Donald Trump has been re-elected as the 47th president of the United States, securing 312 electoral votes against Kamala Harris, who received 226. With a new term in office, Trump’s policies are expected to shape the financial markets and the global economy in significant ways. Investors should pay close attention to his stance on tariffs, tax reforms, relations with China, and his favorable views on cryptocurrency. This article will outline the potential market shifts and key policies that could impact investors in the coming years.

1. Tariffs and Trade Policies: Higher Prices and Slower Job Growth

One of Trump’s central policies is the use of tariffs to protect U.S. industries and reduce trade imbalances, especially with China. According to analysts at Morgan Stanley, if Trump’s proposed tariffs are fully enacted, the U.S. could see a significant impact on inflation and economic growth. Trump’s tariff plan includes a potential 10% blanket tariff on global imports and up to a 60% increase on imports from China. These tariffs would impact about half of U.S. industries, driving up costs for businesses and consumers.

Morgan Stanley economists estimate the effects of these tariffs could be substantial:

- Higher Inflation: The proposed tariffs could increase the Federal Reserve’s preferred inflation measure (the PCE price index) by 0.9 percentage points over four quarters. This means U.S. consumers may see higher prices on everyday goods.

- Reduced Job Growth: Monthly job creation could drop by 50,000 to 70,000, compared to the current average of around 184,000. This reduction would slow economic momentum.

- GDP Slowdown: The tariffs could reduce GDP growth by 1.4 percentage points over several quarters, as inflation limits consumer spending and companies scale back investments.

2. Tax Policy: Expanding Cuts and New Proposals

Trump has proposed several tax cuts, some of which are ambitious and would require Congressional approval. Economists at the University of Pennsylvania estimate that Trump’s tax and spending plans could increase the federal deficit by USD 4.1 trillion over time.

Key points in Trump’s tax agenda include:

- Extending 2017 Tax Cuts: Trump is expected to push for an extension of the tax cuts from his first administration, which lowered the corporate tax rate from 35% to 21%, reduced individual income tax rates, and increased the standard deduction. These cuts are set to expire in 2025, so a renewal could provide stability for businesses and boost investor confidence.

- Further Corporate Tax Reductions: Trump has suggested lowering the corporate tax rate further, possibly to 15%. This move would likely boost corporate profits, especially for large-cap companies, making U.S. stocks more attractive in sectors like technology, energy, and finance.

- Eliminating Taxes on Tips: One unique proposal is Trump’s plan to remove income taxes on tips, which could impact around 2.5% of U.S. workers. This change might lead to a shift in how industries structure compensation, as tipping-based wages could become more common, even in white-collar jobs.

- Tax-Free Social Security Income: Trump has proposed making Social Security income tax-free for seniors. Currently, around 40% of Social Security recipients pay federal income tax on these benefits. Removing this tax would provide relief for seniors but would reduce federal revenue, potentially increasing the deficit.

For investors, Trump’s tax proposals could mean higher corporate earnings and potentially increased consumer spending. However, the long-term effects on the federal deficit could lead to higher interest rates, affecting borrowing costs across the economy.

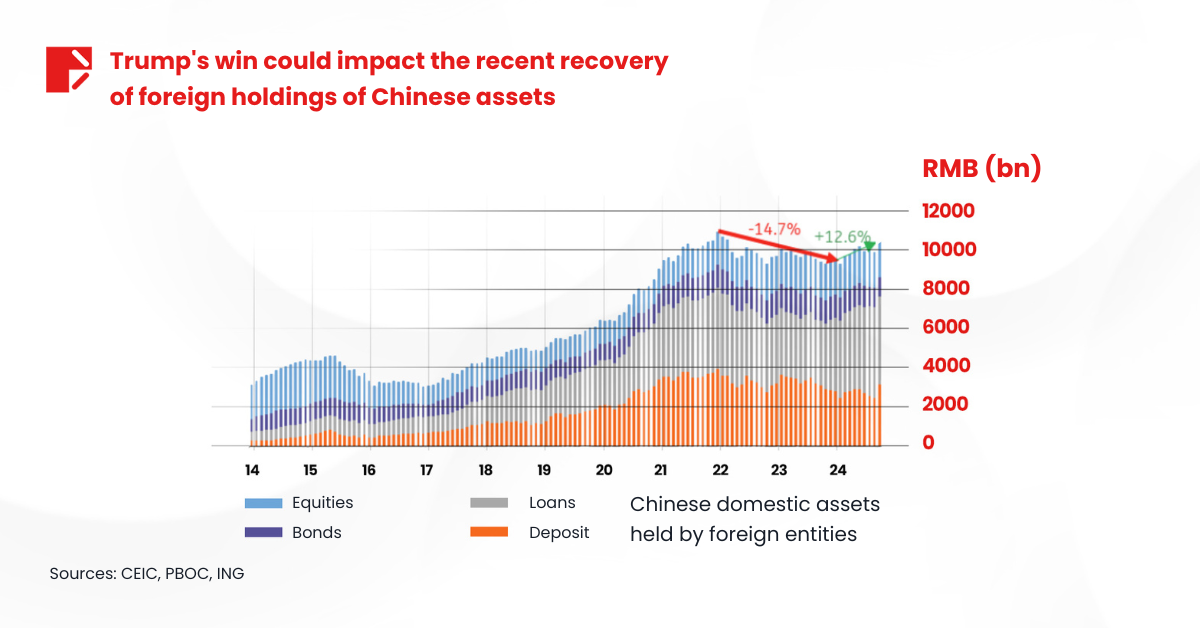

3. China Assets and the Yuan: Currency Wars and Investment Opportunities

Following Trump’s re-election, China’s yuan fell sharply amid concerns about renewed trade tensions between the U.S. and China. The offshore yuan dipped below 7.19 against the U.S. dollar, highlighting the impact of Trump’s policies on global currency markets. Analysts expect that the exchange rate between the dollar and yuan could become a bargaining tool in future tariff negotiations.

In the short term, the U.S. dollar is expected to remain strong due to Trump’s proposed tariffs, which could drive up inflation in the U.S. and limit the Federal Reserve’s ability to lower interest rates. This strength in the dollar, combined with relatively low rates in China, will likely widen the interest rate gap between the two countries, putting further pressure on the yuan.

According to Nick Marro, an economist at the Economist Intelligence Unit, “The stronger-for-longer U.S. dollar, alongside higher-for-longer U.S. interest rates, could preserve the wide interest rate differential between the U.S. and China,” putting more depreciatory pressure on the yuan. The People’s Bank of China (PBOC) is expected to step in to prevent excessive depreciation to maintain economic stability and control capital outflows.

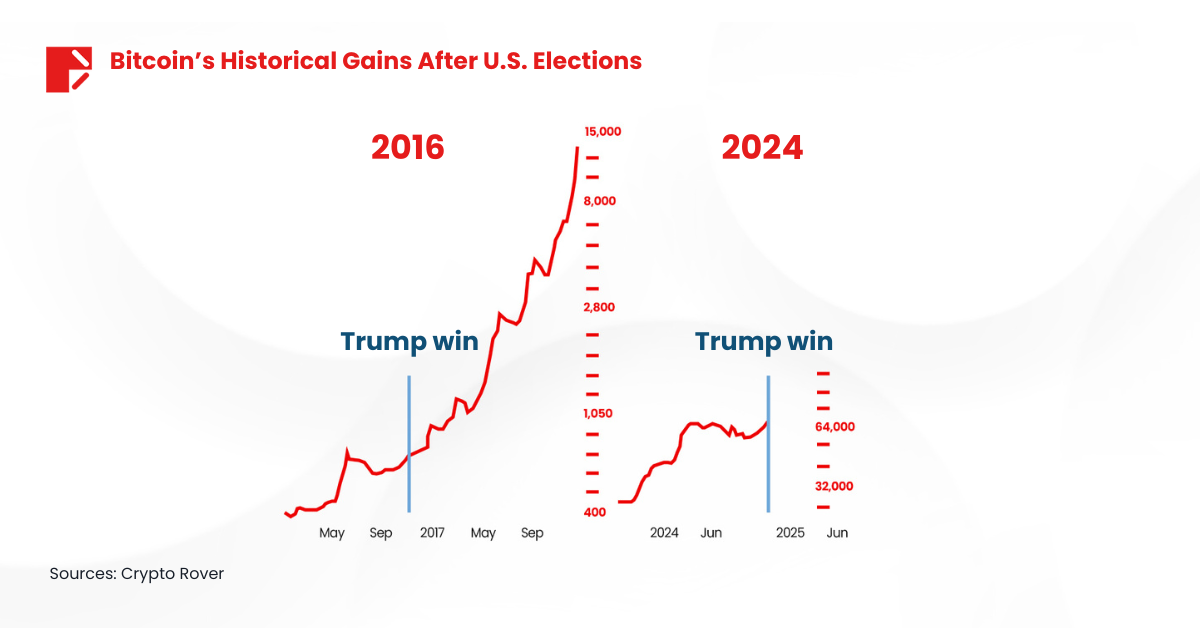

4. Bitcoin’s Bull Run: What the Election Could Mean for Crypto

Historically, Bitcoin has shown significant growth following U.S. presidential elections, particularly under pro-business leaders like Trump. In 2016, after Trump’s first election victory, Bitcoin’s price surged from around USD 700 to over USD 10,000 within a year, as shown in the chart above.

Bitcoin has reached an all-time high, surpassing USD 80,000, with much of the recent surge attributed to Donald Trump’s victory in the 2024 presidential election. In the days leading up to the election and immediately after Trump’s win, Bitcoin saw a sharp increase, rising 80% this year—significantly outpacing the S&P 500’s 25.7% gain. The crypto community views Trump’s win as a bullish signal for Bitcoin and other digital currencies, marking a stark contrast to the more restrictive approach of the previous administration.

With Trump’s pro-crypto stance, his second term may provide a favorable environment for Bitcoin and other digital assets. Trump has openly supported the idea of “mining, minting, and making” cryptocurrency in the U.S. and proposed a strategic national bitcoin stockpile, similar to the U.S. petroleum reserve, aimed at reinforcing Bitcoin’s place in the national economy.

For investors, Trump’s policies suggest a favorable environment for Bitcoin and digital assets. With regulatory hurdles expected to decrease and demand rising, Trump’s second term could pave the way for Bitcoin to reach new milestones, potentially even hitting the USD 100,000 mark.

What’s Next for the Markets?

Trump’s second term presents a complex landscape for investors. While pro-business policies like tax cuts may boost corporate earnings, tariffs could create inflationary pressures and reduce job growth. Investors should stay alert to changes in tariffs, taxes, and U.S.-China relations, as each policy shift could impact the market.

With potential gains in key sectors, Bitcoin, and other digital assets, Trump’s second term may offer substantial opportunities for those prepared to navigate the market’s twists and turns. As always, careful attention to policy developments and economic indicators will be essential for making informed investment decisions.

Follow Doo Prime to stay informed on the latest market trends and seize trading opportunities!

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.