1. Forex Market Insight

EUR/USD

The dollar index fell yesterday and the euro rose against the greenback for the first time in three sessions as Russia hinted that some troops were beginning to return to their permanent bases after completing exercises.

The yen and Swiss franc fell as safe-haven demand faded, and the Norwegian krone weakened along with crude oil prices.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression strength of the 1.1401-line. If the euro runs steadily below the 1.1401-line, we will pay attention to the support strength of the two positions below 1.1315 and 1.1267.

GBP Intraday Trend Analysis

Fundamental Analysis:

Questions about the possibility of a 50 basis point Fed rate hike in March – the Fed usually adjusts rates by 25 basis points – led to a 21 basis point rise in the 2-year Treasury yields on Feb. 10, the largest one-day gain since 2009.

During this interval, the British pound narrowed its gains against the dollar, rising by 0.07% to 1.3538, after rising 0.3% earlier in the day.

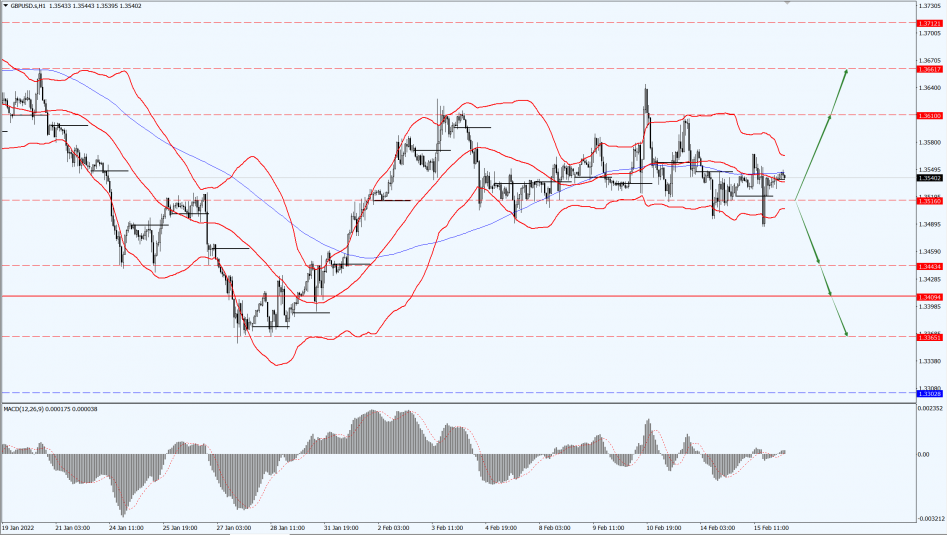

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3516-line today. If the pound runs above the 1.3516-line, it will focus on the suppression strength of the 1.3610 and 1.3661 positions. If the pound runs below the 1.3516-line, it will focus on the support strength of the 1.3443 and 1.3409 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, gold prices surged higher after a sharp drop of nearly 1%, because of the partial withdrawal of Russian troops.

With this, the market risk aversion has eased, and the sharp rise in the stock market has increased the risk-taking impulse. However, the sharp decline in the dollar and the surprisingly hot PPI numbers limited the decline in gold prices.

The focus during the day will be on the U.S. “horror data” retail sales. In addition, the Chinese CPI, PPI, etc. are also worth paying attention to.

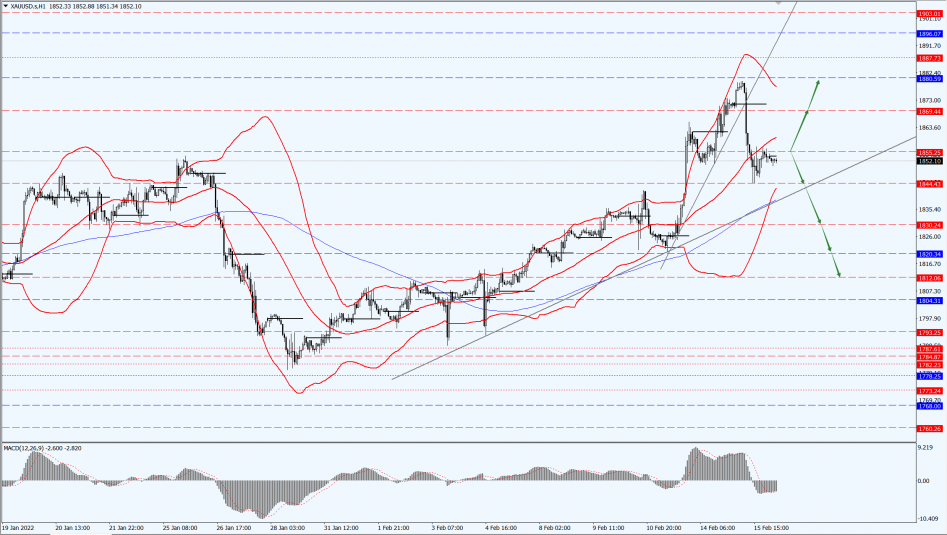

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1855-line today. If the gold price runs steadily below the 1855-line, then pay attention to the support strength of the 1844 and 1820 positions. If the gold price breaks above the 1855-line, it will open up further rebound space. At that time, pay attention to the 1869 and 1880 positions.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices retreated by nearly 3% on Tuesday, 15th February 2022, as Russia said some troops began returning to their posts, easing geopolitical tensions that previously led to a price surge, with investors taking profits on rallies that hit seven-year highs and global stock markets sliding.

However, Biden insisted Russia could invade Ukraine, and lingering concerns about energy supplies capped the slide in oil price.

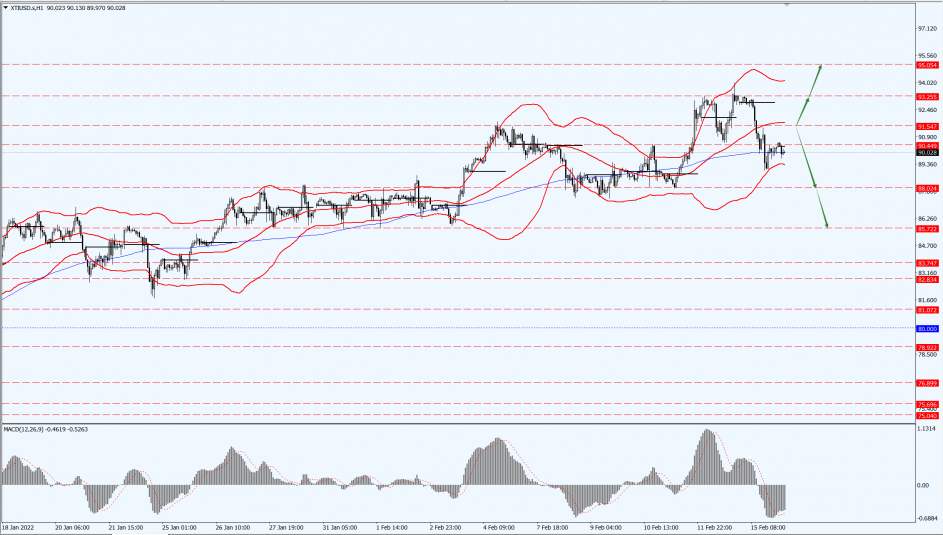

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 91.54-line today. If the oil price runs below the 91.54-line, then pay attention to the support strength of the 88.02 and 85.72 positions. If the oil price breaks above the 91.54-line, then pay attention to the suppression strength of the 93.25 and 95.05 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.