Halloween isn’t just about costumes, candy, and spooky decor; it’s also a major opportunity for investors and traders to ride the wave of increased retail spending.

As Halloween approaches, certain companies are uniquely positioned to capture consumer dollars, presenting potential opportunities for retail investors.

This article spotlights three retail stocks set to benefit from Halloween’s spending boost and explores the potential trading opportunities for each.

Halloween 2024 Spending Forecast

According to the National Retail Federation, Halloween spending has been trending up year after year. This year, US consumers are expected to go big again, with projections exceeding $11 billion as people invest in costumes, candy, decorations, and party supplies. Retailers specializing in seasonal products, party goods, and affordable decor are set to benefit most, with this year showing an even greater interest in Halloween experiences.

So, let’s explore the three retail stocks that are likely to perform well this Halloween season.

Top 3 Retail Stocks to Watch this Halloween

1. Amazon, Inc. (NASDAQ: AMZN)

Why Traders Should Watch

Amazon has become the go-to source for consumers’ Halloween needs, thanks to its extensive product range and quick shipping. From last-minute costumes to bulk candy orders, Amazon’s Prime program and rapid delivery options capture late-season demand, which is crucial for Halloween. The platform’s Halloween deals, curated product lists, and influencer-driven campaigns have fueled consumer interest, keeping it a top choice for holiday shoppers.

Growth Potential

Amazon’s influence in retail makes it a great pick for both seasonal plays and long-term growth. And here’s the trick-or-treat twist: Amazon’s Q3 earnings are set to drop right on Halloween, October 31st! This timing gives investors a sneak peek into how the company is handling seasonal demand and those rising shipping and fulfillment costs.

Trading Opportunity

From a technical perspective, AMZN’s price is currently just above the 180-support level. With strong earnings and a Halloween spending boost, the stock could retest the 200 level and potentially break into new all-time highs.

2. Costco Wholesale Corporation (NASDAQ: COST)

Why Traders Should Watch

Costco’s extensive Halloween offerings position it well to capture Halloween-related spending. With its creative, branded partnerships and high-quality in-house products, Costco has built a loyal customer base that often turns to them for seasonal needs. The store’s membership model and bulk pricing add convenience and value, encouraging larger purchases, which are especially popular during the Halloween season.

Growth Potential

Costco has established itself as a reliable seasonal play for traders, particularly in Q4. This year, the company reported strong Q3 earnings, with impressive revenue growth and steady membership renewals, solidifying its position as a retail leader. As Halloween approaches, Costco’s well-timed offerings—ranging from bulk candy to seasonal decorations—enhance its potential to benefit from increased consumer spending. With its strong seasonal performance, Costco presents promising opportunities for traders heading into the holiday season.

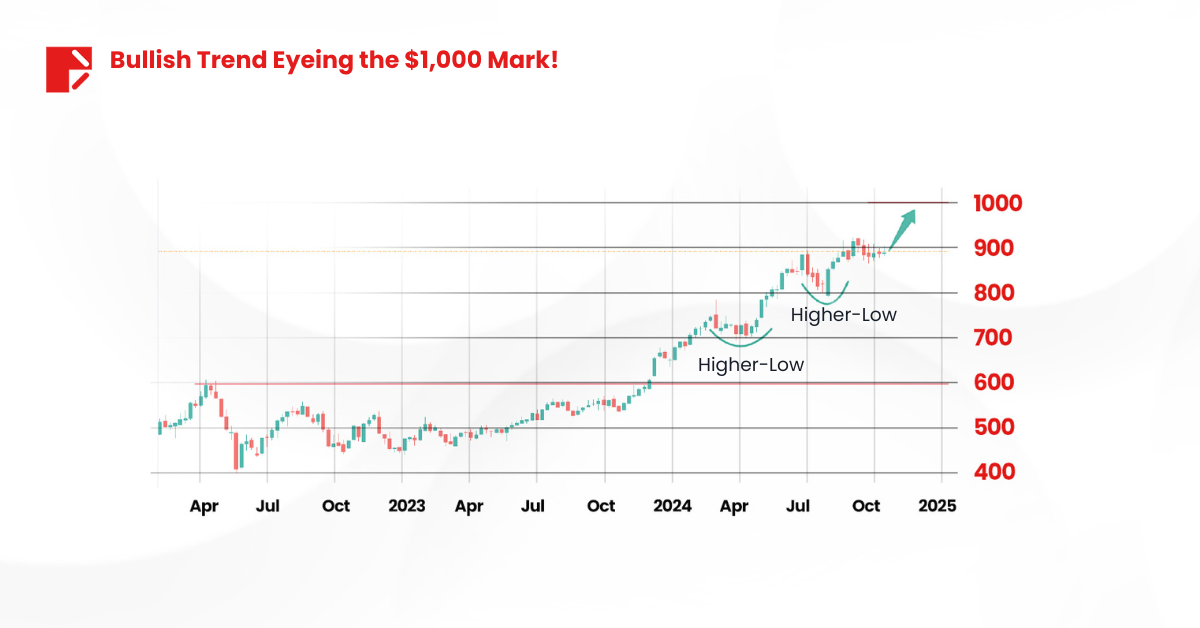

Trading Opportunity From a technical perspective, COST’s price is currently in a very strong bullish trend, with the expectation to continue higher. With a Halloween spending boost and a strong holiday season, the stock could reach the 1000 mark by the end of 2024.

3. Walmart Inc. (NYSE: WMT)

Why Traders Should Watch

Walmart shines in the Halloween season due to its affordable offerings. With inflation impacting discretionary spending, Walmart’s low-price Halloween options make it a perfect choice for budget-conscious families. Their stores are packed with everything from costumes to bulk candy packs and DIY decor, meeting Halloween needs without breaking the bank. Walmart has also been expanding its online marketplace to compete in the e-commerce space.

Growth Potential

Walmart’s affordable offerings could see increased demand this Halloween, leading to a boost in revenue and potential stock movement in October. The company’s Q3 earnings report is set for November 19, which could further boost stock prices if results align with strong seasonal sales. Walmart offers a more conservative trade for risk-averse investors, compared to other, more volatile retail stocks.

Trading Opportunity

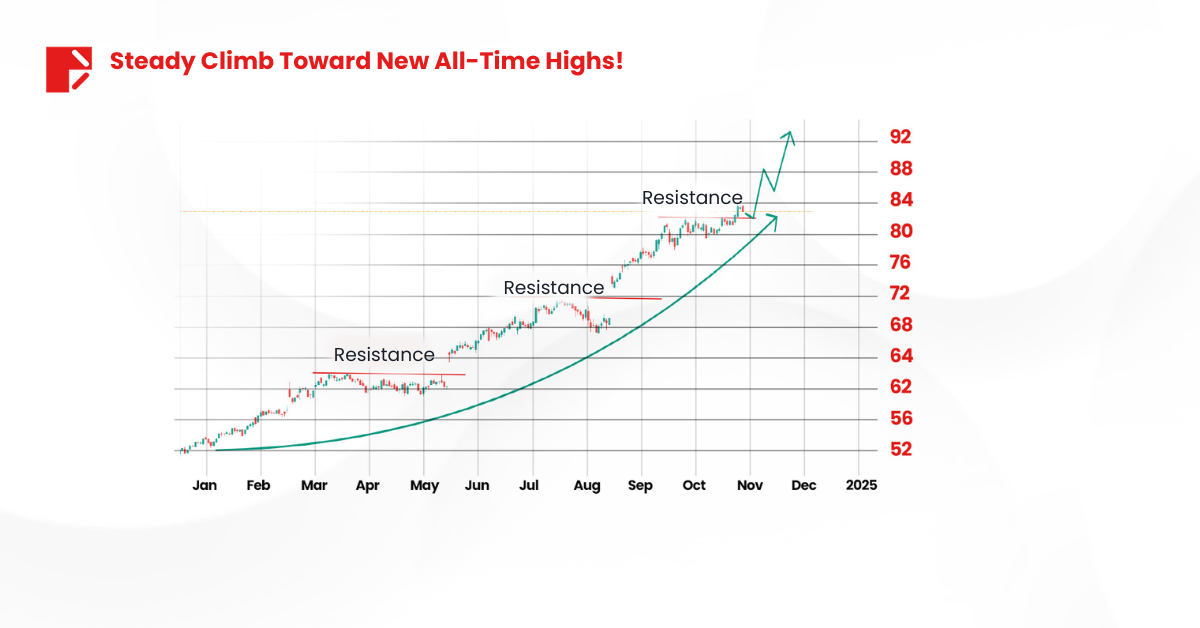

From a technical perspective, Walmart’s price has been on a slow and steady upward trend, consistently breaking through resistance levels without looking back. Unlike Amazon, Walmart’s Q3 earnings report won’t be released until November 19, so we’re less likely to see an immediate price surge. Instead, Walmart may provide a gradual climb toward new all-time highs.

Halloween Trends for Retail Stocks

Halloween represents more than a fun holiday; it’s a major retail event that often offers valuable insights into consumer behavior heading into the holiday season. The three companies mentioned—Amazon, Costco, and Walmart—each have unique advantages that position them well for the Halloween rush. Whether you’re looking for a seasonal pop (Amazon), stable seasonal gains (Costco), or consistent returns with a seasonal edge (Walmart), these stocks have treats to offer investors.

Keep an eye on consumer spending trends, as these will likely indicate how the broader retail market might perform as we move closer to Thanksgiving and Christmas. If Halloween spending is as high as expected, it could signal a strong Q4 for retail as a whole, giving these stocks a potential lift well into the holiday season.

Happy Investing & Happy Halloween!

Check out our previous article: Fascinating Facts About the 2024 Nobel Prize in Economics

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.