1. Forex Market Insight

EUR/USD

The European Central Bank will announce an interest rate resolution. Economists predict that the ECB may change its approach to quantitative easing (QE), withdrawing from the pandemic emergency purchase program (PEPP) next year and expanding its regular asset purchase program (APP).

In addition, the ECB may also raise inflation expectations, suggesting that inflation will take longer to fall back, while lowering economic growth expectations for next year.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1250-line of support. If the euro runs stably above the 1.1250-line, continue to focus on the euro’s rebound strength. At that time, pay attention to the suppression at the top 1.1315 and 1.1357 positions. If the euro’s strength drops below the 1.1250-line, then pay attention to the support strength of 1.1198 two positions at 1.1226 and 1.1226.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England will announce its interest rate resolution. This follows two consecutive trading days of upward movement of the pound against the dollar and a slight retreat during the day.

Currency markets are still wavering on whether the central bank will raise interest rates during the day. If the pandemic uncertainty makes the Bank of England in the inflation spike at a time when interest rates remain unchanged, the bank may pave the way for a more aggressive rate hike in February next year.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3302-line. If the pound runs below the 1.3302-line, then pay attention to the support at the 1.3186 and 1.3104 positions. If the pound strength rises above the 1.3302-line, then pay attention to the 1.3409-line of suppression.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, gold prices bottomed out and rebounded. The U.S. dollar turned to fall and closed up. Earlier, the Fed stated that it would end its stimulus measures during the pandemic in March and hinted that it would raise interest rates three times next year, but the market had anticipated this in advance.

In addition, the factors of the pandemic and the weakness of retail sales also supported gold prices. Intraday, the focus on the Bank of England, the European Central Bank interest rate resolution, and the initial jobless claims are also worth watching.

Technical Analysis:

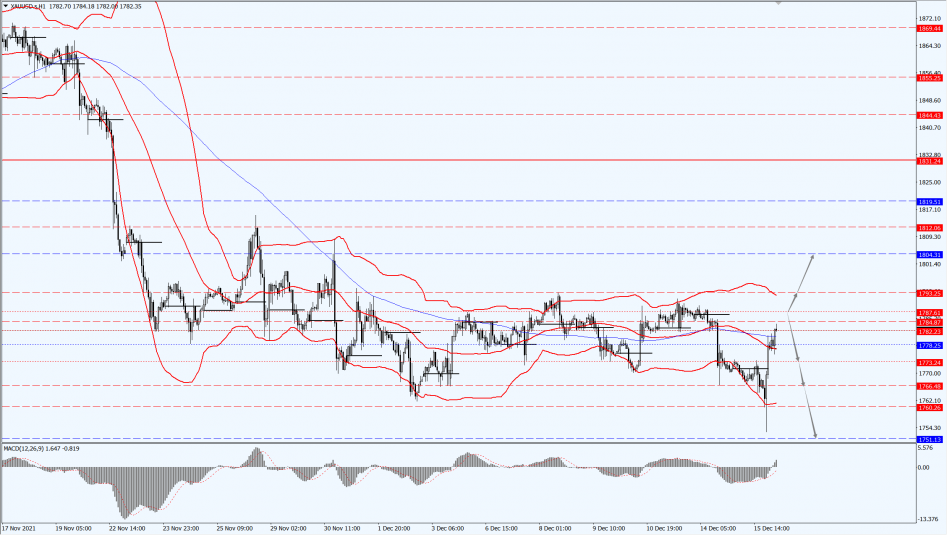

(Gold 1-hour chart)

Trading Strategies:

Gold is paying attention to the 1787-line today. If the price of gold runs below the 1787-line, then it will pay attention to the support of the 1773 and 1766 positions. If the gold price breaks through the 1787-line again, it will open up a further upside space. At that time, pay attention to the suppressive strength of each position at the 1793 and 1804 lines.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose by more than 1.65% on Wednesday, 13th December 2021, as U.S. inventory data showed strong consumer demand. However, oil prices are at downside risk due to accelerated transmission of mutated strains of viruses and expectations of a Fed rate hike. Intraday focus on the U.S. December Markit manufacturing PMI preliminary value, and the U.S. monthly rate of industrial output in November.

Technical Analysis:

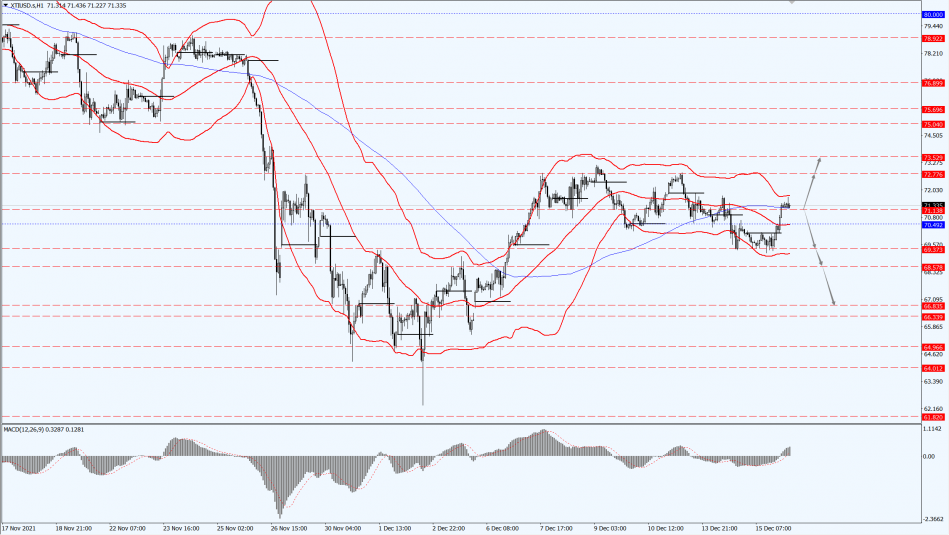

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices are still paying attention to the 71.13-line today. If the oil price runs below the 71.13-line, maintain the bearish, then pay attention to the support of the 68.57 and 66.83 positions in turn. If the oil price breaks through the 71.13-line, it will open up a further upside. At that time, focus on the suppression of the 72.77 and 73.52 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.