When it comes to gold, the world never really falls out of love with this precious metal. Whether it’s tucked away in a vault, crafted into jewelry, or driving trading desks into a frenzy, gold has always been the go-to asset for stability. But what about its future? Specifically, where might gold prices be heading in 2025? Will the shiny metal maintain its glow, or are we looking at a duller outlook? Let’s uncover what lies ahead for gold price predictions in 2025.

Why Gold is Always in the Spotlight

Investors rush to gold during economic uncertainty, viewing it as a “safe haven” asset. When markets get volatile or currencies weaken, gold is like that reliable friend who always shows up with a comforting presence.

In 2024, gold prices hit new all-time highs multiple times, driven by a series of global events: inflation worries, geopolitical tensions, and dovish central bank policies. These factors are likely to stay relevant in 2025, but with a few changes.

Gold Price Predictions: Analyst Projections

Forecasting gold prices isn’t an exact science, it’s a blend of analysis and informed guesses. Here’s a look at the key projections:

- Goldman Sachs’ Golden Outlook

Big players like Goldman Sachs and UBS Group AG project a modest increase in gold prices, estimating levels around $2,900 and $3,000 per ounce in 2025. Their optimism is rooted in the idea that central banks might slow their rate hikes, reducing the dollar’s strength and making gold more attractive globally.

- Bearish Voices

On the flip side, some analysts argue that if economic growth picks up and inflation cools, gold might lose a bit of its glitter, retreating below $2,400 per ounce.

- Wildcards and Highs

A few bullish forecasters even speculate that gold could soar to $3,500 per ounce, driven by unexpected economic slowdown or if inflation jumps back again.

Factors Driving Gold’s 2025 Trajectory

Several forces will influence where gold prices head in 2025. Let’s break them down:

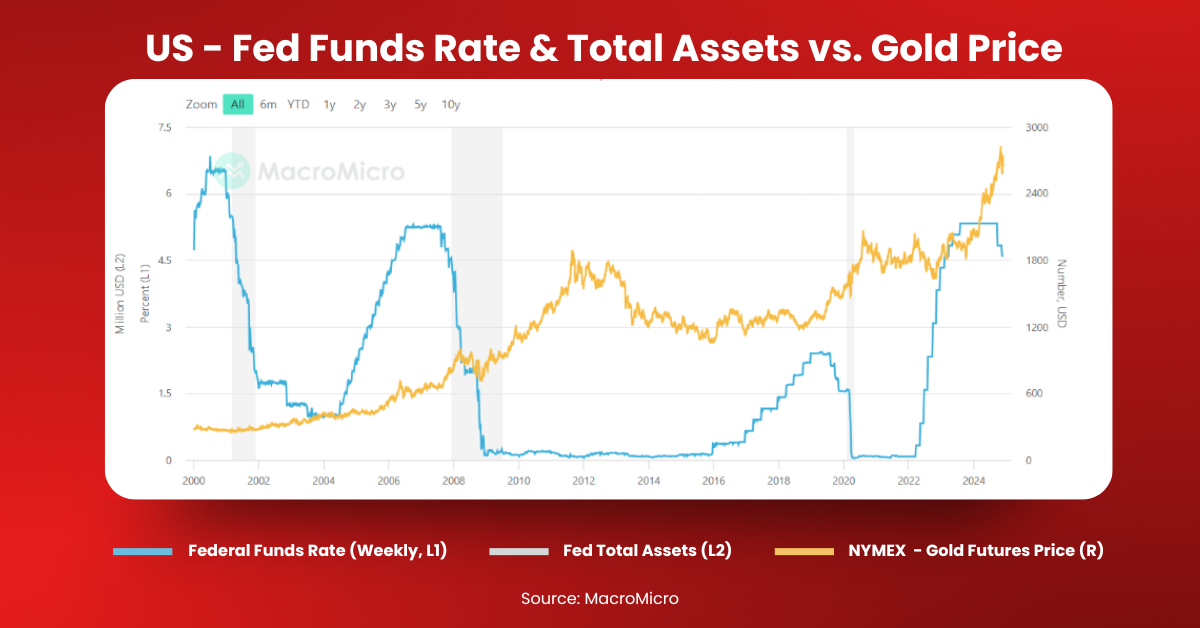

1. The Fed and Interest Rates

Gold often reacts inversely to U.S. interest rates. When rates rise, gold—an asset that doesn’t pay dividends—becomes less appealing. If the Federal Reserve starts easing its policy, gold could find new momentum.

2. Geopolitical Tensions

Turbulent geopolitics can drive safe-haven demand for gold. Whether it’s U.S.-China relations, Ukraine-Russia war, Middle Eastern conflicts, or surprising political shifts, any instability could send gold prices skyrocketing.

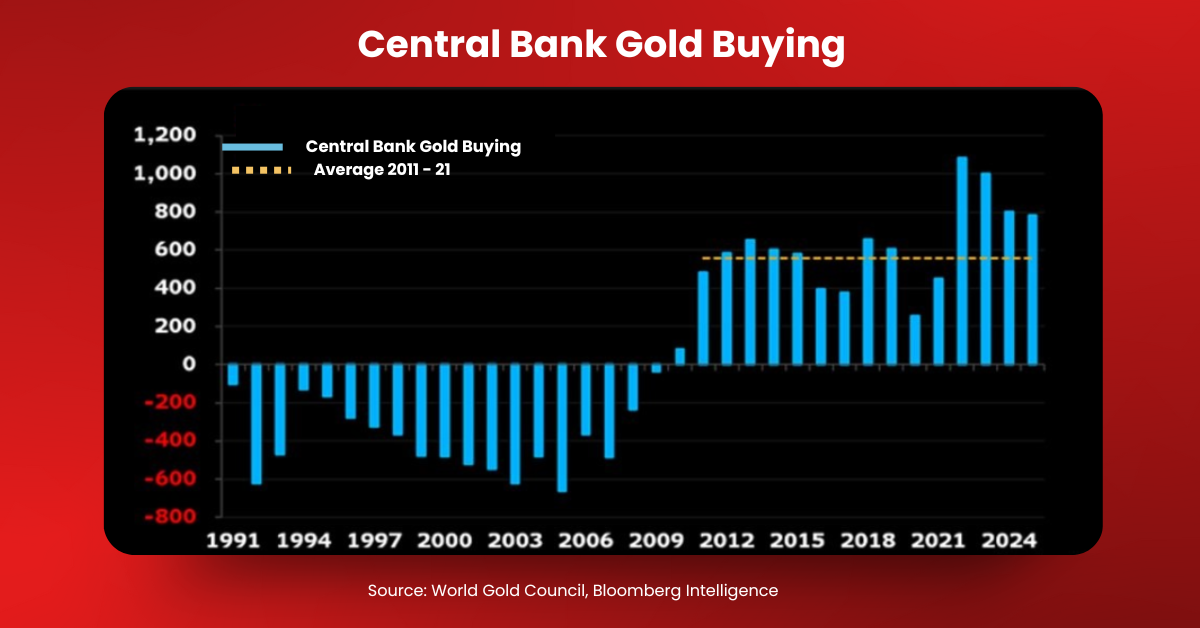

3. Central Bank Demand

In recent years, central banks have been stockpiling gold to diversify away from the U.S. dollar. This trend is expected to continue, adding a solid layer of demand.

4. Inflation and the Dollar

If inflation rears its head again, gold could shine as an inflation hedge. Meanwhile, a weaker dollar often correlates with stronger gold prices, as it becomes cheaper for international buyers.

Risks to Watch Out For

As much as we’d love to paint gold as the ultimate safety net, it’s not without its risks. Over-reliance on gold can limit your exposure to high-growth assets like equities. Plus, a sudden strengthening of the dollar or an unexpected economic boom could send gold prices much lower.

Gold Price Predictions 2025: Technical Analysis

After gold broke above the classic cup and handle pattern, prices surged by an impressive 30%, marking a significant rally.

The recent pullback to $2,550 revealed strong support at this level, establishing it as a crucial pivot point for bullish momentum. This area now serves as a key level for traders to monitor, as staying above it reinforces the bullish trend.

If gold maintains its position above this support, there’s a strong potential for the metal to retest its all-time high of $2,790, keeping the upward trajectory intact for now.

Any break above that key level could signal the start of another bullish leg, potentially pushing prices toward the highly anticipated $3,000 mark.

A Shining 2025?

So, what’s the verdict? Gold in 2025 will likely hover between steady and spectacular, depending on how global dynamics unfold. It may not be the year of massive rallies, but gold’s enduring appeal ensures it remains a must-watch asset.

For those considering adding a touch of gold to their portfolio, now’s the time to start plotting your strategy. After all, whether it’s shining on your wrist or securing your financial future, gold has a way of making life a little more dazzling.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.