A little over a year ago, Tesla was the undisputed top stock listed on the U.S. stock market at that time. Tesla’s stock price topped USD 380 in early November 2021, and its founder and CEO, Elon Musk, was regarded by investors as the real-world “Iron Man”.

However, no one could have predicted that just this past year, Tesla’s stock plunged nearly 70% for the year, wiping out more than USD 700 billion in market value.

This has left the market wondering how did the once highly sought-after top stock suffered such a waterloo in the past year. And will Tesla’s stock price make a comeback this year? Here, we shall look into these questions together.

Market Share: Short & Long Term Concerns

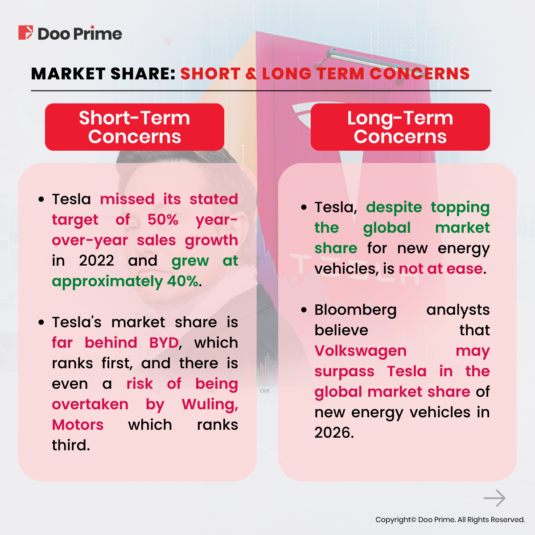

With the official start-up of Tesla’s mega-factory in Shanghai, China, in 2020, Tesla’s ambition to capture market share is already evident. As early as a year ago, Tesla even made a bold statement, aiming to achieve a 50% year-over-year sales growth target for 2022.

However, at the beginning of the 2023 New Year, Tesla announced its latest delivery figures, with 1,133,800 vehicles delivered in 2022, an increase of about 40% year-on-year, which was far below the 50% growth target. As a result, Tesla’s share price took another hit at the start of 2023, closing down 12.24% in a single day on 3rd January 2023.

A major reason for Tesla’s weaker-than-expected delivery numbers is that Tesla’s share is not a one-trick pony in major markets.

Take the China market as an example. According to data from China Automotive Technology and Research Center (CATARC), as cited by Bloomberg, BYD firmly holds the top spot in China’s new energy vehicle retail sales in 2022 with a market share of nearly 20%, well ahead of Tesla’s 11.6% market share.

If it weren’t for Tesla’s continuous price cuts in the second half of 2022 to meet sales targets, Tesla might not even be able to secure its second place, as third place Wuling Motors trails Tesla by only about 0.6% in terms of market share in China.

In terms of the global market, Tesla, despite its current share topping the list, is not at ease. Bloomberg analysts believe that the veteran car company Volkswagen (VW) may surpass Tesla in the global market share of new energy vehicles in 2026.

The main reason behind this speculation is that VW will launch new new-energy vehicle models in the next few years, and these new models are said to greatly improve the latency of the in-car software problem.

At the same time, VW is also actively laying out onboard batteries, aiming to increase battery capacity, and plans to inject 30 billion euros into the supply chain by 2030, including building six new car battery plants in Europe.

As a result, the market generally doubts whether Tesla’s new energy vehicles can still be a dominant player in the industry, thus putting pressure on the stock price.

Market Sentiment: Fed’s Macro Pressure & Elon Musk’s Twitter Mayhem

The Federal Reserve:

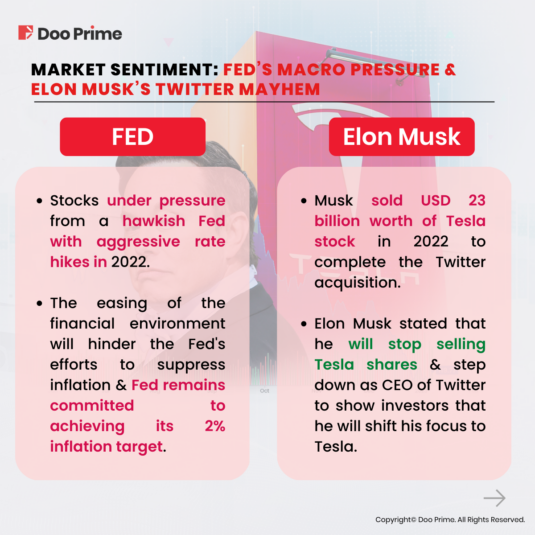

The Fed’s aggressive rate hikes over the past year have had a self-evident impact on financial markets. Under the influence of interest rate hikes, all three major stock indices have fallen in 2022.

The market is also eager for the Fed to slow the pace of rate hikes as soon as 2023, and to switch to a rate-cutting cycle as soon as possible. However, the latest minutes from the Fed’s December meeting, released on 4th January, certainly threw cold water on those hopes.

The minutes showed that the easing of the financial environment will hinder the Fed’s efforts to suppress inflation. In addition, the Fed remains committed to achieving its 2% inflation target, and the market has underestimated the Fed’s determination to fight inflation.

Such a hawkish stance is naturally not good news for the market. But after more than a year of continued pressure from the Fed, the market seems to have gotten used to it. All three stocks ended the day slightly higher, suggesting that the market has already priced in the Fed’s stance of keeping interest rates high.

On the other hand, the Fed did not put the word out in the minutes, but left some room for flexibility in monetary policy given the high level of uncertainty.

However, in any case, a high interest rate is not good for the stock market. Under such a macro background, Tesla’s stock price will naturally be under pressure to a certain extent.

Elon Musk:

Elon Musk has been in the news a lot over the past year, especially with his high-profile acquisition of Twitter.

In order to complete the acquisition of Twitter, Musk has sold USD 23 billion worth of Tesla stock in 2022 to pay USD 44 billion for the Twitter acquisition. This has certainly disappointed Tesla’s investors and is one of the major reasons why Tesla’s stock price has gone all the way down in the last year.

Tesla’s falling stock price is certainly not what Elon Musk wants. As a master of marketing, Elon Musk has publicly stated that he will no longer sell Tesla shares, and claimed that he will step down as CEO of Twitter to show investors that he will shift his focus to Tesla.

There was a time when Elon Musk presented investors with a science-fiction vision of the future, and they were fascinated by such lofty concepts as brain-computer interfaces and migration to Mars. Investors who were convinced of this naturally pushed up Tesla’s stock price. To some extent, the market sees Tesla as a company that brings disruptive technology rather than an ordinary electric car company.

While many investors are now disappointed with what Elon Musk has done over the past year, it is not inconceivable that Musk could restore investor confidence in the future.

Once market sentiment is reshaped, it is equally likely that Tesla shares will restart their upward trajectory.

Financial Fundamentals: Current Stock Prices May Be Undervalued

Despite Tesla’s disappointing performance over the past year, it would be an overstatement to say that the electric car giant is at the end of its rope.

In the context of the above, considering that the Twitter acquisition was a major reason for Tesla’s share price plunge last year. But at this point, the Twitter acquisition has been completed and Elon Musk himself has promised not to sell Tesla’s shares.

Thus, this major factor that weighed on the share price last year is no longer present in the new year.

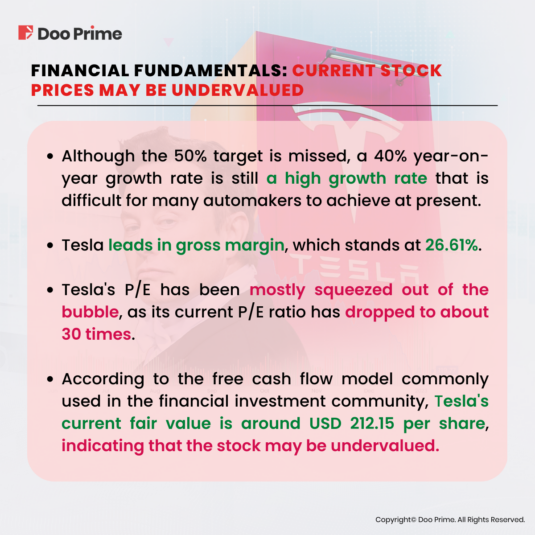

On the other hand, Tesla’s share price plunged about 12% on 3rd January as it reported delivery figures that fell short of expectations. In fact, Tesla’s global sales in 2022 were still up about 40% from a year earlier. Even if the 50% target is missed, a 40% year-on-year growth rate is still a high growth rate that is difficult for many automakers to achieve in today’s moribund global economy and given the looming recession.

In addition, Tesla’s gross margins are much higher than those of many established car companies, thanks to the low cost of its Shanghai, China, mega-factory and its unique single-piece die-casting production technology.

According to the latest earnings data of each car company in the third quarter of 2022, Tesla’s advantage in gross margin is even more evident:

- Tesla Gross Profit Margin:26.61%

- Volkswagen Gross Profit Margin:19.80%

- General Motors Gross Profit Margin:12.89%

- Ford Gross Profit Margin:15.00%

- Toyota Gross Profit Margin:17.03%

In short, in the current global economic downturn, although investors once suspected that the demand side of Tesla has been weak, but the fact is that Tesla’s new energy vehicles can still be sold at a high price. Essentially, its high premium characteristics have not been damaged.

If Tesla were to cut prices again to capture the market, its market share could be visibly improved or consolidated in the future.

To add, many banks and financial institutions have said that the global economy could slip into recession in 2023, just as many have said that even a recession would not be a “Great Depression” like recession, but rather a mild dip.

For example, both J.P.Morgan and Bank of America, have publicly stated that the U.S. economy is expected to fall into a mild recession, rather than a severe recession, by the end of 2023 or the second half of the year.

When analyzed further, Tesla’s current price-to-earnings (P/E) ratio has dropped to about 30 times. While still high compared to other car companies, Tesla’s P/E has been mostly squeezed out of the bubble considering that it had historically surpassed the 1,000 mark a few years ago.

According to the free cash flow model commonly used in the financial investment community, Tesla’s current fair value is around USD 212.15 per share. At the time of writing, Tesla shares are trading at USD 113.64, which is clearly a significant gap from its fair value.

While the free cash flow model is not 100% accurate, it does give some indication that Tesla’s current stock price may be significantly undervalued.

2023’s Trend: Tesla Boasts Strategic Anticipation

Tesla faced a series of negative events last year, but the good news is that over time, the market has gradually digested a lot of the negative impact. Eventually, the market will return its attention to the fundamentals of Tesla itself as the impact of previous events fades.

The current price, around USD 113 per share, is clearly out of line with Tesla’s own fundamental numbers. Assuming Musk does not bring negative news to Tesla this year, and the global economy is not in a recession like the Great Depression, then Tesla’s stock price this year may be worthy of investors’ expectations.

| About Doo Prime

Our Trading Instruments

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.