1. Forex Market Insight

EUR/USD

The comment of Russian President Vladimir Putin shook up the market before the Federal Reserve raised interest rates.

Putin ordered Russia’s first mobilization since World War II and warned the West that if what he called “nuclear blackmail” continued, Moscow would respond with all its vast weapons forces.

The dollar index jumped more than 0.5% to 110.87, the highest level since 2002.

European currencies have borne the brunt of the currency market sell-off, with the region already under pressure from Russian gas supplies to Europe and Putin’s comments fueling concerns about Europe’s economic outlook.

EUR/USD fell to $0.9885 at one point.

Followed by the raise of interest rates by the Fed for the third time at 2:00 a.m. GMT on Thursday, 22nd September 2022. The Fed hinted at further massive rate hikes in the upcoming meeting and EUR/USD fell to a two-week low of 0.9813.

Now the eurozone is really internal disturbances and external problems, not only by the possible expansion of the Russian-Ukrainian war deep impact on the development of its economy, and the Fed’s monetary policy soaring to support the dollar’s continuous climb, making the euro downward pressure is increasing.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9879-line today. If EUR runs steadily below the 0.9879-line, then pay attention to the support strength of the two positions of 0.9810 and 0.9770. If the strength of EUR breaks above the 0.9879-line, then pay attention to the suppression strength of the two positions of 0.9909 and 0.9999.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD hit a 37-year low of 1.1237 on Wednesday, 21st September 2022, after Russian President Vladimir Putin accused the West of “nuclear blackmail” and carried out a general mobilization for war, boosting the safe-haven dollar and causing the pound to suffer a severe sell-off.

The Fed’s third big rate hike later in the day also continues to weigh heavily on the pound’s structure.

Today, the Bank of England will also hold an interest rate meeting, if you can raise interest rates by 75 basis points, or can help the pound to regain some losses.

And if it is just a 50 basis point rate hike, disappointment will probably drive the pound to extend its decline.

In addition, if Russia cuts off gas supplies to mainland Europe, leading to a continued rise in gas prices, the cost of the energy subsidy scheme could soar, the government’s balance sheet would suffer a huge loss, and the pound would fear a significant devaluation.

Technical Analysis:

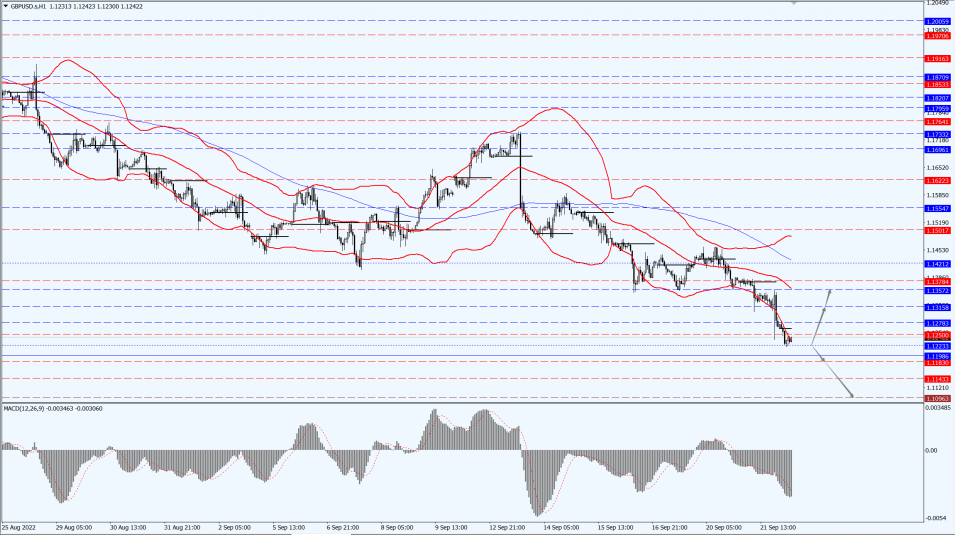

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1223-line today. If GBP runs below the 1.1223-line, it will pay attention to the suppression strength of the two positions of 1.1183 and 1.1096. If GBP runs above the 1.1223-line, then pay attention to the suppression strength of the two positions of 1.1315 and 1.1357.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rebounded on Wednesday, 21st September 2022, as Treasury yields eased after the Federal Reserve raised rates by 75 basis points as expected.

The Federal Reserve raised its target rate by three-quarters of a percentage point and signaled further rate hikes.

Technical Analysis:

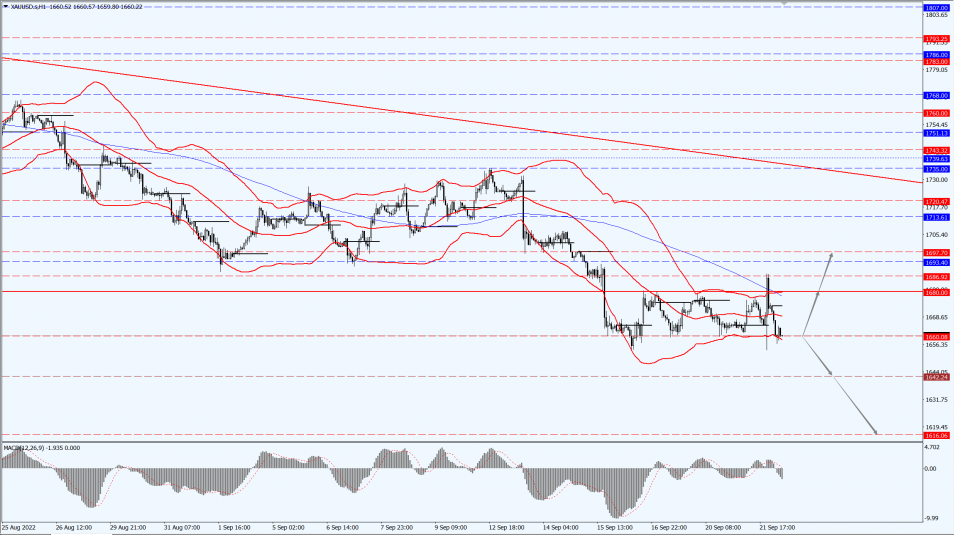

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1660-line today. If the gold price runs steadily below the 1660-line, then it will pay attention to the support strength of the 1642 and 1616 positions. If the gold price breaks above the 1660-line, then pay attention to the suppression strength of the two positions of the 1680 and 1697.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell about 1.5% to a nearly two-week low in shaky trading Wednesday, 21st September 2022, after the Federal Reserve raised interest rates sharply again to curb inflation, which could reduce economic activity and oil demand.

The U.S. Energy Information Administration reported that crude oil inventories rose by 1.1 million barrels last week, half the increase predicted by analysts in a Reuters poll.

Russian President Vladimir Putin has called 300,000 reservists to fight in Ukraine, backed plans to annex parts of the country, and hinted that he is prepared to use nuclear weapons.

U.S. President Joe Biden accused Russia of making “reckless” and “irresponsible” threats about using nuclear weapons.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 82.41-line today. If the oil price runs above the 82.41-line, then focus on the suppression strength of the two positions of 84.02 and 85.72. If the oil price runs below the 82.41-line, then pay attention to the support strength of the two positions of 81.07 and 80.00.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.