WORLDWIDE: HEADLINES

U.S. Adds E-commerce Sites Operated By Tencent, Alibaba To ‘Notorious Markets’ List

E-commerce sites operated by China’s Tencent Holdings Ltd (0700.HK) and Alibaba Group Holding Ltd (9988.HK) were included on the U.S. government’s latest “notorious markets” list, the U.S. Trade Representative’s office said on Thursday.

The list identifies 42 online markets and 35 physical markets that are reported to engage in or facilitate substantial trademark counterfeiting or copyright piracy.

“This includes identifying for the first time AliExpress and the WeChat e-commerce ecosystem, two significant China-based online markets that reportedly facilitate substantial trademark counterfeiting,” the USTR office said in a statement.

China-based online markets Baidu Wangpan, DHGate, Pinduoduo, and Taobao also continue to be part of the list, along with nine physical markets located within China “that are known for the manufacture, distribution, and sale of counterfeit goods,” the USTR office said.

Alibaba said it will continue working with government agencies to address concerns in intellectual property protection across its platforms.

Tencent said it strongly disagreed with the decision and was “committed to working collaboratively to resolve this matter”. It added it actively monitored, deterred and acted upon violations across its platforms and had invested significant resources into intellectual property rights protection.

Inclusion on the list is a blow to the reputation of companies but carries no direct penalties.

The United States and China have been engaged in trade tensions for years over issues like tariffs, technology and intellectual property, among others.

Full coverage: REUTERS

Japan’s Consumer Prices Rise In January, But At Slower Pace

Japan’s core consumer prices rose for a fifth straight month in January but at a slower pace than in the previous month, boosting the likelihood the country’s central bank will lag behind other economies in raising interest rates.

Consumer inflation is expected to pick up in the coming months due to surging energy prices, while last year’s mobile phone fee cuts are also set to fall out of calculations and will no longer be a drag on prices.

The core consumer price index (CPI), which excludes volatile fresh food prices but includes fuel costs, increased 0.2% in January from a year earlier, government data showed on Friday.

That was weaker than the median forecast for a 0.3% gain in a Reuters poll and a 0.5% rise in the previous two months.

“Consumer inflation will pick up from next month onward on higher food and energy prices,” said Taro Saito, executive research fellow at NLI Research Institute.

“It may jump to more than 1.5% in one go in April once the impact of mobile phone fee cuts comes to an end.”

The price data will be among factors the Bank of Japan will scrutinise at its next policy meeting, which is scheduled for the middle of next month.

The core CPI has posted a year-on-year increase every month since September. January’s increase marked the slowest year-on-year rise in three months.

Accommodation prices rose just 0.6% from a year earlier to grow at the weakest rate since June 2021 after a domestic travel campaign in late 2020 came to an end.

Cellphone fee cuts pushed down the CPI by about 1.5 percentage points last month.

Full coverage: REUTERS

WORLDWIDE: FINANCE/BUSINESS

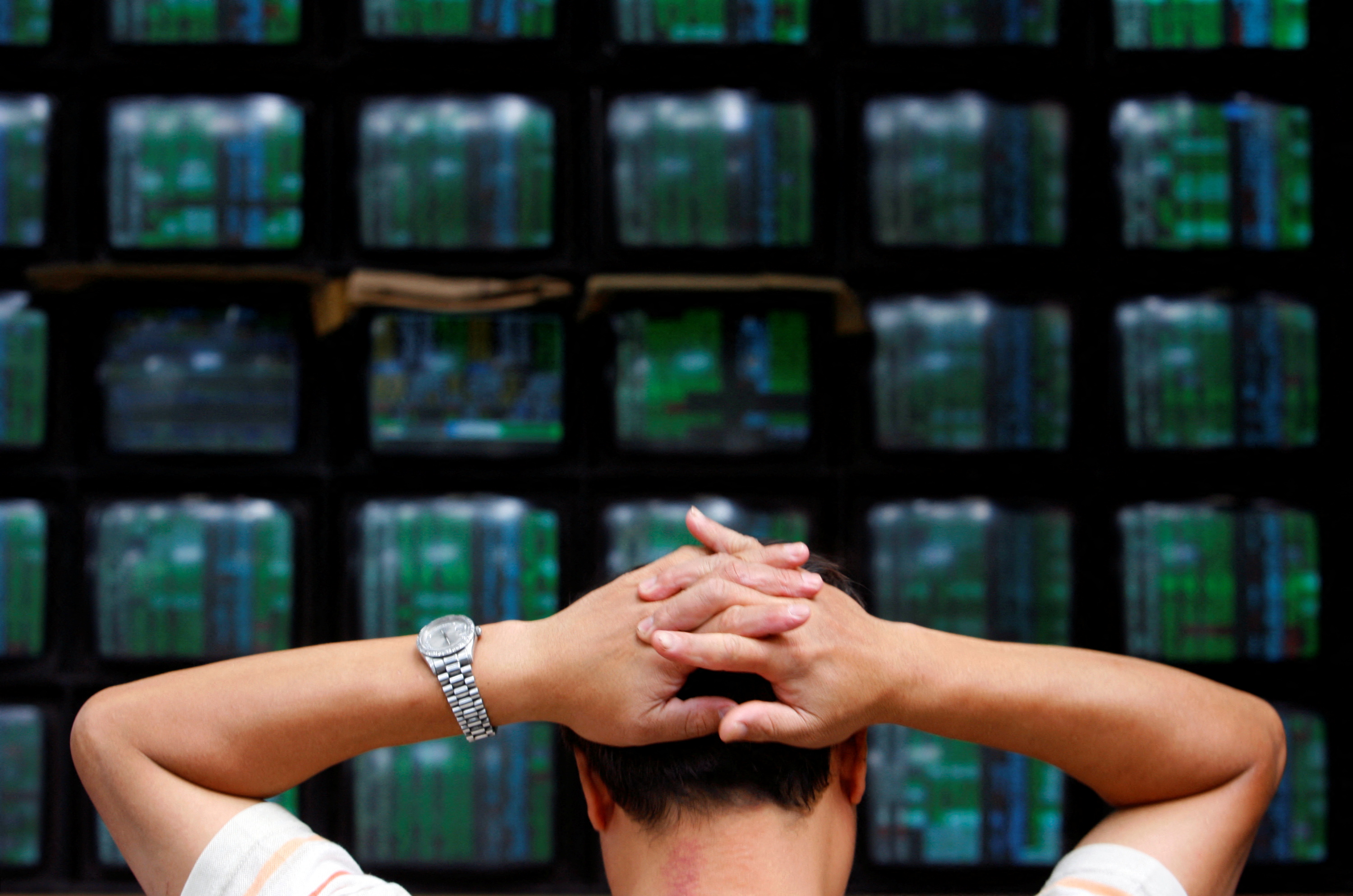

Stocks Steady On Hopes For Diplomacy In Ukraine

U.S. stock futures bounced on Friday and selling pressure eased in Asian share markets after the U.S. Secretary of State agreed to a meeting with Russia’s foreign minister, raising hopes for a diplomatic solution to the East-West standoff over Ukraine.

S&P 500 futures jumped 0.5% on the news and Nasdaq futures rose 0.6%. MSCI’s broadest index of Asia shares outside Japan (.MIAPJ0000PUS) was last down 0.5%, but markets in Tokyo (.N225), Hong Kong (.HSI), Sydney (.AXJO) and Seoul (.KS11) all pared deeper morning losses.

U.S. Secretary of Antony Blinken has accepted an invitation to meet with Russian Foreign Minister Sergei Lavrov late next week provided Russia does not invade Ukraine, the U.S. State Department said.

“It’s better news than what we had yesterday,” said Kyle Rodda, an analyst at IG Markets in Melbourne. “But we’ve seen diplomatic talks go nowhere before, and the troops are still on the border, so risks remain.”

Wall Street had taken a dive overnight, with the S&P 500 (.SPX) dropping 2.1% and the Nasdaq (.IXIC) off 2.9% – while gold shot to an eight-month peak – on renewed U.S. warnings of an imminent Russian invasion.

Investors fear a wider war as one of the deepest crises in post-Cold War relations plays out, with Russia wanting security guarantees, including Ukraine’s never joining NATO.

Overnight, safe-haven currencies such as the Japanese yen and Swiss franc climbed to two-week highs on the dollar and they retreated a little bit in Asia trade.

Treasuries likewise gave back some overnight gains, with the benchmark 10-year yield last up two basis points (bps) to 1.9876%. Two-year yields also rose two bps to 1.4909%.

Oil dipped and Brent crude futures were last down 0.5% on Friday at $92.47 a barrel, more than 4% below Monday’s peak, and U.S. crude fell 0.5% to $91.26 a barrel. Gold dipped about 0.4% from its high to $1,889 an ounce.

Full coverage: REUTERS

Yen Bid As Ukraine Fears Leave Traders Nervous

The safe-haven yen gained more ground on the dollar on Friday as U.S. President Joe Biden said Moscow is preparing a pretext to justify a possible attack on Ukraine, also supporting the Swiss franc.

The dollar slipped to a new two-week low of 114.78 yen in early Asia trade, and is down 0.5% so far this week.

“The support level of 114.63 looks within reach today if more negative headlines on Ukraine emerge,” said CBA analysts in a morning client note, adding that markets were also focused on the Bank of Japan’s policy, as the central bank continues with its policy of yield curve control.

Early morning exchanges of fire on Thursday between Kyiv’s forces and pro-Russian separatists – who have been at war for years and where a ceasefire is periodically violated – have renewed Western fears of an imminent Russian invasion.

U.S. President Joe Biden said Moscow is preparing a pretext to justify a possible attack and the Kremlin expelled an American diplomat.

These tensions also caused the dollar to lose ground on the Swiss franc, with the greenback last at 0.9196 francs, just above Thursday’s two week intraday day low of 0.9186 francs.

The euro continued its week of choppy trading based on Ukraine headlines and was at $1.1360, while the pound was at 1.3609 supported by markets betting on more monetary tightening from the Bank of England.

Central bank policy was also a factor in the yen, after the BOJ this week offered to buy an unlimited amount of benchmark 10 year government bonds to underscore its resolve to contain domestic borrowing costs.

Markets have not aggressively tested the BOJ’s 0.25% yield target on those bonds, but yields on other tenors have been rising.

Full coverage: REUTERS

Oil Falls On Prospect Of Iran Oil Sanctions Easing

Oil prices retreated on Friday after wild swings during the week, as the prospect of extra supply from Iran returning to the market outweighed fears of a possible Russian invasion of Ukraine, which could disrupt supply.

Brent crude futures fell 68 cents, or 0.7%, to $92.29 a barrel at 0124 GMT, extending a 1.9% drop from the previous session.

U.S. West Texas Intermediate (WTI) crude futures shed 67 cents, or 0.7%, to $91.09 a barrel, after sliding 2% in the previous session.

Both benchmark contracts were headed for their first weekly fall in nine weeks after hitting their highest points since September 2014, with a deal taking shape to revive Iran’s 2015 nuclear agreement with world powers.

Diplomats said the draft accord outlines a sequence of steps that would eventually lead to granting waivers on oil sanctions. That would bring about 1 million barrels a day of oil back to the market, but the timing is unclear. read more

“Nevertheless, the spectre of a potential 1 million b/d hitting the oil market saw Brent crude oil prices come under pressure,” ANZ Research analysts said in a note.

Analysts do not expect prices to fall much in the near term, even with the prospect of a return of more Iranian oil, with the Organization of the Petroleum Exporting Countries and allies, together called OPEC+, struggling to meet their production targets.

“Oil markets are vulnerable to supply disruptions given global oil stockpiles are tracking near seven‑year lows and as OPEC+ spare capacity comes into question given disappointing OPEC+ supply growth,” Commonwealth Bank (CBA) analyst Vivek Dhar said in a note.

With oil demand also recovering as air travel and road traffic picks up, CBA sees Brent holding in the $90 to $100 a barrel range in the short term and topping $100 “quite easily” if tensions escalate between Russia and Ukraine.

U.S. President Joe Biden is set to host a call on Friday on the Ukraine crisis with the leaders of Canada, France, Germany, Italy, Poland, Romania, Britain, the European Union, and NATO, the office of Canada’s Prime Minister Justin Trudeau said.

Full coverage: REUTERS