U.S. Stocks

Fundamental Analysis:

U.S. stocks were volatile on Friday, 25th March 2022, with a surge of underbuying near the close, pushing the broader market to close higher.

U.S. Treasuries fell, with the short end of the yield curve bearing the brunt of the decline.

The S&P 500 closed 0.5% higher, near its intraday high, with a 1% oscillation for the day, the lowest since Feb. 15. Meanwhile, the Nasdaq 100 closed essentially flat.

The yield on the two-year Treasury note, one of the most sensitive to interest rate movements, rose 14 basis points to 2.28%.

With the market busy dealing with monetary policy tightening and the risk to the economic recovery from the war in Russia and Ukraine, the S&P 500 recorded a second week of gains in the stock market last week despite dramatic volatility.

Technical Analysis:

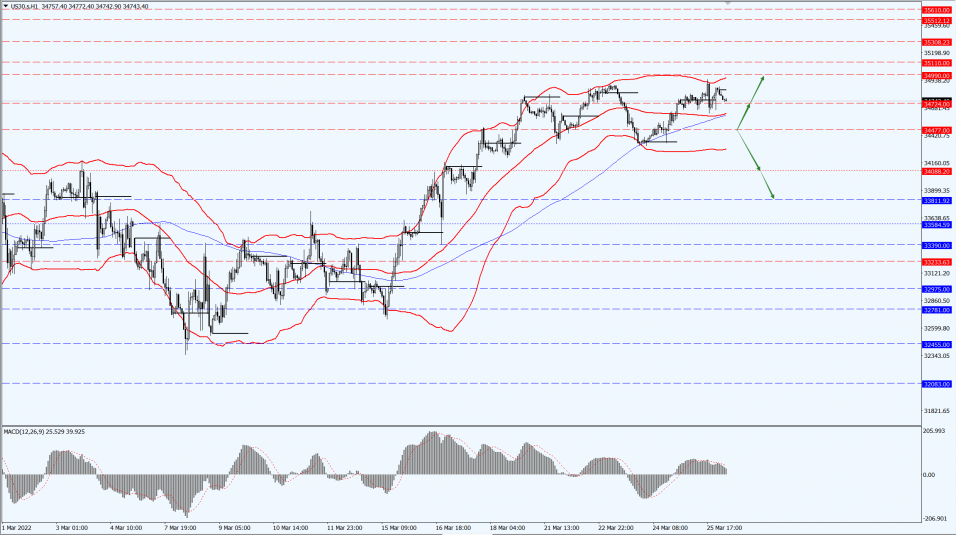

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 34477-line today. If the Dow runs stably above the 34477-line, it will pay attention to the suppression strength of the 34724 and 34990 positions. If the Dow index breaks below the 34477-line, it will pay attention to the support strength of the 34088 and 33811 positions.

Hong Kong Stocks

Fundamental Analysis:

The Hang Seng Index (HSI) opened 0.08% higher, and the trend of technology stocks diverged.

Meituan (3690.HK) opened nearly 6% higher after the results, JD.com, Inc. (9618.HK) fell 2.5%.

China Shenhua Energy Company Limited (1088.HK) rose 7.6%. The company announced a cash payout of 50.4 billion, a big profit of 50.2 billion last year.

On the other hand, domestic housing stocks performed worse, Shimao Group Holdings Limited (0813.HK) fell more than 3%. In early Asia-Pacific markets, the FTSE China A50 Index futures fell 0.6%.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 Index focuses on the 22127-line today. If HK50 can run stably below the 22127-line, then pay attention to the support strength of 21450 and 20467. If HK50 runs above the 22127-line, then pay attention to the suppression strength of 22785 and 23294.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 13983-line today. If the A50 runs steadily below the 13983-line, then pay attention to the support strength of the two positions of 13371 and 12791. If the A50 runs above the 13983-line, it will open up further upward space. At that time, pay attention to the suppression of the 14669-line.

Risk Disclosure

Trading in financial instruments involves a high degree of risk due to fluctuations in the value and price of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.