Good morning.. A very mixed session in Asia after another strong weekly close on Wall St on the charts. Shanghai and HK stocks benefitting from more liquidity injections from the central bank but weakness seen in Japan, Korea, and Oz. The performance of US stocks and the lagging in others, may suggest some capital flows back to US assets and that may see this USD consolidation last a little longer but on a macro basis, I still see the USD lower as the centre of the move is still the Fed. But for now I prefer some crosses and EURJPY and EURGBP are still up there for me. I also see EURNZD has been trending higher for a while and looks set to continue. I think EURAUD is also starting to show some potential to break from its recent sideways action and I have recommended a long this morning (see below). But the risk rally is not broad and in the US if we remove the FAANGS then signals are different. New rises in infections and souring US/China relations are not going to help the global recovery. Brexit negotiations restart this week but there still seems to be irreconcilable differences. But it is the geopolitical risks that worry me most. Also in the US, the social unrest is quite shocking.

Keep the Faith…

Details 17/08/20

Stocks ignoring clear signs of new infections after unlocking. A more clouded view on the USD as risks rise:

–

The impact of the virus on most economies is not going away it seems and news over the weekend was not good, which raises the question as to when global equities start to register the potential impact on the global economy. New Zealand delayed its national election by four weeks over concerns its coronavirus outbreak could disrupt the campaign and balloting. Australia had its deadliest day, while U.S. fatalities exceeded 1,000 for the fifth consecutive day, though cases slowed. Italy and Spain told nightclubs to close, while France’s public health agency warned that all of the country’s Covid-19 indicators are trending upward. South Korea reported more cases after warning over the weekend of a wave of infection, most of them linked to an outbreak at a church. Bloomberg suggests that Malaysia has found a new strain of C-19 that’s been found to be 10x as infectious and the WHO reported that there were +29,4237 global new cases in last 24 hours, a new daily record!

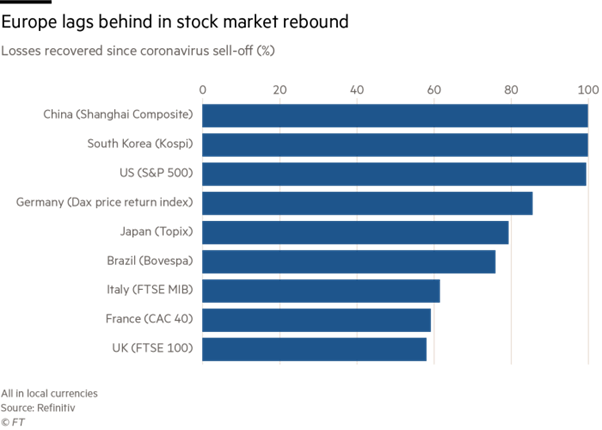

Economies are in danger of being dragged back down at a time when markets are pricing a reflation phase. Thailand’s economy contracted the most in more than two decades, deepening its recession as the nation’s key drivers of trade and tourism remain hobbled by the global coronavirus pandemic. GDP product shrank 12% from a year ago. What will be the impact on Korea, Oz, NZ, the EU and the US going forwards? We need a virus and we need it tested and delivered fast and that is still some way off. I am not sure we will see blanket lockdowns again but targeted ones for sure and it is enough to put a stop to any thoughts of travel, which will leave the tourism and hospitality exposed countries at real risk. Meanwhile, US stocks have another strong weekly close but it is interesting that many others are now lagging again, possibly due to the virus stats.

Europe lags behind in stock market rebound

Does this mean the USD sell-off is over, as capital floods back into US assets? I would comment here that without the FAANGS group, the chart above is very different for the US and so I am not sure the USD capital inflow would be that great at these dizzy levels. But more stimulus from China saw Shanghai stocks up 2.25% last night with HK up over 1% but weakness in Nikkei (0.75% on disappointing GDP data) and Kospi (-1.23%) and Oz (-0.8%) left an unclear picture into the European session.

The picture on the USD is rather less clear now and some of the charts suggest further weakness for currencies like NZD and AUD against the USD while EUR remains pretty solid but losing some upward momentum. The EUR-heavy DXY is still close to 93.00 but the direction for the USD looks rather mixed to me here. I think maybe the better value may rest in some crosses but the likes of EURNZD have already been trending higher for a while.

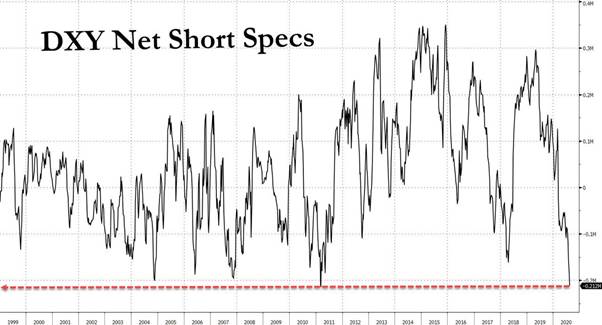

Above is a daily of the cross where you can see a trend developing. I think if the USD is to bounce or let’s say continue to consolidate, then I think the EUR may hold up better than most. The market is short the USD now too according to futures data.

Also, the USD could bounce further if stocks do get spooked by further implications from a resurgent virus. But if we are really seeing changes in reserve and portfolio flows, then this USD drift higher may be short-lived.

The USD rally, if seen, may also impact gold and other commodities and for me gold needs to hold $1872 (the 50% retracement) and break $1970 to confirm a run at a new high. On the weekly chart the EUR closed above 1.1822 (the 62% retracement level), which is positive but the daily has some signs of caution with momentum. But right now I prefer long some of the EUR crosses rather than having a short USD exposure; just while we sort a few things out. I do think EURNZD can keep going and I think there may be decent value in long EURAUD from here. I am happy to keep the long EURGBP (Brexit negotiations start this week and run till Friday) and long EURJPY recommendations but will add EURAUD here at 1.6515 and add at 1.6420 with a stop around 1.6235.

A break of 1.6620 on the daily suggests a decent move higher to me and a breakout of the long running sideways action may be developing.

But overall, I can see further USD weakness down the road as at the core of this weakness is Fed policy, which as I have said on numerous occasions, is not changing any time in the foreseeable future and they may even do more in September. This week’s minutes may be worth a look. This deliberate debasement of the USD is real and at some point, I feel its impact could be significant. It is interesting that Buffet is shifting his portfolio in a way that seems to suggest he is starting to bet against the US by reducing or closing longs in US banks and airlines (and others) and buying gold miners! Something he has said he would not do. I am sticking with my long gold view but we may need the USD to resume its downtrend soon. I am looking for a USD rally to sell again; I am just not sure what against yet but probably EUR.

Daily EUR chart above courtesy of Richard Adcock.

There are a lot of risks out there and some of them seriously dangerous. I am noting with some concern the growing civil/social unrest across large parts of the US and in NY over the last 72hours there has been a serious rise in shootings. In Chicago, the centre of the City was closed down again due to riots ad looting. The US is falling apart socially and many are upping sticks and moving to the suburbs. Russia is offering “support” to the Belarus leader who may take up the offer but at what cost? The US is taunting China and actively supporting Taiwan with a deal to sell 66 F-16 fighters to the country (on top of advanced drones); something that will infuriate China and maybe crossing a red line. Naval exercises are taking place off the Taiwan coast and US and China jets have flown over nearby. Meanwhile, Turkey is imploding and seeing bank runs with many selling their Lira’s and buying gold and with Erdogan in charge, it is certainly unclear what lies ahead.

As the Turkish lira logged fresh record lows against both the dollar and the euro on Friday (and is now down 19% this year against the dollar), attention is turning once again to the potential risks facing lenders. They include a handful of very big Eurozone banks that are heavily exposed to Turkey’s economy via large amounts in loans — much of it in euros — through banks they acquired in Turkey. Although their exposure is not what it was, the strains are beginning to replay those of the last currency/financial crisis in 2018. Meanwhile, virus cases are starting to jump again across the globe, as mentioned above and we still have no vaccine and targeted lockdowns may be back. All of this and the ongoing trade war is going to slow global trade down and see the recoveries across the globe struggle to blossom. But so far, US stocks still attract even though risks suggest otherwise.

—————————————————————————————————————-

Strategy:

Macro:.

Long EURGBP @ .9030.. Stop at .8950ish.

Long Gold @ $1875 Stop at $1820

Long EURJPY ´126.00 Stop at 125.10.

Long EURAUD @ 16515 looking to add at 1.6420 and Stop below 1.6235.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.