Today is Black Friday!

The day after Thanksgiving has become a global phenomenon, marking the official kick-off the holiday shopping season.

For consumers, this day represents massive Black Friday discounts, long queues, and overcrowded stores.

For investors, however, Black Friday is an indicator of a potential surge in retail sales. This presents a unique opportunity to evaluate the best Black Friday stocks of major retailers and e-commerce companies.

In this article, we first examine consumer behavior during Black Friday and its impact on stock prices. Second, we highlight the top 5 Black Friday stocks to consider adding to your watchlist.

The Black Friday Digital Revolution

The world of retail is going through a profound transformation. Studies have shown that online shopping is the new normal shopping experience.

People are choosing to shop from the comfort of their homes for many reasons. It’s convenient, flexible, and gives them access to a wider selection of products.

Traditional stores are struggling to keep up with online retailers. The COVID-19 pandemic accelerated this shift. People don’t want to deal with crowds, traffic, or long queues anymore.

Online platforms offer a more personalized experience, with recommendations and virtual try-on features from the comfort of your home.

Social media and influencers are also changing shopping habits. Consumers are looking to their online networks for inspiration and guidance. Retailers need to adapt to this changing landscape if they want to stay ahead, or even relevant.

Online shopping is not just a trend. It represents a fundamental change in consumer behavior. Retailers who don’t adapt will be left behind.

The consumers have spoken, and this new reality is now reflected in the companies’ stock prices. The future of retail is undoubtedly digital, and it is up to these giant retailers to embrace this transformation and create the shopping experience that consumers want.

Top 5 Black Friday Stocks to Watch

Here are five promising Black Friday stocks to watch:

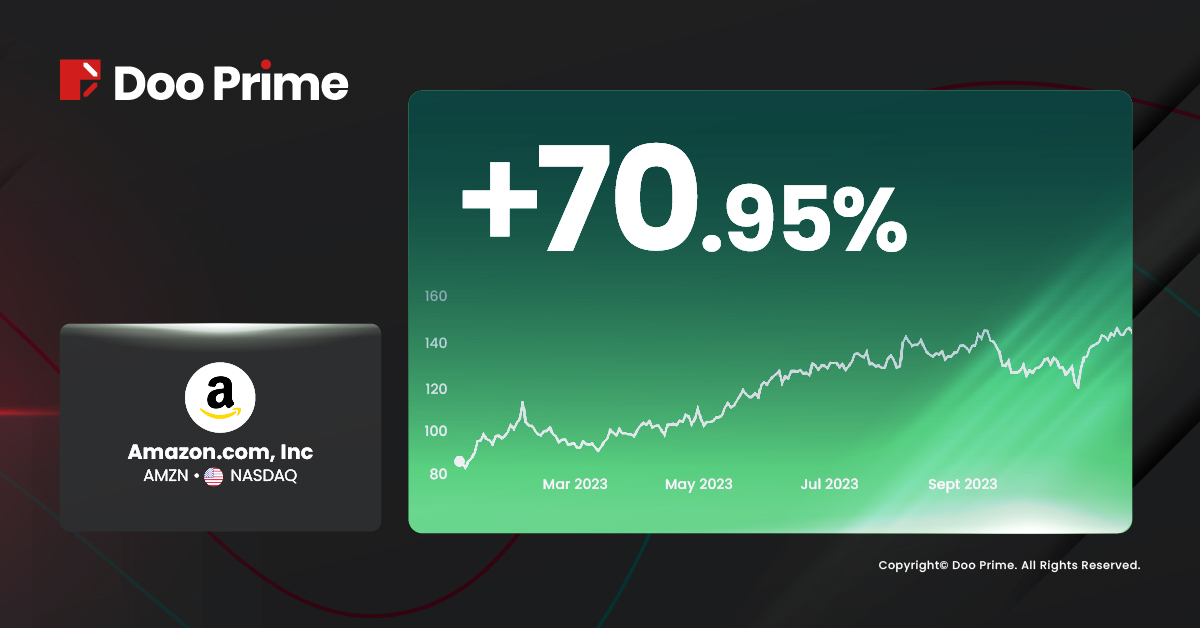

Amazon (AMZN):

Amazon is the undisputed king of e-commerce and has rewritten the rules of retail, transforming the way the world shops.

The industry leader has had a remarkable year, and we expect to continue its impressive growth trajectory in the coming months.

Also, the e-commerce giant has been expanding its cloud computing business, Amazon Web Services (AWS), at a rapid pace. AWS is now the world’s leading cloud computing platform and is a major source of revenue and profit for Amazon.

Additionally, Jeff Bezos keeps reinvesting in its e-commerce business, expanding its product offerings, and improving its delivery network to remain ahead of his competition.

Because of these factors, Amazon is well-positioned for continued growth in the coming years.

Investors should keep a close eye on Amazon stock (AMZN), as it is likely to continue to outperform the market. Shares are already up 70.95% this year, and Black Friday could push them even higher.

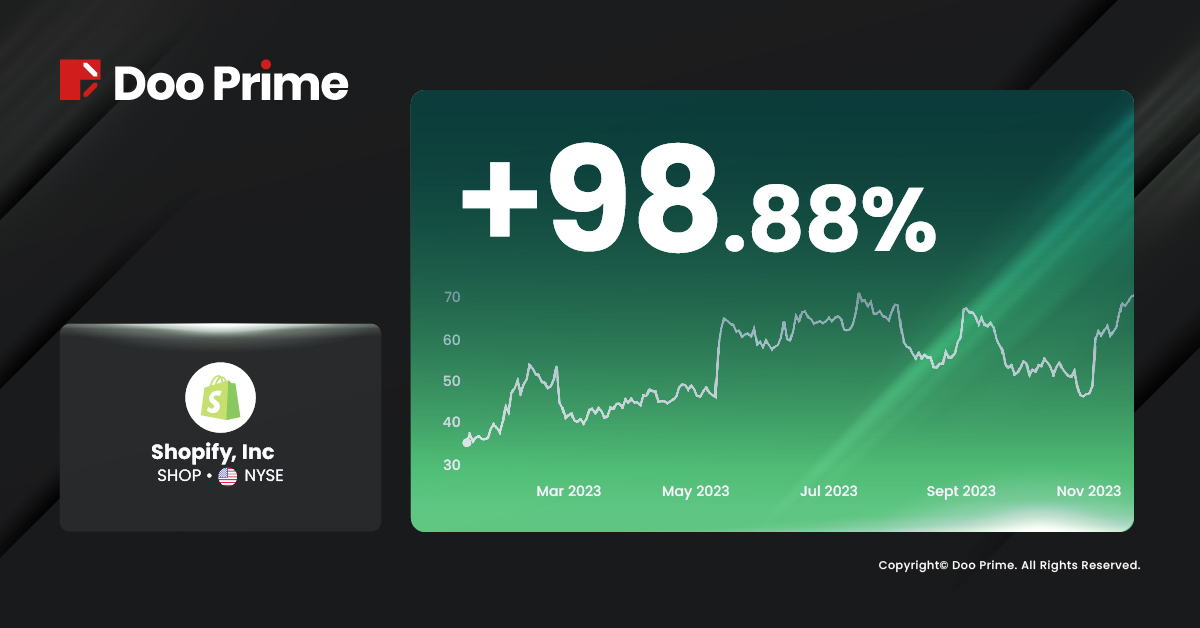

Shopify (SHOP):

Shopify, similar to Amazon, has had a great year so far and could do even better in the coming months.

The company has made some major changes to improve its finances, including layoffs and selling its logistics business. It is now focused on e-commerce again and is using the power of AI to make things easier for its merchants.

Additionally, Shopify is also hoping to attract more enterprise clients by offering them a scalable and customizable platform that can meet their specific needs.

The company’s gross transaction volume (GTV) is growing, and we expect Shopify to continue to grow leading up to Black Friday, which is historically the company’s best weekend.

As a result, Shopify’s stock price is likely to rise after Black Friday as well. At the very least, investors should have Shopify stock (SHOP) on their watchlist, as shares are already up 98.88% during 2023.

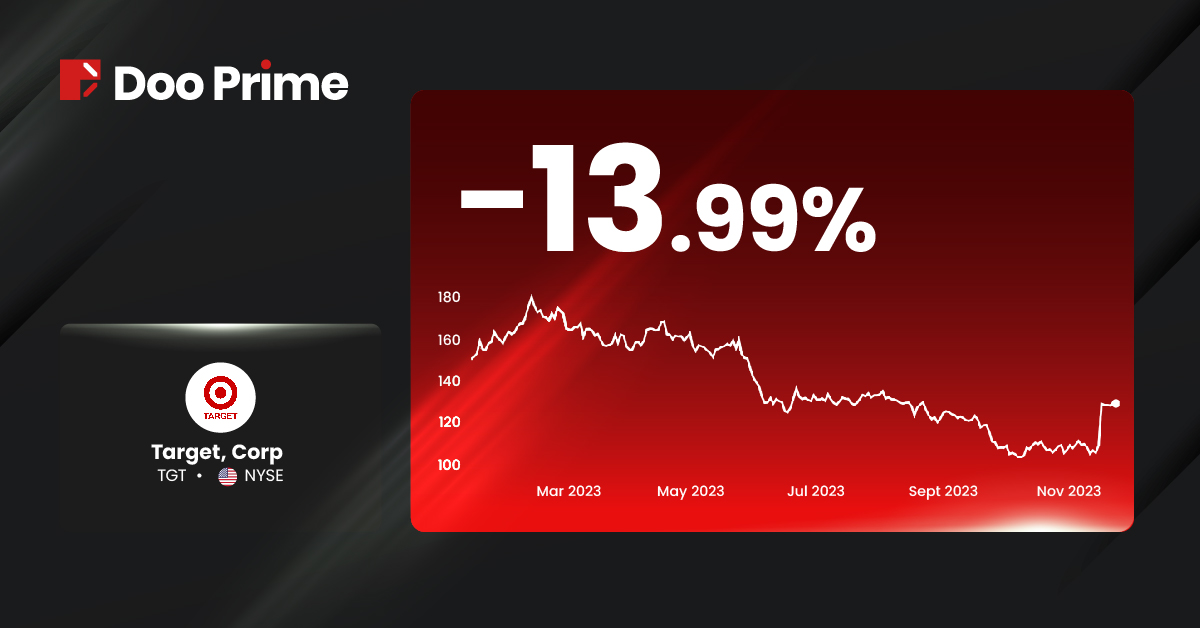

Target (TGT):

Target is one of the top retail stores that is investing heavily in its e-commerce business.

The company has had a strong year and is expected to continue performing well in the coming months. The renowned retailer has been focusing on improving its omnichannel strategy, which has led to increased sales and improved customer satisfaction.

Moreover, the retail giant has also been investing in its digital infrastructure and expanding its product offerings. These efforts are paying off, as they have well-positioned the company for continued growth in the coming years, and we expect it to see strong sales across all channels on Black Friday.

Despite shares being down 13.99% this year, investors should consider this a buying opportunity by adding Target stock (TGT) to their watchlist. Strong Black Friday sales could boost the stock price, making it a solid investment.

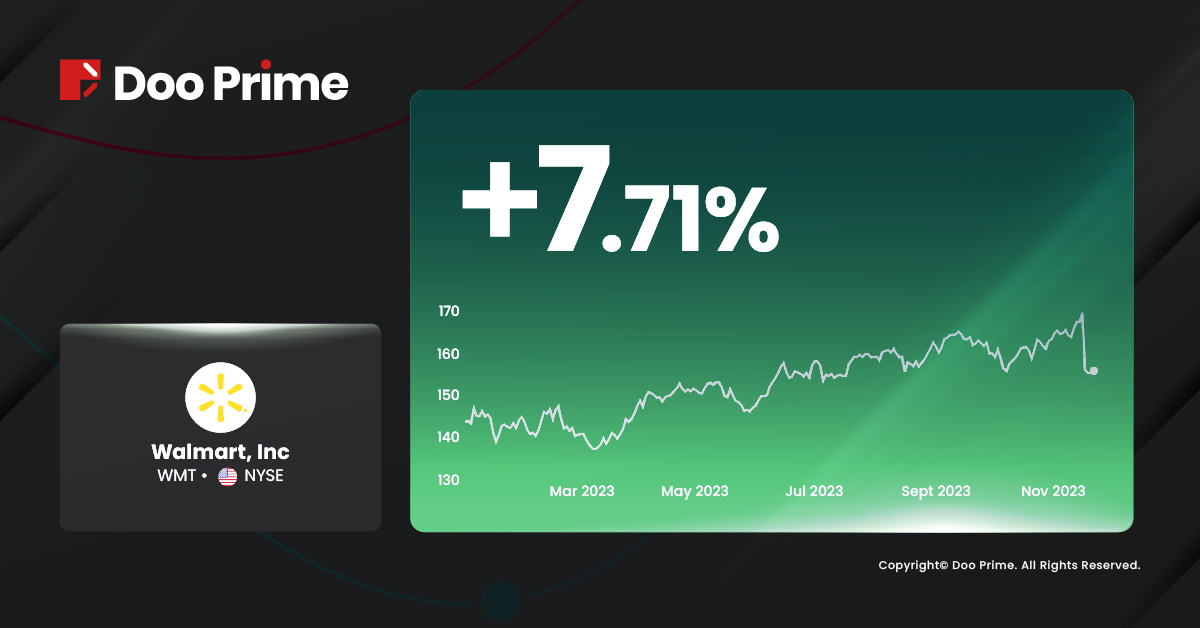

Walmart (WMT):

Walmart remains a dominant player in the retail industry, with a loyal customer base and a wide range of products.

The retail giant has had a solid year and is poised for continued growth in the coming months.

The company has made some strategic acquisitions to expand its online presence, including the purchase of the e-commerce platform Jet.com.

Moreover, this industry leader is also investing heavily in its omnichannel strategy, which aims to provide a seamless shopping experience for customers across all channels. This includes expanding its grocery pickup and delivery services, as well as renovating its stores to make them more shoppable online.

Additionally, Walmart is also benefiting from strong consumer spending and is expected to see a boost in sales during the upcoming Black Friday and holiday shopping seasons.

Another Black Friday stock for investors to keep an eye on is Walmart shares, which are already up 7.71% this year with a clear bullish trend.

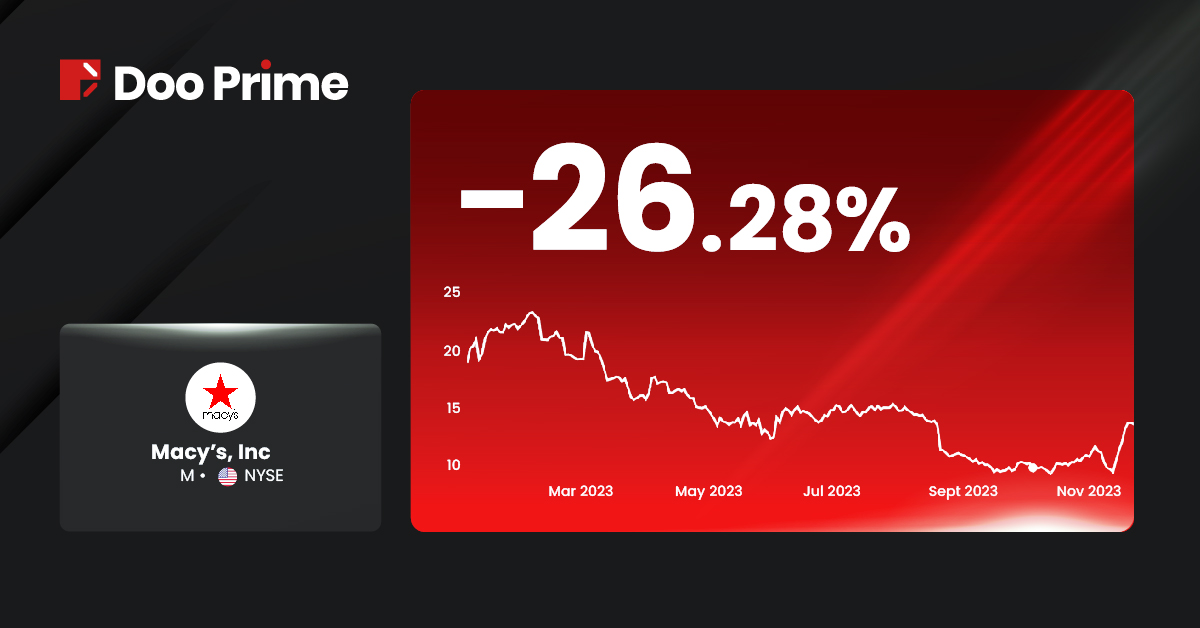

Macy’s (M):

Macy’s is a department store chain that has been struggling in recent years.

Outdated merchandise and poor store locations have been its major criticisms.

However, the company has been implementing several turnaround strategies, including:

- Closing underperforming stores.

- Investing heavily in e-commerce.

- Refreshing its products by introducing new brands and trendy merchandise.

- Reducing costs.

These efforts are helping to attract new customers and boost sales.

Despite a significant decline in Macy’s stock price by 26.28% this year, investors should consider adding the stock (M) to their watchlist in anticipation of Black Friday sales.

Therefore, these ongoing turnaround strategies could boost sales and stock prices in the coming months.

Strategies for Investing in Black Friday Stocks

Investors should consider the following strategies when investing in Black Friday stocks:

- Conduct thorough research: Analyze the financial health and strategies of each retailer before investing.

- Diversify your portfolio: Spread your investments across different sectors to minimize risk.

- Adopt a long-term perspective: Black Friday sales may impact stock prices in the short term, but long-term performance is more important.

- Consider market conditions: Overall market conditions can play a role in stock performance, so consider broader market trends.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement, Risk Disclosure, and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.