points for the rest of the year.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3642-line today. If the pound runs below the 1.3642-line, it will pay attention to the support strength of the 1.3516 and 1.3489 positions. If the pound runs above the 1.3642-line, it will focus on the suppression strength of the 1.3661 and 1.3712 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices bottomed out and closed slightly higher yesterday, setting a new high of more than eight months as risk aversion in the market surged after Russian President Vladimir Putin signed a decree recognizing two self-proclaimed republics by separatist forces in Ukraine.

However, Fed Governor Bowman’s speech acknowledged the possibility of a 50 basis point rate hike, limiting gold price gains. During the day, the main focus will be on the U.S. Conference Board consumer confidence and manufacturing PMI, in addition to the soon-to-be given speech by Atlanta Fed President Bostic.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1909-line today. If the gold price runs steadily below the 1909-line, then it will pay attention to the support strength of the 1887 and 1880 positions. If the gold price breaks above the 1909-line, it will open up a further upward trend. At that time, pay attention to the 1919 and 1929 two positions of suppression strength.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices continued their gains, with Brent oil hitting its highest since 2014 at $97.40 per barrel, and U.S. oil at $92.69 per barrel, as the confrontation between Russia and the West over Ukraine intensified supply concerns, pushing oil prices close to $100 a barrel.

Technical Analysis:

(Crude oil 1-hour chart)

Oil prices focus on the 90.44-line today. If the oil price runs above the 90.44-line, then pay attention to the suppression of the 93.25 and 95.05 positions. If the oil price breaks below the 90.44-line, then pay attention to the support of the 88.02-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.