The warning of a looming recession for the U.S. has been present as early as March 2022 with a possible inverted yield curve. This is concerning to many as the inverted yield curve is commonly seen as a possible recession indicator.

As a case in point, we have seen the inverted yield curve in 2019 prior to the 2020 Covid-induced recession and in 2007 prior to the 2008 Great Recession.

Now in the 4th quarter 2022, the accumulated headstrong inflation along with the U.S. Federal Reserve’s aggressive interest rate hikes and policy tightening are all factoring into a potential recession.

To learn more about recession, read up on our take on the U.S. Recession Fears – What, How, What’s Next.

What CEOs And Economists Forecast On The Looming Recession

Throughout the year, investors have been facing multiple economic concerns one after another including war uncertainty, surging inflation, and decade-high interest rate hikes.

At this point, inflation continues to be the dark cloud over the U.S. economy. To curb this inflation, the Federal Reserve has imposed interest rate hikes repeatedly. Thus, this has led to weaker consumer confidence, and lower value in wages due to an increased standard of living.

According to The Wall Street Journal’s latest survey of economists, the U.S. economy is most probably heading towards a recession in the following 12 months at 63%, the highest level in over two years.

Jamie Dimon, CEO of JPMorgan Chase told CNBC on 10th October 2022 that a particularly severe combination of problems could highly trigger a recession around mid-next year and the stock market could experience greater misery.

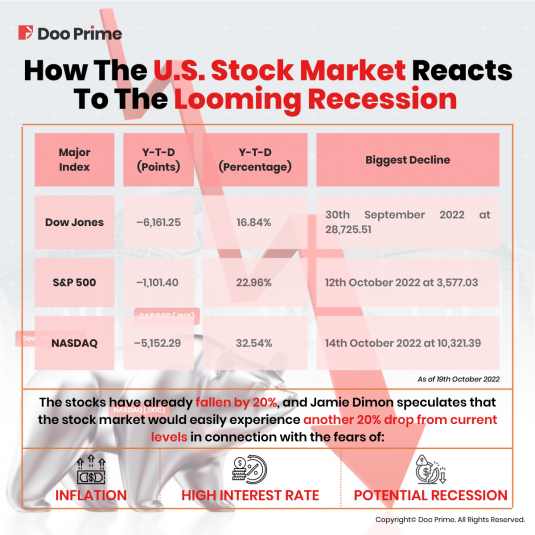

How Did The U.S. Stock Market React To The Looming Recession

As comprehended above, the U.S. stock market has been undoubtedly reacting to the looming recession – to be specific, losing its ground.

At this stage, the stocks’ decline has surpassed 20% from its record highs during the course of this year in connection with fears of inflation, high-interest rates, and the likeliness of a recession. Of course, these volatilities are also moved by several segments of the economic data including treasury yields, and earnings.

Despite the fact that stocks have already fallen by 20%, Jamie Dimon speculates that the stock market would easily experience another 20% drop from current levels, which would put the S&P 500 right around 2,900.

Here, we lay out highlights of the major U.S. stock indexes perform during this interval.

Looking Into The U.S. Stock Market’s Performance During This Interval

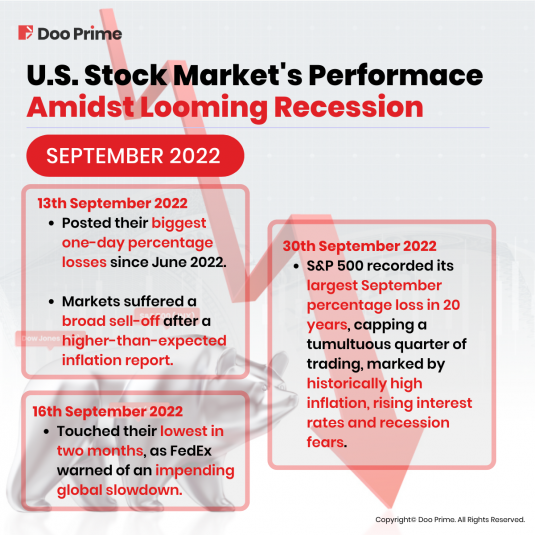

On 13th September 2022, the three major U.S. stock indexes plunged, as markets suffered a broad sell-off after a higher-than-expected inflation report dashed hopes that the Federal Reserve might slow the pace of its tightening policy in the coming months.

All three major U.S. stock indexes were sharply lower, ending a previous four-day streak of gains and posting their biggest one-day percentage losses since June 2020, when the Covid-19 pandemic was at its worst.

On 16th September 2022, U.S. stocks closed lower touching their lowest in two months, as FedEx warned of an impending global slowdown, further pushing investors into safe-haven assets at the end of a shaky week.

On 19th September 2022, all three major U.S. stock indexes touched their lowest levels since mid-July, with the S&P 500 closing below 3,900, a closely watched support level.

On 30th September 2022, the S&P 500 recorded its largest September percentage loss in 20 years, capping a tumultuous quarter of trading that was marked by historically high inflation, rising interest rates and recession fears.

All three major indices were sharply lower, giving back brief early session gains. The S&P 500 and the Dow fell for the third consecutive week, and all three major indexes fell for the second consecutive month.

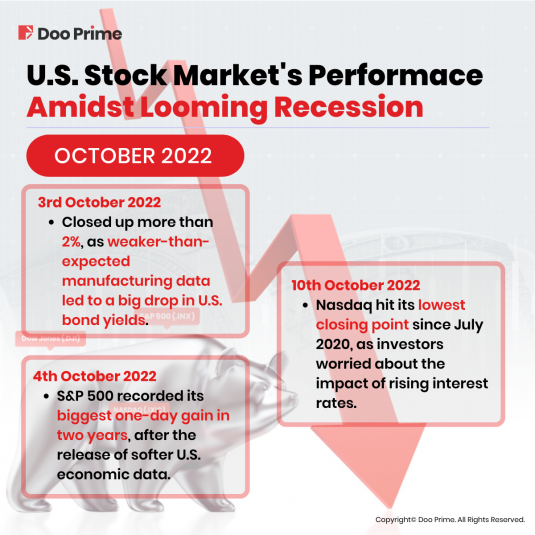

On 3rd October 2022, the three major U.S. stock indexes closed up more than 2%, as weaker-than-expected manufacturing data led to a big drop in U.S. bond yields, boosting the appeal of stocks on the first trading day of the fourth quarter.

At the same time, U.S. stocks have fallen for three straight quarters in this year’s shaky trading, a period characterized by interest rate hikes by multiple central banks to curb inflation, which is at an all-time high, and concerns about a slowing economy.

On 4th October 2022, S&P 500 recorded its biggest one-day gain in two years, after the release of softer U.S. economic data and a smaller-than-expected rate hike by the Australian Federal Reserve stoked hopes that the Fed might be less aggressive in raising interest rates.

On 10th October 2022, Nasdaq hit its lowest closing point since July 2020, as investors worried about the impact of rising interest rates.

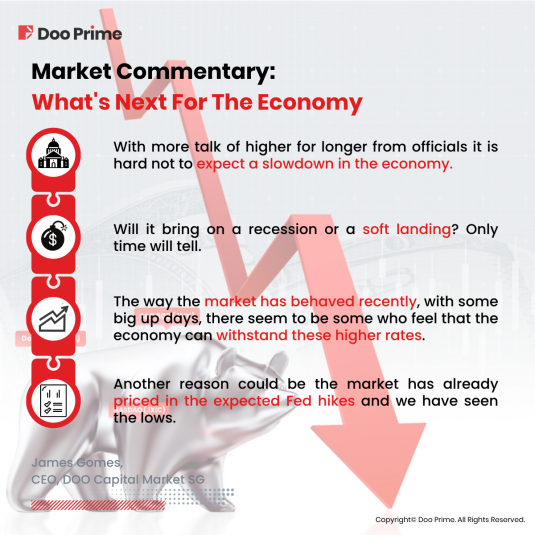

Market Commentary: What’s Next For The Economy

Now that we have seen the market’s performance, let’s take a look at what Doo Prime’s in-house analyst, James Gomes, who has been in the finance industry for over 30 years, has to say about this looming recession.

It is conventional wisdom that higher rates tend to bring about a slowdown in economic activity. That is what the Federal Reserve is hoping for, a slowdown so as to reign inflation.

As it stands, it is anticipated that the Fed will continue to be on the hawkish side, raising 75 basis points in the next 2 meetings and 50 basis points after.

With more talk of higher for longer from officials it is hard not to expect a slowdown in the economy. Will it bring on a recession or a soft landing? Only time will tell.

The way the market has behaved recently, with some big up days, there seem to be some who feel that the economy can withstand these higher rates. Another reason could be the market has already priced in the expected Fed hikes and we have seen the lows.

Meanwhile, analysts from Goldman Sachs, Bank of America, Morgan Stanley and most recently JPMorgan have cut their year-end targets for S&P.

With a weaker sentiment, stubborn inflation and the war in Ukraine analyst feel corporate earnings may be affected negatively.

While some may consider this a bullish signal, i.e., when even a bullish analyst like JPMorgan Marko Kolanovic turns bearish, the contrarian view is that a bottom is near.

Maybe they are right, we are close to a bottom. But there is still a lot of uncertainty out there.

We have to go by what we know and what we know is that the Fed is unlikely to back off anytime soon. Even if it does, they will not pivot until inflation drops to 2%.

With that in mind, we should not be complacent and expect that the market will not sell off more in the near future.

It would be wise to hope for the best but prepare for the worst.

| About Doo Prime

Our Trading Instruments

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 60,000 professional clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.