Today’s News

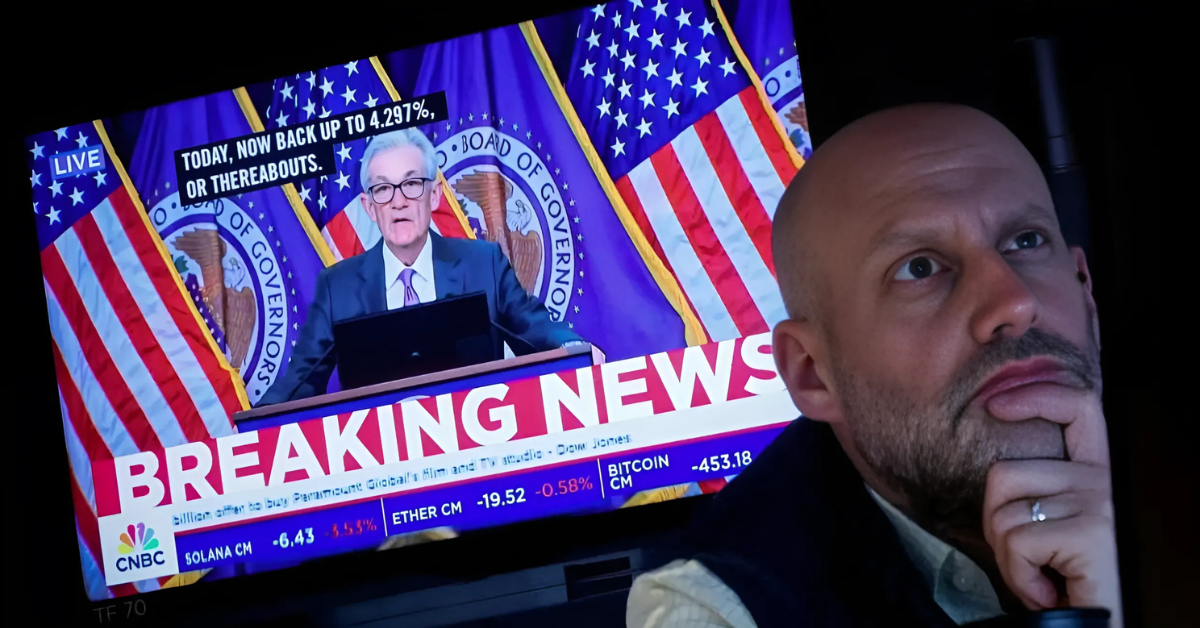

Global stocks advanced on Wednesday, accompanied by a rise in U.S. Treasury yields, after the release of the Federal Reserve’s September meeting minutes indicated more rate cuts could be on the horizon.

Investors are now turning their attention to upcoming inflation data for further clues on the central bank’s next moves regarding interest rates.

Image Source: The Star

The minutes revealed that a “substantial majority” of Fed officials supported the start of easier monetary policy with a significant half-point rate cut. However, they agreed this did not commit the Fed to any particular pace for future cuts.

Following the release of the minutes, U.S. stocks gained ground, with the Dow Jones and S&P 500 closing at record highs. The Dow Jones Industrial Average rose 431.63 points (1.03%) to 42,512.00, the S&P 500 gained 40.91 points (0.71%) to 5,792.04, and the Nasdaq Composite climbed 108.70 points (0.60%) to 18,291.62.

Market expectations for aggressive rate cuts were scaled back after last week’s strong U.S. jobs report. Investors are now focusing on Thursday’s consumer price index (CPI) data for insight into the Fed’s rate path. Corporate earnings season also kicks off Friday, starting with major banks.

Market Optimism Grows as Fed Signals Smaller Rate Cuts

Lindsey Bell, chief strategist at 248 Ventures, commented, “The minutes were also further confirmation that they believe that they’ve won the fight on inflation, so tomorrow’s CPI number shouldn’t be too much of a surprise.” She added that optimism remains in the market following the jobs report, with investors expecting a “soft-to-no landing” scenario.

The market currently expects a 25-basis-point cut at the Fed’s November meeting, with a 79.4% chance of such a move and a 20.6% chance that rates will remain steady, according to CME’s FedWatch Tool. This reflects a slight decrease in expectations for a cut after the Fed minutes were released.

Dallas Federal Reserve Bank President Lorie Logan, while supporting the recent outsized rate cut, emphasized the need for smaller reductions moving forward, citing ongoing inflation risks and economic uncertainties.

Global Stocks Rise, China Stumbles; Yields and Dollar Strengthen

Globally, MSCI’s index of stocks gained 0.43%, while Europe’s STOXX 600 index rose 0.66%, boosted by automakers. However, China’s stock market rally stumbled, with both the Shanghai Composite and CSI300 indexes seeing their largest one-day percentage drops since February 2020. China’s finance ministry is set to announce fiscal stimulus plans at a press conference on Saturday.

U.S. Treasury yields rose after Logan’s comments and the Fed minutes, with the 10-year note yield gaining 3.8 basis points to 4.073% and the 2-year note yield increasing by 4.3 basis points to 4.022%.

In the currency market, the dollar index climbed 0.42%, with the euro dropping 0.38% to USD 1.0938. The dollar also strengthened 0.76% against the Japanese yen, reaching 149.32. Sterling weakened 0.34% to USD 1.3059.

Oil prices declined for the second consecutive session due to rising U.S. crude inventories. However, potential disruptions in Iranian supply caused by the Middle East conflict and Hurricane Milton in the U.S. limited further price drops. U.S. crude settled at USD 73.24 per barrel, down 0.45%, while Brent crude fell 0.78% to USD 76.58 per barrel.

Other News

Oil Prices Climb on Israel-Iran Tensions, U.S. Storm

Oil prices rose due to Israel-Iran conflict fears and increased U.S. fuel demand as Hurricane Milton hit Florida. Brent crude reached USD 76.95, and WTI rose to USD 73.59 per barrel.

India Eases Rules for Startups Returning for IPOs

India’s regulatory changes have shortened the reverse flip process, encouraging startups like Razorpay and Pine Labs to relocate from abroad and prepare for IPOs.

Berkshire Raises USD 1.9 Billion in Yen Bonds

Warren Buffett’s Berkshire Hathaway raised 281.8 billion yen (USD 1.9 billion) through a seven-tranche yen-denominated bond deal for general corporate purposes.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.