1. Forex Market Insight

EUR/USD

While central banks around the world are racing to contain soaring inflation, the European Central Bank (ECB), however, only confirmed this week that it plans to end stimulus in the third quarter, making it one of the world’s most cautious major central banks.

The ECB’s move this week was seen as dovish in the face of soaring inflation, weighing on the euro and indirectly negative for gold.

The blow to consumer confidence from higher energy prices and supply chain disruptions is likely to dim the economic outlook, limiting the pace of the ECB’s monetary tightening.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

We focus on the 1.0832-line today. If the euro runs steadily below the 1.0832-line, then pay attention to the support strength of the two positions of 1.0776 and 1.0734. If the strength of the euro breaks above the 1.0832-line, then pay attention to the suppression strength of the two positions of 1.0890 and 1.0940.

GBP Intraday Trend Analysis

Fundamental Analysis:

Recently, the governor of the Bank of England, Bailey indicated that the shock from energy prices this year will be larger than every single year in the 1970s.

Signs of a slowdown in growth and demand are starting to be seen, and demand pressures will affect domestic inflation.

Under the current circumstances, tightening the policy is appropriate.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2991-line today. If the pound runs above the 1.2991-line, it will pay attention to the suppression strength of the two positions of 1.3104 and 1.3186. If the pound runs below the 1.2991-line, then pay attention to the support strength of the 1.2872-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold rose for the second week in a row, setting a one-month high last week.

Although the market is preparing for the accelerated tightening of monetary policy by the Federal Reserve which will lead to a stronger dollar, the European Central Bank’s surprisingly dovish stance is also positive for the dollar.

However, the annual rate of U.S. inflation broke eight, highest in 40 years. Russia and Ukraine are difficult to cease fire in the short term.

This brought safe-haven demand and further intensified upward pressure on inflation, keeping gold prices within the upward channel.

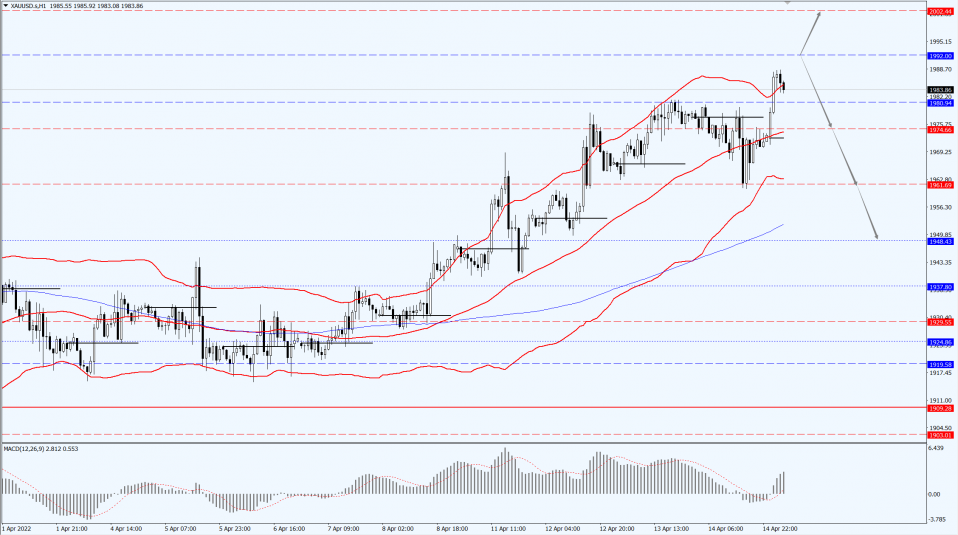

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1992-line today. If the gold price runs steadily below the 1992-line, then it will pay attention to the support strength of the 1974 and 1961 positions. If the gold price breaks above the 1992-line, it will open up further upward space. At that time, pay attention to the suppression strength of the 1992-line and 2002-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil continued its rally and is now at $108.26 per barrel as the European Union indicated over the weekend that a new round of sanctions against Russia would mainly target banks and energy.

Meanwhile, Ukraine has failed to reach an agreement with Russia to stop firing on the evacuation route which leads to the situation remains uncertain.

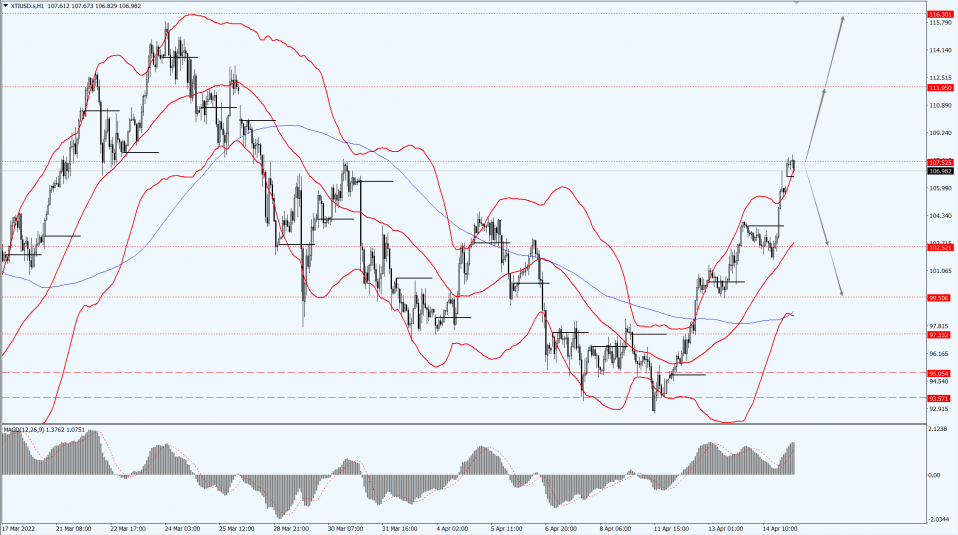

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 107.52-line today. If the oil price runs above the 107.52-line, then focus on the suppression strength of the 102.52 and 99.50 positions. If the oil price runs below the 107.52-line, then pay attention to the support strength of 111.95 and 116.30.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.