2024 witnessed the unbelievable rise of gold when this precious metal continuously set new peaks which were times higher than its year open price. Before the Bitcoin and cryptocurrency market took away the spotlight in the latest months of the year, gold reached an all-time high (ATH) of $2777.80/oz and closed the year at $2606.72/oz.

Conversely, right before the US election, Bitcoin and other tokens constantly surged with new ATHs and topped at $108,268.45 under the astonished eyes of both crypto traders and traditional investors. This was a completely reversed picture compared to the gray performance of cryptocurrencies during most of the year.

Will everything be reversed once again in 2025, or will cryptocurrencies continue to skyrocket and soon surpass gold, becoming the largest asset by total market cap? Will investors keep supporting the traditional gold markets or adopt new strategies to become crypto whales or add both to their portfolios to explore the potential of coins and tokens while reserving gold as a safe haven?

Let’s delve into these topics in this article: The 2025 Dilemma: Gold or Cryptocurrencies?

Gold – The Safe Haven

For millennia, gold has been used as a store of value, a medium of exchange, and a symbol of wealth. In times of economic turbulence, people use gold to hedge against inflations and recessions or even geopolitical risks, reserving it as a mean of saving to prepare for any future investment.

Why Gold Matters

Many people argue that gold has no intrinsic value. Warren Buffett, the chairman and CEO of Berkshire Hathaway, has been critical of gold as an investment. He views gold as an unproductive asset that cannot generate income or compound in value over time.

“Gold … has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end”

– Warrant Buffett in a letter to shareholders –

However, gold offers more than that. Let’s explore some reasons why gold is the top 1 asset in terms of market cap.

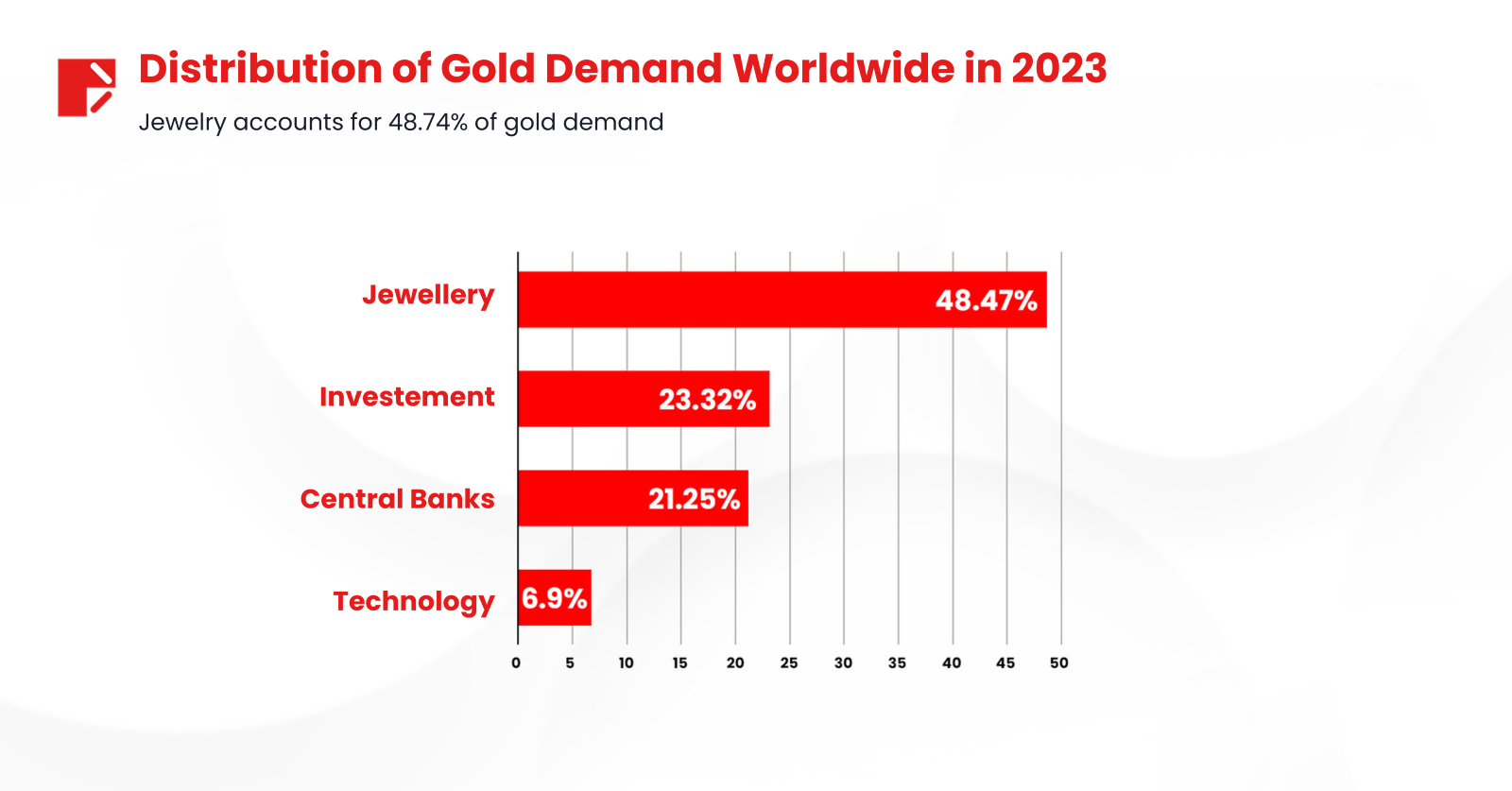

Jewelery

Gold has been used to craft jewelry for approximately 6,000 years. The iconic burial mask of Egyptian pharaoh Tutankhamun was made from gold. Today, about 78% of the gold mined annually is used to make jewelry.

Finance and Investment

Gold has long been recognized as a symbol of wealth. It played a key role in financial transactions. This precious metal is the most favored for investments. Popular investment forms include gold coins, bars, and bullion.

Gradually, to make gold investments more accessible, brokerages offer Gold ETFs, Gold Futures and Options, and Gold CFDs. These even make the money poured into gold larger, making the markets active and increasing investors’ demand.

Aerospace

Gold is essential in the aerospace sector, where reliability is critical. It is used as a lubricant for mechanical parts, in circuitry for electrical conduction, and as a coating inside spacecraft to shield occupants from infrared radiation and heat.

Electronics

Gold’s exceptional conductivity, reliability, and resistance to corrosion make it ideal for electronic circuits. Engineers use small amounts of gold in most electronic devices, including cell phones, televisions, calculators, and GPS units to make them more durable and easier to work with. In desktop and laptop computers, gold enables the rapid and accurate transmission of digital information, essential in today’s digital age.

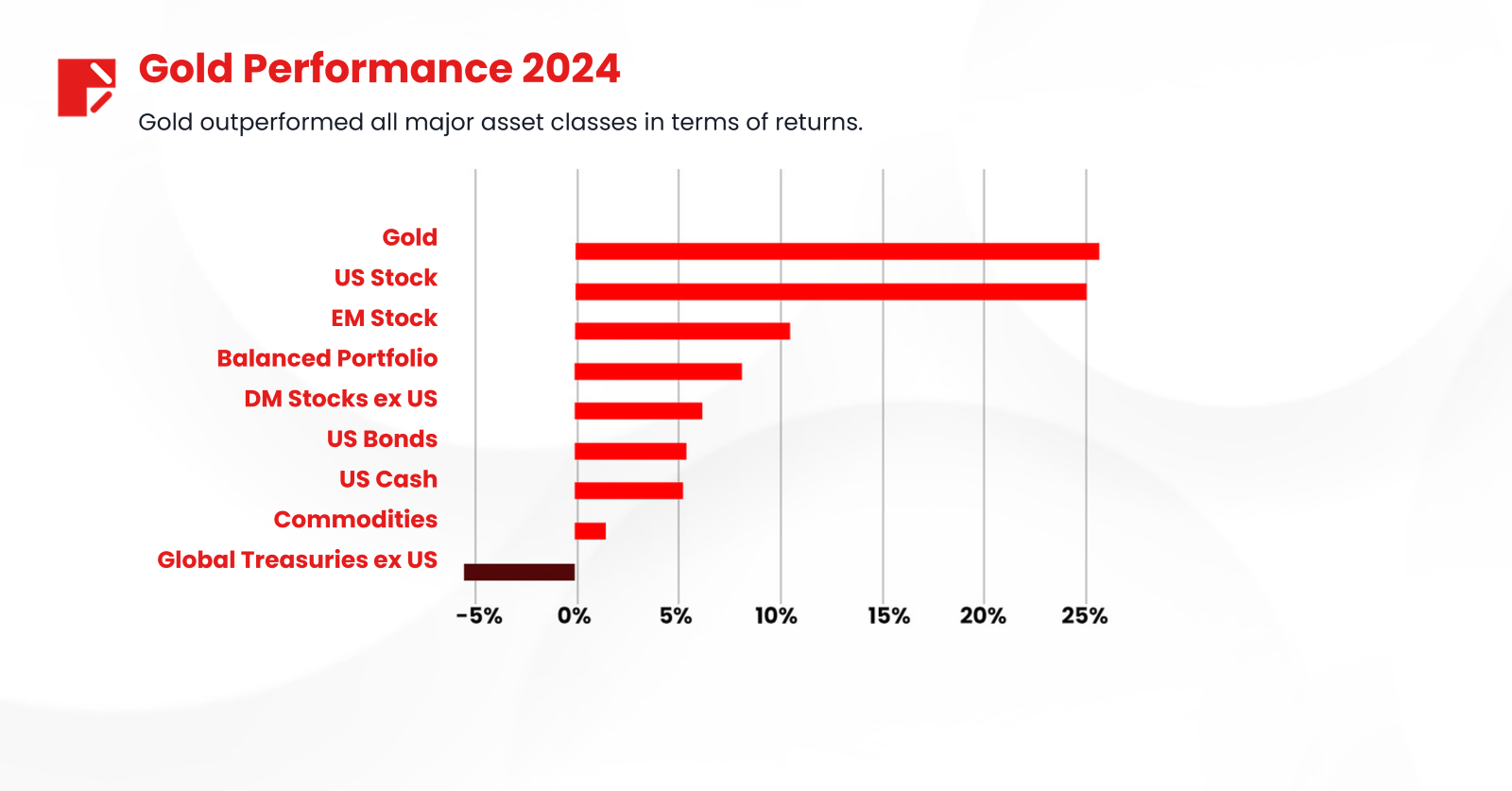

Gold Performance 2024

Gold performance was exceptional in 2024, outperforming all major asset classes and proving as a strong portfolio diversifier. In 2024, gold experienced a steady rise of 25.5% thanks to its role as an effective hedge against the heightened geopolitical tensions and market volatility.

Gold began the year at $1,850 an ounce and then went on to establish 40 new all-time highs (ATHs) with the latest being $2,777.80/oz on 30 October. Central banks and retail investors also accumulated massive gold reserves, pushing purchases to all-time highs of around 1,300 metric tons by mid-2024.

| USD (oz) | EUR (oz) | JPY (g) | GBP (oz) | CAD (oz) | CHF (oz) | INR (10g) | RMB (g) | TRY (oz) | AUD (oz) | |

| 30 Nov Price | 2,651 | 2,509 | 12,751 | 2,084 | 3,711 | 2,366 | 76,400 | 616 | 91,981 | 4,065 |

| Y-t-d return | 27.6% | 33.7% | 35.1% | 27.7% | 35.1% | 33.7% | 21.4% | 28% | 50.3% | 33.9% |

| Y-t-d average price | 2,366 | 2,181 | 11,511 | 1,848 | 3,233 | 2,080 | 70,268 | 551 | 77,621 | 3,573 |

| Y-t-d avg vs 2023 vs | 21.9% | 21.5% | 31.2% | 18.4% | 23.4% | 19.3% | 19.0% | 22.5% | 67.8% | 22.2% |

Gold Outlook in 2025

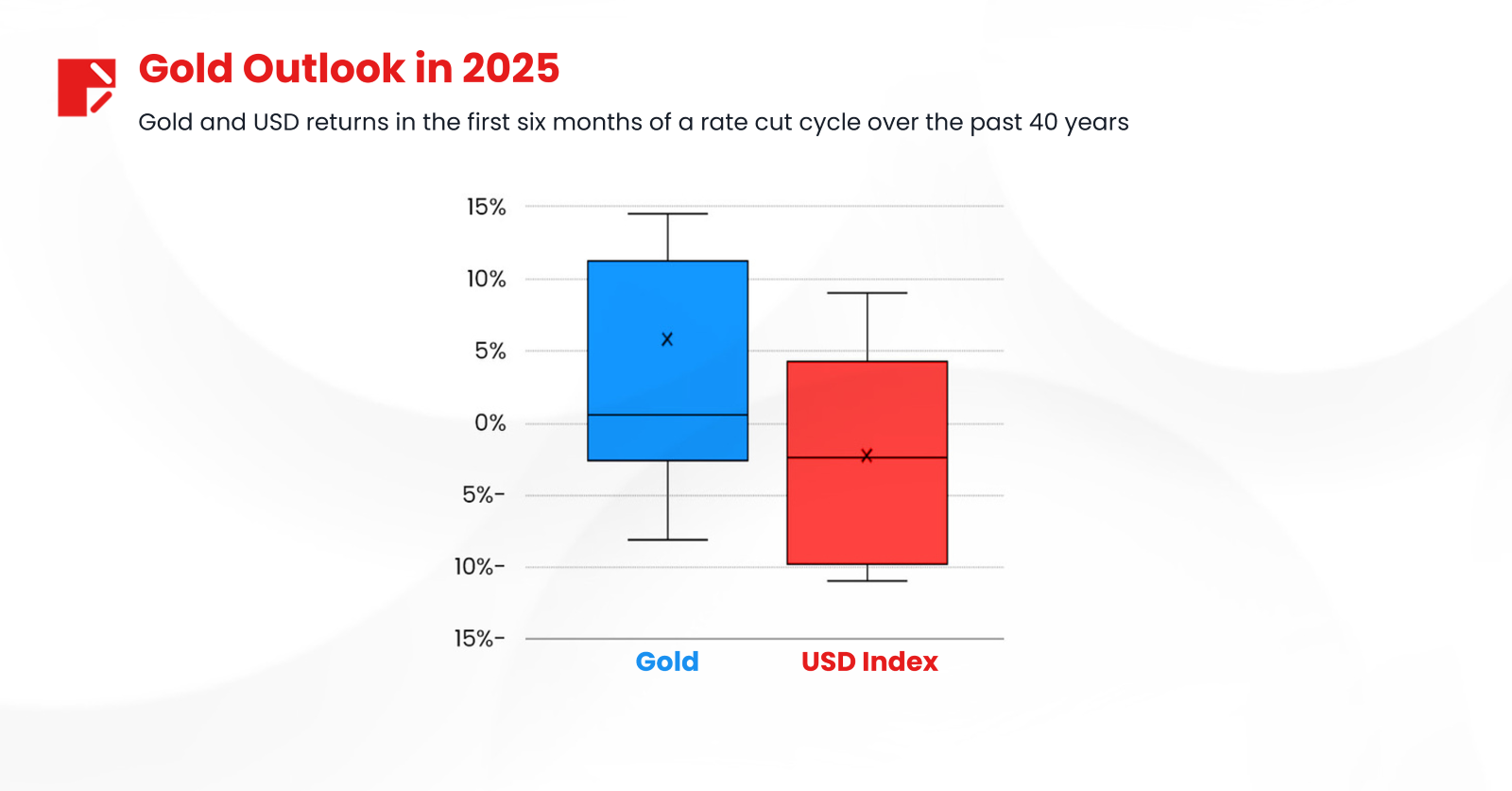

Looking ahead to 2025, the market consensus of key macro variables such as GDP, yields, and inflation suggest positive but much more modest growth. Potential upside could stem from stronger than anticipated central bank purchases or a swift worsening of financial conditions, which will trigger a shift toward safe-haven assets. On the other hand, a reversal in monetary with higher interest rates could impose significant challenges.

In 2025, people anticipate that the US Federal Reserve (Fed) will deliver 2 rate cuts, which means about 50 to at most 100 bps in cuts by year end. Historically, gold has risen by an average of 6% in the first six months of a rate cut cycle.

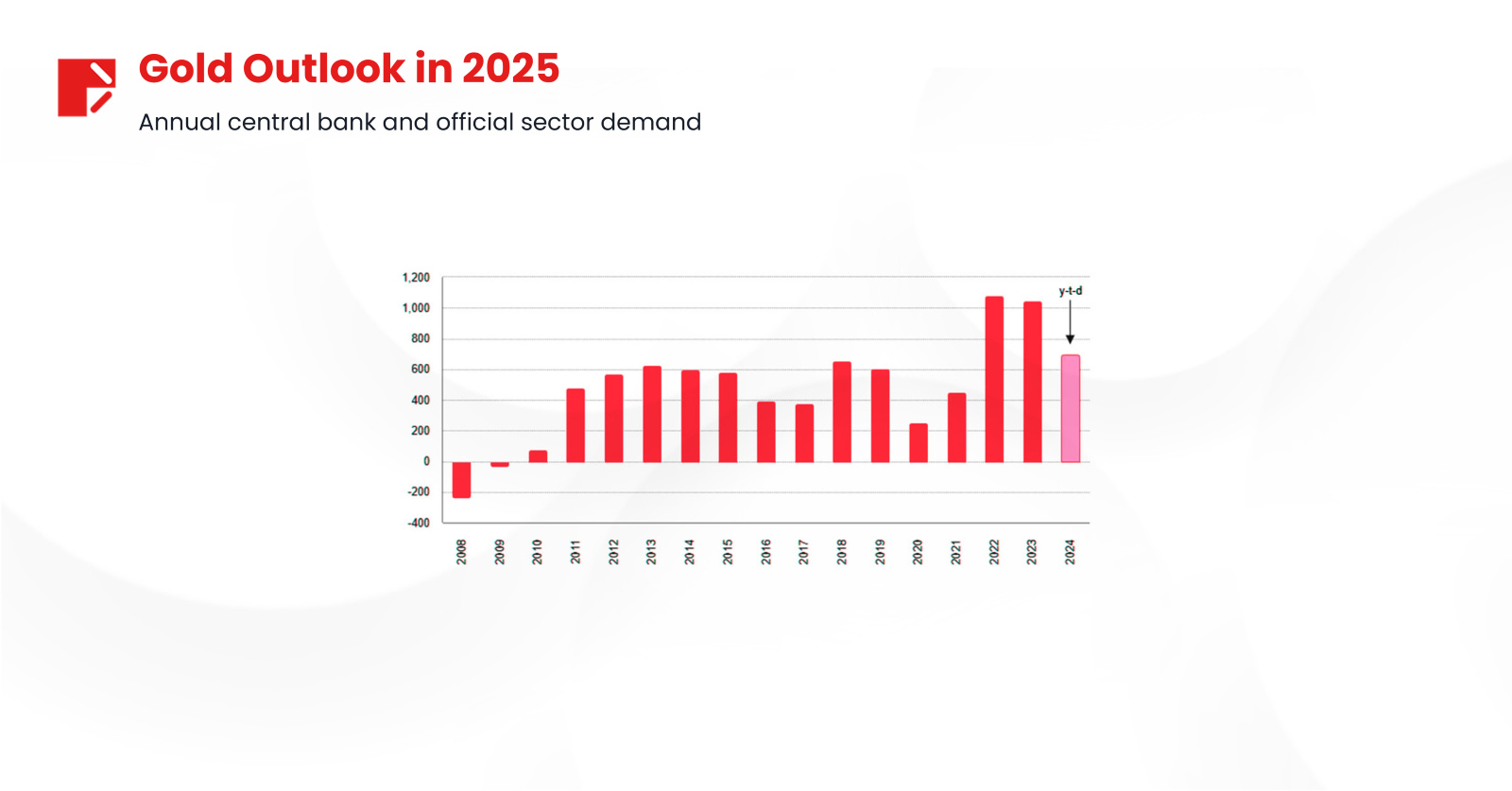

In addition, the performance of gold is heavily influenced by central bank activity and Asian demand, particularly from China and India, which are the largest gold markets. Asia generally accounts for more than 60% of annual gold demand (excluding central banks). In 2024, Asian investors significantly bolstered gold’s performance in the first half, while Indian demand surged in the latter half due to a reduction in import duties.

Central banks have been net buyers of gold for nearly 15 years, consolidating the importance of gold in foreign reserves as a long-term store of value, a diversifier, a crisis performer, and an asset free of credit risk has made it indispensable. Last year, central bank purchases contributed an estimated 7%-10% to the safe haven’s performance.

If the economy were to perform according to consensus in 2025, gold may keep changing hand within a similar range to the last part of the year.

Cryptocurrencies – The New Rising Stars

Cryptocurrencies Performance 2024

In 2024, the cryptocurrency market has undergone an astonishing transformation over the past year – a rollercoaster year – with strong investor interest and a significant resurgence in prices for several coins and tokens. It reached a record high of $3.91T as of December 2024 but experienced a sharp correction towards the end of December when the Fed introduced its plan to reduce the 2025 rate cuts from 4 to 2, despite a modest 0.25% cut during the month.

Bitcoin’s 2024 Performance

Let’s look at the most significant gainer, the “digital gold” of the crypto industry, Bitcoin. Bitcoin started the year at around $46,100 then dipped to $39,000 at the end of January. The coin’s price reached an all-time high before the event and experienced a downtrend in the following months, falling from US$73,097 pre-halving to below US$60,000 in May and July.

The coin didn’t break US$73,000 again until October when driven by the huge institutional adoption and a surge in decentralized finance (DeFi) activity. After that, BTC kept fluctuating before skyrocketing to nearly $98,000 during the US President election. As of December 17th, BTC surged over 310% to reach a new peak of $108,268.45.

Ending the year, BTC secured its position as the 7th largest global asset by market cap and one of the best among the top 10 global assets.

Altcoin Interest Jumps on Bitcoin Boom

Altcoins are non-Bitcoin cryptocurrencies, created as a combination of ‘alternative’ and ‘coin’. It refers to any coin or token which is not Bitcoin, like Ethereum (ETH), Solana (SOL), Toncoin (TON), and memecoins. Altcoins offer more unique features and practical utilities more than mere digital medium of payment. These alternatives can offer faster throughput, lower fees, improved security, and recreational purposes and might draw significant attention from crypto investors, leading to what is called altcoin season.

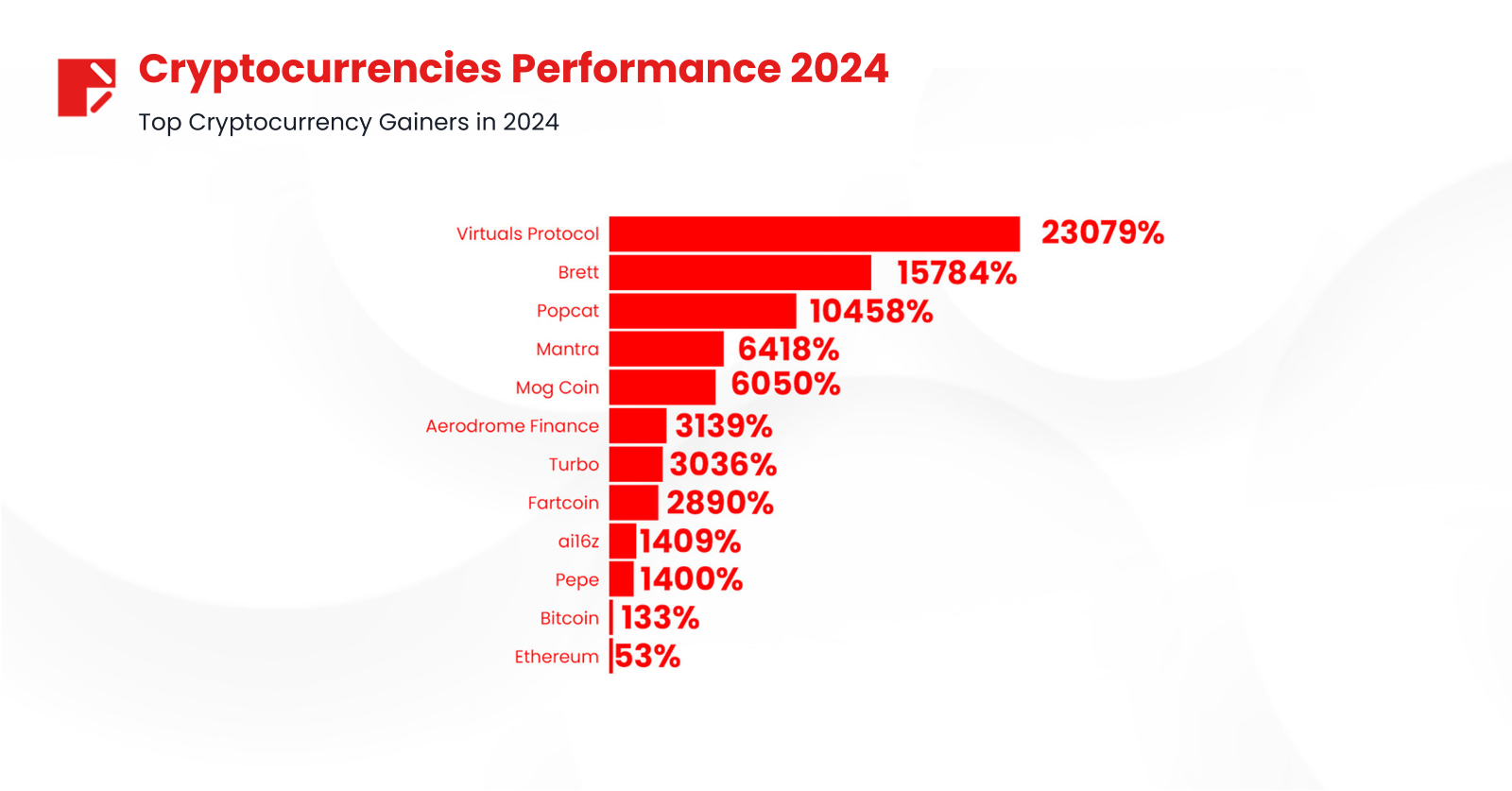

In 2024, along with the lightest stars like Bitcoin, Ethereum, and Solana, crypto enthusiasts witnessed the significant rise of several altcoins.

$VIRTUAL token recorded the highest price returns of 23,079.2%, starting the year at $0.01311 and then surged to $3.04 on December 25. Other top gainer positions mostly belong to memecoins such as Brett, Popcat, Turbo, Fartcoin, ai16z, and Pepe.

MANTRA (OM) ranked fourth with returns of 6,418.3% to be the most profitable real-world asset (RWA) investment of the year, 9 times higher than Ondo Finance (ONDO). Another non-meme token in this ranking is Aerodrome Finance (AERO). In 2024, AERO delivered a 3,139.4$, peaking $1.66 on December 25.

Cryptocurrencies Outlook 2025

As for 2025, experts predict continued growth, albeit with heightened volatility. The crypto bull market will return and reach a mid-term peak in the first quarter and set new highs in the last quarter. BTC is predicted to reach $180,00 – $200,000 by the end of 2025 due to the scarcity of this coin as there are only 21 million BTCs that can ever be created, and 19.79M of them are already in circulation. However, the demand for institutional and retail investors has been growing.

Moreover, as blockchain and cryptography technology advances and the demand for trading rises, the value of tokenized real-world assets will continue to increase remarkably. There is already approximately $12 billion in tokenized securities on-chain, and this number is believed to surpass $50B in 2025. Along with that, stablecoin daily settlement volumes may also reach $300B.

Obviously, these could promote the growth of all DeFi activities, NFT market trades, and decentralized application tokens’ values. People anticipate Decentralized Exchange Trading will exceed $4T and the NFT markets will recover with $30B in trading volumes.

Overall, positive changes will bring a much more active and dynamic playground with several investment opportunities for both crypto enthusiasts and traditional investors.

Conclusion

The 2025 investment landscape presents a fascinating dilemma between gold and cryptocurrencies. Gold, the perennial safe haven, continues to solidify its position as a trusted store of value, supported by central bank demand and geopolitical uncertainties. Meanwhile, cryptocurrencies, driven by technological advancements and increasing adoption, are poised for exponential growth, offering investors high returns albeit with greater volatility.

Choosing between Gold and Cryptocurrencies can be a challenge and depends heavily on individual risk tolerance and investment strategies. Though both are poised for positive performances in 2025, due diligence is essential to help investors hedge against risks while seizing opportunities in the rapidly evolving financial markets.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.