Today’s News

U.S. consumer price inflation rose in October, meeting forecasts and lifting Wall Street indexes on Wednesday, while boosting the dollar close to levels against the yen that have raised concerns at the Bank of Japan.

This inflation data, specifically a rise in the annual rate, has prompted speculation that while the Federal Reserve might be poised for another 25 basis point rate cut in December, it could also reconsider the pace of easing in 2025 if inflation remains persistent. Since September, the Fed has implemented a full percentage point reduction.

Image Source: Reuters

This inflation data, specifically a rise in the annual rate, has prompted speculation that while the Federal Reserve might be poised for another 25 basis point rate cut in December, it could also reconsider the pace of easing in 2025 if inflation remains persistent. Since September, the Fed has implemented a full percentage point reduction.

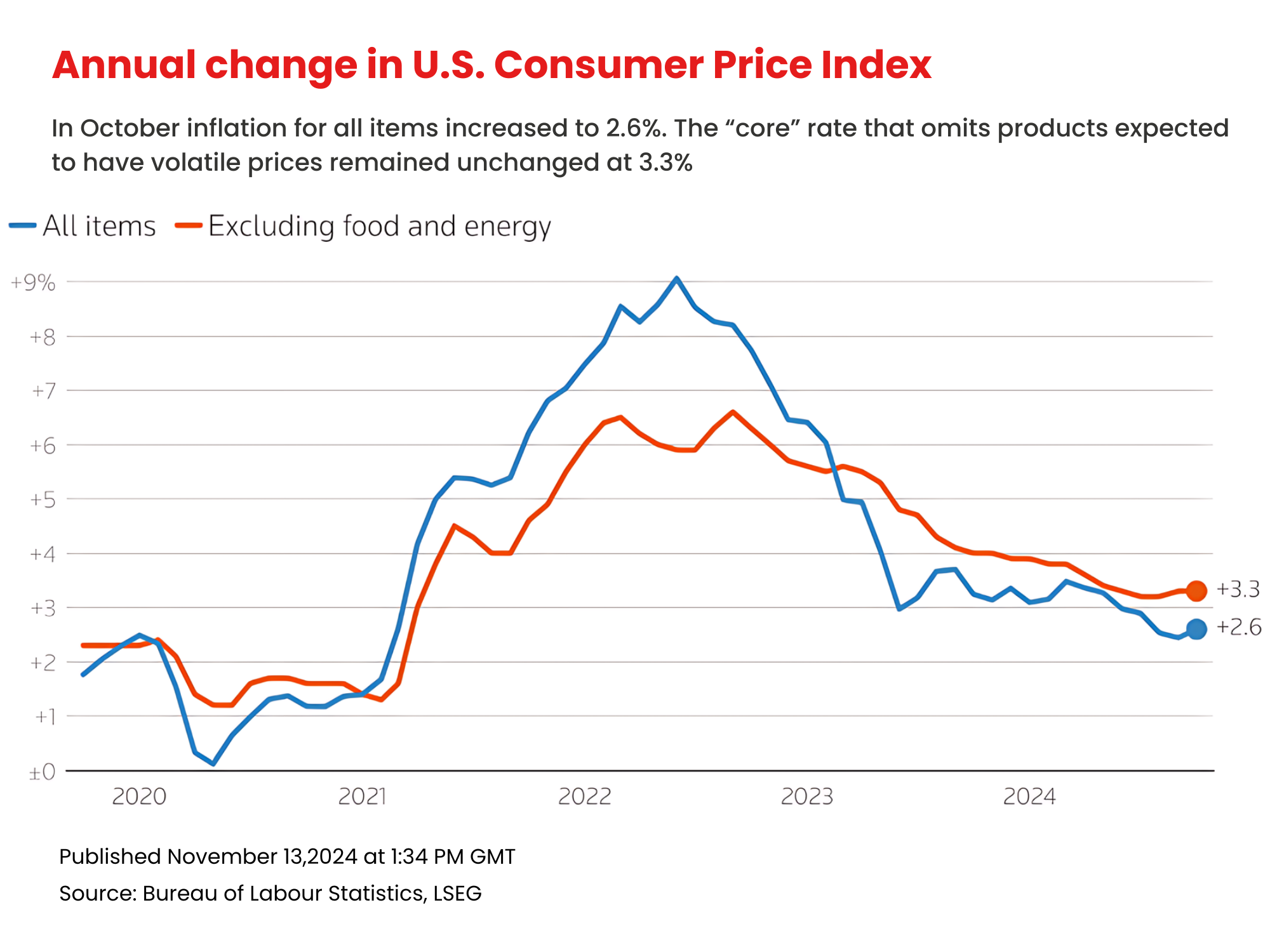

Markets are now closely watching for insight into how the Fed might interpret October’s 0.2% monthly CPI increase — the fourth in a row — and the rise in annual inflation from 2.4% in September to 2.6%.

Fed Chair Jerome Powell is set to deliver a speech on the economic outlook at 3:00 p.m. EST (1700 GMT) on Thursday, followed by a Q&A session. By then, Powell will also have reviewed the October producer price index report, released Thursday morning, which informs the Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) price index due later this month.

Image Source: Reuters

Image Source: Reuters

Meanwhile, Bitcoin surged past USD 93,000, as cryptocurrencies continued to outperform other assets. Since the Nov. 5 election, Bitcoin is up 32%, trading recently at USD 91,910, with smaller cryptocurrencies like Ether up 37% and Dogecoin, supported by Trump-ally Elon Musk, soaring over 150%.

U.S. President-elect Donald Trump had endorsed digital assets during his campaign, vowing to make the U.S. the “crypto capital of the planet” and amass a national Bitcoin reserve.

In foreign exchange, the dollar rose to 155.62 yen, the highest level since July 24, which could prompt intervention from Japanese authorities. With the Fed’s potential shift on easing taking center stage, the Bank of Japan’s next rate hike timeline has taken a back seat, despite Japan’s October wholesale inflation jump making that decision more challenging.

Recently, Japan shifted from a deflationary outlook to inflation concerns, ending negative rates in March. BOJ Governor Kazuo Ueda has signaled readiness for further hikes if inflation persists or the yen weakens further.

Elsewhere, the euro fell to near a yearly low against the dollar, and the euro/yen rate held steady at 164.33. U.S. officials also announced that President Joe Biden will meet Chinese President Xi Jinping in Peru on Saturday, likely for the last time as Beijing prepares for a potentially tougher relationship under Trump’s administration.

Concerns are mounting as Trump appears set to fill his cabinet with China hawks like Senator Marco Rubio for Secretary of State and Representative Mike Waltz as National Security Advisor.

Other News

Dollar Surges to 1-Year High on Trump Trade Hopes

The U.S. dollar hit a one-year high as Trump’s election momentum outpaced Fed rate-cut expectations, with rising Treasury yields and bitcoin also gaining.

Red Sweep Eases Debt Fears, Stirs Bond Worries

Republican control of Congress and the presidency could reduce debt ceiling standoffs, though concerns rise over increased deficits and bond pressures.

U.S. Inflation Slows, Fed Rate Cut Path Uncertain

U.S. inflation rose 0.2% in October, led by shelter costs, slowing overall progress and potentially impacting the Fed’s rate cut plans for next year.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.