WORLDWIDE: HEADLINES

UK Jobs Market Lost A Bit More Momentum In May, REC Says

British employers added staff in May at the slowest pace since early 2021, according to a survey that adds to signs that the labour market is losing some of its heat.

A measure of permanent staff hiring by accountants KPMG and the Recruitment and Employment Confederation (REC) fell for a sixth month to 59.2 from 59.8 in April, but remained well above the 50 threshold for growth.

The survey’s gauge of temporary staff hiring in May also fell to its lowest since early last year.

The Bank of England has expressed concern that the surge in demand for staff could create longer-term inflation pressure after prices recently leapt on the reopening of the global economy followed by Russia’s invasion of Ukraine.

The BoE is widely expected to increase interest rates for the fifth time since December on June 16.

Full coverage: REUTERS

China’s Producer Inflation Eases To 14-Month Low In May

China’s factory-gate inflation cooled to its slowest pace in 14 months in May, official data showed on Friday, depressed by weak demand for steel, aluminium and other key industrial commodities due to tight COVID-19 curbs.

The producer price index (PPI) rose 6.4% year-on-year, the National Bureau of Statistics (NBS) said in a statement, after the 8.0% rise in April, and in line with forecasts in a Reuters poll. It was the weakest reading since March 2021.

The consumer price index (CPI) gained 2.1% from a year earlier in May, in line with April’s growth. In a Reuters poll, the CPI was expected to rise 2.2%.

The world’s second-largest economy has slowed significantly in recent months, hit by strict COVID-19 controls, disrupting supply chains and jolting production and consumption.

China’s cabinet in late May announced a package of 33 measures covering fiscal, financial, investment and industrial policies to revive its economy.

Last month, widespread COVID-19 lockdowns shut factories and stores, choking purchases of metals-intensive products from cars to appliances.

Full coverage: REUTERS

WORLDWIDE: FINANCE/BUSINESS

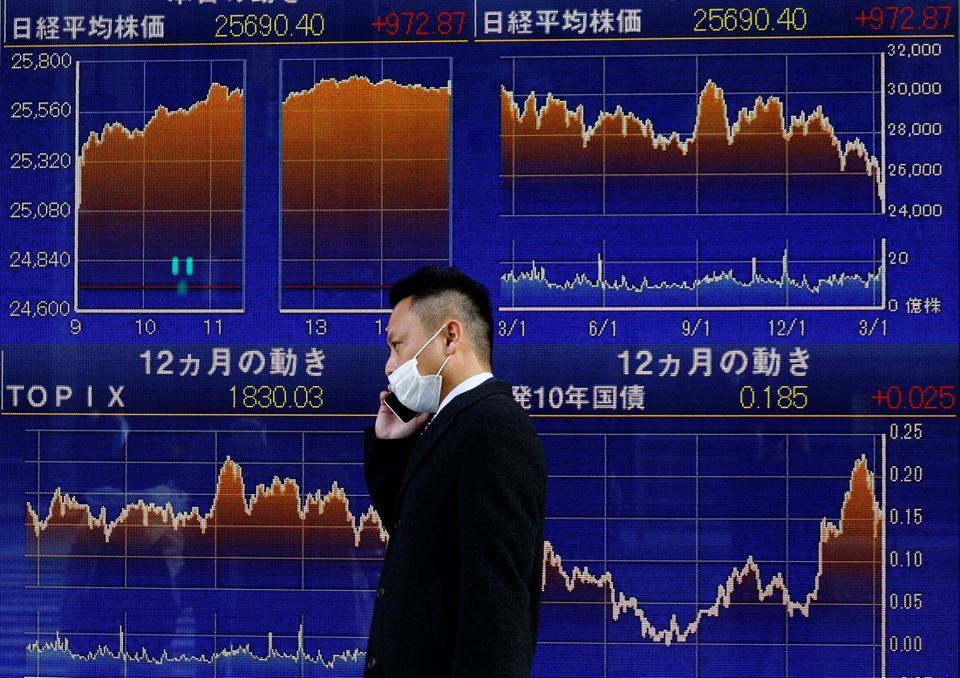

Asian Stocks Track Global Shares Lower, U.S. CPI In Focus

Asian shares tracked Wall Street lower on Friday, while the dollar held on to its overnight gains, after rate hike guidance from the European Central Bank and upcoming U.S. inflation data unnerved investors.

MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 1.2% in early Asian trade, weighed down by drops of 1.5% in Hong Kong (.HSI), 0.8% in resources-heavy Australia (.AXJO) and 1.6% in South Korea (.KS11).

Japan’s Nikkei (.N225) fell 1.2%.

Tech giants listed in Hong Kong (.HSTECH) were hit hard, with their sub-index opening 2.9% lower. Hong Kong shares of Alibaba (9988.HK) fell 3.3% after affiliate Ant Group said it had no plan to initiate an initial public offering. This was a response to media reports that Beijing had approved relaunching the IPO.

Alibaba shares in the U.S. slid 8.1% overnight.

Market sentiment in China has been soured by renewed restrictions in Beijing and Shanghai as new COVID-19 cases have emerged. Multiple districts in Beijing are shutting down entertainment venues, while most citizens in Shanghai are facing new rounds of mass testing to prevent a new outbreak

On Thursday, the European Central Bank ended a long-running stimulus scheme and said it would deliver next month its first interest rate rise since 2011, followed by a potentially larger move in September.

Full coverage: REUTERS

Dollar On Front Foot As Traders Await U.S. Inflation Data For Fed Cues

The dollar was at a two-week high on the euro on Friday, ahead of inflation data that should guide the Federal Reserve’s policy tightening path, and after the European Central Bank said it would start its rate-hike campaign next month.

U.S. core consumer price growth is expected to cool a fraction, data later in the global day is set to show. Such as outcome would provide some reassurance to those hoping decades-high inflation had peaked in March and that the April pullback was a one-off.

This could give the Fed some wiggle room to raise rates less aggressively later in the year as it tries to rein in inflation without tipping the economy into recession.

In the nearer term, markets expect the Fed next week to announce the second of its three consecutive 50-basis-point interest rate hikes, which has boosted the dollar in recent months.

The dollar index , which measures the greenback against six peers, was steady at 103.3 after a 0.7% overnight gain.

Full coverage: REUTERS

Oil Falls On Demand Worries Over Shanghai’s New Partial Lockdowns

Oil prices fell on Friday but still hovered near three-month highs, with fears over new COVID-19 lockdown measures in Shanghai outweighing solid demand for fuels in the world’s top consumer United States.

Brent crude futures for August was down $1.01, or 0.8%, at $122.06 a barrel as of 0141 GMT after a 0.4% decline the previous day. U.S. West Texas Intermediate crude for July fell 98 cents, or 0.8%, to $120.53 a barrel, having dropped 0.5% on Thursday.

Still, with prices rallying over the last two months, Brent was on track for a fourth consecutive weekly gain and WTI was set for a seventh straight weekly increase. Both benchmarks on Wednesday marked their highest closes since March 8, when they hit their highest settlements since 2008.

“Shanghai’s new pandemic restrictions raised concerns over demand in China,” said Kazuhiko Saito, chief analyst at Fujitomi Securities Co Ltd.

“But losses were capped by expectations that tight global supply will continue with solid U.S. demand for fuels and slow increase in crude output by OPEC+,” he said.

Full coverage: REUTERS