U.S. Stocks

Fundamental Analysis:

U.S. stocks closed slightly higher on Monday, 27th February 2023.

Investors bought the dip after last week’s biggest percentage drop in the main benchmark index for 2023, but concerns persisted about further rate hikes ahead to curb stubbornly high inflation.

All three major stock indexes climbed more than 1% shortly after the opening, partly due to a pullback in U.S. bond yields, but all closed away from daily highs.

With U.S. Treasury yields off their daily lows, stocks gradually gave back gains during the day.

The Dow Jones Industrial Average rose 72.17 points, or 0.22%, to 32,889.09, the S&P 500 rose 12.2 points, or 0.31%, to 3,982.24, while the Nasdaq rose 72.04 points, or 0.63%, to 11,466.98.

Last week, the Dow Jones Industrial Average posted its largest weekly percentage decline since September, while the S&P 500 and the Nasdaq each posted their biggest weekly declines since December as economic data and speeches by Federal Reserve officials fueled expectations that the Fed will be more aggressive in raising interest rates.

Data showed that new orders for key capital goods manufactured in the U.S. rose the most in five months in January, and shipments of such core capital goods also rebounded, indicating a pickup in corporate spending on equipment at the start of the first quarter.

A slide in yields helped growth stocks rally 0.63% and electric car maker Tesla jumped 5.46% after the company said its plant in Brandenburg near Berlin is producing 4,000 cars a week, three weeks ahead of schedule according to the latest production plan Reuters has learned.

Technical Analysis:

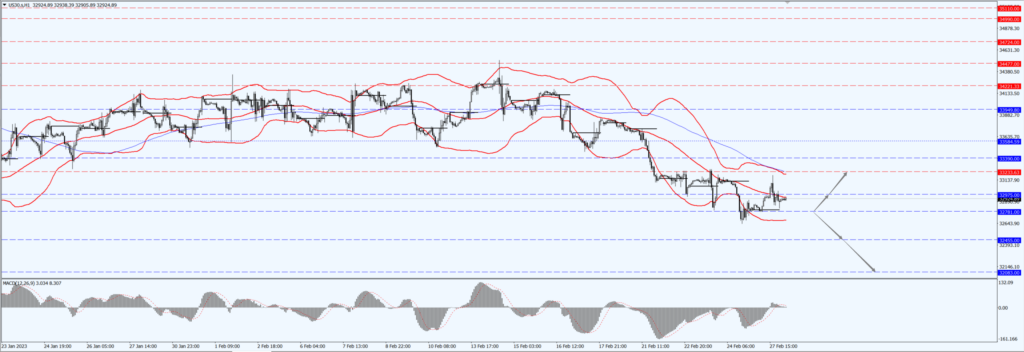

(Dow 30, 1-hour chart)

Execution Insight:

The Dow pays attention to the 32781-line today. If the Dow runs stably above the 32781-line, then pay attention to the suppression strength of the 32975 and 33233 positions.

Hong Kong Stocks

Fundamental Analysis:

Overnight, European and American stock markets rose.

The U.S. dollar index once exceeded 105 on Monday, but then turned around and fell.

The fall in U.S. bond yields boosted the stock indexes.

Affected by the above factors, on 28th February, the three major indices of Hong Kong stocks opened collectively higher.

The Hang Seng Index (HSI) rose 0.38%, at 20020.17 points, the Hang Seng TECH Index (HSTECH) rose 0.29%, at 4001.54 points, and the Hang Seng China Enterprises Index (HSCEI) rose 0.27%, at 6688.31 points.

On the market, the heavyweight technology stocks were mixed, Baidu, Inc. (9888.HK) rose 2.2%, while Meituan (3690.HK) rose 1.54%.

Domestic insurance stocks rose significantly, while telecommunications stocks, dairy stocks, and film and television entertainment stocks strengthened.

GDS rose more than 2%, Kingsoft Corporation Limited (3888.HK), while Kingdee International Software Group Company Limited (0268.HK) rose more than 1%,

The three major telecom operators were strong, China Telecom Corporation Limited (0728.HK) rose 2.36%, China Unicom (Hong Kong) Limited (0762.HK) rose 1.66%, China Mobile Limited (0941.HK) rose 0.87%.

On the other hand, photovoltaic stocks fell significantly, Xinyi Solar Holdings Limited (0968.HK) performance fell 1.58%, while domestic banking stocks, e-cigarette concept stocks, gas stocks, and wind power stocks were lower.

The continuous decline in auto stocks partially rebounded, and new car manufacturers still fell.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 pays attention to the 2046-line today. If HK50 can run stably above the 20467-line, then pay attention to the suppression strength of the two positions of 21450 and 22127.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.