‘Gundam’-like Robot Being Developed In Japan Startup

Tokyo-based start-up Tsubame Industries has developed a 4.5-metre-tall (14.8-feet), four-wheeled robot that looks like “Mobile Suit Gundam” from the wildly popular Japanese animation series, and it can be purchased for USD 3 million.

Oil Prices Hikes Spurs Investor Appetite

Oil prices climbed today, reversing some of Friday’s losses as investors focused on a tight global supply outlook and a last-minute deal that avoided a U.S. government shutdown have restored their risk appetite.

Updated Tesla Model Y Keeps Starting Price Unchanged

U.S. automaker Tesla (TSLA.O) on Sunday released an updated version of its Model Y in China, the company’s global best seller, with minor changes to the vehicle’s exterior and interior, allowing them to retain its price.

Today’s News

Everyone expects a soft landing but must always brace for impact. That is a very important lesson to learn, based on recent economic happenings — and these reigns true even for the U.S. with no exceptions, despite being the world’s largest economy.

A summer in which inflation trended lower, jobs remained plentiful and an increase in consumer spending has bolstered confidence in the masses and that a U.S. recession has been averted.

Although a last-minute deal to avoid a government shutdown was exactly what was needed to nudge immediate risks a little further ahead into the future, a major auto strike, the resumption of student loan repayments, and a shutdown that may yet come back after the stop-gap spending deal lapses, could easily result in a percentage point off the GDP growth in the fourth quarter.

Besides this, dwindling pandemic savings, soaring interest rates and oil price fluctuations have all snowballed into a potential tipping point that might send the U.S. tumbling off the mountain before 2023 ends.

Other news include:

Nerves Soothe As U.S. Averts A Shutdown

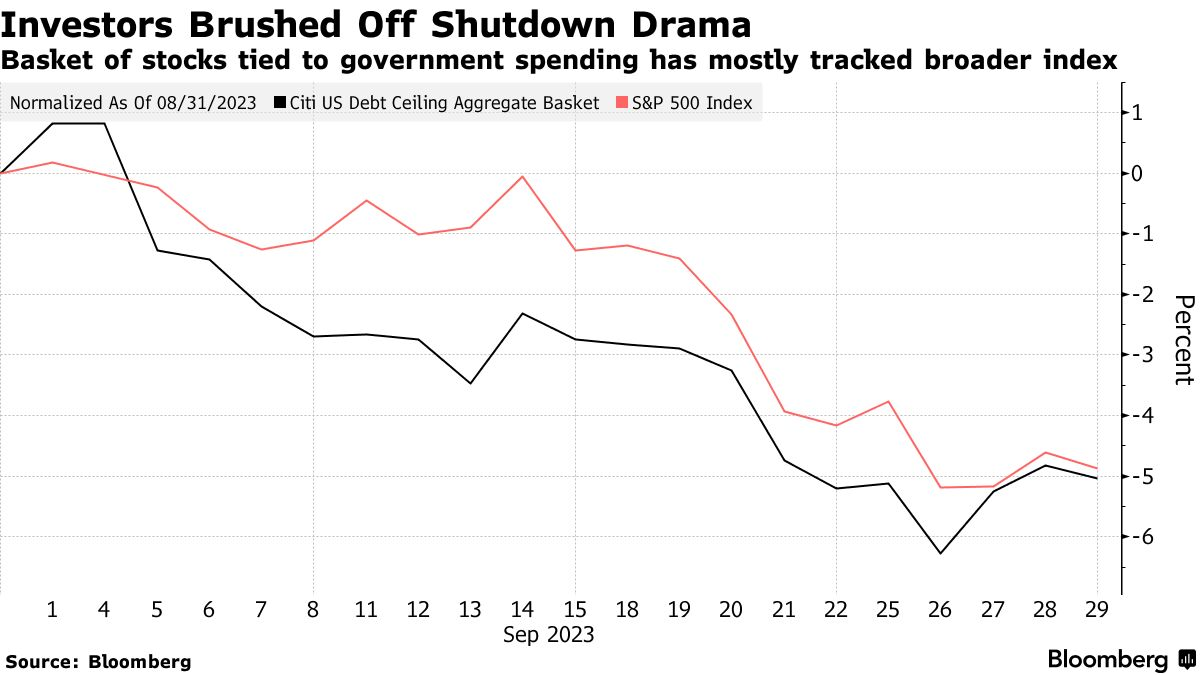

In a battle of epic proportions, the U.S. has successfully averted a shutdown that could have led to catastrophic repercussions on a global scale. Wall Street sighs with a breath of relief after a week of endless interest rate-spurred market disruptions.

While money managers largely shrugged off the political circus in Washington, the passage of compromise legislation to keep the government running until November 17 gives financial markets some breathing room after the recent plunge in stocks and bonds.

U.S. Stocks Jumps Back On The Climb

U.S. stock futures and Asian equities simultaneously rose after a deal was reached on the weekend to avoid a dreaded U.S. government shutdown as treasuries fell.

Futures contracts on the S&P 500 climbed as much as 0.7% at the start of Asian trade after U.S. lawmakers have passed to compromise legislation to keep the government running until November 17. Japanese and Australian stocks both rose as well, while a number of Asian markets including China and South Korea are shut for holidays.

Markets On Edge Even After Averting Shutdown

Investors have become rather squeamish during a stock market slump that pushed the S&P 500 Index into its first losing quarter of the year. But beneath the surface, signs of stress are emerging that go far beyond the newly averted U.S. government shutdown.

It is not the intensity of the drop that is weighing on the sentiment, but rather the fact that big down days are becoming more frequent, and rebounds are getting scarce. Three of the six days when the S&P 500 lost more than 1% in the last quarter occurred since mid-September. And there were only two days when the index gained more than 1% in the quarter. That down-to-up ratio of three is the highest since 1994, according to recent data.