1. Forex Market Insight

EUR/USD

This week, investors need to pay attention to the performance of the Eurozone CPI final value in January. Eurozone inflation surpassed expectations again in January, jumping to 5.1% from 5.0% in December.

The final estimate will provide the details needed to unravel the overall data and assess changes in potential price pressure. Core inflation unexpectedly rose in January, with core inflation falling less than expected to 2.3% from 2.6% in December.

Food and energy costs both unexpectedly rose. The market expects energy pressure mainly due to a stronger-than-expected increase in household energy expenditure led by Italy.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression strength of the 1.1401-line. If the euro runs steadily below the 1.1401-line, we will pay attention to the support strength of the two positions below 1.1357 and 1.1315.

GBP Intraday Trend Analysis

Fundamental Analysis:

The preliminary U.K. PMI is a forward-guiding indicator that central bank watchers use to gauge whether the Bank of England raises interest rates again in March.

The UK’s composite PMI data for February will give markets an early indication of how quickly the outbreak has rebounded after restrictions eased and virus cases fell.

Markets are expecting the UK composite PMI to show a re-acceleration of economic growth, with the indicator likely to rise to 55.5 from 54.2 in January.

Following a smaller-than-expected decline in December, the U.K. GDP is expected to fall in January as consumer caution and the impact of government restrictions and job losses continue to weigh on economic activity.

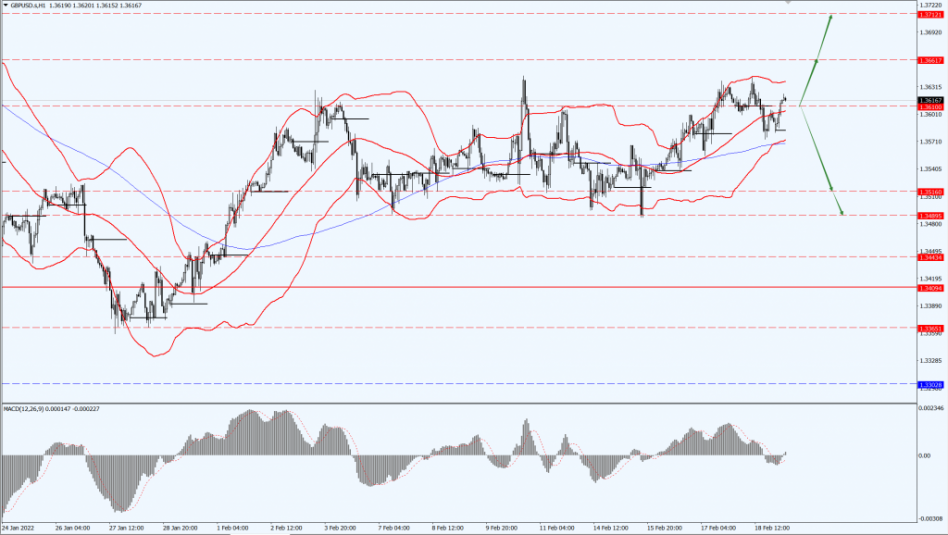

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused about the 1.3610-line today. If the pound runs below the 1.3610-line, it will pay attention to the support strength of the 1.3516 and 1.3489 positions. If the pound runs above the 1.3610-line, it will focus on the suppression strength of the 1.3661 and 1.3712 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Today, at the opening of the Asian market, spot gold fluctuated higher, reaching a new high of $1,908.34 per ounce since June 3, 2021. The news about the situation in Russia and Ukraine over the weekend has caused market concerns to continue to heat up, providing gold prices with upward momentum.

Affected by factors such as geopolitical concerns, the U.S. stock market fell to a new low in nearly three weeks last Friday, while two Fed officials reiterated their view that they would only support a 25 basis point interest rate hike in March, prompting an increase in gold ETF holdings and supporting gold prices.

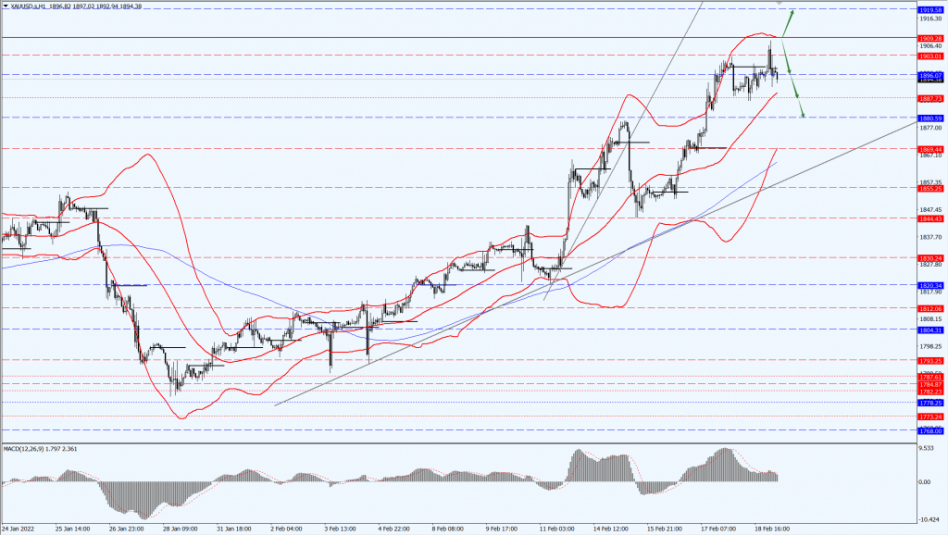

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1909-line today. If the gold price runs steadily below the 1909-line, then pay attention to the support strength of the 1887 and 1880 positions. If the gold price breaks above the 1909-line, it will open up further upward space, and then pay attention to the suppression strength of the 1919-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Biden remains affirmative in saying he will defend Ukraine and will impose sanctions such as blocking energy sales as a retaliation against Russian military action.

Oil prices are already at multi-year highs due to supply and demand imbalances, and further tensions could mean oil could rise further (over $100), which could negatively impact both the U.S. and global economies.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 88.02-line today. If the oil price runs above the 88.02-line, then focus on the suppression strength of the 90.44 and 93.25 positions. If the oil price breaks below the 88.02-line, then pay attention to the support strength of the 85.72 and 83.74 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.