2024’s Double 11 shopping festival has arrived earlier than usual!

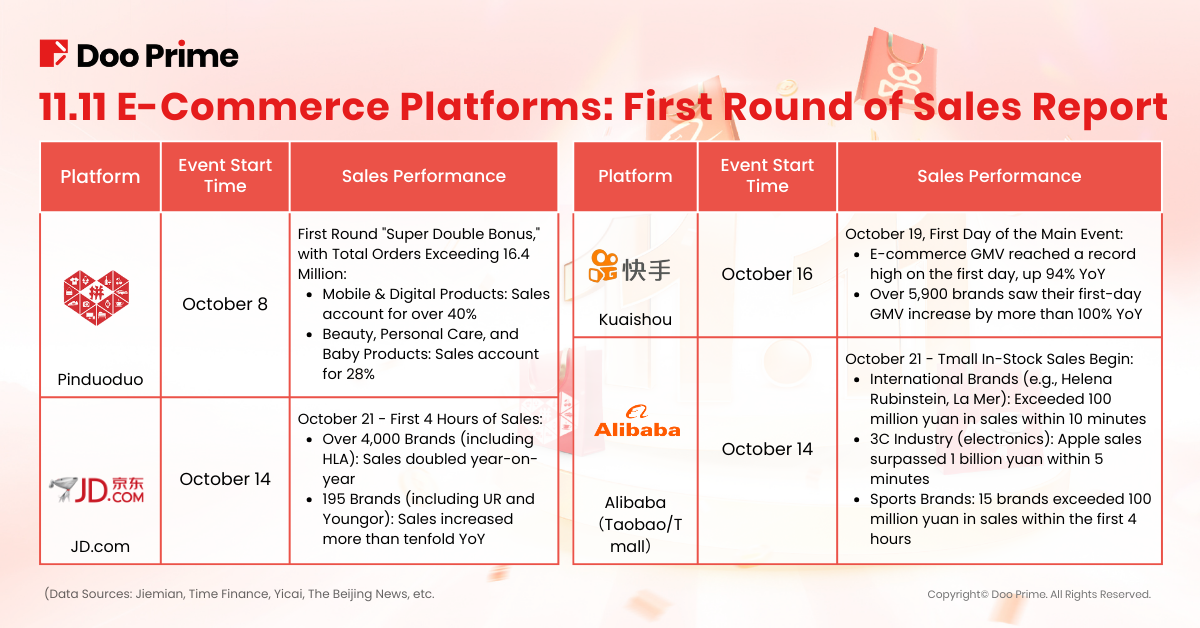

Douyin kicked off its promotions on October 8, with JD and Tmall following on October 14—around ten days earlier than last year. This extended timeline has earned 2024’s Double 11 the title of the longest shopping festival to date.

In addition to a longer timeframe, e-commerce platforms are moving away from the typical “price wars,” instead focusing on easing the burden on merchants. As of this article, the first round of Double 11 sales data is already out, and Double 11-related concept stocks are starting to attract attention in the market.

As the 11.11 Shopping Festival marks its 16th anniversary, fresh features and trends are reshaping this year’s event. Which stocks are positioned to gain the most from these developments? And how can investors position themselves to capitalize on the festival’s momentum? Let’s dive in.

No Price Wars: What’s new for This Year’s Double 11?

- Platforms Are Breaking Down Barriers

One major shift this year is that platforms are working together, offering consumers more payment choices than ever before. Wu Jia, Alibaba’s VP and head of Taotian User Platform and Alimama, expects record participation in this year’s Double 11.

Earlier in September, Taobao and WeChat announced a “wall removal,” sparking a notable increase in Taobao’s new users. Meanwhile, JD will now accept Alipay payments, just in time for the festival.

- Longer Promotion Periods for Earlier Shopping

Another big change is the extended promotion period. Platforms like Pinduoduo and Douyin have expanded their Double 11 deals to last over a month. Taobao and JD also started pre-sales about ten days earlier than last year, making this the longest-running Double 11 yet.

Industry experts think this extended time gives shoppers more freedom to browse and buy, though whether it will lead to higher sales is still to be seen.

- New Trade-In Subsidies for Appliances

This year, Double 11 is incorporating trade-in subsidies on appliances, combined with platform discounts, to give an extra boost to spending.

Since October, the home appliance sector has seen rising demand, and it hit a new peak with the start of Double 11. In the first hour of Tmall’s sale, brands like Haier, Midea, and Dyson hit sales over 100 million yuan, with 224 brands exceeding last year’s first-day totals in just that first hour.

Which E-Commerce Stocks Could Lead the Market?

As Double 11 heats up, the first round of sales data has revealed a few standouts:

Even before Double 11 officially began, institutional investors had already bought shares in Alibaba and Pinduoduo, with optimism also high for JD and Kuaishou’s performances.

Alibaba (BABA/09988)

According to its latest quarterly report, E Fund’s Zhang Kun increased exposure to the consumer sector. The E Fund Blue Chip Fund, managed by Zhang, is a leading product with assets totaling 44 billion yuan. For the first time, Alibaba entered the fund’s top ten holdings, now ranked as the second-largest holding after replacing CNOOC.

Since Alibaba was officially included in the Stock Connect program in September, it’s likely that Zhang added to his position in mid-to-late September via QDII funds.

Pinduoduo (PDD)

In an October 22 SEC filing, BlackRock disclosed that it had increased its Pinduoduo ADR holdings to 33.01 million shares, accounting for 2.4% of Pinduoduo’s total ADRs.

JD.com (JD/09618)

With Double 11’s new appliance trade-in subsidies, Guosheng Securities believes JD.com stands to gain the most, given that its appliance sales make up a large portion of its revenue. Based on an 11x 2025 estimated P/E, Guosheng values JD at 520.5 billion RMB, with a target price of USD 46 for U.S. stocks and HKD 181 for Hong Kong stocks, maintaining an “Overweight” rating.

Kuaishou (01024)

Kuaishou has also attracted attention during this e-commerce battle. BOCI previously predicted revenue growth for Kuaishou, driven by higher online ad revenue and e-commerce GMV. In mid-October, UBS added Kuaishou-W to its top stocks list, setting a 12-month target price of HKD 76.70, suggesting a potential upside of over 60%.

Other Concept Stocks to Watch This Double 11

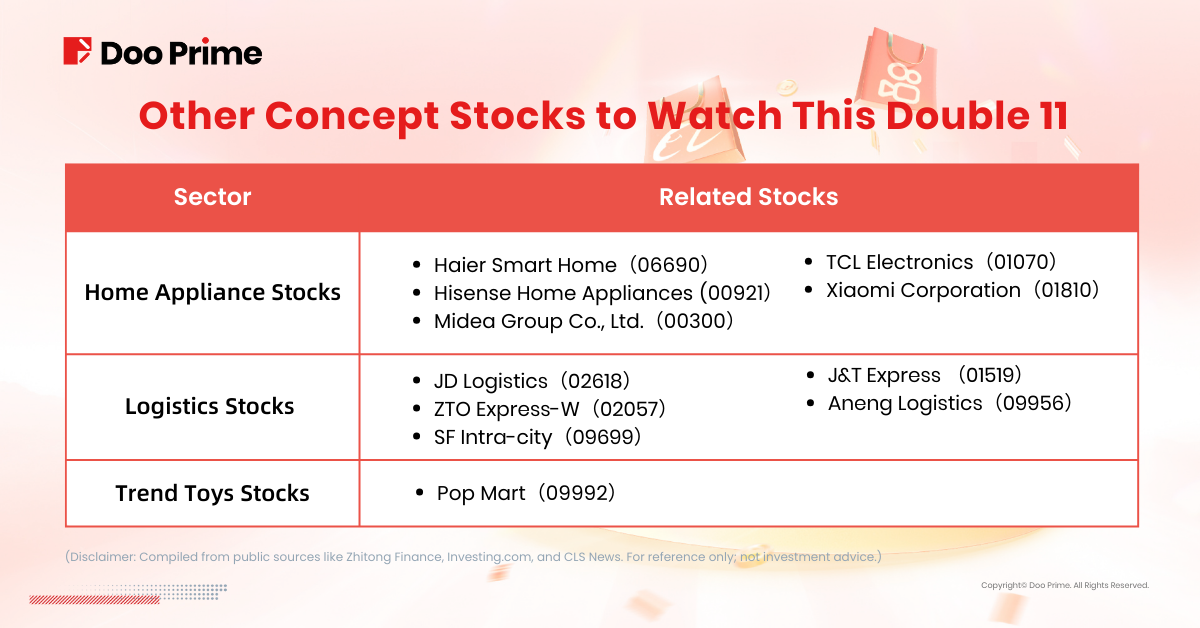

- Home Appliance Stocks

This year marks the first time Double 11 has combined appliance trade-in subsidies with platform discounts, adding more buzz to the home appliance sector.

A report by CITIC Securities notes that trade-in subsidies exceeded expectations in August and September, positively impacting white goods stocks. With nationwide rollouts and lower subsidy requirements as of September, home appliance sales could accelerate through the fourth quarter.

- Logistics Stocks

Double 11’s massive sales have created a peak season for logistics. Taobao and Tmall began their first round of Double 11 sales on October 21, causing a logistics surge. On October 22, a record 729 million packages were collected nationwide in a single day, a 74% increase year-on-year. Experts believe this year’s Double 11 could see even higher volumes than last year.

- Trend Toys Stocks

As consumer preferences evolve, demand is rising for non-essential items like blind boxes. Pop Mart, known as the “leading trend toy stock,” has launched Double 11 deals across platforms like Tmall and Douyin, attracting significant market attention.

On October 22, Pop Mart’s impressive Q3 earnings report drove its stock price up nearly 20% on October 23, with its market cap temporarily exceeding 100 billion yuan. The market has high expectations for Pop Mart’s Q4, with demand for popular IPs like Labubu driving sales during Double 11.

Tianfeng Securities and Essence International believe that Double 11 and other key sales events in the second half of the year will lift Pop Mart’s future performance. Last week, Morgan Stanley raised Pop Mart’s target price from HKD 69 to HKD 81, marking the sixth price increase this year.

Who Will Come Out on Top in the Double 11 Battle?

With this year’s Double 11 extended, the usual low-price tactics are no longer the focus, and appliance trade-ins are a new twist. Now in its 16th year, Double 11 still delivers fresh excitement and trends.

The first round of competition has ended, but more key battles are yet to come. Who will be the biggest winner, and which concept stocks will lead the market? Stay tuned.

Double 11 is heating up, and for investors looking to keep up with market trends or adjust their portfolios for market changes, Doo Prime offers thousands of CFDs, including popular U.S. and Hong Kong stocks like Alibaba. With Doo Prime’s stable, efficient trading environment, investors can choose the best opportunities to match their strategies.

Follow Doo Prime’s practical guides to stay informed on the latest market trends and seize trading opportunities!

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.