WORLDWIDE: HEADLINES

Global Growth To Slow As Inflation Bites: Reuters Poll

The global economy will expand more slowly than predicted three months ago, according to Reuters polls of over 500 economists, who said higher commodity prices and an escalation in the Russia-Ukraine war could prompt another downgrade.

Already under pressure from monetary tightening as central banks try to stem rising inflation, world economic output was dealt a body blow when Russia invaded Ukraine on Feb. 24, sending commodity prices through the roof and triggering waves of economic sanctions.

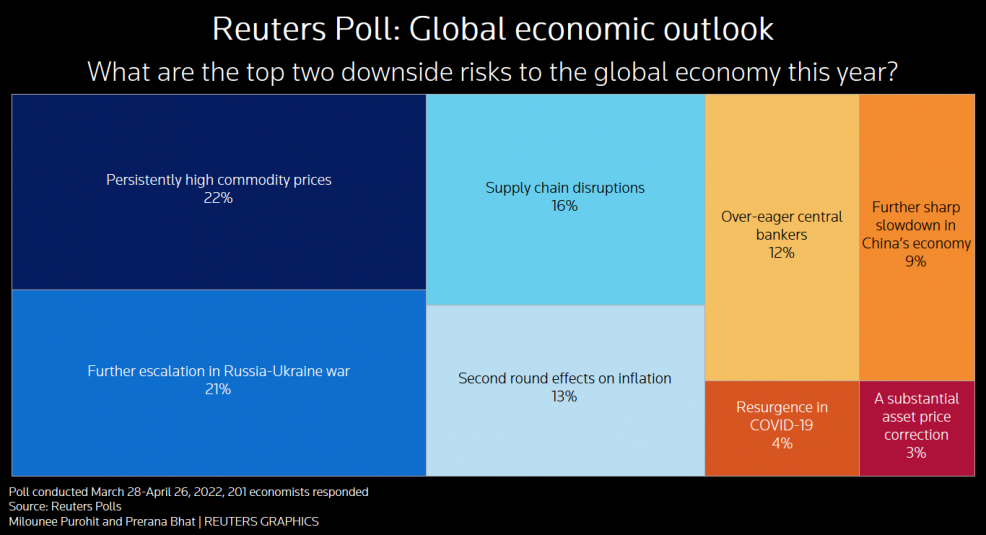

When asked to name the biggest two downside risks to the global economy this year, the top picks of roughly 200 respondents were persistently higher commodity prices and a further escalation in the Russia-Ukraine war.

They were closely followed by supply chain disruptions – exacerbated by the Russian invasion – followed by second-round inflation effects and over-eager central bankers.

“MASSIVE SUPPLY SHOCK”

Even without those future risks, median forecasts for global growth collected in this month’s Reuters polls on over 45 economies were chopped to 3.5% this year and 3.4% for 2023 from 4.3% and 3.6% in a January poll.

That compares to an International Monetary Fund prediction of 3.6% growth in both years.

“Even before the Russia-Ukraine confrontation escalated, central banks were fighting a severe upsurge in inflation that reflected the imprint of the pandemic, stressed global supply chains, and tightening labor markets,” said Nathan Sheets, global chief economist at Citi.

Full coverage: REUTERS

Australian Grocery Chain Coles Sees Inflation Through To 2023

Australia’s No. 2 grocer Coles Group (COL.AX) said on Thursday it hopes improved stock availability will curtail racing inflation as it met analysts’ third-quarter sales forecasts, but warned soaring supply costs would dog the economy for another year.

The update shows inflation striking at the heart of the Australian economy just weeks from a May 21 election, where the cost of living is shaping as one of the main issues. Coles and larger rival Woolworths Group Ltd (WOW.AX) take two-thirds of Australian grocery sales.

A day earlier, official figures showed Australian inflation hit its fastest pace in two decades amid supply chain blockages and surging oil prices, fuelling speculation that the Reserve Bank of Australia would begin hiking rates from next month, not in 2024 as it had previously flagged.

For the three months to end-March, Coles said sales jumped 3.6% as supermarket shelf prices, flat in the prior quarter, leapt 3.3%, led in particular by the cost of red meat. It added that it expected inflation to continue until mid-2023.

“The inflationary pressures on suppliers are increasing and not decreasing,” said Chief Executive Officer Steven Cain on an analyst call. But he noted inflation at Coles was slower than Australia’s overall inflation rate, a sign the grocer was not automatically passing its rising costs to shoppers.

“I don’t see this current wave (of inflation) as an opportunity to increase the gross margin percentage. What we’ll see is people potentially buying more own-brand going forward,” Cain said.

Full coverage: REUTERS

WORLDWIDE: FINANCE/BUSINESS

Earnings Help Stocks But Dollar Bulls Show Nerves

Share markets steadied on Thursday, taking comfort in technology earnings, though an energy crisis in Europe and China’s lengthy lockdowns kept the mood cautious and have propelled the dollar close to 20-year highs as investors seek out safety and yield.

Nasdaq 100 futures were up 1% in the Asia session and S&P 500 futures rose 0.7% after Facebook owner Meta (FB.O) beat Wall Street profit forecasts and said it had eked out user growth, sending its shares up almost 20% after hours.

A rally in Microsoft (MSFT.O) shares overnight also helped Wall Street indexes to a steady close.

MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) rose 0.5%, led by a 1% bounce in Australian stocks (.AXJO) from Wednesday’s one-month trough.

Japan’s Nikkei (.N225) rose 0.6%.

“The real question is, whether this really matters for a durable turnaround in otherwise fraught global circumstances,” said Vishnu Varathan, head of economics at Mizuho Bank in Singapore.

“Volatility is still high .. .even if not outright fear, the trepidation is hard to miss with on-going uncertainty from the war in Ukraine, which continues to threaten with more widespread economic pain.”

The most recent pressure point has been Russia’s halt on gas supplies to Bulgaria and Poland on Wednesday, which sent tremors through European energy markets and whacked the euro.

Full coverage: REUTERS

Dollar Nears Two-Decade Peaks As Problems Plague Euro, Yen

The dollar was nearing heights not seen in two decades on Thursday as the energy crisis in Europe hamstrung the euro, while the yen was undercut by expectations the Bank of Japan would stick to its super-easy policies.

Measured against a basket of currencies, the dollar index had reached a five-year top of 103.28 and a further push above 103.82 would see it to levels not visited since late 2002.

The euro was pinned at $1.0553, having hit a five-year low of $1.0515 on Wednesday. The single currency has fallen 4.6% so far in April and is heading for its worst month since early 2015.

The currency is now perilously close to huge chart support levels stretching from $1.0500 down to a trough from 2017 at $1.0344. A break would take it to depths not seen since 2002 and risk a damaging decline below parity.

The slide only adds to Europe’s economic troubles as it raises the cost of energy priced in dollars, just as natural gas costs soar on Russia’s move to cut off Poland and Bulgaria.

“This appears to be the first overt act of energy warfare,” warned Helima Croft, head of global commodity research at RBC Capital Markets.

“The question now is whether the cut-off will extend to other major importers in what could quickly become a stark test of European resolve to support Ukraine in the face of surging energy prices and rising recession risks.”

Full coverage: REUTERS

Oil Edges Lower As Mass COVID Testing Begins In China

Oil prices edged lower in early Asian trade on Thursday as concerns about rising coronavirus cases in China, the world’s biggest oil importer, weighed on futures markets.

China’s capital Beijing reported 48 new symptomatic and 2 new asymptomatic COVID-19 cases for April 27, state broadcaster CCTV reported on Thursday.

The city recorded 31 symptomatic cases a day earlier and three asymptomatic ones, as it began a mass testing program aimed at containing a new outbreak.

Brent crude futures fell 37 cents, or 0.4%, to $104.95 a barrel by 0006 GMT. U.S. West Texas Intermediate crude futures fell 27 cents, or 0.3%, to $101.75 a barrel.

Authorities in Beijing are continuing to crack down on COVID-19 outbreaks and trying to avert the city-wide lockdown that has shrouded Shanghai for a month.

China’s Hangzhou city of 12.2 million people, home to e-commerce giant Alibaba, will conduct mass COVID testing from April 28, state media reported on Wednesday.

Full coverage: REUTERS