Today’s News

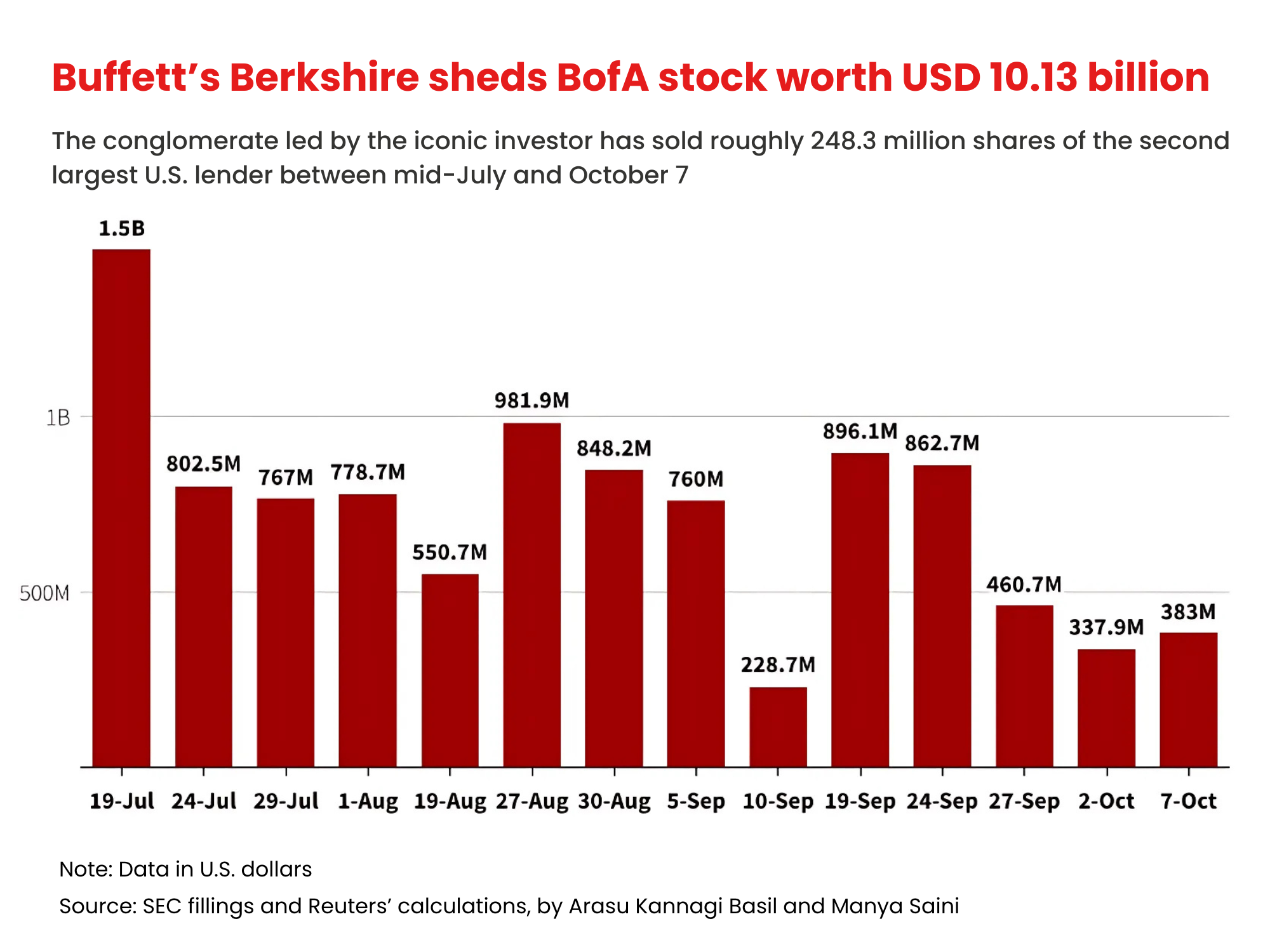

Berkshire Hathaway, led by Warren Buffett, has sold off a significant portion of its stake in Bank of America (BofA), generating over USD 10 billion since it began selling shares in July, according to a filing released on Monday.

Buffett, who started investing in BofA in 2011, saw his stake reduced from 13.1% to 10.1%.

Image Source: Shutterstock

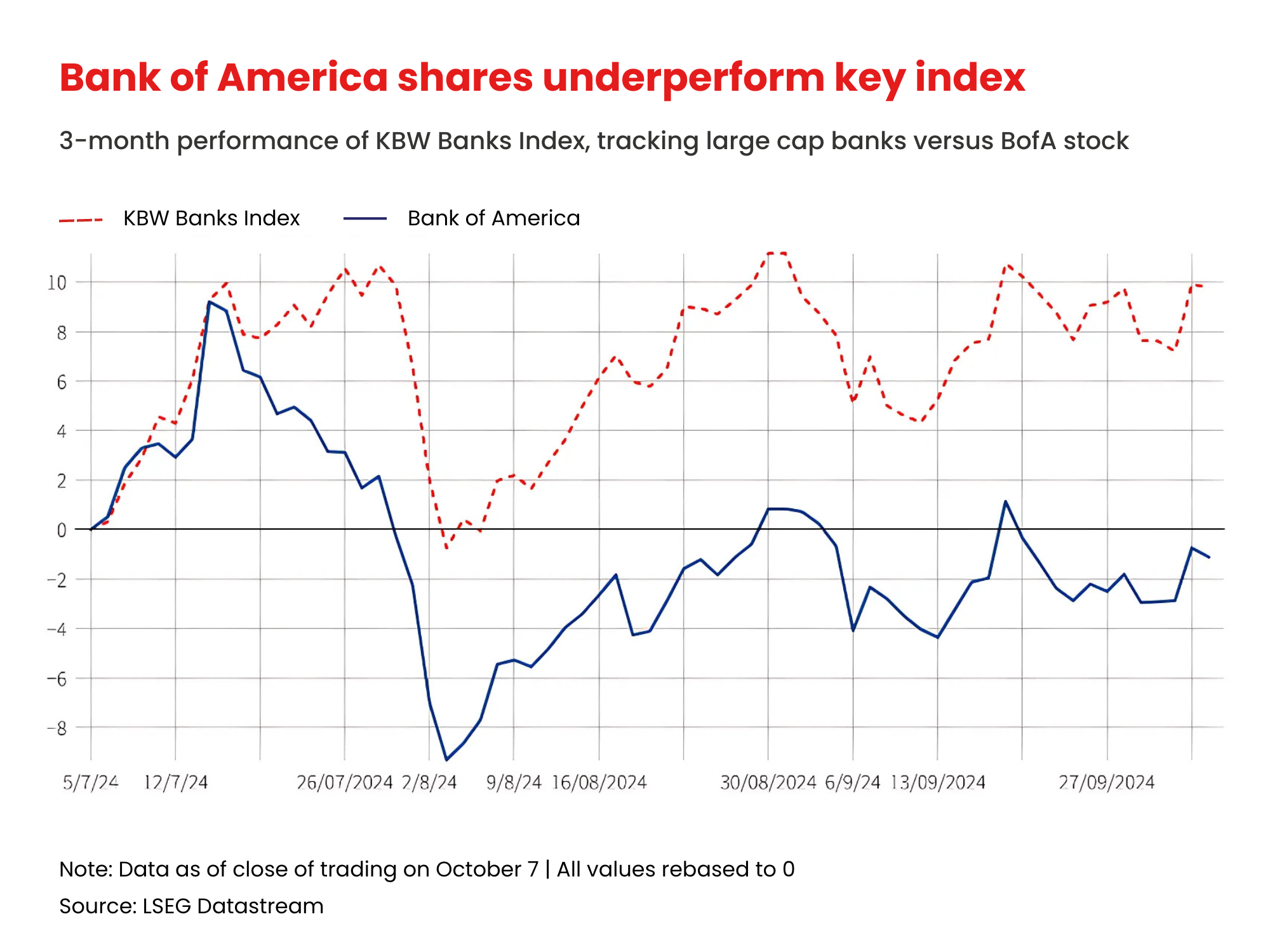

The large-scale selloff has unsettled other BofA shareholders, particularly given ongoing uncertainty surrounding the banking sector amid fears of a potential U.S. recession. Since Berkshire’s first sale in July, BofA shares have dropped nearly 7%, while JPMorgan Chase, the largest U.S. bank, has gained 0.5%, and the KBW Bank index has risen nearly 2%.

“When one of America’s foremost investors is selling, that creates apprehension,” said Macrae Sykes, portfolio manager at Gabelli Funds, which has invested in BofA. Analysts have cautioned that if Buffett continues to reduce his stake, it could put additional pressure on the stock. Although Buffett has never actively managed the bank, his large holdings classify him as an insider under U.S. regulations.

While Buffett has not provided a reason for selling, his move has sparked speculation about his outlook on the U.S. economy and the stock market. Some investors see the sales as reflecting his concerns about inflation and high interest rates, while others believe it indicates a lack of confidence in the stock market, which Buffett has criticized for “casino-like behavior.”

Bank of America, which reports its third-quarter results next week alongside Citigroup, faces challenges such as rising deposit costs and sluggish loan demand. Analysts like Morningstar’s Suryansh Sharma are skeptical about a near-term recovery for BofA stock, noting that the stock is “not cheap” after having gained nearly 50% from its 2023 lows.

Buffett’s history with BofA dates back to 2011, when he invested in the bank during a time of widespread concern about its capital needs after the financial crisis. Since then, BofA shares have risen nearly sixfold. CEO Brian Moynihan has praised Buffett, calling him a “great investor” who helped stabilize the company.

Image Source: Reuters

Image Source: Reuters

In recent years, Buffett has also reduced his stake in Wells Fargo, a holding he had since 1989, and halved his position in Apple earlier this year. At Berkshire’s annual meeting in May, Buffett mentioned that selling made sense, given potential changes to the federal tax rate on capital gains depending on the outcome of the U.S. election.

Other News

Boeing Weighs Cash Options Amid Rating Risk

Boeing is exploring to raise USD 10-15 billion through stock or hybrid securities to avoid a credit rating downgrade, pressured by debt and production issues.

NZ Central Bank Cuts Rates, Signals More Easing

New Zealand’s central bank cut rates by 50 basis points to 4.75%, citing inflation within target but a weakened economy, sparking expectations of further easing.

China Rally Takes a Pause Amid Stimulus Wait

Chinese shares fell as investors awaited further stimulus details, while Hong Kong markets rebounded. Commodities nursed losses after Tuesday’s sharp drop.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.