Trump tariffs are back in the spotlight. President Donald Trump has reintroduced substantial tariffs on key trading partners, including Mexico, Canada, the European Union (EU), and China. These actions have reignited discussions about their potential effects on the US economy, particularly concerning the US dollar (USD). Will trump tariffs boost the greenback, or could they backfire and weaken it? Let’s break it down.

Trump Tariffs: Who’s on the Receiving End?

During his first term, Trump imposed sweeping tariffs on Chinese imports, setting off a full-blown trade war. Now, he has taken an even more aggressive stance on tariff policies, not just against China but also Mexico, Canada, and the EU.

Here’s a snapshot of his potential moves:

- China: Trump wants to reinstate 10% tariffs on Chinese goods or even expanding them as a countermeasure to Beijing’s economic policies. His administration previously slapped 25% tariffs on billions of dollars’ worth of Chinese imports, triggering retaliatory measures from China.

- Mexico & Canada: Trump has criticized trade imbalances with Mexico and Canada, even hinting at renegotiating the USMCA (United States-Mexico-Canada Agreement) or imposing new 25% tariffs to curb manufacturing shifts across borders.

- European Union: The EU has been a frequent target of Trump’s tariff threats, particularly in sectors like automobiles and agriculture. A potential escalation could lead to retaliatory tariffs from Europe.

The US Dollar’s Reaction: Strength or Weakness?

Historically, trump tariffs have had mixed effects on the US dollar. The dollar often strengthens when tariffs are introduced because tariffs tend to reduce imports, improving trade balances in the short run. Additionally, market uncertainty drives investors toward safe-haven assets, including the USD. However, prolonged trade wars can hurt economic growth, leading to a weaker dollar in the long run. Here’s how different scenarios could play out:

- Dollar Strengthening: If Trump’s tariffs force foreign companies to produce more in the US or if investors see the trade policies as strengthening America’s economic position, the USD could appreciate.

- Dollar Weakening: If tariffs escalate into a full-scale trade war with major economies, causing supply chain disruptions and slower economic growth, the Fed could cut interest rates, which would weigh on the dollar.

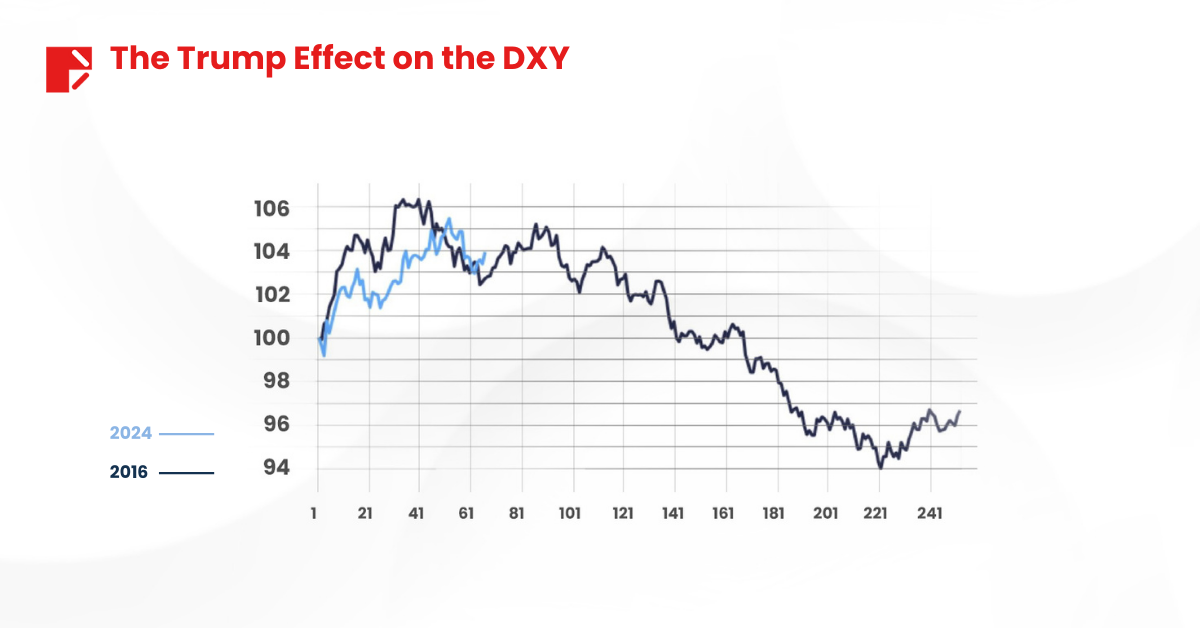

Comparing the USD Under Trump in 2016 vs. 2024

The historical impact of Trump’s presidency on the US dollar provides valuable insight into what may lie ahead. The chart above illustrates the movement of the DXY (US Dollar Index) following Trump’s elections in 2016 and 2024. Initially, the dollar experienced strength in both cases, likely due to market optimism and policy expectations. However, in 2016, the USD declined over the following months as trade tensions escalated and economic uncertainty grew. If history repeats itself, the dollar could face renewed pressure despite initial gains.

The Trump Tariffs Inflation Debate: A Reality Check

One of the biggest concerns around tariffs is inflation. Critics argue that tariffs increase prices for consumers and businesses by making imports more expensive. However, Trump’s first term challenges this assumption.

Despite a prolonged trade war with China from 2018 to 2020, inflation remained remarkably low, hovering around 2%. This contradicts the fear that trump tariffs automatically lead to high inflation. With inflation concerns already at the forefront of economic debates, could the alarm over new tariffs be exaggerated? Possibly.

In today’s economic environment, where inflation has already been a problem post-COVID, new tariffs could have a different impact than before. However, Trump’s previous track record suggests that tariffs alone don’t necessarily fuel runaway inflation. Other factors, such as monetary policy and energy prices, play a much bigger role.

Trump’s Mind Games: Peace Through Strength?

There’s also a strategic element to Trump’s tariff threats. Could this all be a calculated negotiation tactic rather than an economic blunder? Trump has long been a believer in “peace through strength”, using bold economic moves to pressure foreign nations into compliance.

By creating an atmosphere of uncertainty, Trump may be trying to force trading partners to strike better deals with the US. His approach with China, for example, led to the Phase One Trade Agreement in early 2020, which included commitments from China to purchase more American goods.

If Trump follows a similar playbook, tariffs might just be a bargaining tool rather than a long-term economic policy. In this case, the market impact could be temporary, with the US dollar experiencing volatility but no major trend reversal.

Traders and Investors—Brace for Volatility

As Trump’s tariff talk heats up, the US dollar is set for a bumpy ride. While tariffs could initially support the greenback by reducing trade deficits and reinforcing America’s economic leverage, prolonged uncertainty could erode confidence in the currency.

More importantly, history tells us that Trump’s tariffs might be more about power dynamics than actual economic protectionism. Whether or not they materialize, the mere fear of tariffs could be enough to move markets, making the USD a key currency to watch.

For traders and investors, this means staying ahead of the news, monitoring policy shifts, and watching how global markets react. One thing is certain—whether Trump reintroduces tariffs or not, the dollar will be at the heart of the action.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.