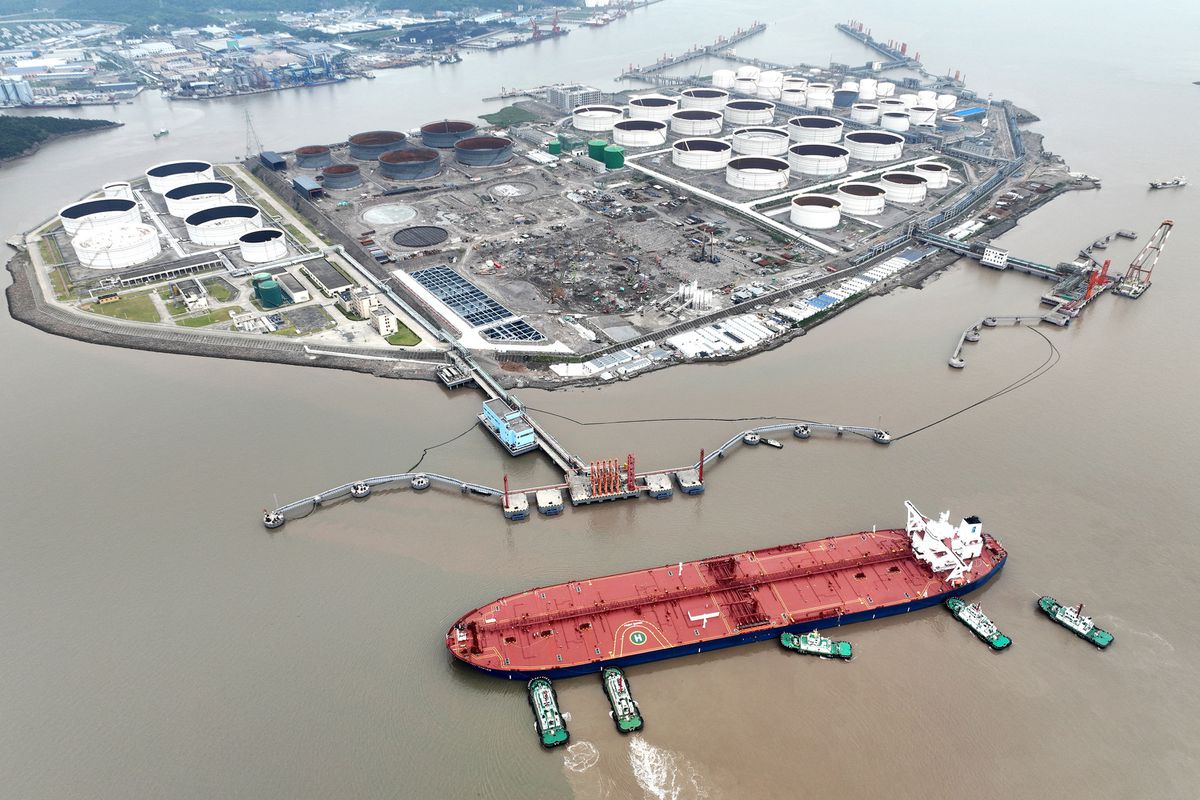

SINGAPORE, Oct 6 (Reuters) – Global oil supply is set to tighten, intensifying concerns over soaring inflation after the OPEC+ group of nations announced its largest supply cut since 2020 ahead of European Union embargoes on Russian energy.

The move has widened a diplomatic rift between the Saudi-backed bloc and Western nations, which worry higher energy prices will hurt the fragile global economy and hinder efforts to deprive Moscow of oil revenue following Russia’s invasion of Ukraine.

Full coverage: REUTERS

Weaker Refining, Gas Trading To Hit Shell’s Q3 Results

LONDON, Oct 6 (Reuters) – Shell (SHEL.L) said on Thursday its third-quarter profits would be pressured by a near halving of oil refining margins, crumbling chemical margins and weaker natural gas trading.

The British energy giant reported two consecutive quarters of record profits in the first half of the year amid soaring oil and gas prices, and stellar earnings from its trading operations, the world’s biggest.

Full coverage: REUTERS

Swiss Pursue Home-grown Energy Panacea – Reluctantly

BERN/GRANDE DIXENCE, Switzerland, Oct 6 (Reuters) – Having dodged most of the fuel-driven surge in inflation plaguing its neighbours, Switzerland is moving ahead with plans to boost its energy security and lock in tame power prices – but only reluctantly.

Switzerland’s focus on hydropower, which Energy Minister Simonetta Sommaruga calls “the backbone” of its electricity production, has helped shelter the country compared with others from soaring oil and gas costs, but it is far from immune.

Full coverage: REUTERS

Samsung Quarterly Profit Set To Slump 25%, First Decline In Nearly Three Years

SEOUL, Oct 6 (Reuters) – Samsung Electronics Co Ltd’s (005930.KS) third-quarter profit could tumble 25%, the first year-on-year decline in nearly three years, as an economic downturn saps demand for electronic devices and the chips that power them.

Globally, inflation is on the rise, central banks are aggressively hiking interest rates, fears of recession are growing and uncertainty about the fallout from Russia’s invasion of Ukraine is ever-present. As a result, businesses and consumers alike have reined in spending.

Full coverage: REUTERS

Oil Hovers Near Three-Week Highs After OPEC+ Agrees To Slash Crude Output

SINGAPORE, Oct 6 (Reuters) – Oil prices stabilised near three-week highs on Thursday after OPEC+ agreed to further tighten global crude supply with a deal to slash production by about 2 million barrel per day, the largest reduction since 2020.

Brent crude futures for December settlement edged down 8 cents to $93.29 per barrel by 0656 GMT after settling 1.7% higher in the previous session.

U.S. West Texas Intermediate (WTI) crude futures for November delivery slid 15 cents to $87.61 per barrel, building on a 1.4% rise on Tuesday.

Full coverage: REUTERS