U.S Stocks

Fundamental Analysis:

The S&P 500 Index broke away from its record highs due to the poor ADP National Employment Report and General Motors (GM) plunge.

Nine of the S&P 500’s 11 sectors were lower. This includes stocks for industrial and energy industries – they both slumped. In addition, data showed that U.S. private-sector job gains in July were much weaker than expected, due to the possibility of labor and raw material supply shortages.

The tech-dominated Nasdaq Index, bucked the trend after another report indicates that the U.S. service sector index jumped to a record high last month. Essentially, it suggests that the overall economy is still on a rebound track.

Ross Mayfield, Investment Strategy Analyst at Baird said: “The ADP employment data released in the morning is much weaker than expected. This is pushing investors’ attention firmly on the number of tomorrow’s jobless claims and Friday’s nonfarm payrolls report, which is a major driving factor.”

“Overall, the continuous outbreaks of the Covid-19 virus and the spread of the Delta variant in recent weeks and months have caused people to reassess growth prospects,” Mayfield said, in an attempt to influence the market on accepting his implication for reinflation trading and the bond market.

After six consecutive months of gains, the S&P 500 Index struggles in August. The market posts its concerns towards the speed of the economy’s rebound from the recession triggered by the pandemic. Not only that, corporate earnings season is also under pressure, due to the market’s worries on rising inflation overshadowing the earnings’ promising performance.

Technical Analysis:

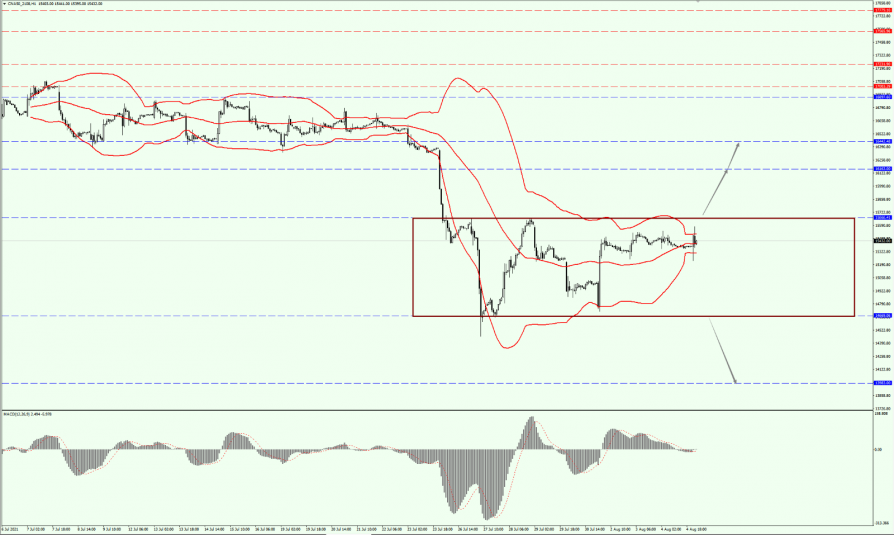

(Dow30,1-hour chart)

Execution Insight:

Today, pay attention to the middle track of Bollinger Bands.

As long as the Dow is running below the middle track of Bollinger Bands, it will maintain its bearish trend.

On the bottom, pay attention to the 34724 and 34477 positions on supporting strength.

Hong Kong Stocks

Fundamental Analysis:

During the early morning, Hong Kong stock market’s major indices opened lower. The Hang Seng Index rose by 0.2%, the Hang Seng China Enterprises Index (HSCEI) rose by 0.1%, while the Hang Seng TECH Index fell by 0.1%.

On the market, the Hang Seng Index (HSI) blue-chip stocks were mixed.

Haidilao rebounded over by 6%, WuXi Biologics rose by nearly 3%, Alibaba rose by over 2%, Alibaba Health Information Technology fell by over 3%, while PetroChina fell by nearly 3%.

On top of that, Hang Seng TECH Index stocks contributed a large part of the decline. Kuaishou Technology fell by more than 8%, NetEase fell by more than 3%, Alibaba rose by more than 2%, and Meituan rose by nearly 2%.

In terms of industry sectors, food and beverage, aerospace military, medical equipment & services, and cosmetics stocks rose, while the gaming industry stocks rebounded. The tobacco industry’s stocks fell significantly. In particular, Smoore International fell by more than 5%.

Technical Analysis:

(HK50,1-hour chart)

Execution Insight:

On HK50 today, continue to pay attention towards the support of the 25880-line today. If the HK50 runs above the 25880-line, it will still maintain a rebound trend.

With that, pay attention to the suppression between the 26535 and 26951 positions, in particular, the 26535-line.

Once the HK50 breaks through the 26535-line, it will create an upside potential.

If the market outlook of HK50 falls below the 25880-line, it will open up the room for further correction after this wave of rebound. At that time, pay attention to the support of the 25160-line.

FTSE China A50 Index

Technical Analysis:

(A50,1-hour chart)

Execution Insight:

Today, on A50, continue to focus on the direction of the 15666 to 14669 breakthrough. If it breaks the above 15666-line, it will open up a greater upside potential.

Then, pay attention to the suppression on the 16163-line. If it falls below the 14669-line, it will open up a greater downside potential.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.