1. Forex Market Insight

EUR/USD

The EUD/USD fell 0.21% at 1.1004, after falling as much as 0.6% to $1.0964 amid selling pressure.

Capital is currently gradually withdrawing from Europe, because Europe is geographically closer to Ukraine, and there is also the impact of sanctions. Therefore, a lot of funds are withdrawing from Europe and returning to the United States.

If there is a new round of sanctions, then the blow to the West will fall disproportionately on Europe.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today we focus on the 1.1055-line, if the euro runs steadily below the 1.1055-line, then pay attention to the support strength of the two positions of 1.0986 and 1.0940. If the strength of the euro breaks above the 1.1055-line, then pay attention to the suppression strength of the two positions of 1.1096 and 1.1143.

GBP Intraday Trend Analysis

Fundamental Analysis:

GUP/USD was down 0.44% at 1.3203, the worst performer among G-10 currencies after hitting a three-week high of $1.3297.

Inflation in the U.K. last month was faster than expected, rising 6.2% year-on-year, the highest in 30 years.

After the inflation data was released, UK Chancellor of the Exchequer Sunac cut taxes for the people and lowered fuel taxes.

Sunak is trying to ease the pressure on the cost of living against a backdrop of rapidly rising prices and slowing economic growth.

Technical Analysis:

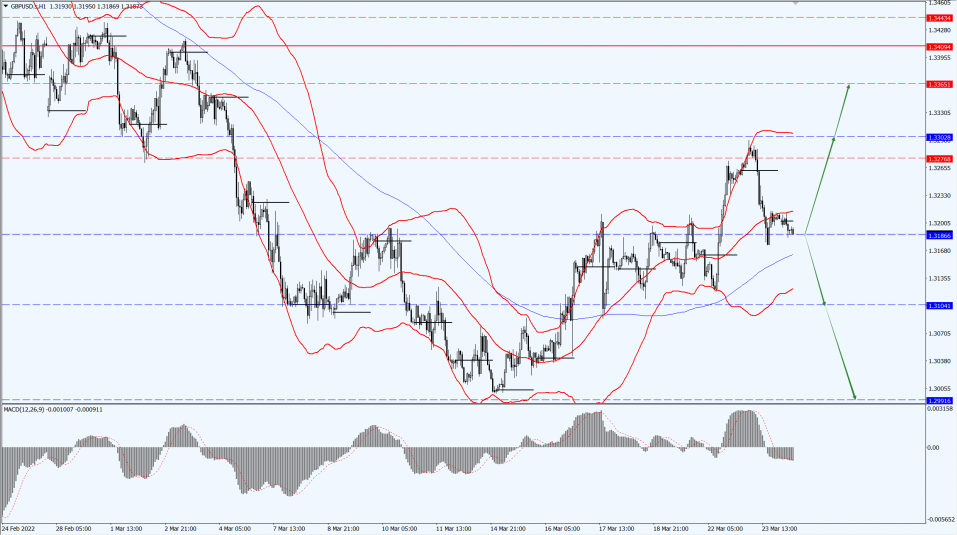

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3186-line today. If the pound runs above the 1.3186-line, it will focus on the suppression strength of the 1.3302 and 1.3365 positions. If the pound runs below the 1.3186-line, it will focus on the support strength of the 1.3104 and 1.2991 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

The price of gold rose yesterday, 23rd March 2022, and spot gold once rose by more than 1%, refreshing the high since 17th March to $1948.30 per ounce.

Unmanageable inflation and the deepening crisis in Ukraine have boosted demand for safe-haven gold, but a stronger dollar and Treasury yields at high levels limited gains.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1948-line today. If the gold price runs steadily below the 1948-line, it will pay attention to the support strength of the 1929 and 1919 positions. If the gold price breaks above the 1948-line, it will open up further upward space. At that time, we will pay attention to the suppression strength of the two positions in 1960 and 1974.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

A report from the U.S. Energy Information Administration showed that U.S. crude oil inventories fell by 2.51 million barrels last week, further sending a bullish signal.

Meanwhile, EU and NATO leaders will gather in Brussels on Thursday, 24th March 2022, where White House national security adviser John Sullivan said the United States and its allies would impose further sanctions on Moscow.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

The oil price is focused on the 111.95-line today. If the oil price runs above the 111.95-line, then it will pay attention to the suppression strength of the two positions of 116.30 and 120. If the oil price runs below the 111.95-line, it will pay attention to the support strength of 107.52 and 102.52.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.