The seven wonders of the trading world are on the rise. The U.S. stock market is currently witnessing an ascent, driven by the emergence of what can be dubbed as the ‘Magnificent 7’ stocks. These powerhouse entities, namely Apple (AAPL), Alphabet (GOOGL, GOOG), Microsoft (MSFT), Amazon (AMZN), Meta (META), Nvidia (NVDA), and Tesla (TSLA), have become the focal points propelling the market to new heights.

With just five weeks left in 2023, the S&P 500 (^GSPC) experienced a remarkable surge, recording a near 19% gain. And the Magnificent 7 played a pivotal role in shaping this year’s market narrative.

These mega-cap stocks command the spotlight, and have collectively contributed to the surge, primarily fueled by the excitement surrounding artificial intelligence. The stocks are also involved in cloud computing, artificial intelligence, hardware and software, and investors view them as potent catalysts for emerging technologies that will drive the global economy and impact billions of people’s lives.

To further prove their importance, their dominance is underscored by their hefty 28% total weighting in the S&P 500, effectively steering the overall performance of the index. In addition, according to Goldman Sachs’ chief U.S. equities strategist David Kostin, the seven stocks have stronger balance sheets, higher margins, faster expected sales growth, and a higher re-investment ratio than the other 493 stocks. They also trade at a relative valuation that is in line with recent averages after taking expected growth into account.

Let’s take a deeper look at some of these powerhouses.

7 U.S. Stocks To Watch As The S&P 500 Aims To New Highs

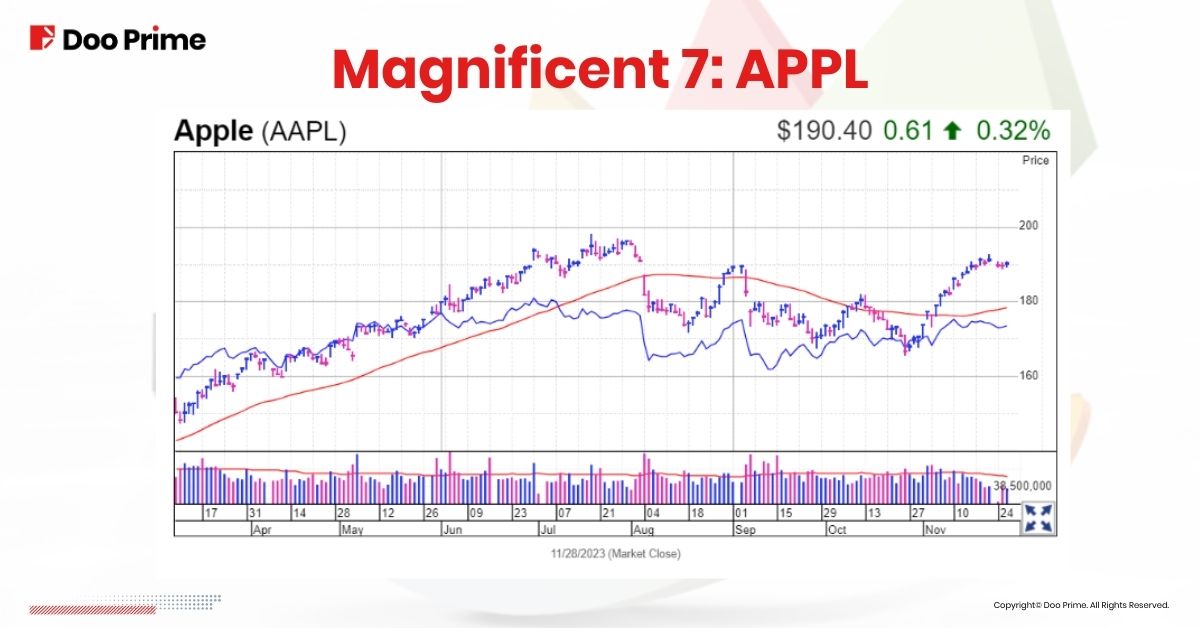

November has seen a 1.1% increase in Apple stock. They saw a comeback on October 26th, after plunging to a multi-month low. The S&P 500 had its follow-through day on November 2nd, and although Apple Inc. guided lower on holiday-quarter revenue, the stock recovered its 50-day line.

Apple stock provided an early entry on November 6th, as it recovered from the 50-day line and narrowly avoided a downward-sloping trendline. Like the Nasdaq and S&P 500, shares have continued to rise toward their peak in early September. As of right now, Apple is farther away from the official buy mark of 198.23 and farther away from the early entrance.

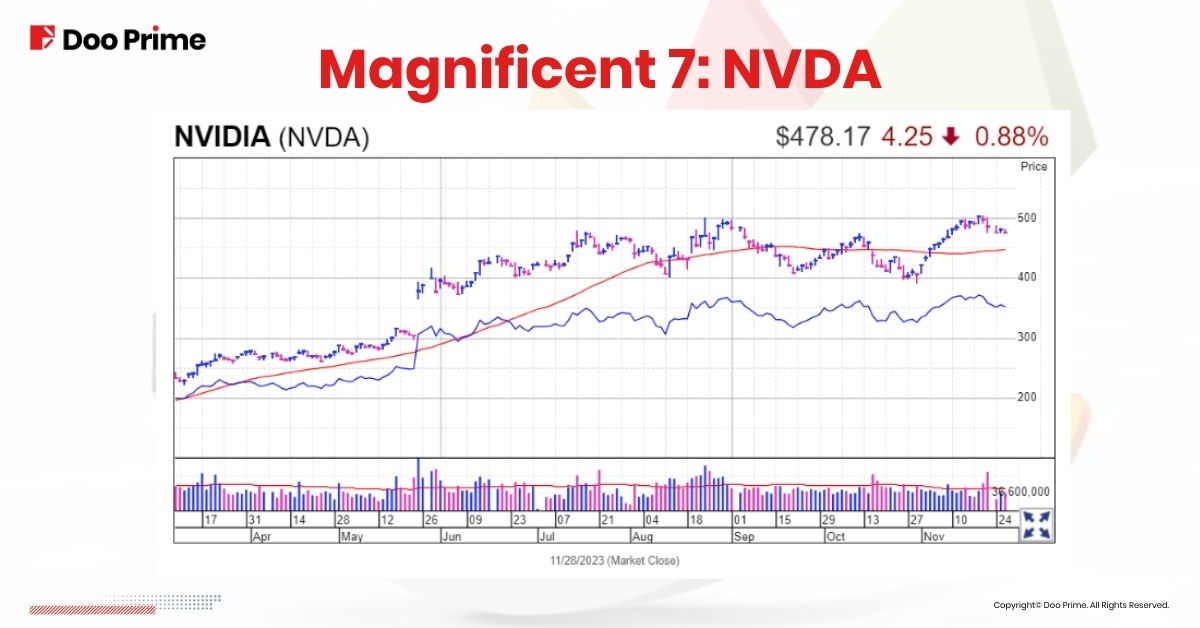

As of October 29, 2023, Nvidia‘s fiscal third quarter sales were USD18.12 billion. Although this was a considerably less impressive 34% growth from the previous quarter, it was still more than treble the amount for the same period last year.

The company’s profits for the quarter came to USD9.24 billion, up from USD6.19 billion in the prior quarter and USD680 million in the prior year. The company has successfully created a market for graphics processing units, which data centers use to boost their AI capability and support the growth of AI for their corporate clients. All things considered, NVDA stock has surged 237.3% in 2023, making it the best performer in the S&P 500.

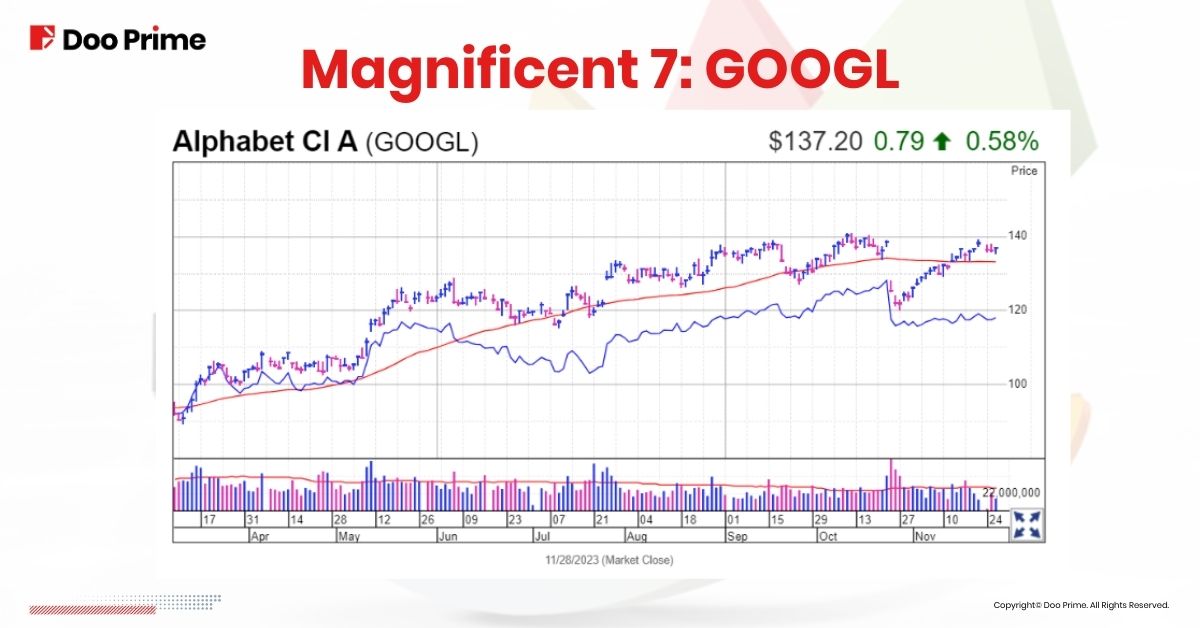

Alphabet beat overall expectations for its third-quarter earnings. November saw a 9.1% increase in Google stock. However, that came after October’s 5.2% fall, which was exemplified by a 9.9% loss in the week ending October 27 as a result of unsatisfactory Google Cloud growth.

Shares have recovered since then. Currently, GOOGL’s stock is just over the 50-day line. Their buy point is 141.22, derived from an awkwardly flat basis. If the Nov. 16 high of 137.22 is cleared, Google shares would be eligible for an early entry.

According to CNBC, the price of Amazon’s shares fell prior to its earnings release, but it swiftly increased following its disclosure made after hours. The company exceeded analyst projections of 59 cents per share and USD141.7 billion in sales by reporting earnings of 94 cents per share on USD143.1 billion in revenue.

That being said, not all of the news for Amazon was positive. The company’s fourth-quarter guidance at midpoint fell short of projections. Furthermore, it appears that Amazon is losing some cloud market share. Compared to Microsoft Azure’s 29% increase and Google Cloud’s 22% gain, Amazon Web Services had a 12% increase in cloud revenue.

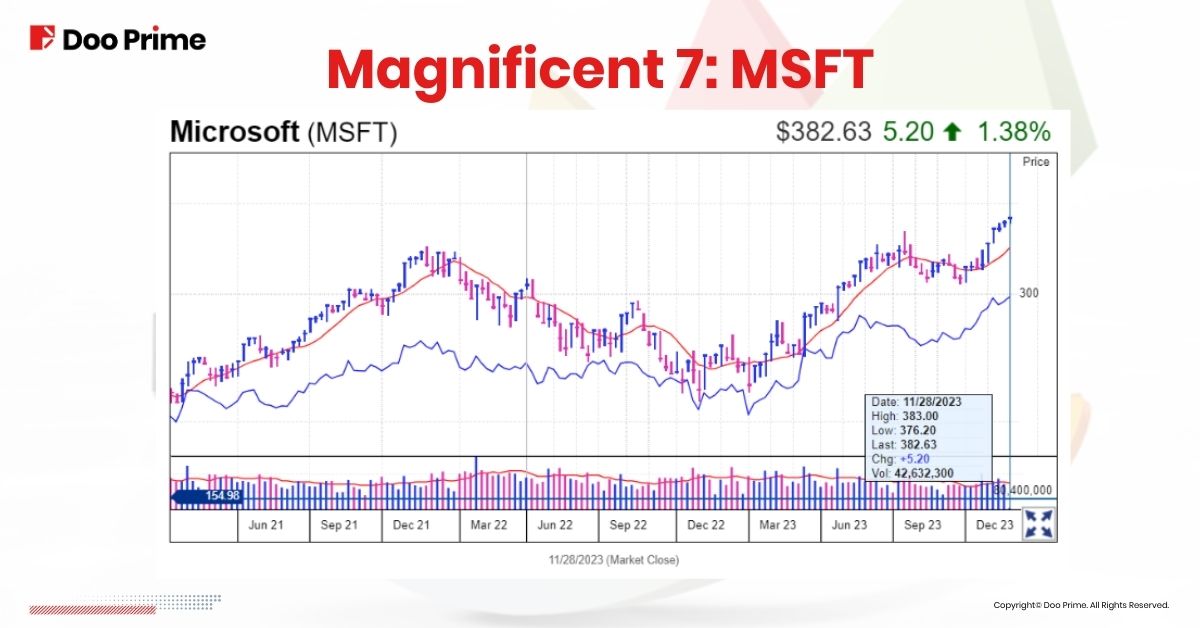

Based on analyst forecasts, Microsoft produced a practically faultless quarter, and its shares initially increased. Microsoft exceeded analysts’ projections by earning USD2.99 per share on sales of USD56.5 billion in the quarter that ended in September. The revenue increase was a 13% year-over-year increase and the third consecutive quarter of faster growth.

To add, Wall Street predicts 15% growth for both the current and upcoming year.

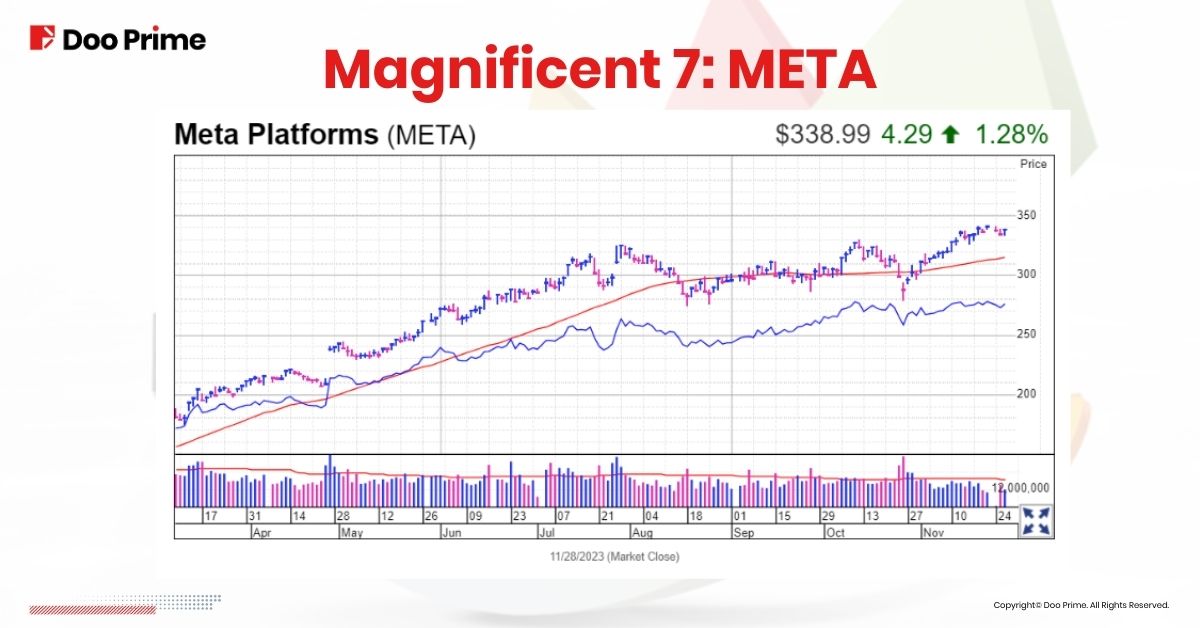

In contrast to the consensus estimates of USD3.70 per share and USD33.45 billion, Meta revealed earnings of USD4.39 per share on USD34.15 billion in revenue. However, investors became concerned over management commentary indicating caution on the ad market due to the heightened tensions in the Middle East, which caused the social networking giant’s stock to plunge.

Despite the concerns, the company’s strong fundamentals could provide the necessary support to push the stock to new all-time highs.

In contrast to forecasts of 73 cents per share on USD24.14 billion in revenue, Tesla revealed earnings of 66 cents per share on USD23.35 billion in sales. The company’s shares have yet to return to their pre-earnings announcement levels.

So, Should Investors Go For The Magnificent 7?

In general, despite ups and downs, all seven of the Magnificent 7 have gained double- or triple-digits so far this year – and they don’t seem to be going downwards.

However, predicting the future is almost impossible, especially if 2023 is any indication. Throughout the year, forecasters had to modify their outlooks and strategy multiple times due to unforeseen events. This notion still rings true.

Investing in the Magnificent 7 or any other asset class should ultimately be based on an individual’s financial objectives, and risk appetite. Adaptability and a long-term view are critical for overcoming challenges and attaining lasting investing success in the ever-evolving world of finance.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement, Risk Disclosure, and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.